Asia Pacific Autonomous Robot Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

1.47 Billion

USD

4.70 Billion

2024

2032

USD

1.47 Billion

USD

4.70 Billion

2024

2032

| 2025 –2032 | |

| USD 1.47 Billion | |

| USD 4.70 Billion | |

|

|

|

Asia-Pacific Autonomous Robot Market Segmentation, By Type (Goods-to-Person Picking Robots, Self-Driving Forklifts, Unmanned Aerial Vehicle, and Autonomous Inventory Robots), Offering (Hardware, Software, Services), Mode of Operations (Semi-Autonomous and Fully-Autonomous), Application (Warehouse Fleet Management, Sorting, Pick & Place, Tugging, and Others), End User (Industrial & Manufacturing, Warehousing & Logistics, E-Commerce, Healthcare, Agriculture, Military & Defense, and Others) – Industry Trends and Forecast to 2032

Autonomous Robot Market Analysis

The autonomous robot market is experiencing significant growth, driven by advancements in artificial intelligence, machine learning, and sensor technologies. These robots are increasingly adopted across industries such as logistics, manufacturing, healthcare, agriculture, and defense, addressing demands for automation, operational efficiency, and safety. The rise of e-commerce, coupled with labor shortages and the need for faster and more accurate operations, has particularly boosted the use of autonomous mobile robots in warehouses and fulfillment centers. In addition, government investments in robotics research and the expansion of smart technologies are propelling the market further. However, high initial costs and integration challenges remain key barriers. The market's future is poised for strong expansion as industries continue embracing automation to meet evolving operational needs.

Autonomous Robot Market Size

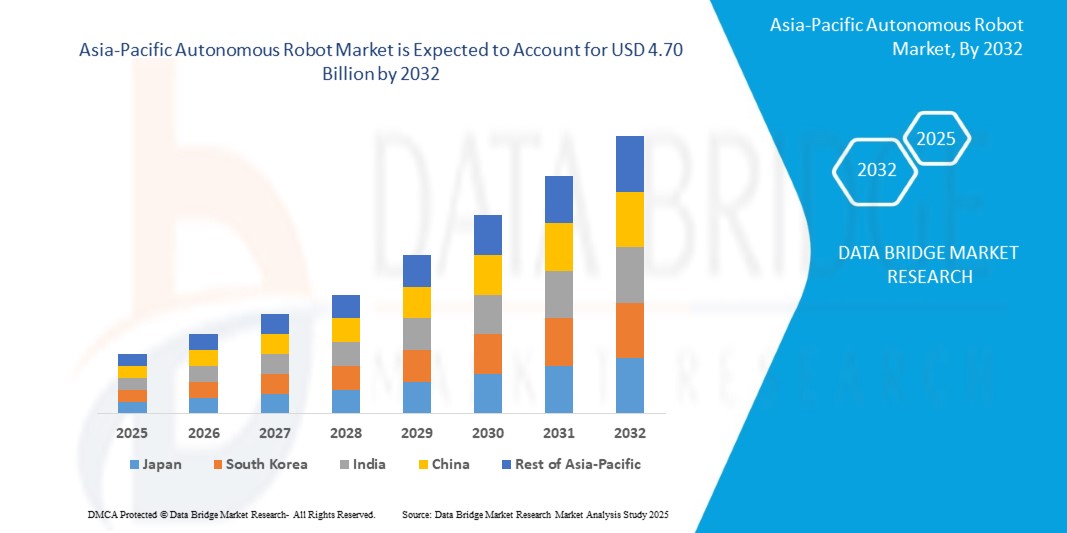

Asia-Pacific autonomous robot market size was valued at USD 1.47 billion in 2024 and is projected to reach USD 4.70 billion by 2032, with a CAGR of 15.7% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Autonomous Robot Market Trends

“Growing Adoption of Smart Manufacturing”

The growing adoption of smart manufacturing is significantly driving the expansion of the autonomous robot market. As industries seek to enhance operational efficiency, reduce costs, and improve product quality, autonomous robots are increasingly being integrated into production lines for tasks such as material handling, assembly, and inspection. These robots, equipped with advanced AI and machine learning algorithms, offer real-time data processing, adaptability, and precision, making them essential in modern manufacturing environments, this aligning with broader trends in the autonomous robot market. The demand for automation, coupled with technological advancements in robotics, is accelerating the deployment of autonomous robots, helping manufacturers meet the rising expectations for faster, more flexible, and cost-effective production processes.

Report Scope and Autonomous Robot Market Segmentation

|

Attributes |

Autonomous Robot Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

China, Japan, India, South Korea, Australia, Indonesia, Thailand, Malaysia, Singapore, Philippines, New Zealand, Taiwan, Vietnam, and Rest of Asia-Pacific |

|

Key Market Players |

KUKA AG (Germany), Locus Robotics (U.S.), GreyOrange Inc. (U.S.), Harvest Automation (U.S.), ABB (Switzerland), OMRON Corporation (Japan), Geekplus Technology Co., Ltd (China), Multiway Robotics (Shenzhen) Co., Ltd. (China), Teradyne Inc. (U.S.), Clearpath Robotics, Inc., a Rockwell Automation Company (Canada), Zebra Technologies Corp. (U.S.), SESTO Robotics (Singapore), and Robotnik (Spain), among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Autonomous Robot Market Definition

An autonomous robot is a type of robot that operates independently, performing tasks without human intervention by utilizing sensors, algorithms, and artificial intelligence to navigate and make decisions based on its environment. These robots are equipped with capabilities such as self-navigation, task execution, and learning from experiences, allowing them to adapt to new situations. Autonomous robots are used in various industries, including manufacturing for assembly lines, logistics for warehouse automation, healthcare for assisting patients, agriculture for crop monitoring, and in hazardous environments such as mining or disaster response, where human presence may be limited or unsafe.

Autonomous Robot Market Dynamics

Drivers

- Enhanced Sensor Technologies and Computer Vision

Enhanced sensor technologies and computer vision are pivotal in driving the growth of the autonomous robot market. These advancements enable robots to perceive and interact with their environments more accurately and efficiently, improving tasks such as navigation, object recognition, and obstacle avoidance. By integrating high-resolution cameras, LIDAR, infrared sensors, and advanced algorithms, autonomous robots can operate autonomously in complex, dynamic environments across various industries. As sensor and vision systems become more sophisticated, they enhance the precision and reliability of robots, leading to broader adoption in manufacturing, logistics, healthcare, and other sectors, thus expanding the market potential.

For instance,

In September 2024, Luxolis, a South Korea-based company, introduced advanced 3D vision and data tools designed to enhance the precision of industrial and collaborative robots in electronics manufacturing. Luxolis’ technologies, including the 3D Capture system with Sony’s IMX566PLR Time-of-Flight (ToF) sensor, enable sub-millimeter precision for real-time depth imaging. These innovations allow robots to perform complex tasks such as quality control and Electrostatic Discharge (ESD) testing with high accuracy and efficiency. The integration of AI with Luxolis’ 3D vision systems enhances the ability of robots to autonomously detect edges and boundaries, reducing labor costs and improving operational efficiency. These developments in enhanced sensor technologies and computer vision are pivotal in driving the growth of the autonomous robot market, as they enable robots to operate more effectively in dynamic and complex environments across industries.

- Improvements in AI and Machine Learning Capabilities

AI와 머신 러닝의 발전은 자율 로봇의 진화에 중요한 역할을 하며, 로봇이 실시간으로 학습하고, 적응하고, 결정을 내릴 수 있도록 합니다. 이러한 기술을 통해 로봇은 방대한 양의 데이터를 처리하고, 패턴을 인식하고, 인간의 개입 없이 지속적으로 성능을 개선할 수 있습니다. 지각, 의사 결정 및 작업 실행의 기능이 향상됨에 따라 자율 로봇은 점점 더 효율적이고 더 복잡하고 역동적인 환경을 처리할 수 있게 되었습니다. 그 결과 제조, 물류 및 의료와 같은 산업은 더 빠르고 지능적인 자동화를 목격하고 있으며, 자율 로봇 시장의 성장을 촉진하고 있습니다.

예를 들어,

Business Standards에서 발표한 뉴스에 따르면, 2024년 11월 로봇 스타트업 Addverb가 2025년에 차세대 휴머노이드 로봇을 출시할 계획이라고 발표했습니다. 이 로봇은 고급 AI와 머신 러닝 알고리즘을 활용하여 시각, 오디오, 터치 입력에서 다중 모달 데이터를 처리하여 복잡한 환경을 탐색하고 복잡한 작업을 수행할 수 있습니다. 자체 학습 알고리즘으로 구동되는 이 휴머노이드는 창고, 국방, 의료와 같은 산업의 다양한 워크플로에 적응하면서 소포 처리, 품질 검사, 재난 구호와 같은 작업을 실행합니다. AI와 머신 러닝의 이러한 발전은 자율 로봇이 실시간으로 결정을 내리고 동적 환경에 자율적으로 적응하는 능력을 더욱 향상시켜 자율 로봇 시장의 성장을 촉진합니다.

기회

- 정부 이니셔티브로 지원되는 로봇 투자

로봇 투자를 지원하는 정부 이니셔티브는 자율 로봇 시장에 상당한 기회를 창출하고 있습니다. 많은 정부가 제조, 의료, 물류와 같은 산업 전반에 걸쳐 로봇 기술의 개발과 배치를 장려하기 위해 자금 지원, 세금 인센티브 및 보조금을 제공하고 있습니다. 이러한 이니셔티브는 채택에 대한 재정적 장벽을 낮출 뿐만 아니라 로봇 분야에서 혁신, 협업 및 성장을 촉진하여 다양한 시장에서 자율 로봇의 광범위한 통합을 가속화합니다. 결과적으로 기업은 효율성 개선과 비용 절감의 혜택을 누릴 수 있으며, 정부는 기술적 리더십과 산업 경쟁력을 강화할 수 있습니다.

예를 들어,

2023년 1월, 국제 로봇 연맹에 따르면, 전 세계적으로 여러 정부 지원 이니셔티브가 로봇 산업을 크게 발전시키고 자율 로봇 시장에 주요 기회를 창출하고 있습니다. 중국에서는 4,350만 달러의 자금이 지원되는 "제14차 5개년 계획"과 "지능형 로봇" 프로그램이 로봇 기술 분야의 선두 주자가 되는 것을 목표로 합니다. 일본의 "새로운 로봇 전략"은 2022년에 9억 3,000만 달러 이상을 할당했으며, 제조, 의료, 농업과 같은 다양한 분야에 중점을 두어 국가를 로봇 혁신 허브로 자리 매김했습니다. 로봇에 대한 1억 7,220만 달러의 투자와 높은 로봇 밀도가 결합되어 로봇을 핵심 산업으로 개발하려는 의지를 보여줍니다. 2021-2027년 예산이 943억 달러인 EU의 Horizon Europe 프로그램은 이 지역의 로봇 개발을 더욱 촉진합니다. 독일의 하이테크 전략 2025와 1,400만 달러의 기금을 지원하는 미국의 국가 로봇 이니셔티브(NRI-3.0)도 로봇 분야의 성장과 혁신에 기여합니다. 이러한 이니셔티브는 자율 로봇 시장에 상당한 성장 기회를 제공하여 기술 발전과 산업 전반에 걸친 광범위한 채택을 촉진합니다.

- 재활용, 에너지 최적화 및 정밀 농업 분야 배치

재활용, 에너지 최적화, 정밀 농업 에 자율 로봇을 배치하면 자율 로봇 시장에 상당한 기회가 생깁니다. 이러한 응용 프로그램은 폐기물 관리, 자원 효율성, 지속 가능한 식량 생산과 같은 중요한 과제를 해결하여 고급 로봇 솔루션에 대한 수요를 촉진합니다. 산업이 생산성을 높이고 환경 목표를 달성하기 위해 자동화를 우선시함에 따라 이러한 분야에서 로봇을 통합하면 시장 성장이 촉진되어 다양한 부문에서 혁신과 확장을 위한 길이 열릴 것으로 예상됩니다.

예를 들어,

2024년 6월, 샌프란시스코에 본사를 둔 회사인 Glacier는 폐기물 분류를 자동화하여 재활용 효율성을 높이도록 설계된 AI 지원 로봇을 선보였습니다. 이 로봇은 컴퓨터 비전과 분석을 사용하여 재활용 가능한 재료를 고정밀로 식별하고 분류하여 매년 1,000만 개 이상의 품목이 매립지로 가는 것을 방지합니다. 이러한 발전은 재활용, 에너지 최적화 및 정밀 농업에서 자율 로봇의 혁신적인 역할을 강조하며, 자율 로봇 시장에서 지속 가능성을 촉진하고 상당한 성장 기회를 창출할 수 있는 잠재력을 강조합니다.

제약/도전

- 자격을 갖춘 로봇 엔지니어 부족

자율 로봇 시장은 자격을 갖춘 로봇 엔지니어의 부족으로 인해 상당한 어려움에 직면해 있습니다. 다양한 산업에서 첨단 로봇 솔루션에 대한 수요가 증가함에 따라 숙련된 전문가의 가용성이 제한되어 최첨단 기술의 개발 및 배포가 방해를 받습니다. 이러한 전문성 격차는 프로젝트 일정을 지연시키고 혁신을 제한하며 모든 부문에서 자율 로봇의 광범위한 채택을 방해할 수 있습니다. 이러한 부족을 해결하는 것은 시장의 잠재력을 최대한 활용하고 증가하는 자율 로봇 수요를 충족하는 데 중요합니다.

예를 들어,

2023년 5월, Mark Allen Group에서 발행한 기사에 따르면 자격을 갖춘 로봇 엔지니어의 부족이 자율 로봇 시장에 상당한 영향을 미쳐 혁신과 배포 속도를 저해했습니다. 산업이 숙련된 전문가의 부족에 직면함에 따라 자율 로봇의 개발 및 통합이 둔화되었으며, 특히 제조 및 의료와 같이 전문성이 절실한 분야에서 그렇습니다. 이러한 인재 격차로 인해 로봇 프로그래밍, 유지 관리 및 시스템 최적화가 지연되어 궁극적으로 자율 로봇의 잠재력이 제한되었습니다. 그러나 업스킬링 프로그램과 교육 기관과의 파트너십을 포함하여 이러한 과제를 해결하기 위한 노력은 장기적으로 부담을 완화하고 시장 성장을 지원하는 데 도움이 되고 있습니다.

- 인간 상호작용과의 호환성

인간 상호작용과의 호환성은 자율 로봇 시장에 상당한 과제를 안겨줍니다. 로봇이 다양한 분야에 점점 더 통합되고 있지만, 인간과 함께 매끄럽고 안전하게 작업할 수 있는 능력은 여전히 주요 장애물입니다. 로봇이 사고나 불편함을 유발하지 않고 실시간으로 인간의 행동, 감정 및 결정을 이해하고 대응할 수 있도록 하려면 정교한 AI, 센서 및 직관적 인터페이스가 필요합니다. 로봇이 의료 또는 고객 서비스와 같은 민감한 환경에 더 많이 관여함에 따라 이러한 인간-로봇 상호작용의 복잡성이 증가하여 실제 응용 프로그램에서 호환성과 효율성을 보장하기 위해 로봇 설계 및 프로그래밍에서 추가 발전이 요구됩니다.

예를 들어,

2024년 11월, 로욜라 메리마운트 대학교에서 발표한 기사에 따르면, 샹이 청 교수의 연구는 로봇공학, 증강 현실, AI 기술을 통해 인간-로봇 상호작용을 강화하는 데 중점을 두고 있으며, 특히 의료 및 교육 분야에서 그렇습니다. 청은 컴퓨터 비전 및 머신 러닝과 같은 기술을 활용하여 이러한 분야를 개선하는 솔루션을 개발하는 것을 목표로 합니다. 그녀의 연구는 자율 로봇 시장의 성장에 중요한 영역인 로봇과 인간 상호작용 간의 원활한 호환성을 달성하는 과제를 강조합니다. 로봇이 일상 생활에 더욱 통합됨에 따라, 로봇이 인간과 효과적으로 소통하고 협업할 수 있도록 하는 것은 광범위한 채택과 시장 확장을 위한 중요한 장애물로 남아 있습니다.

이 시장 보고서는 최근의 새로운 개발, 무역 규정, 수출입 분석, 생산 분석, 가치 사슬 최적화, 시장 점유율, 국내 및 지역 시장 참여자의 영향, 새로운 수익 창출처, 시장 규정의 변화, 전략적 시장 성장 분석, 시장 규모, 범주 시장 성장, 응용 분야 틈새 시장 및 지배력, 제품 승인, 제품 출시, 지리적 확장, 시장의 기술 혁신에 대한 분석 기회를 제공합니다. 시장에 대한 자세한 정보를 얻으려면 Data Bridge Market Research에 연락하여 분석가 브리핑을 받으세요. 저희 팀은 시장 성장을 달성하기 위한 정보에 입각한 시장 결정을 내리는 데 도움을 드립니다.

자율 로봇 시장 범위

시장은 유형, 운영 모드, 제공, 애플리케이션 및 최종 사용자를 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 핵심 시장 애플리케이션을 식별하기 위한 전략적 결정을 내리는 데 도움이 되는 귀중한 시장 개요와 시장 통찰력을 제공하는 데 도움이 됩니다.

유형

- 상품 대 사람 피킹 로봇

- 자율 주행 포크리프트

- 무인 항공기

- 자율 재고 로봇

운영 모드

- 반자율적

- 완전 자율

헌금

- 하드웨어

- 유형

- 감지기

- 액추에이터

- 전원 공급 장치

- 제어 시스템

- 기타

- 유형

- 소프트웨어

- 서비스

애플리케이션

- 창고 차량 관리

- 정렬

- 픽앤플레이스

- 잡아당기기

- 기타

최종 사용자

- 산업 및 제조

- 유형

- 상품 대 사람 피킹 로봇

- 자율 주행 포크리프트

- 무인 항공기

- 자율 재고 로봇

- 유형

- 창고 및 물류

- 유형

- 상품 대 사람 피킹 로봇

- 자율 주행 포크리프트

- 무인 항공기

- 자율 재고 로봇

- 유형

- 전자상거래

- 유형

- 상품 대 사람 피킹 로봇

- 자율 주행 포크리프트

- 무인 항공기

- 자율 재고 로봇

- 유형

- 헬스케어

- 유형

- 상품 대 사람 피킹 로봇

- 자율 주행 포크리프트

- 무인 항공기

- 자율 재고 로봇

- 유형

- 농업

- 유형

- 상품 대 사람 피킹 로봇

- 자율 주행 포크리프트

- 무인 항공기

- 자율 재고 로봇

- 유형

- 군사 및 방위

- 유형

- 상품 대 사람 피킹 로봇

- 자율 주행 포크리프트

- 무인 항공기

- 자율 재고 로봇

- 유형

- 기타

자율 로봇 시장 지역 분석

위에 언급된 대로 국가, 유형, 운영 방식, 제공 서비스, 애플리케이션 및 최종 사용자별로 시장을 분석하고 시장 규모에 대한 통찰력과 추세를 제공합니다.

이 시장에서 다루는 국가는 중국, 일본, 인도, 한국, 호주, 인도네시아, 태국, 말레이시아, 싱가포르, 필리핀, 뉴질랜드, 대만, 베트남, 그리고 기타 아시아 태평양 지역입니다.

중국은 아시아 태평양 자율 로봇 시장을 선도할 것으로 예상됩니다. 이러한 성장은 급속한 산업화, 다양한 부문에서 자동화 도입 증가, 직장 안전에 대한 강조 증가 등 여러 요인에 기인할 수 있습니다.

보고서의 국가 섹션은 또한 개별 시장 영향 요인과 국내 시장의 현재 및 미래 트렌드에 영향을 미치는 규제 변화를 제공합니다. 다운스트림 및 업스트림 가치 사슬 분석, 기술 트렌드 및 포터의 5가지 힘 분석, 사례 연구와 같은 데이터 포인트는 개별 국가의 시장 시나리오를 예측하는 데 사용되는 몇 가지 포인터입니다. 또한 아시아 태평양 브랜드의 존재 및 가용성과 지역 및 국내 브랜드와의 대규모 또는 희소한 경쟁으로 인해 직면한 과제, 국내 관세 및 무역 경로의 영향이 국가 데이터에 대한 예측 분석을 제공하는 동안 고려됩니다.

자율 로봇 시장 점유율

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Autonomous Robot Market Leaders Operating in the Market Are:

- KUKA AG (Germany)

- Locus Robotics (U.S.)

- GreyOrange Inc. (U.S.)

- Harvest Automation (U.S.)

- ABB (Switzerland)

- OMRON Corporation (Japan)

- Geekplus Technology Co., Ltd (China)

- Multiway Robotics (Shenzhen) Co., Ltd. (China)

- Teradyne Inc. (U.S.)

- Clearpath Robotics, Inc., a Rockwell Automation Company (Canada)

- Zebra Technologies Corp. (U.S.)

- SESTO Robotics (Singapore)

- Robotnik (Spain)

Latest Developments in Autonomous Robot Market

- In March 2020, KUKA secured a major contract to plan and supply a fully automated battery pack production line. The line, set to manufacture battery systems for premium electric vehicles starting in 2021, incorporates over fifty KUKA industrial robots for various tasks, from assembly to quality control. This acquisition strengthens KUKA’s position in the electro-mobility sector, showcasing its expertise in battery production automation. It will also support growth in KUKA’s robotics sector by enhancing capabilities in high-demand, precision manufacturing and digital factory technologies

- In April 2024, OMRON Corporation, Neura Robotics and Safety Technologies Inc. have formed a strategic partnership to advance cognitive robotics in manufacturing. This collaboration integrates Neura’s AI-driven cognitive robotics with OMRON’s global automation expertise to enhance efficiency, flexibility, and safety in factory automation. Together, they aim to revolutionize the industry by enabling robots to adapt, learn, and perform complex tasks, setting new standards in industrial automation

- In October 2024, ABB has partnered with US start-up Molg to create robotic micro factories for automated disassembly and recycling of data center e-waste. This collaboration addresses rising e-waste challenges by enabling responsible disposal, recovery of rare materials, and circularity in the electronics sector. ABB's robotics division supports innovation by advancing automation solutions that enhance efficiency, sustainability, and worker safety in industrial processes

- In November 2024, Geekplus Technology Co., Ltd. and Intel unveiled the Vision Only Robot Solution, the first-ever vision-only autonomous mobile robot (AMR) powered by Intel's Visual Navigation Modules to advance smart logistics. This innovation strengthens Geekplus's leadership in vision-based AMR technology, improving navigation, obstacle avoidance, and adaptability in complex settings, while enhancing efficiency and accuracy in autonomous warehouse and logistics processes

- In March 2024, Teradyne Inc. has teamed up with NVIDIA to incorporate AI technology into its robots, including Universal Robots' cobots and the MiR1200 Pallet Jack. This partnership boosts the robots' capabilities with accelerated computing, enhancing path planning efficiency and enabling autonomous pallet handling in complex environments. By leveraging NVIDIA's advanced AI solutions, Teradyne Robotics improves the performance and autonomy of its robots, opening up new application possibilities, particularly in automation and material handling. This collaboration strengthens Teradyne's position as a leader in the AI-driven robotics sector

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC AUTONOMOUS ROBOT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 USE CASE ANALYSIS

4.1.1 INDUSTRIAL & MANUFACTURING

4.1.2 E-COMMERCE

4.1.3 MILITARY & DEFENSE

4.1.4 WAREHOUSING & LOGISTICS

4.1.5 HEALTHCARE

4.1.6 AGRICULTURE

4.2 REGULATORY FRAMEWORK

4.3 TECHNOLOGY TREND

4.3.1 AI AND MACHINE LEARNING INTEGRATION

4.3.2 ADVANCED SENSOR TECHNOLOGY

4.3.3 BATTERY AND POWER INNOVATIONS

4.4 INVESTMENT VS ADOPTION MODEL

4.5 PORTERS FIVE FORCES

4.6 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING ADOPTION OF SMART MANUFACTURING

5.1.2 ENHANCED SENSOR TECHNOLOGIES AND COMPUTER VISION

5.1.3 IMPROVEMENTS IN AI AND MACHINE LEARNING CAPABILITIES

5.1.4 REDUCTION IN HUMAN ERROR-RELATED COSTS

5.2 RESTRAINTS

5.2.1 SIGNIFICANT UPFRONT COSTS AND ROBOT DEPLOYMENT

5.2.2 DATA PRIVACY AND SECURITY CONCERNS

5.3 OPPORTUNITIES

5.3.1 INVESTMENT IN ROBOTICS SUPPORTED BY GOVERNMENT INITIATIVES

5.3.2 DEPLOYMENT IN RECYCLING, ENERGY OPTIMIZATION, AND PRECISION AGRICULTURE

5.4 CHALLENGES

5.4.1 SHORTAGE OF QUALIFIED ROBOTICS ENGINEERS

5.4.2 COMPATIBILITY WITH HUMAN INTERACTION

6 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY TYPE

6.1 OVERVIEW

6.2 GOODS-TO-PERSON PICKING ROBOTS

6.3 SELF-DRIVING FORKLIFTS

6.4 UNMANNED AERIAL VEHICLE

6.5 AUTONOMOUS INVENTORY ROBOTS

7 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS

7.1 OVERVIEW

7.2 SEMI-AUTONOMOUS

7.3 FULLY-AUTONOMOUS

8 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY OFFERING

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 HARDWARE, BY TYPE

8.2.1.1 SENSOR

8.2.1.2 ACTUATOR

8.2.1.3 POWER SUPPLY

8.2.1.4 CONTROL SYSTEM

8.2.1.5 OTHER

8.3 SOFTWARE

8.4 SERVICE

9 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 WAREHOUSE FLEET MANAGEMENT

9.3 SORTING

9.4 PICK AND PLACE

9.5 TUGGING

9.6 OTHER

10 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY END-USER

10.1 OVERVIEW

10.2 INDUSTRIAL & MANUFACTURING

10.2.1 GOODS-TO-PERSON PICKING ROBOTS

10.2.2 SELF-DRIVING FORKLIFTS

10.2.3 UNMANNED AERIAL VEHICLE

10.2.4 AUTONOMOUS INVENTORY ROBOTS

10.3 WAREHOUSING & LOGISTICS

10.3.1 GOODS-TO-PERSON PICKING ROBOTS

10.3.2 SELF-DRIVING FORKLIFTS

10.3.3 UNMANNED AERIAL VEHICLE

10.3.4 AUTONOMOUS INVENTORY ROBOTS

10.4 E-COMMERCE

10.4.1 GOODS-TO-PERSON PICKING ROBOTS

10.4.2 SELF-DRIVING FORKLIFTS

10.4.3 UNMANNED AERIAL VEHICLE

10.4.4 AUTONOMOUS INVENTORY ROBOTS

10.5 HEALTHCARE

10.5.1 GOODS-TO-PERSON PICKING ROBOTS

10.5.2 SELF-DRIVING FORKLIFTS

10.5.3 UNMANNED AERIAL VEHICLE

10.5.4 AUTONOMOUS INVENTORY ROBOTS

10.6 AGRICULTURE

10.6.1 GOODS-TO-PERSON PICKING ROBOTS

10.6.2 SELF-DRIVING FORKLIFTS

10.6.3 UNMANNED AERIAL VEHICLE

10.6.4 AUTONOMOUS INVENTORY ROBOTS

10.7 MILITARY & DEFENSE

10.7.1 GOODS-TO-PERSON PICKING ROBOTS

10.7.2 SELF-DRIVING FORKLIFTS

10.7.3 UNMANNED AERIAL VEHICLE

10.7.4 AUTONOMOUS INVENTORY ROBOTS

10.8 OTHER

11 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 SOUTH KOREA

11.1.4 INDIA

11.1.5 AUSTRALIA

11.1.6 NEW ZEALAND

11.1.7 INDONESIA

11.1.8 THAILAND

11.1.9 MALAYSIA

11.1.10 SINGAPORE

11.1.11 TAIWAN

11.1.12 PHILIPPINES

11.1.13 VIETNAM

11.1.14 REST OF ASIA-PACIFIC

12 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 KUKA AG

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 OMRON CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 ABB

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 GEEKPLUS TECHNOLOGY CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 TERADYNE INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 AETHON, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 CLEARPATH ROBOTICS, INC. (A ROCKWELL AUTOMATION COMPANY)

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 FETCH ROBOTICS, INC (ZEBRA TECHNOLOGIES CORP.)

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 GREYORANGE INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 HARVEST AUTOMATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 LOCUS ROBOTICS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 MULTIWAY ROBOTICS (SHENZHEN) CO., LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 ROBOTNIK

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 SEEGRID

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 SESTO ROBOTICS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 REGULATORY FRAMEWORKS

TABLE 2 OBSTACLES AND DISINCENTIVES TO ROBOTICS TECHNOLOGIES ADOPTION

TABLE 3 ROBOTS PRICE BREAKDOWN FOR DEVELOPMENT 2024

TABLE 4 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC GOODS-TO-PERSON PICKING ROBOTS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC SELF-DRIVING FORKLIFTS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC UNMANNED AERIAL VEHICLE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC AUTONOMOUS INVENTORY ROBOTS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC SEMI-AUTONOMOUS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC FULLY-AUTONOMOUS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032, (USD THOUSAND)

TABLE 13 ASIA-PACIFIC HARDWARE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC HARDWARE IN AUTONOMOUS ROBOT MARKET, BY, 2018-2032, (USD THOUSAND)

TABLE 15 ASIA-PACIFIC SOFTWARE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC SERVICE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC WAREHOUSE FLEET MANAGEMENT IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC SORTING IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC PICK AND PLACE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC TUGGING IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC OTHERS FLEET MANAGEMENT IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC OTHERS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 CHINA AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 CHINA AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 52 CHINA AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 53 CHINA HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 CHINA AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 55 CHINA AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 56 CHINA INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 CHINA WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 CHINA E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 CHINA HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 CHINA AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 CHINA MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 JAPAN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 JAPAN AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 64 JAPAN AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 65 JAPAN HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 JAPAN AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 JAPAN AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 68 JAPAN INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 JAPAN WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 JAPAN E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 JAPAN HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 JAPAN AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 JAPAN MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 SOUTH KOREA AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 SOUTH KOREA AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 76 SOUTH KOREA AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 77 SOUTH KOREA HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 SOUTH KOREA AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 SOUTH KOREA AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 80 SOUTH KOREA INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 SOUTH KOREA WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 SOUTH KOREA E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 SOUTH KOREA HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 SOUTH KOREA AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 SOUTH KOREA MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 INDIA AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 INDIA AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 88 INDIA AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 89 INDIA HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 INDIA AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 91 INDIA AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 92 INDIA INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 INDIA WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 INDIA E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 INDIA HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 INDIA AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 INDIA MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 AUSTRALIA AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 AUSTRALIA AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 100 AUSTRALIA AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 101 AUSTRALIA HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 AUSTRALIA AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 AUSTRALIA AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 104 AUSTRALIA INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 AUSTRALIA WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 AUSTRALIA E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 AUSTRALIA HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 AUSTRALIA AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 AUSTRALIA MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 NEW ZEALAND AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 NEW ZEALAND AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 112 NEW ZEALAND AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 113 NEW ZEALAND HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 NEW ZEALAND AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 NEW ZEALAND AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 116 NEW ZEALAND INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 NEW ZEALAND WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 NEW ZEALAND E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 NEW ZEALAND HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 NEW ZEALAND AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 NEW ZEALAND MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 INDONESIA AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 INDONESIA AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 124 INDONESIA AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 125 INDONESIA HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 INDONESIA AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 127 INDONESIA AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 128 INDONESIA INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 INDONESIA WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 INDONESIA E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 INDONESIA HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 INDONESIA AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 INDONESIA MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 THAILAND AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 THAILAND AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 136 THAILAND AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 137 THAILAND HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 THAILAND AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 THAILAND AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 140 THAILAND INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 THAILAND WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 THAILAND E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 THAILAND HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 THAILAND AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 THAILAND MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 MALAYSIA AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 MALAYSIA AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 148 MALAYSIA AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 149 MALAYSIA HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 MALAYSIA AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 151 MALAYSIA AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 152 MALAYSIA INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 MALAYSIA WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 MALAYSIA E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 MALAYSIA HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 MALAYSIA AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 MALAYSIA MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 SINGAPORE AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 SINGAPORE AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 160 SINGAPORE AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 161 SINGAPORE HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 SINGAPORE AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 163 SINGAPORE AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 164 SINGAPORE INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 SINGAPORE WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 SINGAPORE E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 SINGAPORE HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 SINGAPORE AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 SINGAPORE MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 170 TAIWAN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 171 TAIWAN AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 172 TAIWAN AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 173 TAIWAN HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 TAIWAN AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 175 TAIWAN AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 176 TAIWAN INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 TAIWAN WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 TAIWAN E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 TAIWAN HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 TAIWAN AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 TAIWAN MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 PHILIPPINES AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 PHILIPPINES AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 184 PHILIPPINES AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 185 PHILIPPINES HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 186 PHILIPPINES AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 187 PHILIPPINES AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 188 PHILIPPINES INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 PHILIPPINES WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 PHILIPPINES E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 PHILIPPINES HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 PHILIPPINES AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 PHILIPPINES MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 VIETNAM AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 VIETNAM AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 196 VIETNAM AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 197 VIETNAM HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 VIETNAM AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 199 VIETNAM AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 200 VIETNAM INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 201 VIETNAM WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 202 VIETNAM E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 203 VIETNAM HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 VIETNAM AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 205 VIETNAM MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 206 REST OF ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

그림 목록

FIGURE 1 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: MULTIVARIATE MODELING

FIGURE 10 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: TYPE TIMELINE CURVE

FIGURE 11 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: MARKET END USER COVERAGE GRID

FIGURE 12 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: SEGMENTATION

FIGURE 13 FOUR SEGMENTS COMPRISE THE ASIA-PACIFIC AUTONOMOUS ROBOT MARKET, BY TYPE (2024)

FIGURE 14 EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 GROWING ADOPTION OF SMART MANUFACTURING IS EXPECTED TO DRIVE THE ASIA-PACIFIC AUTONOMOUS ROBOT MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 GOODS-TO-PERSON PICKING ROBOTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC AUTONOMOUS ROBOT MARKET IN 2025 & 2032

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA-PACIFIC AUTONOMOUS ROBOT MARKET

FIGURE 19 ADOPTION OF ROBOTICS IN ACROSS SECTORS IN (%)

FIGURE 20 ROBOTICS R&D PROGRAMS OFFICIALLY DRIVEN BY GOVERNMENTS IN MILLIONS

FIGURE 21 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: BY TYPE, 2024

FIGURE 22 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: BY MODE OF OPERATIONS, 2024

FIGURE 23 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: BY OFFERING, 2024

FIGURE 24 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: BY APPLICATION, 2024

FIGURE 25 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: BY END-USER, 2024

FIGURE 26 ASIA-PACIFIC AUTONOMOUS ROBOT MARKET: SNAPSHOT (2024)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.