Global Cancer Supportive Care Products Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

21.66 Billion

USD

26.40 Billion

2024

2032

USD

21.66 Billion

USD

26.40 Billion

2024

2032

| 2025 –2032 | |

| USD 21.66 Billion | |

| USD 26.40 Billion | |

|

|

|

|

Global Cancer Supportive Care Products Market Segmentation, By Drug Class (Nonsteroidal Anti-Inflammatory Drugs, Anti-Infective, Anti-Emetics,Monoclonal AntibodiesErythropoietin Stimulating Agents, Opioid Analgesics, Bisphosphonates, and Granulocyte Colony Stimulating Factor), Indication (Lung Cancer, Breast Cancer, Prostate Cancer, Liver Cancer, Bladder Cancer, Leukemia, Ovary Cancer, Melanoma Cancer, and Others), Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Compounding Pharmacies) - Industry Trends and Forecast to 2032

Cancer Supportive Care Products Market Size

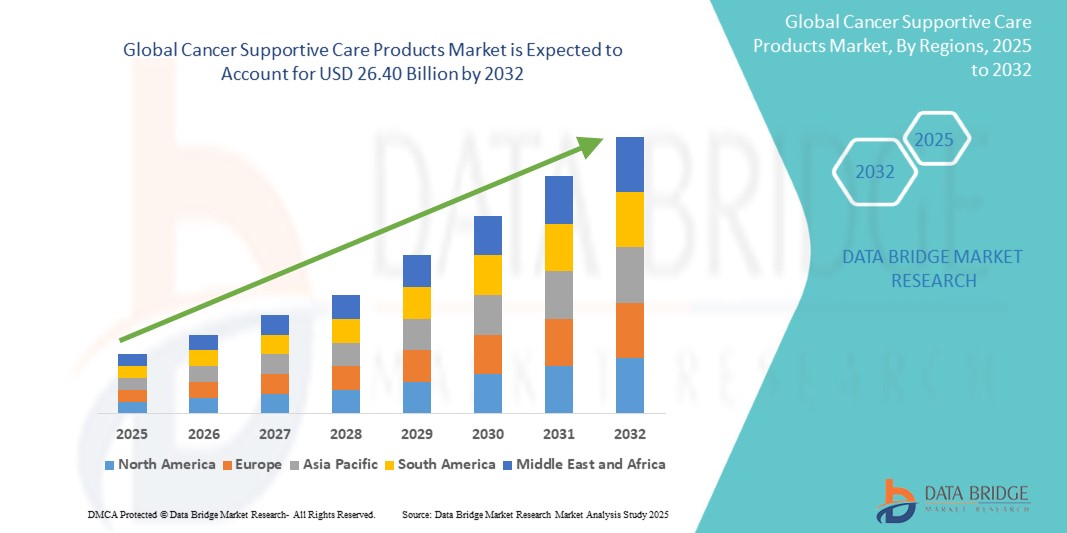

- The global cancer supportive care products market size was valued at USD 21.66 billion in 2024 and is expected to reach USD 26.40 billion by 2032, at a CAGR of 2.50% during the forecast period

- This growth is driven by increasing cancer incidences

Cancer Supportive Care Products Market Analysis

- Cancer supportive care products play a crucial role in oncology by managing side effects of cancer treatments such as chemotherapy-induced nausea,neutropenia, anemia, and bone complications, thereby improving patients’ quality of life and adherence to primary therapies

- The demand for supportive care therapies is growing steadily due to the rising global cancer burden, increasing survival rates, and growing awareness of integrated cancer management approaches

- North America is expected to dominate the cancer supportive care products market with the largest market share of 48.87%, driven by a high prevalence of cancer, widespread adoption of advanced supportive therapies, robust healthcare spending, and strong regulatory frameworks

- Asia-Pacific is projected to witness the highest growth rate in the cancer supportive care products market during the forecast period, supported by rising cancer incidence, expanding healthcare access, increasing government healthcare spending, and growing adoption of biosimilars in emerging economies

- The granulocyte colony stimulating factor segment is expected to dominate the usability segment with the largest market share of 25.34% in 2025, as it serves as a frontline treatment for cancer-related neutropenia and is one of the most widely used supportive care therapies in the management of breast and lymphoma cancers

Report Scope andCancer Supportive Care Products Market Segmentation

|

Attributes |

Cancer Supportive Care Products KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cancer Supportive Care Products Market Trends

“Growing Focus on Oral Supportive Care Therapies”

- A prominent trend in the cancer supportive care products market is the shift toward oral formulations for managing side effects such as nausea, anemia, and neutropenia, driven by patient convenience and adherence benefits

- Oral supportive care drugs are being increasingly favored over intravenous formulations due to lower hospitalization needs, reduced healthcare costs, and enhanced patient quality of life

- This trend aligns with the industry’s broader move toward outpatient care and home-based cancer treatment protocols

- For instance, in 2023, Amgen expanded access to its oral antiemetic portfolio to support outpatient chemotherapy centers across the U.S.

- The growing preference for oral supportive care options is improving patient compliance, expanding market reach, and reshaping cancer treatment delivery models

Cancer Supportive Care Products Market Dynamics

Driver

“Rising Prevalence of Chemotherapy-Induced Side Effects”

- The global increase in chemotherapy usage for various cancer types has led to a higher incidence of treatment-related complications such as neutropenia, anemia, and bone loss

- This surge in side effects is driving the demand for supportive care drugs such as G-CSF agents, erythropoiesis-stimulating agents, bisphosphonates, andantiemetics

- Hospitals and oncology centers are increasingly prioritizing prophylactic supportive therapies to reduce treatment delays and improve patient outcomes

- For instance, in 2024, the National Comprehensive Cancer Network (NCCN) updated its guidelines to recommend earlier use of growth factors during chemotherapy cycles for breast and lung cancer patients

- This driver is expected to continue supporting market growth by increasing the usage of preventive supportive care products in standard oncology protocols

Opportunity

“Expansion of Biosimilar Supportive Care Products”

- The patent expiration of several blockbuster supportive care drugs is opening doors for biosimilar development, making these therapies more affordable and accessible globally

- Biosimilars offer a cost-effective alternative for managing cancer treatment side effects without compromising clinical outcomes, especially in emerging economies

- Regulatory support and rising confidence among physicians are further boosting biosimilar adoption across healthcare systems

- For instance, in 2023, Biocon Biologics received regulatory approval in Latin America for its biosimilar pegfilgrastim, expanding access to neutropenia management for underserved cancer patients

- The biosimilars boom represents a major opportunity for market penetration and growth in cost-sensitive and high-burden regions

Restraint/Challenge

“Stringent Regulatory Hurdles for Supportive Care Drug Approvals”

- Regulatory agencies impose rigorous clinical and quality standards for the approval of supportive care drugs, particularly biosimilars and novel formulations

- The complexity of demonstrating equivalence in efficacy and safety compared to reference drugs delays market entry and increases R&D costs

- Moreover, differing regulatory pathways across countries create inconsistencies in approval timelines and hinder global commercialization

- For instance, in 2023, a biosimilar application by a European manufacturer for anti-anemia therapy was stalled in the U.S. due to additional data requests from the FDA

- Addressing regulatory challenges will be critical for accelerating the availability of advanced supportive care options and fostering innovation in the market

Cancer Supportive Care Products Market Scope

The market is segmented on the basis of drug class, indication, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Drug Class |

|

|

By Indication |

|

|

By Distribution Channel |

|

In 2025, the granulocyte colony stimulating factor is projected to dominate the market with a largest share in drug class segment

The granulocyte colony stimulating factor segment is expected to dominate the cancer supportive care products market with the largest market share of 25.34% in 2025, as it serves as a frontline treatment for cancer-related neutropenia and is one of the most widely used supportive care therapies in the management of breast and lymphoma cancers.

The breast cancer is expected to account for the largest share during the forecast period in indication segment

In 2025, the breast cancer segment is expected to dominate the market with the largest market share of 15.11% due to its treatment includes combination of surgery, radiation therapy, chemotherapy, and targeted therapy, each of which may lead to various side effects such as fatigue, pain, nausea, and emotional strain.

Cancer Supportive Care Products Market Regional Analysis

“North America Holds the Largest Share in the Cancer Supportive Care Products Market”

- North America is expected to dominate the global cancer supportive care products market with the largest market share of 48.87%, due to the introduction and swift adoption of biosimilars, along with restrictions on opioid prescriptions, are influencing treatment patterns

- The U.S. continues to lead the region due to high cancer prevalence, widespread use of supportive care therapies, and strong insurance coverage supporting access to advanced treatments

- Technological innovations in drug delivery systems, focus on patient-centric supportive therapies, and collaborative efforts between government bodies and private players are expected to maintain North America's market dominance throughout the forecast period

“Asia-Pacific is Projected to Register the HighestCAGR in the Cancer Supportive Care Products Market”

- Asia-Pacific is projected to experience the highest compound annual growth rate (CAGR) in the cancer supportive care products market, driven by rising cancer incidence, improving access to care, and government initiatives promoting early diagnosis and treatment

- Countries such as India, China, and Japan are key contributors, with health programs such as India's "Ayushman Bharat" and China’s "Healthy China 2030" supporting infrastructure development and the inclusion of supportive care medications in treatment protocols

- Increasing awareness of quality-of-life interventions and expanding distribution channels such as online and retail pharmacies are accelerating market growth, solidifying Asia-Pacific as a major future growth region for cancer supportive care

Cancer Supportive Care Products Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Acacia Pharma Group Plc(U.K.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Fagron(Belgium)

- KYOWA HAKKO BIO CO.,LTD. (Japan)

- APR (Switzerland)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Amgen Inc. (U.K.)

- Baxter (U.S.)

- Bayer AG (Germany)

- DAIICHI SANKYO COMPANY, LIMITED. (Japan)

- GSK Plc (U.K.)

Latest Developments in Global Cancer Supportive Care Products Market

- In June 2023, the FDA approved the use of selumetinib (Koselugo) for treating patients with metastatic melanoma that has progressed after previous therapies. Selumetinib functions as a MEK inhibitor, targeting pathways that drive cancer cell proliferation. This approval expands the treatment options available for late-stage melanoma patients facing limited alternatives

- In May 2023, the FDA granted approval for denosumab (Prolia) to be used in the prevention of bone loss among breast cancer patients receiving aromatase inhibitors. Denosumab, a monoclonal antibody, works by blocking the RANKL protein, which is associated with bone degradation. This decision supports bone health preservation in patients undergoing hormonal cancer therapies

- In April 2023, the FDA authorized the use of pembrolizumab (Keytruda) for the treatment of advanced solid tumors that have progressed despite prior therapies. Pembrolizumab is a checkpoint inhibitor that disrupts the PD-1/PD-L1 interaction, thereby enhancing the immune system's ability to target cancer cells. This broadens the clinical application of immunotherapy in resistant solid tumor cases

- In March 2022, Novartis received FDA approval for Pluvicto, a therapy for metastatic castration-resistant prostate cancer (mCRPC) patients with PSMA-positive tumors who had already undergone hormone and chemotherapy treatments. Pluvicto offers a new avenue of treatment for patients with advanced stages of prostate cancer

- In March 2022, Australian biotech firm Imugene entered into a collaboration with MSD (Merck & Co., Inc.) to evaluate the combination of HER-Vaxx, a B-cell activating immunotherapy, with KEYTRUDA (pembrolizumab) in HER-2 positive gastric cancer patients. This clinical trial aims to explore the safety and efficacy of combining immunotherapies for enhanced treatment outcomes

- In June 2020, Pfizer Inc. announced that the FDA approved NYVEPRIA (pegfilgrastim-apgf), a biosimilar to Neulasta, designed to reduce the risk of infection due to febrile neutropenia in patients undergoing myelosuppressive chemotherapy for non-myeloid malignancies. This biosimilar expands access to supportive care therapies critical in cancer treatment cycles

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.