Global Active Pharmaceutical Ingredient Api Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

253.27 Million

USD

419.16 Million

2024

2032

USD

253.27 Million

USD

419.16 Million

2024

2032

| 2025 –2032 | |

| USD 253.27 Million | |

| USD 419.16 Million | |

|

|

|

|

Global Active Pharmaceutical Ingredient (API) Market Segmentation, By Molecule (Small Molecule, and Large Molecule), Type (Innovative Active Pharmaceutical Ingredients, and Generic Innovative Active Pharmaceutical Ingredients), Type of Manufacturer (Captive API Manufacturer, and Merchant API Manufacturer), Synthesis (Synthetic Active Pharmaceutical Ingredients, and Biotech Active Pharmaceutical Ingredients), Chemical Synthesis (Acetaminophen, Artemisinin, Saxagliptin, Sodium Chloride, Ibuprofen, Losartan Potassium, Enoxaparin Sodium, Rufinamide, Naproxen, Tamoxifen, and Others), Type of Drug (Prescription Drugs, and Over-the-Counter), Usage (Clinical, and Research), Potency (Low-to-Moderate Potency Active Pharmaceutical Ingredients, and Potent-to-Highly Potent Active Pharmaceutical Ingredient), Therapeutic Application (Cardiology, CNS and Neurology, Oncology, Orthopedic, Endocrinology, Pulmonology, Gastroenterology, Nephrology, Ophthalmology, and Other Therapeutic Application) - Industry Trends and Forecast to 2032

Active Pharmaceutical Ingredient (API) Market Size

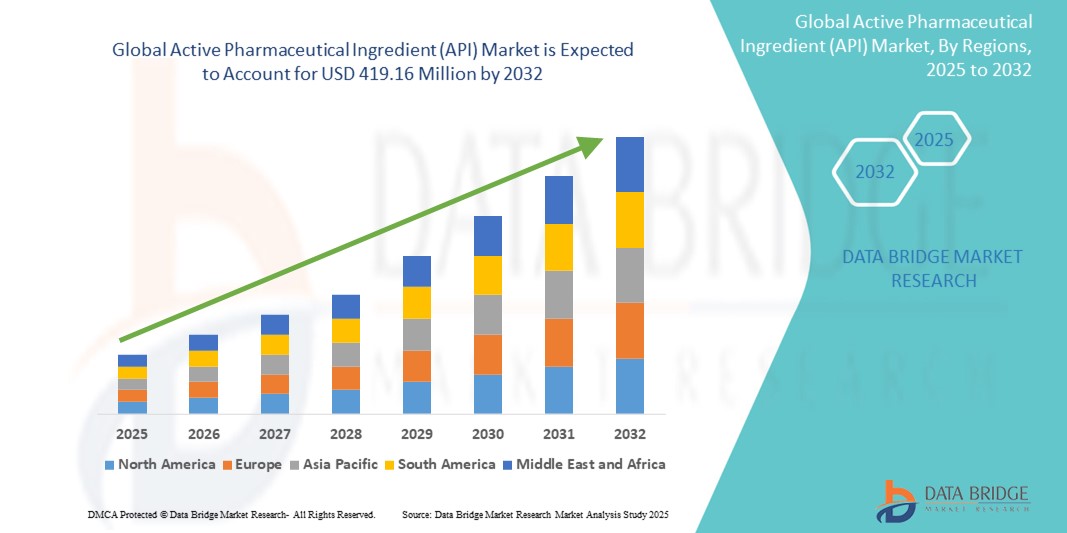

- The global active pharmaceutical ingredient (API) market size was valued atUSD 253.27 million in 2024and is expected to reachUSD 419.16 million by 2032, at aCAGR of 6.50%during the forecast period

- This growth is driven by factors such as the rising geriatric population, increasing prevalence of chronic diseases like cancer and diabetes, and ongoing advancements in biologics and drug manufacturing technologies

Active Pharmaceutical Ingredient (API) Market Analysis

- Active pharmaceutical ingredients (APIs) are the biologically active components used in drug formulation, playing a vital role in the treatment of various chronic and infectious diseases. They are essential for producing medications in therapeutic areas such as oncology, cardiology, neurology, and endocrinology

- The demand for APIs is significantly driven by the increasing global burden of chronic diseases, aging populations, and the rise in generic drug production, especially in emerging economies

- North America is expected to dominate the API market with the largest share of 38.05%, due to the presence of leading pharmaceutical companies, advanced manufacturing technologies, and strong regulatory frameworks

- Asia-Pacific is expected to be the fastest growing region in the active pharmaceutical ingredient (API) market during the forecast period due to low production costs, growing investments in pharmaceutical manufacturing, and supportive government policies

- Prescription drugs segment is expected to dominate the market with a largest market share of 79.16% due to the increasing prevalence of chronic and lifestyle-related diseases such as cancer, diabetes, and cardiovascular disorders. These conditions require long-term treatment plans that rely heavily on prescription medications

Report Scope and Active Pharmaceutical Ingredient (API) Market Segmentation

|

Attributes |

Active Pharmaceutical Ingredient (API) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Active Pharmaceutical Ingredient (API) Market Trends

“Advancements in API Manufacturing & Biotech Integration for Personalized Medicine”

- One prominent trend in the evolution of the global Active Pharmaceutical Ingredient (API) market is the increasing focus on the integration of biotechnology and personalized medicine

- These innovations enhance drug efficacy and safety by enabling the development of tailor-made therapeutic solutions, particularly for oncology, autoimmune diseases, and genetic disorders

- For instance, the rise of biologics and biosimilars has led to the growing demand for complex APIs, with companies focusing on high-potency APIs (HPAPIs) and specialized drug formulations

- These advancements are transforming the pharmaceutical landscape, driving demand for next-generation APIs, and increasing the focus on sustainable and cost-effective manufacturing processes

Active Pharmaceutical Ingredient (API) Market Dynamics

Driver

“Growing Demand Due to Prevalence of Chronic and Lifestyle Diseases”

- The rising prevalence of chronic diseases such as diabetes, cardiovascular diseases, cancer, and neurological disorders is significantly contributing to the increased demand for active pharmaceutical ingredients (APIs)

- As the global population ages and lifestyles continue to evolve, the incidence of these conditions is rising, with more individuals requiring long-term medication and specialized treatments

- With the increasing need for therapeutic solutions for these conditions, the demand for APIs continues to grow, driving the need for innovative drug formulations and advanced manufacturing processes

For instance,

- According to the World Health Organization (WHO), the global prevalence of diabetes has increased, with approximately 463 million people affected in 2019, leading to a higher demand for insulin and related APIs

- As a result, the rising prevalence of chronic and lifestyle diseases is significantly driving the growth of the global API market

Opportunity

“Expanding Opportunities with Biotech and Personalized Medicine Integration”

- The integration of biotechnology and personalized medicine in the API market offers significant opportunities for developing tailored therapies, particularly for complex diseases such as cancer, autoimmune disorders, and genetic conditions

- Biotechnology-driven APIs enable the production of biologics and biosimilars, which are revolutionizing treatments for chronic and life-threatening diseases by targeting specific biomarkers and molecular mechanisms

- Additionally, personalized medicine relies on genetic profiling and individualized drug formulations, driving demand for highly specialized APIs that can be customized to meet unique patient needs

For instance,

- In 2024, the growth of gene therapies and precision medicine is expected to drive an increase in demand for complex and high-potency APIs, opening new revenue streams for API manufacturers

- The expansion of personalized treatments and the rise of biologic drugs present a key growth opportunity in the global API market, offering high-value, niche products with significant market potential

Restraint/Challenge

“High Manufacturing and Regulatory Costs Hindering Market Growth”

- The high cost of manufacturing active pharmaceutical ingredients (APIs) presents a significant challenge, particularly affecting small and medium-sized pharmaceutical companies and API producers

- APIs, especially complex and high-potency APIs, often require advanced manufacturing processes and stringent quality control measures, resulting in substantial production costs

- Regulatory compliance with global standards such as GMP (Good Manufacturing Practices) and extensive testing adds to the financial burden, particularly for smaller companies in emerging markets

For instance,

- In 2024, according to a report by the International Federation of Pharmaceutical Manufacturers and Associations (IFPMA), the growing regulatory demands, such as ensuring adherence to environmental and safety guidelines, are increasing operational costs for API manufacturers

- As a result, these high manufacturing and regulatory costs can limit the ability of certain companies to enter the market or expand their market share, thereby restricting overall market growth

Active Pharmaceutical Ingredient (API) Market Scope

The market is segmented on the basis of molecule, type, type of manufacturer, synthesis, chemical synthesis, type of drug, usage, potency, and therapeutic application

|

Segmentation |

Sub-Segmentation |

|

By Molecule |

|

|

By Type |

|

|

By Type of Manufacturer |

|

|

By Synthesis |

|

|

By Chemical Synthesis |

|

|

By Type of Drug |

|

|

By Usage |

|

|

By Potency |

|

|

By Therapeutic Application |

|

In 2025, the prescription drugs is projected to dominate the market with a largest share in type of drug segment

The prescription drugs segment is expected to dominate the active pharmaceutical ingredient (API) market with a largest market share of 79.16% due to the increasing prevalence of chronic and lifestyle-related diseases such as cancer, diabetes, and cardiovascular disorders. These conditions require long-term treatment plans that rely heavily on prescription medications

The innovative active pharmaceutical ingredients is expected to account for the largest share during the forecast period in type segment

In 2025, the innovative active pharmaceutical ingredients segment is expected to dominate the market with the largest market share of 63.21% due to increased funding and favorable regulations for research and development facilities. A number of novel products are currently in the pipeline due to extensive research in this area, with many expected to launch in the near future

Active Pharmaceutical Ingredient (API) Market Regional Analysis

“North America Holds the Largest Share in the Active Pharmaceutical Ingredient (API) Market”

- North America dominates the global API market with the largest share of 38.05%, driven by the presence of major pharmaceutical companies, advanced drug manufacturing capabilities, and strict regulatory standards that ensure high-quality production

- The U.S. accounts for a significant share of approximately 35%, due to its strong research and development ecosystem, high healthcare expenditure, and growing demand for both branded and generic drugs

- Additionally, favorable reimbursement policies, rapid adoption of innovative therapies, and a well-established supply chain contribute to the region's leading position in the market

- The growing prevalence of chronic diseases such as cancer, diabetes, and cardiovascular disorders further accelerates the demand for APIs, solidifying North America's dominance

“Asia-Pacific is Projected to Register the Highest CAGR in the Active Pharmaceutical Ingredient (API) Market”

- The Asia-Pacific region is expected to experience the fastest growth in the API market, fueled by low production costs, growing pharmaceutical manufacturing capabilities, and favorable government initiatives to boost local drug production

- Countries such as India and China are emerging as global API hubs due to their robust infrastructure, skilled workforce, and large-scale export of generic APIs to developed markets

- India, known as the "pharmacy of the world," plays a pivotal role with its extensive network of API manufacturing facilities and strong regulatory compliance

- China is expanding its footprint through increased investments in high-value APIs and biosimilars, while Japan contributes through its focus on advanced drug formulations and biopharmaceuticals. The region’s growing healthcare needs and rising incidence of chronic illnesses further support market growth

Active Pharmaceutical Ingredient (API) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Eli Lilly and Company(U.S.)

- AbbVie Inc.(U.S.)

- Merck & Co., Inc. (U.S.)

- Novartis AG(Switzerland)

- AstraZeneca PLC(U.K.)

- Pfizer Inc.(U.S.)

- Sanofi S.A. (France)

- GlaxoSmithKline plc (GSK) (U.K.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Viatris Inc. (U.S.)

- BASF SE (Germany)

- Lonza Group Ltd. (Switzerland)

- Dr. Reddy’s Laboratories Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Cipla Limited (India)

- Aurobindo Pharma Limited (India)

- Divi’s Laboratories Limited (India)

- Cadila Healthcare Ltd. (Zydus Cadila) (India)

- Hikma Pharmaceuticals PLC (U.K.)

- Boehringer Ingelheim GmbH (Germany)

Latest Developments in Global Active Pharmaceutical Ingredient (API) Market

- In 2022, Pfizer formed a strategic agreement with Acuitas Therapeutics to incorporate a lipid nanoparticle (LNP) delivery system in the development of mRNA-based vaccines, including COMIRNATY (tozinameran), and other mRNA therapeutics. This innovation supports the growth of the active pharmaceutical ingredient (API) market by driving demand for high-quality, complex APIs used in advanced therapeutic modalities

- In 2022, Sanofi and IGM Biosciences entered into a strategic collaboration to advance the development and commercialization of IgM antibody agonists targeting oncology, immunology, and inflammatory diseases. The alliance contributes to the expansion of the active pharmaceutical ingredient (API) pipeline by driving innovation in complex biologic therapies

- In 2021, the U.S. Food and Drug Administration (FDA) approved a new long-acting injectable treatment for schizophrenia, developed jointly by Teva Pharmaceuticals and MEDinCell. The approval of this novel therapy increases demand for specialized active pharmaceutical ingredients (APIs) used in long-acting formulations, driving growth in the psychiatric segment of the API market

- In May 2024, Eli Lilly announced an expansion of its investment at its Lebanon, Indiana manufacturing facility, raising the total commitment to USD 9 billion. This expansion underscores the growing importance of advanced API manufacturing capabilities, particularly for peptide-based therapies. As global prevalence of obesity and diabetes continues to rise, such investments enhance supply chain resilience and production scalability—factors critical to sustaining growth in the global API market and addressing increasing therapeutic demand

- In April 2023, Eli Lilly announced an additional USD 1.6 billion investment in the construction of two new manufacturing facilities in Indiana, bringing its total investment in the state to USD 3.7 billion. These large-scale investments reinforce the growing need for robust and localized active pharmaceutical ingredient (API) manufacturing capabilities. By expanding production capacity for high-demand therapies across multiple therapeutic areas, Eli Lilly’s continued investment enhances supply chain security, supports the scaling of complex APIs, and contributes significantly to the growth and resilience of the global API market

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.