Europe Lightweight Metals Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

36.60 Billion

USD

303.51 Billion

2024

2052

USD

36.60 Billion

USD

303.51 Billion

2024

2052

| 2025 –2052 | |

| USD 36.60 Billion | |

| USD 303.51 Billion | |

|

|

|

|

تجزئة سوق المعادن خفيفة الوزن في أوروبا، حسب النوع (الألومنيوم وسبائكه، التيتانيوم وسبائكه، المغنيسيوم وسبائكه، البريليوم وسبائكه، الفولاذ وسبائكه، وغيرها)، والتطبيقات (السيارات والنقل، الفضاء والدفاع، الزراعة، الإلكترونيات والسلع الاستهلاكية، البحرية، وغيرها) - اتجاهات الصناعة وتوقعاتها حتى عام ٢٠٥٢

حجم سوق المعادن خفيفة الوزن في أوروبا

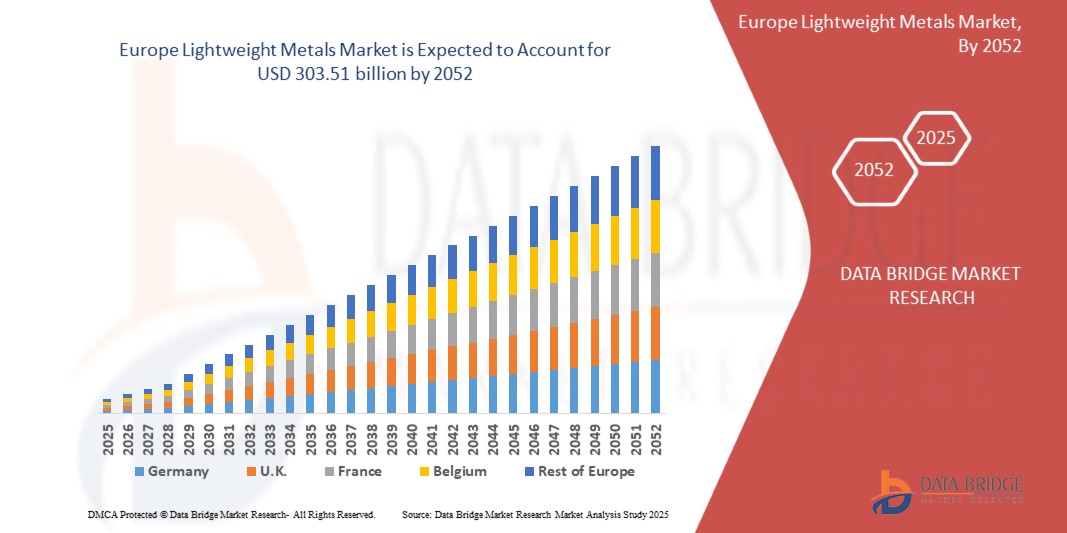

- تم تقييم حجم سوق المعادن خفيفة الوزن في أوروبا بـ 36.60 مليار دولار أمريكي في عام 2024 ومن المتوقع أن يصل إلى 303.51 مليار دولار أمريكي بحلول عام 2052 ، بمعدل نمو سنوي مركب قدره 7.9٪ خلال الفترة المتوقعة

- يتم دعم نمو السوق إلى حد كبير من خلال الطلب المتزايد في قطاعي السيارات والفضاء

- علاوة على ذلك، يتزايد اعتماد المعادن خفيفة الوزن في السلع الاستهلاكية المعمرة والأجهزة المنزلية. تُسرّع هذه العوامل المتقاربة من اعتماد حلول المعادن خفيفة الوزن، مما يُعزز نمو هذه الصناعة بشكل كبير.

تحليل سوق المعادن خفيفة الوزن في أوروبا

- تكتسب المعادن خفيفة الوزن أهمية كبيرة بسبب دورها الأساسي في الصناعات مثل صناعة السيارات والفضاء والبناء والإلكترونيات الاستهلاكية، حيث يعد تقليل وزن المكونات أمرًا بالغ الأهمية لتعزيز كفاءة الوقود والأداء والاستدامة

- إن التركيز المتزايد على كفاءة الوقود، ولوائح انبعاثات الكربون، والتحول الأوروبي نحو المركبات الكهربائية، يُعزز بشكل كبير الطلب على المعادن خفيفة الوزن مثل الألومنيوم والمغنيسيوم والتيتانيوم. بالإضافة إلى ذلك، تُمكّن التطورات في تقنيات معالجة المعادن وعلم المعادن من إنتاج مواد أقوى وأخف وزنًا وأكثر مقاومة للتآكل.

- تهيمن ألمانيا على سوق المعادن خفيفة الوزن في أوروبا، حيث تمتلك أكبر حصة من الإيرادات بنسبة 18.89٪ في عام 2024، ويعزى ذلك إلى صناعات الطيران والسيارات القوية، والتبني المتزايد للسيارات الكهربائية، والبنية التحتية القوية للتصنيع، والاستثمارات المستمرة في تقنيات المواد المتقدمة.

- ومن المتوقع أن تصبح ألمانيا أسرع دولة نمواً في السوق خلال الفترة المتوقعة، مدفوعة باللوائح البيئية الصارمة التي تشجع على تخفيف الوزن، وزيادة إنتاج المركبات الكهربائية والهجينة، والتركيز القوي على الاستدامة وممارسات التصنيع الخضراء.

- من المتوقع أن تهيمن شريحة الألومنيوم وسبائك الألومنيوم على سوق المعادن خفيفة الوزن في أوروبا، بحصة سوقية تبلغ 55.93٪ في عام 2025، وذلك بسبب تنوعها وإمكانية إعادة تدويرها واستخدامها الواسع عبر قطاعات متعددة بما في ذلك السيارات والتعبئة والتغليف والفضاء والبناء، بدعم من الطلب المتزايد في أوروبا على حلول مستدامة وكفؤة في استخدام الطاقة.

نطاق التقرير وتقسيم سوق المعادن خفيفة الوزن في أوروبا

|

صفات |

رؤى رئيسية حول سوق المعادن خفيفة الوزن |

|

القطاعات المغطاة |

|

|

الدول المغطاة |

أوروبا

|

|

اللاعبون الرئيسيون في السوق |

|

|

فرص السوق |

|

|

مجموعات معلومات البيانات ذات القيمة المضافة |

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، فإن تقارير السوق التي تم إعدادها بواسطة Data Bridge Market Research تشمل أيضًا تحليل الاستيراد والتصدير، ونظرة عامة على القدرة الإنتاجية، وتحليل استهلاك الإنتاج، وتحليل اتجاه الأسعار، وسيناريو تغير المناخ، وتحليل سلسلة التوريد، وتحليل سلسلة القيمة، ونظرة عامة على المواد الخام / المواد الاستهلاكية، ومعايير اختيار البائعين، وتحليل PESTLE، وتحليل بورتر، والإطار التنظيمي. |

اتجاهات سوق المعادن خفيفة الوزن في أوروبا

ارتفاع الطلب في قطاعي السيارات والفضاء

- إن القوة الدافعة الرئيسية وراء سوق المعادن خفيفة الوزن في أوروبا هي الدفع المتزايد نحو كفاءة الوقود وتقليل الانبعاثات وتحسين الأداء، وخاصة في صناعات السيارات والفضاء، مدفوعة بالمخاوف البيئية والتفويضات التنظيمية في جميع المناطق.

- على سبيل المثال، في مايو 2021، نشر الباحثان جوفان تان وسيرام راماكريشنا مراجعة شاملة تُبرز جاذبية المغنيسيوم الهندسية، مشيرين إلى خفة وزنه، ونسبة قوته إلى وزنه العالية، وسهولة تشغيله الممتازة. هذه الميزات تجعله مثاليًا لتطبيقات السيارات والفضاء التي تركز على كفاءة الطاقة وخفض الانبعاثات.

- في قطاع السيارات، أدى التحول نحو المركبات الكهربائية إلى زيادة كبيرة في الطلب على المعادن خفيفة الوزن. وتُدمج شركات صناعة السيارات الآن ألواح هياكل من الألومنيوم، وأجزاء هيكلية من المغنيسيوم، وسبائك معدنية في مكونات أساسية مثل الشاسيه والإطارات وأنظمة التعليق، لموازنة وزن البطارية وزيادة مدى السيارة.

- في الوقت نفسه، تواصل صناعة الطيران والفضاء اعتماد سبائك الألومنيوم والليثيوم المتطورة ومكونات التيتانيوم لتقليل وزن الإقلاع، وتحسين كفاءة استهلاك الوقود، وإطالة العمر التشغيلي للطائرات. مع تزايد السفر الجوي العالمي وإنتاج السيارات الكهربائية، من المتوقع أن يظل الطلب على المعادن خفيفة الوزن مرتفعًا.

- وفقًا لبيان صحفي صادر عن شركة Industry Outlook Manufacturing، يتم اعتماد الألمنيوم والمغنيسيوم بسرعة في تصميم المركبات، مما يوفر تحسنًا في استهلاك الوقود بنسبة تتراوح بين 6% و8% لكل انخفاض في وزن المركبة بنسبة 10%. تجعلهما أسعارهما المعقولة وأدائهما الهيكلي مناسبين بشكل خاص للسيارات الكهربائية مقارنةً بالفولاذ التقليدي.

- يُسرّع الطلب المتزايد من قطاعي السيارات والفضاء، إلى جانب التطورات في التصنيع الإضافي وابتكارات السبائك المعدنية، من اعتماد المعادن خفيفة الوزن إقليميًا. ومع إعطاء الصناعات الأولوية للتنقل المستدام والجيل القادم من الطائرات، يستمر دور الألومنيوم والمغنيسيوم والتيتانيوم في التوسع في التطبيقات التقليدية والناشئة.

ديناميكيات سوق المعادن خفيفة الوزن في أوروبا

سائق

تزايد استخدام السلع الاستهلاكية المعمرة والأجهزة المنزلية

- إن الطلب المتزايد على المعادن خفيفة الوزن مدفوع بشكل كبير بتفضيل المستهلكين المتزايد للأجهزة الموفرة للطاقة والمتينة وخفيفة الوزن، والتي تتوافق مع أهداف الاستدامة وتوقعات الأداء في قطاع السلع الاستهلاكية المعمرة.

- على سبيل المثال، شددت مدونة نشرتها الجمعية الدولية للمغنيسيوم على الطلب المتزايد على الأجهزة المدمجة سهلة النقل، مع استبدال سبائك المغنيسيوم بشكل متزايد بالبلاستيك. يتميز المغنيسيوم بخفة وزن مماثلة مع قوة أكبر بكثير، ونقل حراري فائق، وحماية من التداخل الكهرومغناطيسي وتداخل الترددات الراديوية، مما يجعله مثاليًا للأجهزة الحديثة.

- تُستخدم المعادن خفيفة الوزن، مثل الألومنيوم والمغنيسيوم، على نطاق واسع في الثلاجات والغسالات ومكيفات الهواء وأجهزة الطهي، نظرًا لمقاومتها للتآكل، وكفاءتها الحرارية العالية، ومرونة تصميمها. تُسهّل هذه المزايا النقل والتركيب، مع تقليل تكاليف الشحن الإجمالية وانبعاثات الكربون.

- في منشورٍ على مدونةٍ نشرتها شركة ماغنوم أستراليا، ذُكر المغنيسيوم وسبائك خفيفة الوزن أخرى كبدائلَ أفضل للبلاستيك، بفضل متانتها، وتبديدها الحراري، وعزلها الكهرومغناطيسي. ويُؤكد استخدام سوني للمغنيسيوم في نوفمبر 2023 في البنية الداخلية لعدسة FE 300mm F2.8 GM OSS، الدورَ المتنامي لهذا المعدن في الإلكترونيات الاستهلاكية المتقدمة.

- بالإضافة إلى ذلك، سلّط بلينو الضوء على الشعبية المتزايدة للألمنيوم في خزائن المطابخ الحديثة، حيث يُفضّل لمظهره الأنيق ومتانته ومقاومته للتآكل. هذه الخصائص تجعله مادة مثالية لتصاميم المطابخ المعاصرة التي تتطلب مزيجًا من الجمالية والوظائف العملية.

- إلى جانب الأجهزة، تشهد سبائك التيتانيوم أيضًا استخدامًا متزايدًا في المعدات الطبية الحيوية، كما ورد في مقال نُشر في ديسمبر 2023 بواسطة المكتبة الوطنية للطب. وقد عززت توافقية هذه المادة الحيوية الممتازة وقوتها ومقاومتها للتآكل استخدامها في زراعة العظام، وأجهزة طب الأسنان، وتطبيقات أمراض القلب والأوعية الدموية، حيث تتداخل تقنيات الإنتاج غالبًا مع تقنيات سوق السلع الاستهلاكية المعمرة الفاخرة.

- يدعم المبادرات التنظيمية والمعايير الطوعية، مثل ENERGY STAR، تزايد استخدام الألومنيوم والمغنيسيوم في الأجهزة، مما يدفع المصنّعين إلى تحقيق معايير كفاءة أعلى. ومع استمرار البحث والتطوير في تطوير السبائك والابتكار في التصميم، أصبحت المعادن خفيفة الوزن جزءًا لا يتجزأ من تصنيع الأجهزة التي تلبي احتياجات المستهلكين والمعايير البيئية، مما يعزز دورها في النمو المستدام لسوق المعادن خفيفة الوزن في أوروبا.

فرصة

التطورات في إعادة التدوير وإنتاج المعادن الخضراء

- إن التركيز المتزايد على الاستدامة والاقتصاد الدائري يدفع الطلب على المعادن خفيفة الوزن المنتجة من خلال طرق منخفضة الانبعاثات وأنظمة إعادة التدوير المغلقة.

- تتيح التقنيات المتقدمة - مثل فرز السبائك باستخدام الذكاء الاصطناعي، والصهر بالطاقة الشمسية، واستعادة الخبث - إنتاج الألومنيوم والمغنيسيوم المعاد تدويرهما عالي النقاء للاستخدام في قطاعات السيارات والفضاء والبناء.

- تدعم الحكومات والشركات مبادرات المعادن الخضراء من خلال الحوافز السياسية، والمشتريات التي تركز على الحوكمة البيئية والاجتماعية والمؤسسية، والاستثمارات في البنية التحتية منخفضة الكربون.

- في عام 2024، أصبحت شركة الإمارات العالمية للألمنيوم (EGA) أول شركة تنتج الألمنيوم تجاريًا باستخدام الطاقة الشمسية (CelestiAL)، مما أدى إلى خفض الانبعاثات المرتبطة بعمليات الصهر التقليدية بشكل كبير.

- في فبراير 2025، قدمت الأبحاث المنشورة في مجلة Resources, Conservation & Recycling نظامًا قائمًا على CNN مع ميزات SIFT وHOG لتصنيف خردة سبائك الألومنيوم بدقة تزيد عن 90%، مما يحسن كفاءة إعادة التدوير.

- قام مشروع RAD4AL المدعوم من الاتحاد الأوروبي بتطوير أول خط طلاء لفائف الألومنيوم المعالجة بالإشعاع في أوروبا، مما أدى إلى التخلص من أفران الغاز الطبيعي ومذيبات المركبات العضوية المتطايرة، وتحسين كفاءة الطاقة بشكل كبير وتقليل الانبعاثات

ضبط النفس/التحدي

تكاليف الإنتاج والمعالجة المرتفعة

- تُشكّل تكاليف الإنتاج والمعالجة المرتفعة المرتبطة بتصنيع المعادن خفيفة الوزن، بما في ذلك الألومنيوم والتيتانيوم والمغنيسيوم، عائقًا كبيرًا أمام توسّع السوق الإقليمية. تتطلب هذه المعادن أساليب استخلاص وتكرير كثيفة الاستهلاك للطاقة، مثل الصهر في درجات حرارة عالية، والتحليل الكهربائي، والتقطير الفراغي، والتي تتطلب جميعها بنية تحتية متطورة واستثمارات رأسمالية ضخمة.

- على سبيل المثال، في ديسمبر 2023، سلّطت دراسةٌ بعنوان "التيتانيوم: أداءٌ عالٍ، تكلفةٌ مرتفعة - عوائق وتحدياتٌ أمام الاستخدام الواسع" أجراها باحثون في المركز الوطني للبحوث العلمية والهندسة والتكنولوجيا والهندسة والرياضيات (CNR-STEMS) بإيطاليا، الضوء على عملية كرول كعاملٍ رئيسيٍّ في ارتفاع تكلفة إنتاج التيتانيوم. وحددت الدراسة خطوات الاستخلاص العديدة، وتفاعل التيتانيوم مع الأكسجين والنيتروجين، وضعف قابلية التصنيع بسبب انخفاض الموصلية الحرارية، كعوامل رئيسيةٍ وراء التكلفة.

- بالإضافة إلى ذلك، استكشفت دراسةٌ أجراها معهد MDPI في فبراير 2023 قيودَ عملية كرول، مؤكدةً أن إنتاج كيلوغرام واحد فقط من التيتانيوم يتطلب حوالي 257.78 ميغا جول من الطاقة. ورغم كونها المعيارَ الصناعي، فإن عدم كفاءة عملية كرول ومتطلباتها من الطاقة يعيقان بشدة إمكانيةَ التوسع في إنتاج التيتانيوم وتكاليفه المعقولة.

- يتطلب إنتاج المعادن خفيفة الوزن، وخاصةً في قطاعات مثل الفضاء والسيارات، رقابة صارمة على الجودة ودقة في التصنيع، مما يزيد من تكاليف العمالة ووقت المعالجة. هذه العوامل تُثني المصنّعين الصغار والاقتصادات الناشئة عن دخول السوق، وتحدّ من انتشار استخدام هذه المعادن في التطبيقات الحساسة للتكلفة.

- في حين أن البحث والتطوير المستمر في تقنيات إعادة التدوير وتحسين السبائك وكفاءة التصنيع أمر واعد، فإن قيود الطاقة والتكلفة الحالية لا تزال تعمل على تقليل القدرة التنافسية، وتثبط الاستثمار، وتقييد اختراق السوق - وخاصة في المناطق ذات إمدادات الطاقة غير المستقرة أو باهظة الثمن.

- إلى أن تُصبح البدائل الاقتصادية والقابلة للتطوير لعمليات مثل هول-هيرولت للألمنيوم وكرول للتيتانيوم مجدية تجاريًا، سيظل هيكل التكلفة المرتفعة عائقًا رئيسيًا أمام سوق المعادن الخفيفة في أوروبا. وسيكون التغلب على هذه التحديات أمرًا بالغ الأهمية لفتح المجال أمام تبني أوسع لهذه العمليات في مختلف صناعات الاستخدام النهائي.

نطاق سوق المعادن خفيفة الوزن في أوروبا

يتم تقسيم السوق على أساس النوع والتطبيق.

- حسب النوع

يُقسّم السوق، حسب نوعه، إلى الألومنيوم وسبائكه، والتيتانيوم وسبائكه، والمغنيسيوم وسبائكه، والبريليوم وسبائكه، والصلب وسبائكه، وغيرها. في عام 2025، سيهيمن قطاع الألومنيوم وسبائكه على السوق بحصة سوقية تبلغ 55.93%، مدفوعًا باستخدامه الواسع في صناعات السيارات والفضاء والتعبئة والتغليف والبناء. ومن أهم العوامل التي تُعزى إلى خفة وزن الألومنيوم، ومقاومته للتآكل، وقابليته العالية لإعادة التدوير، وقدرته على التكيف مع التطبيقات الموفرة للطاقة والمستدامة.

من المتوقع أن يشهد قطاع الألومنيوم وسبائكه أسرع معدل نمو بنسبة 8.1% بين عامي 2025 و2052، مدفوعًا بالاعتماد المتزايد عليه في صناعات الطيران والفضاء، والغرسات الطبية، والدفاع، نظرًا لارتفاع نسبة القوة إلى الوزن، والتوافق الحيوي، والمقاومة الفائقة للبيئات القاسية. كما تُسهم التطورات المستمرة في تقنيات معالجة التيتانيوم وإعادة تدويره في تزايد الطلب عليه.

- حسب الطلب

بناءً على التطبيق، يُقسّم السوق إلى قطاعات السيارات والنقل، والفضاء والدفاع، والزراعة، والإلكترونيات والسلع الاستهلاكية، والقطاع البحري، وغيرها. ومن المتوقع أن يستحوذ قطاع السيارات والنقل على أكبر حصة من إيرادات السوق بنسبة 41.87% في عام 2025، مدفوعًا بالاعتماد الواسع على المعادن خفيفة الوزن لتحسين كفاءة الوقود، وتقليل الانبعاثات، وتلبية المعايير التنظيمية الصارمة. وقد ساهم التحول المتزايد نحو المركبات الكهربائية، وزيادة استخدام مواد مثل الألومنيوم والمغنيسيوم في هياكل السيارات ومكونات أنظمة الدفع، في تعزيز نمو هذا القطاع.

من المتوقع أن يشهد قطاع السيارات والنقل أسرع معدل نمو سنوي مركب بنسبة 8.3% من عام 2025 إلى عام 2052، مدفوعًا بالطلب المتزايد على طائرات الجيل التالي، وزيادة جهود التحديث العسكري، واستخدام سبائك التيتانيوم والألومنيوم والليثيوم لتقليل وزن الطائرات، وتحسين الأداء، وتحسين كفاءة الوقود.

تحليل إقليمي لسوق المعادن خفيفة الوزن في أوروبا

- أوروبا هي ثاني أكبر سوق للمعادن خفيفة الوزن، حيث ستستحوذ على حصة كبيرة من الإيرادات في عام 2025، ومن المتوقع أن تنمو بمعدل نمو سنوي مركب قوي يبلغ 7.9% من عام 2025 إلى عام 2052. ويعود نمو المنطقة إلى اللوائح التنظيمية الصارمة للانبعاثات، والاعتماد المتزايد على التنقل الكهربائي، وزيادة الاستثمارات في التقنيات خفيفة الوزن في قطاعات السيارات والفضاء والسلع الاستهلاكية.

- تستفيد أوروبا من أطر سياسات قوية، مثل الصفقة الخضراء الأوروبية وحزمة "الكفاءة لـ 55 عامًا"، التي تشجع على تخفيف وزن المركبات وكفاءة استهلاك الطاقة. علاوة على ذلك، يُسهم التعاون بين مصنعي المعدات الأصلية ومبتكري علوم المواد، بالإضافة إلى برامج البحث والتطوير المدعومة حكوميًا، في تعزيز التقدم التكنولوجي في تطبيقات الألومنيوم والتيتانيوم والمغنيسيوم.

- تتصدر دول مثل ألمانيا وفرنسا والمملكة المتحدة المنطقة من حيث التبني واسع النطاق للمواد خفيفة الوزن في الصناعات الرئيسية والبنية التحتية القوية للتصنيع

نظرة عامة على سوق المعادن خفيفة الوزن في ألمانيا وأوروبا

من المتوقع أن تحظى ألمانيا بأكبر حصة من إيرادات السوق بنسبة 19.44% في أوروبا بحلول عام 2025، وذلك بفضل ريادتها في تصنيع السيارات، والحضور القوي لموردي صناعة الطيران من الدرجة الأولى، والاستثمارات المستمرة في البحث والتطوير للمواد المتقدمة.

نظرة عامة على سوق المعادن الخفيفة في فرنسا وأوروبا

من المتوقع أن تسجل فرنسا معدل نمو سنوي مركب ملحوظًا بنسبة 8.0% بين عامي 2025 و2052، مدفوعًا بقطاعي الطيران والدفاع، لا سيما بوجود شركات عالمية رائدة مثل إيرباص. وتساهم المبادرات الحكومية الداعمة للطيران الأخضر، وأبحاث المواد خفيفة الوزن، وتشجيع ممارسات الاقتصاد الدائري، في تعزيز الطلب على السبائك والمركبات عالية الأداء.

نظرة عامة على سوق المعادن الخفيفة في المملكة المتحدة وأوروبا

تبرز المملكة المتحدة كمساهم رئيسي في سوق المعادن خفيفة الوزن في أوروبا، بدعم من برامج كهربة السيارات، ومراكز ابتكار المواد المستدامة، والشراكات بين القطاعين العام والخاص. وبفضل التمويل الكبير لمركبات الطاقة النظيفة وتحديث الدفاعات، تعمل المملكة المتحدة على تعزيز اعتماد الألومنيوم والمغنيسيوم والمركبات الهجينة في التطبيقات الهيكلية والتطبيقات ذات الأهمية الحاسمة للأداء.

حصة سوق المعادن خفيفة الوزن في أوروبا

وتقود صناعة المعادن خفيفة الوزن في المقام الأول شركات راسخة، بما في ذلك:

- مجموعة هونغتشياو الصينية المحدودة (الصين)

- شركة Hindalco Industries Ltd. (الهند)

- thyssenkrupp Steel Europe (ألمانيا)

- شركة أميتيك (الولايات المتحدة)

- شركة فيدانتا المحدودة (الهند)

- شركة نورسك هيدرو آسا (النرويج)

- AMAG Austria Metall AG (النمسا)

- SSAB (السويد)

- كوستيليوم (فرنسا)

- أرسيلور ميتال (لوكسمبورغ)

- شركة لوكسفر القابضة بي إل سي (المملكة المتحدة)

أحدث التطورات في سوق المعادن خفيفة الوزن في أوروبا

- في يناير 2025، طبّق فرع الألومينا الثاني في هونغتشياو بروتوكولات اختبار متطورة لتحسين جودة وكفاءة عمليات الإنتاج بشكل ملحوظ. تركز هذه المبادرة على تشديد ضوابط الجودة، وتسريع تحليل البيانات، وتحسين معايرة المعدات. ونتيجةً لذلك، حقق الفرع اتساقًا أكبر في معايير المنتجات، وقلّل من العيوب. تعكس هذه الخطوة التزام هونغتشياو بالأداء العالي، والسلامة التشغيلية، ورضا العملاء. كما يُعدّ التدريب المستمر وتحديث مرافق المختبرات من العوامل الرئيسية المساهمة في هذا التحسين.

- في يونيو 2025، استحوذت شركة هندالكو على شركة ألوكيم الأمريكية مقابل 125 مليون دولار أمريكي من خلال شركتها التابعة أديتيا القابضة. تُضيف ألوكيم، المُنتجة للألومينا عالية النقاء، قيمةً استراتيجيةً لتوسع هندالكو العالمي في قطاع الألومينا عالية التقنية. تُعزز هذه الخطوة تركيز هندالكو على المنتجات ذات القيمة المضافة، مدعومةً بالنمو القوي والربحية العالية لأعمالها الحالية في مجال الألومينا المتخصصة.

- في أكتوبر 2024، طورت شركة تيسنكروب ستيل منتجها "بلو مينت ستيل"، لإنتاج فولاذ منخفض انبعاثات ثاني أكسيد الكربون باستخدام الخردة في أفران الصهر. وهذا يُساعد الشركة وعملائها على تقليل البصمة الكربونية. كما يجري تطوير فولاذ عالي الأداء وشديد المتانة، مما يُمكّن من إنتاج مركبات أخف وزنًا وأكثر أمانًا مع كفاءة أفضل في استهلاك الوقود وأداء أفضل.

- في يوليو 2025، وضع رئيس مجلس إدارة مجموعة تاتا، ن. شاندراسيكاران، حجر الأساس لفرن القوس الكهربائي (EAF) الجديد لشركة تاتا ستيل المملكة المتحدة في بورت تالبوت. يهدف هذا المشروع للصلب الأخضر، الذي تبلغ تكلفته 2.25 مليار دولار أمريكي، بدعم من حكومة المملكة المتحدة بقيمة 500 مليون جنيه إسترليني، إلى خفض انبعاثات الكربون بنسبة 90% وتوفير 5000 وظيفة. وسيكون فرن القوس الكهربائي من أكبر هذه المشاريع في العالم، حيث ينتج 3 ملايين طن من الفولاذ منخفض الكربون سنويًا. وتمثل هذه المبادرة خطوةً رئيسيةً في استراتيجية تاتا لإزالة الكربون والتحول الصناعي في المملكة المتحدة.

- في أبريل 2024، استضافت شركة فيدانتا للألمنيوم مؤتمر "أوتو-إيدج" للترويج لاستخدام الألومنيوم في صناعة السيارات. جمع هذا الحدث شركات السيارات الرائدة لمناقشة مستقبل التنقل ودور المعادن خفيفة الوزن. عرضت فيدانتا مجموعتها المتنوعة من المنتجات، بما في ذلك سبائك الألومنيوم المستخدمة في تصنيع المركبات.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INDUSTRY RIVALRY

4.2 PRODUCTION CONSUMPTION ANALYSIS

4.3 VALUE CHAIN ANALYSIS: EUROPE LIGHTWEIGHT METALS MARKET

4.3.1 PROCUREMENT:

4.3.2 MANUFACTURING:

4.3.3 MARKETING & DISTRIBUTION:

4.4 VENDOR SELECTION CRITERIA

4.4.1 QUALITY AND CONSISTENCY OF SUPPLY

4.4.2 RELIABILITY AND TIMELINESS

4.4.3 COST COMPETITIVENESS

4.4.4 TECHNICAL CAPABILITY AND INNOVATION

4.4.5 REGULATORY COMPLIANCE AND SUSTAINABILITY

4.4.6 FINANCIAL STABILITY

4.4.7 CUSTOMER SERVICE AND SUPPORT

4.5 BRAND OUTLOOK

4.5.1 BRAND COMPETITIVE ANALYSIS OF THE EUROPE LIGHTWEIGHT METALS MARKET

4.5.2 PRODUCT VS BRAND OVERVIEW

4.5.3 PRODUCT OVERVIEW

4.5.4 BRAND OVERVIEW

4.5.5 CONCLUSION

4.6 CLIMATE CHANGE SCENARIO

4.6.1 ENVIRONMENTAL CONCERNS

4.6.2 INDUSTRY RESPONSE

4.6.3 GOVERNMENT’S ROLE

4.6.4 ANALYST RECOMMENDATIONS

4.7 COST ANALYSIS BREAKDOWN

4.7.1 RAW MATERIALS

4.7.2 ENERGY CONSUMPTION

4.7.3 LABOR AND OPERATIONAL COSTS

4.7.4 RESEARCH AND DEVELOPMENT

4.8 INDUSTRY ECOSYSTEM ANALYSIS

4.8.1 PROMINENT COMPANIES

4.8.2 SMALL & MEDIUM-SIZE COMPANIES

4.8.3 END USERS

4.8.4 RESEARCH AND DEVELOPMENT

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.1 CLIMATE CHANGE SCENARIO

4.10.1 ENVIRONMENTAL CONCERNS

4.10.2 INDUSTRY RESPONSE

4.10.3 GOVERNMENT’S ROLE

4.10.4 ANALYST RECOMMENDATIONS

4.11 CONSUMER BUYING BEHAVIOUR

4.12 PROFIT MARGINS SCENARIO

4.12.1 MARGIN RANGE BY PRODUCT TYPE

4.12.2 KEY FACTORS INFLUENCING MARGINS

4.12.3 DOMESTIC VS. EXPORT MARKET MARGINS

4.13 RAW MATERIAL SOURCING ANALYSIS ON THE EUROPE LIGHTWEIGHT METALS MARKET

4.13.1 ALUMINUM

4.13.2 MAGNESIUM

4.13.3 TITANIUM

4.13.4 BERYLLIUM

4.13.5 CARBON AND METAL MATRIX COMPOSITES (ADDITIVES)

4.13.6 CONCLUSION

4.14 TECHNOLOGIES ADVANCEMENTS

4.14.1 OVERVIEW

4.14.2 ADVANCED ALLOY DEVELOPMENT

4.14.3 METALLURGICAL PROCESS INNOVATIONS

4.14.4 SURFACE ENGINEERING AND COATINGS

4.14.5 RECYCLING AND CIRCULAR MANUFACTURING TECHNOLOGIES

4.14.6 INTEGRATED LIGHTWEIGHT DESIGN AND SIMULATION TOOLS

4.15 TARIFFS AND THEIR IMPACT ON MARKET

4.15.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.15.2 OUTLOOK: LOCAL PRODUCTION VS IMPORT RELIANCE

4.15.3 VENDOR SELECTION CRITERIA DYNAMICS

4.15.4 IMPACT ON SUPPLY CHAIN

4.15.4.1 RAW MATERIAL PROCUREMENT

4.15.4.2 MANUFACTURING AND PRODUCTION

4.15.4.3 LOGISTICS AND DISTRIBUTION

4.15.4.4 PRICE PITCHING AND POSITION OF MARKET

4.15.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.15.5.1 SUPPLY CHAIN OPTIMIZATION

4.15.5.2 JOINT VENTURE ESTABLISHMENTS

4.15.6 IMPACT ON PRICES

4.15.7 REGULATORY INCLINATION

4.15.7.1 GEOPOLITICAL SITUATION

4.15.7.2 TRADE PARTNERSHIPS BETWEEN COUNTRIES

4.15.7.2.1 FREE TRADE AGREEMENTS

4.15.7.2.2 ALLIANCE ESTABLISHMENTS

4.15.7.2.3 STATUS ACCREDITATION (INCLUDING MFN)

4.15.7.3 DOMESTIC COURSE OF CORRECTION

4.15.7.3.1 INCENTIVE SCHEMES TO BOOST PRODUCTION OUTPUTS

4.15.7.3.2 ESTABLISHMENT OF SPECIAL ECONOMIC ZONES / INDUSTRIAL PARKS

5 REGULATORY COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND IN THE AUTOMOTIVE AND AEROSPACE SECTORS

6.1.2 GROWING ADOPTION OF CONSUMER DURABLES AND APPLIANCES

6.1.3 GROWING DEMAND FOR FUEL-EFFICIENT VEHICLES GLOBALLY

6.1.4 REGULATORY INITIATIVES SUPPORTING LIGHTWEIGHT DESIGN

6.2 RESTRAINTS

6.2.1 HIGH PRODUCTION AND PROCESSING COSTS

6.2.2 CORROS.ION SENSITIVITY AND ALLOY LIMITATIONS

6.3 OPPORTUNITIES

6.3.1 RISING PENETRATION OF ELECTRIC VEHICLES WORLDWIDE

6.3.2 ADVANCEMENTS IN RECYCLING AND GREEN METAL PRODUCTION

6.3.3 MARINE INDUSTRY SHIFTING TOWARD WEIGHT-OPTIMIZED DESIGNS

6.4 CHALLENGES

6.4.1 RAW MATERIAL AVAILABILITY AND GEOPOLITICAL DEPENDENCY

6.4.2 COMPATIBILITY ISSUES WITH TRADITIONAL MANUFACTURING EQUIPMENT

7 EUROPE LIGHTWEIGHT METALS MARKET, BY TYPE

7.1 OVERVIEW

7.2 ALUMINUM AND ALUMINUM ALLOY

7.3 TITANIUM AND TITANIUM ALLOYS

7.4 MAGNESIUM AND MAGNESIUM ALLOY

7.5 STEEL AND STEEL ALLOYS

7.6 BERYLLIUM AND BERYLLIUM ALLOY

7.7 OTHERS

8 EUROPE LIGHTWEIGHT METALS MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 AUTOMOTIVE & TRANSPORTATION

8.3 AEROSPACE & DEFENSE

8.4 ELECTRONICS & CONSUMER GOODS

8.5 MARINE

8.6 AGRICULTURE

8.7 OTHERS

9 EUROPE LIGHTWEIGHT METALS MARKET, BY REGION

9.1 EUROPE

9.1.1 GERMANY

9.1.2 FRANCE

9.1.3 U.K.

9.1.4 SPAIN

9.1.5 ITALY

9.1.6 NETHERLANDS

9.1.7 RUSSIA

9.1.8 SWEDEN

9.1.9 BELGIUM

9.1.10 SWITZERLAND

9.1.11 POLAND

9.1.12 DENMARK

9.1.13 FINLAND

9.1.14 TURKEY

9.1.15 NORWAY

9.1.16 LUXEMBOURG

9.1.17 REST OF EUROPE

10 EUROPE LIGHTWEIGHT METALS MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: EUROPE

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 CHINA HONGQIAO GROUP LIMITED

12.1.1 COMPANY SNAPSHOT

12.1.2 RECENT FINANCIALS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 HINDALCO INDUSTRIES LTD.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENT

12.3 THYSSENKRUPP STEEL EUROPE

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENT

12.4 AMETEK INC.

12.4.1 COMPANY SNAPSHOT

12.4.2 RECENT FINANCIALS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENT

12.5 VEDANTA LIMITED

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 ALCOA CORPORATION

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT DEVELOPMENT/NEWS

12.7 ARCELORMITTAL

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 AMAG AUSTRIA METALL AG

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 AMETEK SPECIALTY METAL PRODUCTS (AMETEK INC.)

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 ATI, INC.

12.10.1 COMPANY SNAPSHOT

12.10.2 REVENUE ANALYSIS

12.10.3 PRODUCT PORTFOLIO

12.10.4 RECENT DEVELOPMENT

12.11 ATLAS STEELS

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENTS/NEWS

12.12 BAVARIA STAHL UND METALL IMPORT/EXPORT GMBH

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS/NEWS

12.13 COSTELLIUM

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENT

12.14 CLINTON ALUMINUM

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 CORPORATION VSMPO-AVISMA

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 DWA ALUMINUM COMPOSITES USA, INC

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 EMIRATES EUROPE ALUMINIUM PJSC

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 ICL

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS/NEWS

12.19 KAISER ALUMINUM

12.19.1 COMPANY SNAPSHOT

12.19.2 REVENUE ANALYSIS

12.19.3 PRODUCT PORTFOLIO

12.19.4 RECENT DEVELOPMENT

12.2 LUXFER HOLDINGS PLC

12.20.1 COMPANY SNAPSHOT

12.20.2 REVENUE ANALYSIS

12.20.3 PRODUCT PORTFOLIO

12.20.4 RECENT DEVELOPMENTS

12.21 METALWERKS

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENTS/NEWS

12.22 MATERION CORPORATION

12.22.1 COMPANY SNAPSHOT

12.22.2 REVENUE ANALYSIS

12.22.3 PRODUCT PORTFOLIO

12.22.4 RECENT DEVELOPMENTS/NEWS

12.23 MSKS IP INC.

12.23.1 COMPANY SNAPSHOT

12.23.2 PRODUCT PORTFOLIO

12.23.3 RECENT DEVELOPMENT

12.24 NUCOR CORPORATION

12.24.1 COMPANY SNAPSHOT

12.24.2 REVENUE ANALYSIS

12.24.3 PRODUCT PORTFOLIO

12.24.4 RECENT DEVELOPMENTS

12.25 NORSK HYDRO ASA

12.25.1 COMPANY SNAPSHOT

12.25.2 PRODUCT PORTFOLIO

12.25.3 RECENT DEVELOPMENT/NEWS

12.26 PRECISION CASTPARTS CORP.

12.26.1 COMPANY SNAPSHOT

12.26.2 PRODUCT PORTFOLIO

12.26.3 RECENT DEVELOPMENT

12.27 POSCO

12.27.1 COMPANY SNAPSHOT

12.27.2 REVENUE ANALYSIS

12.27.3 PRODUCT PORTFOLIO

12.27.4 RECENT DEVELOPMENTS/NEWS

12.28 RUSAL

12.28.1 COMPANY SNAPSHOT

12.28.2 REVENUE ANALYSIS

12.28.3 PRODUCT PORTFOLIO

12.28.4 RECENT DEVELOPMENT

12.29 RIO TINTO

12.29.1 COMPANY SNAPSHOT

12.29.2 REVENUE ANALYSIS

12.29.3 PRODUCT PORTFOLIO

12.29.4 RECENT DEVELOPMENT

12.3 RELIANCE, INC.

12.30.1 COMPANY SNAPSHOT

12.30.2 REVENUE ANALYSIS

12.30.3 PRODUCT PORTFOLIO

12.30.4 RECENT DEVELOPMENT

12.31 RYERSON HOLDING CORPORATION

12.31.1 COMPANY SNAPSHOT

12.31.2 REVENUE ANALYSIS

12.31.3 PRODUCT PORTFOLIO

12.31.4 RECENT DEVELOPMENTS

12.32 SCOPE METALS GROUP LTD.

12.32.1 COMPANY SNAPSHOT

12.32.2 REVENUE ANALYSIS

12.32.3 PRODUCT PORTFOLIO

12.32.4 RECENT DEVELOPMENT

12.33 SSAB

12.33.1 COMPANY SNAPSHOT

12.33.2 REVENUE ANALYSIS

12.33.3 PRODUCT PORTFOLIO

12.33.4 RECENT DEVELOPMENT

12.34 SMITHS METAL CENTRES LIMITED

12.34.1 COMPANY SNAPSHOT

12.34.2 PRODUCT PORTFOLIO

12.34.3 RECENT DEVELOPMENT

12.35 TW METALS, LLC.

12.35.1 COMPANY SNAPSHOT

12.35.2 PRODUCT PORTFOLIO

12.35.3 RECENT DEVELOPMENT

12.36 TATA STEEL

12.36.1 COMPANY SNAPSHOT

12.36.2 RECENT FINANCIALS

12.36.3 PRODUCT PORTFOLIO

12.36.4 RECENT DEVELOPMENT

12.37 THYSSENKRUPP MATERIALS NA, INC.

12.37.1 COMPANY SNAPSHOT

12.37.2 PRODUCT PORTFOLIO

12.37.3 RECENT DEVELOPMENT

12.38 TOHO TITANIUM CO., LTD.

12.38.1 COMPANY SNAPSHOT

12.38.2 REVENUE ANALYSIS

12.38.3 PRODUCT PORTFOLIO

12.38.4 RECENT DEVELOPMENT

12.39 US MAGNESIUM LLC

12.39.1 COMPANY SNAPSHOT

12.39.2 PRODUCT PORTFOLIO

12.39.3 RECENT DEVELOPMENT

12.4 VULCAN INC.

12.40.1 COMPANY SNAPSHOT

12.40.2 PRODUCT PORTFOLIO

12.40.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

표 목록

TABLE 1 CONSUMER BUYING BEHAVIOUR

TABLE 2 REGULATORY COVERAGE

TABLE 3 EUROPE ELECTRIC VEHICLE (EV) SALES AND MARKET SHARE (2023–2024)

TABLE 4 WEIGHT COMPARISON BETWEEN STEEL AND ALUMINUM WELD PLATES (PER 100 PIECES)

TABLE 5 WEIGHT COMPARISON BETWEEN STEEL AND ALUMINUM COVER PLATE (PER 100 PIECES)

TABLE 6 EUROPE LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 7 EUROPE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 8 EUROPE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 9 EUROPE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND

TABLE 10 EUROPE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 11 EUROPE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 12 EUROPE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 13 EUROPE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 14 EUROPE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 15 EUROPE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 16 EUROPE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 17 EUROPE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 18 EUROPE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 19 EUROPE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 20 EUROPE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 21 EUROPE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 22 EUROPE OTHERS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 23 EUROPE LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 24 EUROPE AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 25 EUROPE AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 26 EUROPE PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 27 EUROPE ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 28 EUROPE LIGHT COMMERCIAL VEHICLES (LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 29 EUROPE HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 30 EUROPE TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 31 EUROPE AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 32 EUROPE AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 33 EUROPE ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 34 EUROPE AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 35 EUROPE CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 36 EUROPE PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 37 EUROPE AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 38 EUROPE HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 39 EUROPE MARINE IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 40 EUROPE MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 41 EUROPE AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 42 EUROPE AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 43 EUROPE OTHERS IN LIGHTWEIGHT METALS MARKET, BY REGION, 2018-2052 (USD THOUSAND)

TABLE 44 EUROPE LIGHTWEIGHT METALS MARKET, BY COUNTRY, 2018-2052 (USD THOUSAND)

TABLE 45 EUROPE LIGHTWEIGHT METALS MARKET, BY COUNTRY, 2018-2052 (TONS)

TABLE 46 EUROPE LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 47 EUROPE LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 48 EUROPE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 49 EUROPE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 50 EUROPE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 51 EUROPE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 52 EUROPE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 53 EUROPE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 54 EUROPE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 55 EUROPE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 56 EUROPE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 57 EUROPE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 58 EUROPE LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 59 EUROPE AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 60 EUROPE PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 61 EUROPE ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 62 EUROPE LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 63 EUROPE HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 64 EUROPE TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 65 EUROPE AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 66 EUROPE ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 67 EUROPE CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 68 EUROPE PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 69 EUROPE AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 70 EUROPE HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 71 EUROPE MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 72 EUROPE AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 73 GERMANY LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 74 GERMANY LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 75 GERMANY ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 76 GERMANY ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 77 GERMANY TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 78 GERMANY TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 79 GERMANY MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 80 GERMANY MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 81 GERMANY STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 82 GERMANY STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 83 GERMANY BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 84 GERMANY BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 85 GERMANY LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 86 GERMANY AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 87 GERMANY PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 88 GERMANY ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 89 GERMANY LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 90 GERMANY HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 91 GERMANY TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 92 GERMANY AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 93 GERMANY ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 94 GERMANY CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 95 GERMANY PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 96 GERMANY AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 97 GERMANY HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 98 GERMANY MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 99 GERMANY AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 100 FRANCE LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 101 FRANCE LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 102 FRANCE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 103 FRANCE ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 104 FRANCE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 105 FRANCE TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 106 FRANCE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 107 FRANCE MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 108 FRANCE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 109 FRANCE STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 110 FRANCE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 111 FRANCE BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 112 FRANCE LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 113 FRANCE AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 114 FRANCE PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 115 FRANCE ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 116 FRANCE LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 117 FRANCE HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 118 FRANCE TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 119 FRANCE AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 120 FRANCE ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 121 FRANCE CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 122 FRANCE PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 123 FRANCE AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 124 FRANCE HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 125 FRANCE MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 126 FRANCE AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 127 U.K. LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 128 U.K. LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 129 U.K. ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 130 U.K. ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 131 U.K. TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 132 U.K. TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 133 U.K. MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 134 U.K. MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 135 U.K. STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 136 U.K. STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 137 U.K. BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 138 U.K. BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 139 U.K. LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 140 U.K. AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 141 U.K. PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 142 U.K. ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 143 U.K. LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 144 U.K. HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 145 U.K. TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 146 U.K. AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 147 U.K. ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 148 U.K. CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 149 U.K. PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 150 U.K. AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 151 U.K. HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 152 U.K. MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 153 U.K. AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 154 SPAIN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 155 SPAIN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 156 SPAIN ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 157 SPAIN ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 158 SPAIN TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 159 SPAIN TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 160 SPAIN MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 161 SPAIN MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 162 SPAIN STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 163 SPAIN STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 164 SPAIN BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 165 SPAIN BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 166 SPAIN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 167 SPAIN AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 168 SPAIN PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 169 SPAIN ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 170 SPAIN LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 171 SPAIN HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 172 SPAIN TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 173 SPAIN AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 174 SPAIN ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 175 SPAIN CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 176 SPAIN PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 177 SPAIN AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 178 SPAIN HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 179 SPAIN MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 180 SPAIN AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 181 ITALY LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 182 ITALY LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 183 ITALY ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 184 ITALY ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 185 ITALY TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 186 ITALY TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 187 ITALY MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 188 ITALY MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 189 ITALY STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 190 ITALY STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 191 ITALY BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 192 ITALY BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 193 ITALY LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 194 ITALY AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 195 ITALY PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 196 ITALY ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 197 ITALY LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 198 ITALY HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 199 ITALY TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 200 ITALY AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 201 ITALY ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 202 ITALY CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 203 ITALY PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 204 ITALY AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 205 ITALY HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 206 ITALY MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 207 ITALY AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 208 NETHERLANDS LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 209 NETHERLANDS LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 210 NETHERLANDS ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 211 NETHERLANDS ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 212 NETHERLANDS TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 213 NETHERLANDS TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 214 NETHERLANDS MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 215 NETHERLANDS MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 216 NETHERLANDS STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 217 NETHERLANDS STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 218 NETHERLANDS BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 219 NETHERLANDS BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 220 NETHERLANDS LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 221 NETHERLANDS AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 222 NETHERLANDS PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 223 NETHERLANDS ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 224 NETHERLANDS LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 225 NETHERLANDS HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 226 NETHERLANDS TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 227 NETHERLANDS AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 228 NETHERLANDS ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 229 NETHERLANDS CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 230 NETHERLANDS PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 231 NETHERLANDS AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 232 NETHERLANDS HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 233 NETHERLANDS MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 234 NETHERLANDS AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 235 RUSSIA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 236 RUSSIA LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 237 RUSSIA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 238 RUSSIA ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 239 RUSSIA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 240 RUSSIA TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 241 RUSSIA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 242 RUSSIA MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 243 RUSSIA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 244 RUSSIA STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 245 RUSSIA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 246 RUSSIA BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 247 RUSSIA LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 248 RUSSIA AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 249 RUSSIA PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 250 RUSSIA ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 251 RUSSIA LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 252 RUSSIA HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 253 RUSSIA TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 254 RUSSIA AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 255 RUSSIA ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 256 RUSSIA CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 257 RUSSIA PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 258 RUSSIA AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 259 RUSSIA HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 260 RUSSIA MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 261 RUSSIA AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 262 SWEDEN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 263 SWEDEN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 264 SWEDEN ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 265 SWEDEN ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 266 SWEDEN TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 267 SWEDEN TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 268 SWEDEN MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 269 SWEDEN MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 270 SWEDEN STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 271 SWEDEN STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 272 SWEDEN BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 273 SWEDEN BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 274 SWEDEN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 275 SWEDEN AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 276 SWEDEN PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 277 SWEDEN ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 278 SWEDEN LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 279 SWEDEN HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 280 SWEDEN TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 281 SWEDEN AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 282 SWEDEN ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 283 SWEDEN CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 284 SWEDEN PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 285 SWEDEN AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 286 SWEDEN HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 287 SWEDEN MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 288 SWEDEN AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 289 BELGIUM LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 290 BELGIUM LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 291 BELGIUM ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 292 BELGIUM ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 293 BELGIUM TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 294 BELGIUM TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 295 BELGIUM MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 296 BELGIUM MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 297 BELGIUM STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 298 BELGIUM STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 299 BELGIUM BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 300 BELGIUM BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 301 BELGIUM LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 302 BELGIUM AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 303 BELGIUM PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 304 BELGIUM ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 305 BELGIUM LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 306 BELGIUM HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 307 BELGIUM TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 308 BELGIUM AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 309 BELGIUM ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 310 BELGIUM CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 311 BELGIUM PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 312 BELGIUM AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 313 BELGIUM HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 314 BELGIUM MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 315 BELGIUM AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 316 SWITZERLAND LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 317 SWITZERLAND LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 318 SWITZERLAND ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 319 SWITZERLAND ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 320 SWITZERLAND TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 321 SWITZERLAND TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 322 SWITZERLAND MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 323 SWITZERLAND MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 324 SWITZERLAND STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 325 SWITZERLAND STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 326 SWITZERLAND BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 327 SWITZERLAND BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 328 SWITZERLAND LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 329 SWITZERLAND AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 330 SWITZERLAND PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 331 SWITZERLAND ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 332 SWITZERLAND LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 333 SWITZERLAND HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 334 SWITZERLAND TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 335 SWITZERLAND AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 336 SWITZERLAND ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 337 SWITZERLAND CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 338 SWITZERLAND PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 339 SWITZERLAND AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 340 SWITZERLAND HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 341 SWITZERLAND MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 342 SWITZERLAND AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 343 POLAND LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 344 POLAND LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 345 POLAND ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 346 POLAND ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 347 POLAND TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 348 POLAND TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 349 POLAND MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 350 POLAND MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 351 POLAND STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 352 POLAND STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 353 POLAND BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 354 POLAND BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 355 POLAND LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 356 POLAND AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 357 POLAND PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 358 POLAND ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 359 POLAND LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 360 POLAND HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 361 POLAND TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 362 POLAND AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 363 POLAND ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 364 POLAND CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 365 POLAND PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 366 POLAND AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 367 POLAND HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 368 POLAND MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 369 POLAND AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 370 DENMARK LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 371 DENMARK LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 372 DENMARK ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 373 DENMARK ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 374 DENMARK TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 375 DENMARK TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 376 DENMARK MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 377 DENMARK MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 378 DENMARK STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 379 DENMARK STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 380 DENMARK BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 381 DENMARK BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 382 DENMARK LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 383 DENMARK AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 384 DENMARK PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 385 DENMARK ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 386 DENMARK LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 387 DENMARK HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 388 DENMARK TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 389 DENMARK AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 390 DENMARK ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 391 DENMARK CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 392 DENMARK PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 393 DENMARK AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 394 DENMARK HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 395 DENMARK MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 396 DENMARK AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 397 FINLAND LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 398 FINLAND LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 399 FINLAND ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 400 FINLAND ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 401 FINLAND TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 402 FINLAND TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 403 FINLAND MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 404 FINLAND MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 405 FINLAND STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 406 FINLAND STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 407 FINLAND BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 408 FINLAND BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 409 FINLAND LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 410 FINLAND AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 411 FINLAND PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 412 FINLAND ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 413 FINLAND LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 414 FINLAND HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 415 FINLAND TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 416 FINLAND AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 417 FINLAND ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 418 FINLAND CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 419 FINLAND PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 420 FINLAND AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 421 FINLAND HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 422 FINLAND MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 423 FINLAND AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 424 TURKEY LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 425 TURKEY LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (TONS)

TABLE 426 TURKEY ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 427 TURKEY ALUMINUM AND ALUMINUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 428 TURKEY TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 429 TURKEY TITANIUM AND TITANIUM ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 430 TURKEY MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 431 TURKEY MAGNESIUM AND MAGNESIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 432 TURKEY STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 433 TURKEY STEEL AND STEEL ALLOYS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 434 TURKEY BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY GRADE, 2018-2052 (USD THOUSAND)

TABLE 435 TURKEY BERYLLIUM AND BERYLLIUM ALLOY IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 436 TURKEY LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 437 TURKEY AUTOMOTIVE & TRANSPORTATION IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 438 TURKEY PASSENGER VEHICLES IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 439 TURKEY ELECTRIC VEHICLE IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 440 TURKEY LIGHT COMMERCIAL VEHICLES(LCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 441 TURKEY HEAVY COMMERCIAL VEHICLES (HCV) IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 442 TURKEY TWO AND THREE WHEELERS IN LIGHTWEIGHT METALS MARKET, BY TYPE, 2018-2052 (USD THOUSAND)

TABLE 443 TURKEY AEROSPACE & DEFENSE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 444 TURKEY ELECTRONICS & CONSUMER GOODS IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 445 TURKEY CONSUMER ELECTRONICS IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 446 TURKEY PORTABLE DEVICES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 447 TURKEY AUDIO-VISUAL EQUIPMENT IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 448 TURKEY HOME APPLIANCES IN LIGHTWEIGHT METALS MARKET, BY PRODUCT, 2018-2052 (USD THOUSAND)

TABLE 449 TURKEY MARINE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)

TABLE 450 TURKEY AGRICULTURE IN LIGHTWEIGHT METALS MARKET, BY APPLICATION, 2018-2052 (USD THOUSAND)