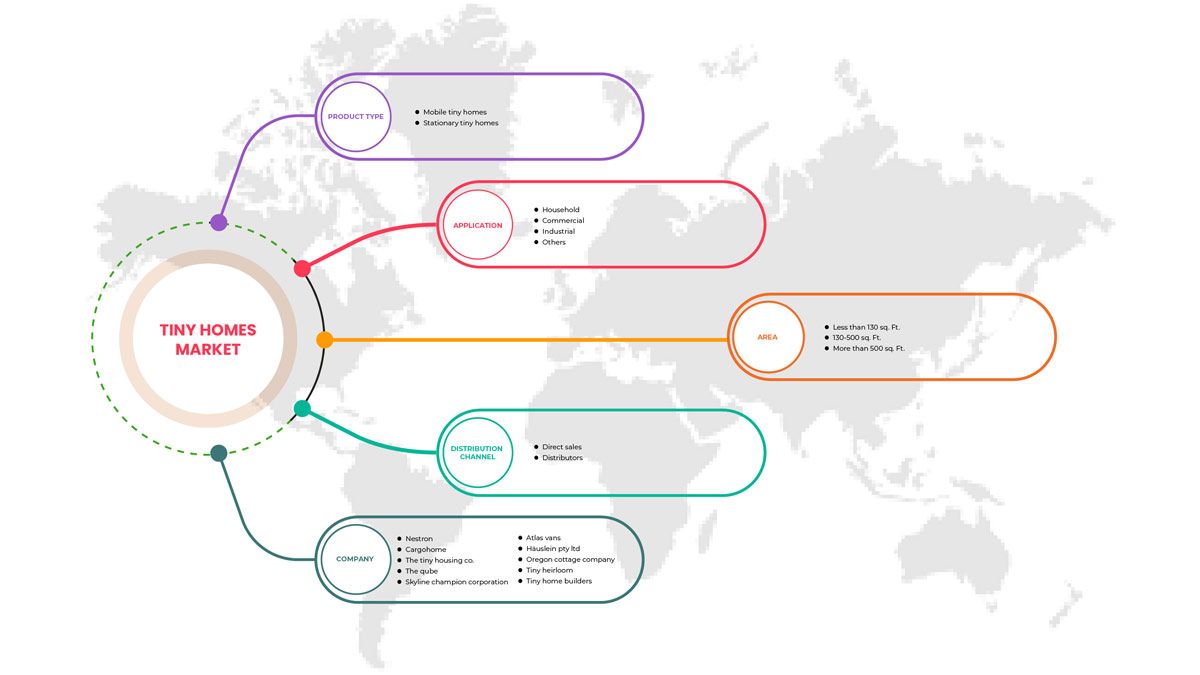

Asia-Pacific Tiny Homes Market, By Product Type (Mobile Tiny Homes and Stationary Tiny Homes), Area (Less Than 130 Sq. Ft., 130-500 Sq. Ft., and More Than 500 Sq. Ft.), Application (Household, Commercial, Industrial, and Others), Distribution Channel (Direct Sales and Distributors) Industry Trends and Forecast to 2029.

Asia-Pacific Tiny Homes Market Analysis and Size

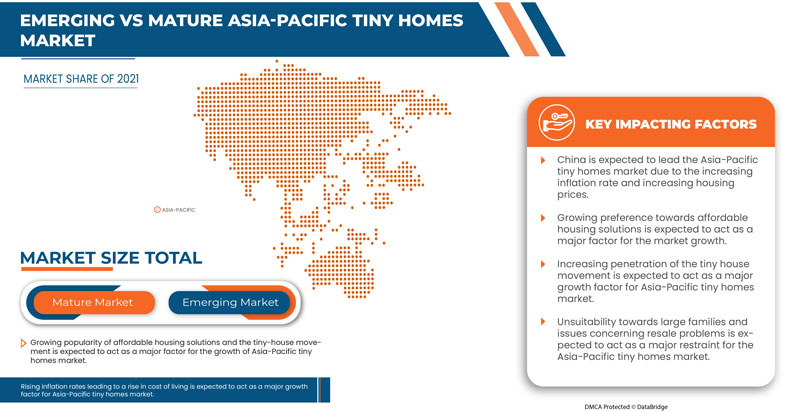

The increasing use of tiny homes in tourism activities is an important driver for the Asia-Pacific tiny homes market. The rising inflation leading to a rise in living costs and the increasing popularity of affordable housing solutions, and the tiny-house movement are expected to propel the growth of the Asia-Pacific tiny homes market.

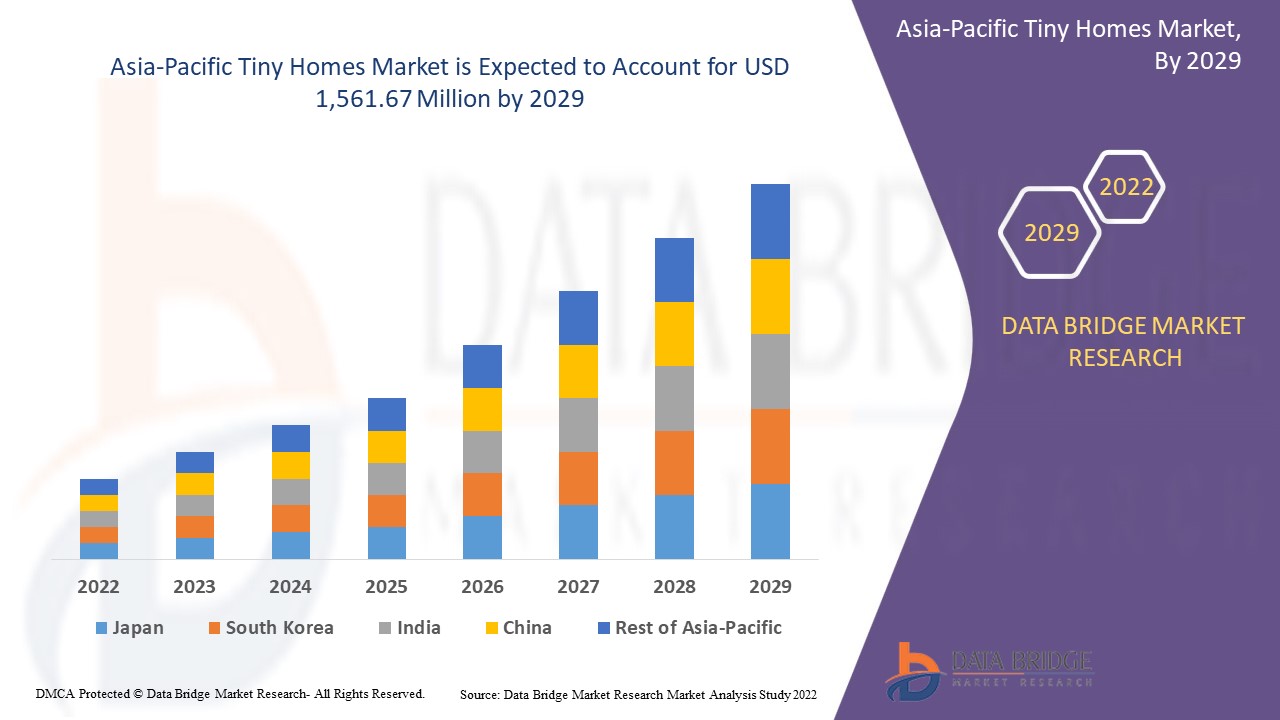

Data Bridge Market Research analyses that the Asia-Pacific tiny homes market is expected to reach a value of USD 1,561.67 million by the year 2029, at a CAGR of 3.9% during the forecast period. "Household" accounts for the most prominent application segment in the respective market owing to the rise in tiny homes. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product Type (Mobile Tiny Homes and Stationary Tiny Homes), Area (Less Than 130 Sq. Ft., 130-500 Sq. Ft., and More Than 500 Sq. Ft.), Application (Household, Commercial, Industrial, and Others), Distribution Channel (Direct Sales and Distributors). |

|

Countries Covered |

Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, Rest of Asia-Pacific. |

|

Market Players Covered |

Nestron, CargoHome, Häuslein Pty Ltd. |

Market Definition

A tiny home generally refers to a single dwelling unit of less than 400 square feet in area, built on a permanent or movable foundation. It offers consumers and their local communities several significant advantages, such as lower purchase price, lower construction material waste, reduced carbon footprint, and significantly reduced energy consumption.

Tiny homes have evolved over the recent decades and come in many styles and designs, appealing to people from all walks of life, retirees, starter home-seeking couples, and minimalist young people, among others. Tiny homes offer a wide range of quality, affordable, and environmentally friendly housing that can be used to meet personal dreams, financial and lifestyle goals, and community needs.

Market Dynamics of the Asia-Pacific Tiny Homes Market

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers/Opportunities

- Increasing usage of tiny homes in tourism activities

Tiny homes do not require permits in many parts of the world as they are considered vehicles. Many families have invested in tiny houses and then rented them to people. Some service providers even rent their tiny homes in various architectural and decor styles. These styles depict modern or minimalist to rustic or traditional as a unique alternative to the hotel stay. They equip the tiny homes with a kitchen, living space, bathroom, and sleeping area. Various factors, such as globalization, internet penetration, and growing social media influence, have boosted the demand for tiny homes. Furthermore, new lifestyles, higher disposable incomes, and increasing consumer environmental awareness create demand for tiny homes. This, in turn, is expected to act as a driver for the growth of the Asia-Pacific tiny homes market.

- Rising inflation leads to a rise in living costs

Interest rates on home loans have prompted consumers to seek more affordable housing options. Consumers are also becoming more interested in low-maintenance, energy-efficient, and environmentally friendly homes. The growing interest in and spending on such low-cost, environmentally friendly tiny houses is expected to drive up demand for tiny houses in the coming years. Thus, the Asia-Pacific tiny house market is likely driven by rising living costs and high home loan interest rates.

- Increasing popularity of affordable housing solutions and the tiny-house movement

The tiny homes trend is rising as it is an innovative, affordable housing solution. It requires less space, land, and cost to build and can be maintained with basic amenities. Money is saved on heating, cooling, property taxes, or home maintenance. There is a huge saving on electricity, water, and energy in tiny homes compared to large houses, which require more maintenance costs.

Tiny-house movement, also known as the small-house movement, aims to downsize living spaces, simplify, and essentially "living with less." According to INTERNATIONAL CODE COUNCIL, INC., a tiny house is termed a "dwelling unit with a maximum of 37 square meters (400 sq. ft.) of floor area, excluding lofts." People have made many efforts to increase the tiny house movement.

- Less burden of maintenance as well as environment friendly

The increasing use of clear metallic oxide coating on windows to control the temperature of tiny homes requires a significantly smaller number of electronic components and fixtures than in conventional homes. Due to less area and space, the maintenance cost is less compared to a conventional home. Thus, tiny homes have less maintenance burden and are environment friendly, which is expected to drive the Asia-Pacific tiny homes market.

- Shifting consumer preference toward the environmentally friendly homes

More consumers are also being more proactive in their pursuit of adopting a more sustainable lifestyle, whether by selecting products with ethical or environmentally sustainable practices and values or by no longer purchasing certain products because they have concerns about sustainability practices or values. For most consumers, adopting a more sustainable lifestyle starts at home, recycling, composting or reducing food waste. People are also increasingly choosing the tiny home lifestyle by embracing the philosophy and freedom that comes with downsizing the living space by simplifying and living with less.

Furthermore, factors including rising living costs, increasing environmental consciousness, and rising government initiatives are creating demand in the Asia-Pacific tiny homes market. Furthermore, shifting consumer preference toward environmentally friendly homes may provide opportunities for the growth of the Asia-Pacific tiny homes market.

- Introduction of sustainable 3D printed tiny homes

The use of concrete 3D printing technology, which incorporates digital technology and the application of material technology, helps in creating various shapes and designs. It allows architects to build various shapes, such as curves, spheres, and others, in much less time and cost. 3D printing technology is an upcoming technology in the construction industry. However, there is a need to upgrade the conventional or standard methods for construction with the help of technological advancements. This, in turn, provides new opportunities for the growth of the Asia-Pacific tiny homes market.

Restraints/Challenges

- Low preference towards tiny homes over conventional homes

Tiny houses don't require much land to build compared to conventional homes. But many towns make it difficult to build one. Zoning laws often include a minimum size for dwellings. Such as, in North Carolina, the tiny home must be at least 150 square feet to get a building permit, and 100 square feet must be added for every additional occupant. These zoning regulations can prohibit people from buying land and building their own tiny houses on it. Sometimes to get a loan to build a tiny home is another challenge. Sometimes it is 'impossible to take standard mortgage loans as banks don't consider a tiny house to have enough value to make good collateral.

- Growing number of residential buildings

Consumers who move to their new spaces and renovate older ones stay in residential buildings. Changing lifestyle and increased disposable income motivates consumers to live in buildings and big spaces to maintain their standard and status. Due to this reason, people prefer to stay in residential buildings. Thus, a growing number of residential construction is expected to restrain the Asia-Pacific tiny homes market.

- Unsuitable for large families and issues concerning resale problems

Tiny homeowners often struggle to regulate the temperature in their homes. As a result, water builds up on the windows, walls, and furniture. There is a lack of proper ventilation and cooling systems in tiny homes. Many people who move into tiny homes with the dream of traveling later realize that it is difficult to move home from one place to another. In most cases, a bigger truck is required to be attached, drastically increasing the costs. Also, the belongings need to be tied down so that they do not fall and break while moving.

Moreover, more vulnerability to natural disasters along with limited awareness. Furthermore, the unsuitability of tiny homes for large families and issues concerning the resale of tiny homes may challenge the growth of the Asia-Pacific tiny homes market.

Post-COVID-19 Impact on Asia-Pacific Tiny Homes Market

COVID-19 impacted various manufacturing industries in the year 2020-2021 as it led to the closure of workplaces, disruption of supply chains, and restrictions on transportation. Due to the lockdown, the market has experienced a downfall in sales due to the shutdown of retail outlets and the restrictions on customer access over the past few years.

However, the growth of the market post-pandemic period is attributed to more people working from home and increased disposable income. This has led to an increased demand for a sustainable, eco-friendly, and affordable housing solution. The key market players are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple R&D activities to improve their offerings. They are enhancing its market share by exploring different retail channels and expanding into new regions.

This Asia-Pacific tiny homes market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the tiny homes market, contact Data Bridge Market Research for an Analyst Brief. Our team will help you make an informed market decision to achieve market growth.

Recent Developments

- In October 2019, Häuslein Pty Ltd launched two new tiny house models - the Little Sojourner and the Grand Sojourner. The products are the smallest and the largest new addition to the family of high-end tiny houses, respectively. The newly launched products will help the company enhance its market presence with high-quality tiny houses.

Asia-Pacific Tiny Homes Market Scope

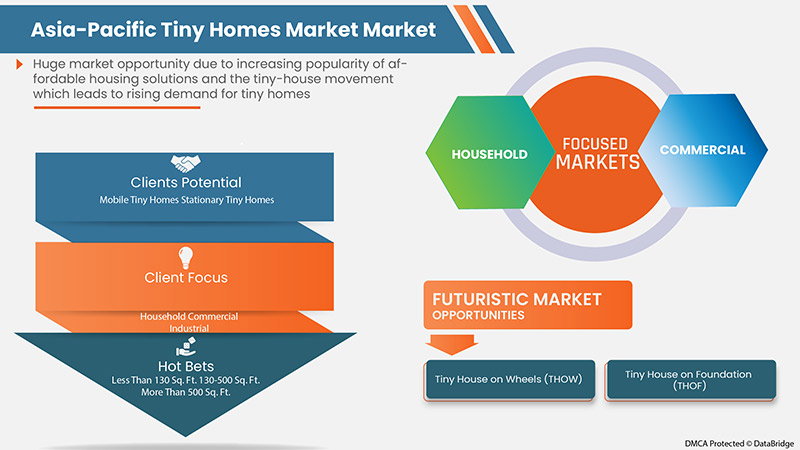

The Asia-Pacific tiny homes market is segmented on the basis of product type, area, application, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Mobile Tiny Homes

- Stationary Tiny Homes

Based on product type, the Asia-Pacific tiny homes market is segmented into mobile tiny homes and stationary tiny homes.

Area

- Less Than 130 Sq. Ft.

- 130-500 Sq. Ft.

- More Than 500 Sq. Ft.

Based on the area, the Asia-Pacific tiny homes market is segmented into less than 130 sq. ft., 130-500 sq. ft., and more than 500 sq. ft.

Application

- Household

- Commercial

- Industrial

- Others

Based on application, the Asia-Pacific tiny homes market is segmented into household, commercial, industrial, and others.

Distribution Channel

- Direct Sales

- Distributors

Based on distribution channel, the Asia-Pacific tiny homes market is segmented into direct sales and distributors.

Asia-Pacific Tiny Homes Market Regional Analysis/Insights

The Asia-Pacific tiny homes market is analyzed, and market size insights and trends are provided by country, product type, area, application, and distribution channel, as referenced above.

The countries covered in the Asia-Pacific tiny homes market report are Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, and the rest of Asia-Pacific.

In 2022, China is expected to dominate the Asia-Pacific tiny homes market due to a rise in consumer spending on tiny homes due to the tiny house movement in the region. The rise in investments and initiatives toward the construction of tiny homes for both commercial and residential is propelling the region's demand for tiny homes.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Tiny Homes Market Share Analysis

The Asia-Pacific tiny homes market competitive landscape provides details by a competitor. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to Asia-Pacific tiny homes market.

Some of the major players operating in the tiny homes market are Nestron, CargoHome, and Häuslein Pty Ltd, among others.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC TINY HOMES MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 3D PRINTING IN TINY HOMES

4.2 CONSUMERS BUYING BEHAVIOUR

4.2.1 OVERVIEW

4.2.2 COMPLEX BUYING BEHAVIOR

4.2.3 DISSONANCE-REDUCING BUYING BEHAVIOR

4.2.4 HABITUAL BUYING BEHAVIOR

4.2.5 VARIETY SEEKING BEHAVIOR

4.2.6 CONCLUSION

4.3 LIST OF SUPPLIERS & DISTRIBUTORS

4.3.1 ASIA PACIFIC

4.4 CONSUMERS ANALYSIS

4.5 REGULATION COVERAGE

4.5.1 INTERNATIONAL RESIDENTIAL CODE (IRC)

4.5.1.1 GENERAL

4.5.1.2 DEFINITIONS

4.5.1.3 CEILING HEIGHT

4.5.1.4 LOFTS

4.5.1.5 EMERGENCY ESCAPE AND RESCUE OPENINGS

4.5.1.6 ENERGY CONSERVATION

4.5.2 NATIONAL FIRE PROTECTION ASSOCIATION (NFPA)

4.5.3 RV INDUSTRY ASSOCIATION

4.5.4 U.S. DEPARTMENT OF HOUSING AND URBAN DEVELOPMENT (HUD)

4.5.5 NATIONAL ORGANIZATION OF ALTERNATIVE HOUSING (NOAH)

5 REGIONAL SUMMARY

5.1 ASIA PACIFIC

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING USAGE OF TINY HOMES IN TOURISM ACTIVITIES

6.1.2 RISING INFLATION LEADS TO A RISE IN LIVING COSTS

6.1.3 INCREASING POPULARITY OF AFFORDABLE HOUSING SOLUTIONS AND THE TINY-HOUSE MOVEMENT

6.1.4 LESS BURDEN OF MAINTENANCE AS WELL AS ENVIRONMENT FRIENDLY

6.2 RESTRAINTS

6.2.1 LOW PREFERENCE TOWARDS THE TINY HOMES OVER CONVENTIONAL HOMES

6.2.2 LACK OF WELL-ESTABLISHED INFRASTRUCTURE AND LIMITED AWARENESS

6.2.3 GROWING NUMBER OF RESIDENTIAL BUILDINGS

6.3 OPPORTUNITIES

6.3.1 SHIFTING CONSUMER PREFERENCE TOWARD THE ENVIRONMENTALLY FRIENDLY HOMES

6.3.2 HIGH INTEREST RATES ON HOME LOANS

6.3.3 INTRODUCTION OF SUSTAINABLE 3D PRINTED TINY HOMES

6.4 CHALLENGES

6.4.1 LIMITED DEMAND FROM DEVELOPING ECONOMIES

6.4.2 UNSUITABLE FOR LARGE FAMILIES AND ISSUES CONCERNING RESALE PROBLEMS

7 ASIA PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 STATIONARY TINY HOMES

7.3 MOBILE TINY HOMES

8 ASIA PACIFIC TINY HOMES MARKET, BY AREA

8.1 OVERVIEW

8.2 130-500 SQ.FT

8.3 LESS THAN 130 SQ.FT

8.4 MORE THAN 500 SQ.FT

9 ASIA PACIFIC TINY HOMES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 HOUSEHOLD

9.3 COMMERCIAL

9.4 INDUSTRIAL

9.5 OTHERS

10 ASIA PACIFIC TINY HOMES MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 DIRECT SALES

10.3 DISTRIBUTORS

11 ASIA PACIFIC TINY HOMES MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 INDIA

11.1.4 AUSTRALIA & NEW ZEALAND

11.1.5 SOUTH KOREA

11.1.6 THAILAND

11.1.7 INDONESIA

11.1.8 MALAYSIA

11.1.9 SINGAPORE

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA PACIFIC TINY HOMES MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.2 PRODUCT LAUNCHES

12.3 PARTNERSHIP

12.4 PARTICIPATION

12.5 AWARDS

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 NESTRON

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 CARGOHOME

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENTS

14.3 THE TINY HOUSING CO.

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 THE QUBE

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 SKYLINE CHAMPION CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ATLAS VANS

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 HÄUSLEIN PTY LTD

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 OREGON COTTAGE COMPANY

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 TINY HEIRLOOM

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 TINY HOME BUILDERS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENTS

14.11 TINY SMART HOUSE, INC.

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 TUMBLEWEED TINY HOUSE COMPANY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 NEW FRONTIER TINY HOMES

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 TIMBERCARAFT TINY HOMES

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 MUSTARD SEED TINY HOMES LLC

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 AMERICAN TINY HOUSE

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 B&B MICRO MANUFACTURING, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 PRODUCT PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 CALIFORNIA TINY HOUSE

14.18.1 COMPANY SNAPSHOT

14.18.2 PRODUCT PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 MAVERICK TINY HOMES, LLC

14.19.1 COMPANY SNAPSHOT

14.19.2 PRODUCT PORTFOLIO

14.19.3 RECENT DEVELOPMENTS

14.2 TINY IDAHOMES

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

표 목록

TABLE 1 ASIA PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC STATIONARY TINY HOMES IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC MOBILE TINY HOMES IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC 130-500 SQ.FT IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC LESS THAN 130 SQ.FT IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC MORE THAN 500 SQ.FT IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC HOUSEHOLD IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC COMMERCIAL IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC INDUSTRIAL IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC OTHERS IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC DIRECT SALES IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC DISTRIBUTORS IN TINY HOMES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA-PACIFIC TINY HOMES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 17 ASIA-PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA-PACIFIC TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 19 ASIA-PACIFIC TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 20 ASIA-PACIFIC TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 21 CHINA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 22 CHINA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 23 CHINA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 CHINA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 25 JAPAN TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 26 JAPAN TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 27 JAPAN TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 28 JAPAN TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 INDIA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 INDIA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 31 INDIA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 INDIA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 33 AUSTRALIA & NEW ZEALAND TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 AUSTRALIA & NEW ZEALAND TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 35 AUSTRALIA & NEW ZEALAND TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 36 AUSTRALIA & NEW ZEALAND TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 SOUTH KOREA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 SOUTH KOREA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 39 SOUTH KOREA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 40 SOUTH KOREA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 41 THAILAND TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 THAILAND TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 43 THAILAND TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 44 THAILAND TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 45 INDONESIA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 INDONESIA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 47 INDONESIA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 INDONESIA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 49 MALAYSIA TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 MALAYSIA TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 51 MALAYSIA TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 52 MALAYSIA TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 SINGAPORE TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 SINGAPORE TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 55 SINGAPORE TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 56 SINGAPORE TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 57 PHILIPPINES TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 PHILIPPINES TINY HOMES MARKET, BY AREA, 2020-2029 (USD MILLION)

TABLE 59 PHILIPPINES TINY HOMES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 60 PHILIPPINES TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 61 REST OF ASIA-PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

그림 목록

FIGURE 1 ASIA PACIFIC TINY HOMES MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC TINY HOMES MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC TINY HOMES MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC TINY HOMES MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC TINY HOMES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC TINY HOMES MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC TINY HOMES MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC TINY HOMES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC TINY HOMES MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC TINY HOMES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC TINY HOMES MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC TINY HOMES MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC TINY HOMES MARKET: SEGMENTATION

FIGURE 14 INCREASING POPULARITY OF AFFORDABLE HOUSING SOLUTIONS IS EXPECTED TO DRIVE THE ASIA PACIFIC TINY HOMES MARKET IN THE FORECAST PERIOD

FIGURE 15 THE STATIONARY TINY HOMES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC TINY HOMES MARKET IN 2022 & 2029

FIGURE 16 ASIA PACIFIC TINY HOMES MARKET: TYPES OF CONSUMER'S BUYING BEHAVIOUR

FIGURE 17 ASIA PACIFIC TINY HOMES MARKET: SHARE OF CONSUMER TYPE

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC TINY HOMES MARKET

FIGURE 19 ASIA PACIFIC TINY HOMES MARKET, BY PRODUCT TYPE, 2021

FIGURE 20 ASIA PACIFIC TINY HOMES MARKET, BY AREA, 2021

FIGURE 21 ASIA PACIFIC TINY HOMES MARKET, BY APPLICATION, 2021

FIGURE 22 ASIA PACIFIC TINY HOMES MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 23 ASIA-PACIFIC TINY HOMES MARKET: SNAPSHOT (2021)

FIGURE 24 ASIA-PACIFIC TINY HOMES MARKET: BY COUNTRY (2021)

FIGURE 25 ASIA-PACIFIC TINY HOMES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 ASIA-PACIFIC TINY HOMES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 ASIA-PACIFIC TINY HOMES MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 28 ASIA PACIFIC TINY HOMES MARKET: COMPANY SHARE 2021 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.