Global Canned Alcoholic Beverages Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

104.98 Million

USD

268.40 Million

2025

2033

USD

104.98 Million

USD

268.40 Million

2025

2033

| 2026 –2033 | |

| USD 104.98 Million | |

| USD 268.40 Million | |

|

|

|

|

Global Canned Alcoholic Beverages Market Segmentation, By Type (Beer, Cider, Wine, Ready-to-Drink Cocktails, and Spirits), Flavor (Fruity, Spicy, Herbal, Classic, and Savory), Packaging Type (Standard Cans, Slim Cans, Large Format Cans, Can Multi-Packs, and Aluminum Bottles), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, and Bars/Restaurants)- Industry Trends and Forecast to 2033

Canned Alcoholic Beverages Market Size

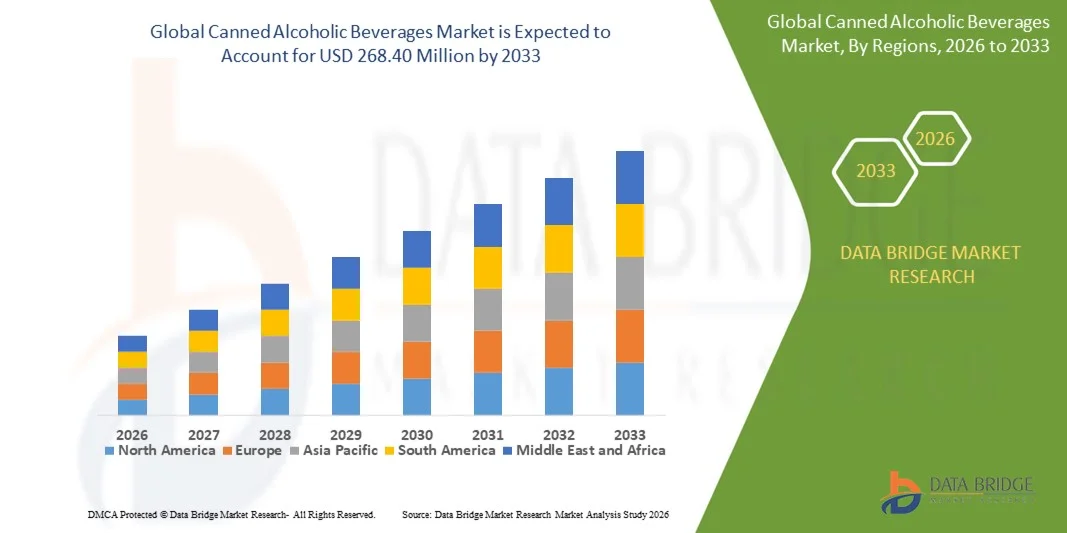

- The global canned alcoholic beverages market size was valued at USD 104.98 million in 2025 and is expected to reach USD 268.40 million by 2033, at a CAGR of 12.45% during the forecast period

- The market growth is largely fuelled by changing consumer preferences toward convenient, portable, and ready-to-drink alcoholic products that align with on-the-go lifestyles

- Rising demand among younger consumers for innovative flavors, portion-controlled packaging, and premium canned formats is significantly supporting market expansion

Canned Alcoholic Beverages Market Analysis

- The market is witnessing strong momentum due to the shift away from traditional glass packaging toward lightweight, recyclable cans that offer better portability and sustainability benefits

- Product innovation in terms of low-calorie, low-sugar, and craft-style alcoholic beverages is enhancing consumer appeal and encouraging trial across diverse demographic groups

- North America dominated the global canned alcoholic beverages market with the largest revenue share of 95.3% in 2025, driven by rising consumer preference for convenient, ready-to-drink alcoholic options and a growing culture of outdoor and on-the-go consumption

- Asia-Pacific region is expected to witness the highest growth rate in the global canned alcoholic beverages market, driven by rapid urbanization, adoption of Western drinking trends, rising disposable incomes, and increasing popularity of convenient RTD and flavored alcoholic beverages

- The ready-to-drink cocktails segment held the largest market revenue share in 2025 driven by rising consumer preference for convenient, pre-mixed alcoholic beverages that offer consistent taste and ease of consumption. RTD cocktails in cans appeal strongly to urban consumers and younger demographics due to their portability, premium positioning, and wide variety of flavor profiles, supporting their strong adoption across social and on-the-go drinking occasions

Report Scope and Canned Alcoholic Beverages Market Segmentation

|

Attributes |

Canned Alcoholic Beverages Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Canned Alcoholic Beverages Market Trends

Rising Demand For Convenient And Ready-To-Drink Alcoholic Products

- The growing preference for convenience-oriented and on-the-go consumption is significantly shaping the canned alcoholic beverages market, as consumers increasingly seek portable, easy-to-consume alcohol formats. Canned alcoholic beverages are gaining popularity due to their lightweight packaging, single-serve portions, and ease of storage, making them suitable for social gatherings, outdoor activities, and casual consumption occasions

- Increasing demand for ready-to-drink alcoholic products among younger consumers is accelerating market growth, particularly for flavored beers, hard seltzers, canned cocktails, and wine-based drinks. Consumers are actively seeking variety, innovative flavors, and lower alcohol or calorie options, encouraging manufacturers to expand product portfolios and experiment with new formulations

- Sustainability and packaging innovation trends are influencing purchasing decisions, with aluminum cans being favored for their recyclability and lower environmental impact compared to glass bottles. Brands are emphasizing eco-friendly packaging, minimalist design, and premium aesthetics to differentiate products and attract environmentally conscious consumers while strengthening brand identity

- For instance, in 2024, companies such as Anheuser-Busch InBev in Belgium and Diageo in the U.K. expanded their canned alcoholic beverage offerings, introducing new canned cocktails and flavored alcoholic drinks across retail and online channels. These launches targeted convenience-seeking consumers and highlighted portability and sustainability benefits to drive higher adoption

- While demand for canned alcoholic beverages continues to grow, sustained market expansion depends on consistent product innovation, effective branding, and regulatory compliance across regions. Manufacturers are focusing on flavor diversification, premium positioning, and strategic distribution partnerships to maintain competitiveness and expand consumer reach

Canned Alcoholic Beverages Market Dynamics

Driver

Growing Preference For Convenience And On-The-Go Alcohol Consumption

- Rising consumer inclination toward convenient and ready-to-drink alcoholic beverages is a major driver for the canned alcoholic beverages market. Manufacturers are increasingly offering canned formats to cater to busy lifestyles, social drinking occasions, and outdoor events, enhancing product accessibility and consumption frequency

- Expanding applications across beer, wine, spirits, and ready-to-drink cocktails are influencing market growth. Canned alcoholic beverages offer portion control, consistent quality, and ease of transportation, enabling brands to appeal to a wide consumer base while maintaining product freshness and flavor integrity

- Beverage manufacturers are actively promoting canned alcoholic products through marketing campaigns, limited-edition launches, and collaborations with retailers and event organizers. These efforts are supported by strong demand for innovative flavors, premium offerings, and low-calorie options, encouraging repeat purchases and brand loyalty

- For instance, in 2023, brands such as Molson Coors in the U.S. and Heineken in the Netherlands reported increased sales of canned beers and ready-to-drink alcoholic beverages. This growth was driven by rising demand for portable alcohol formats and increased presence in convenience stores, festivals, and e-commerce platforms

- Although convenience-driven demand supports market growth, long-term expansion relies on continuous innovation, pricing strategies, and effective distribution. Investment in product differentiation, supply chain efficiency, and consumer engagement will be essential to sustain competitive advantage

Restraint/Challenge

Regulatory Restrictions And Premium Pricing Concerns

- Strict regulations governing alcohol production, packaging, labeling, and distribution remain a key challenge for the canned alcoholic beverages market. Compliance with varying regional regulations increases operational complexity and limits market entry for smaller players, particularly in emerging economies

- Premium pricing of canned alcoholic beverages compared to traditional bottled alternatives can restrict adoption among price-sensitive consumers. Higher production costs associated with innovative formulations, branding, and sustainable packaging contribute to elevated prices, impacting volume growth in certain markets

- Distribution and shelf-space constraints also affect market expansion, as retailers may limit space for alcoholic beverages or prioritize established brands. In addition, alcohol advertising restrictions in several regions reduce promotional flexibility and brand visibility

- For instance, in 2024, retailers in markets such as India and parts of Southeast Asia reported slower adoption of canned alcoholic beverages due to regulatory limitations, higher pricing, and restricted advertising opportunities. These factors influenced consumer awareness and limited product availability in mainstream retail channels

- Addressing these challenges will require strategic pricing, regulatory alignment, and targeted marketing approaches. Strengthening partnerships with distributors, optimizing packaging costs, and adapting products to local regulations will be critical for unlocking long-term growth potential in the global canned alcoholic beverages market

Canned Alcoholic Beverages Market Scope

The market is segmented on the basis of type, flavor, packaging type, and distribution channel

- By Type

On the basis of type, the global canned alcoholic beverages market is segmented into beer, cider, wine, ready-to-drink cocktails, and spirits. The ready-to-drink cocktails segment held the largest market revenue share in 2025 driven by rising consumer preference for convenient, pre-mixed alcoholic beverages that offer consistent taste and ease of consumption. RTD cocktails in cans appeal strongly to urban consumers and younger demographics due to their portability, premium positioning, and wide variety of flavor profiles, supporting their strong adoption across social and on-the-go drinking occasions.

The beer segment is expected to witness steady growth from 2026 to 2033 supported by the growing acceptance of canned beer formats and the increasing presence of craft and flavored beer options in cans. Canned beer benefits from better portability, faster chilling, and improved sustainability compared to glass bottles, making it a preferred choice for outdoor events and casual consumption.

- By Flavor

On the basis of flavor, the market is segmented into fruity, spicy, herbal, classic, and savory. The fruity segment accounted for the largest revenue share in 2025 due to strong consumer inclination toward refreshing and easy-to-drink flavor profiles. Fruity canned alcoholic beverages, such as citrus- and berry-based variants, are widely favored by first-time drinkers and younger consumers, enhancing their popularity across both developed and emerging markets.

The classic segment is expected to register the fastest growth from 2026 to 2033 driven by demand for traditional taste profiles that replicate bar-style drinks. Classic flavors appeal to consumers seeking familiarity and authenticity, particularly in canned beer, wine, and spirit-based beverages, supporting consistent market expansion.

- By Packaging Type

On the basis of packaging type, the global canned alcoholic beverages market is segmented into standard cans, slim cans, large format cans, can multi-packs, and aluminum bottles. The standard cans segment dominated the market in 2025 attributed to their cost-effectiveness, wide availability, and suitability for mass production. Standard cans offer ease of handling and efficient storage, making them the preferred packaging format for manufacturers and retailers.

The slim cans segment is expected to register the fastest growth from 2026 to 2033 driven by premiumization trends and aesthetic appeal. Slim cans are increasingly used for RTD cocktails and flavored alcoholic beverages, as they attract health-conscious and style-driven consumers while supporting brand differentiation on retail shelve.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into supermarkets/hypermarkets, convenience stores, online retail, specialty stores, and bars/restaurants. The supermarkets/hypermarkets segment held the largest market share in 2025 driven by wide product assortments, competitive pricing, and strong visibility of canned alcoholic beverages. These retail formats enable consumers to compare brands and flavors easily, supporting high-volume sales.

The online retail segment is expected to register the fastest growth from 2026 to 2033 fueled by increasing digital adoption and the convenience of home delivery. Online platforms offer access to a broader range of products, subscription models, and exclusive launches, making them an attractive channel for tech-savvy consumers and premium beverage brands.

Canned Alcoholic Beverages Market Regional Analysis

- North America dominated the global canned alcoholic beverages market with the largest revenue share of 95.3% in 2025, driven by rising consumer preference for convenient, ready-to-drink alcoholic options and a growing culture of outdoor and on-the-go consumption

- Consumers in the region value portability, consistent taste, and premium packaging, with canned beverages increasingly preferred for social gatherings, events, and casual drinking occasions

- The market is further supported by high disposable incomes, a trend-focused population, and the growing influence of health-conscious and flavor-seeking consumers, establishing canned alcoholic beverages as a favored choice across multiple occasions

U.S. Canned Alcoholic Beverages Market Insight

The U.S. canned alcoholic beverages market captured the largest revenue share in 2025 within North America, fueled by the rising demand for ready-to-drink (RTD) cocktails, flavored malt beverages, and craft beer in cans. Consumers are increasingly prioritizing convenience, portability, and variety in alcoholic drinks. The growing trend of premiumization, combined with robust e-commerce and retail infrastructure, further drives market growth. In addition, innovative flavors and limited-edition offerings are attracting younger demographics and enhancing consumer engagement.

Europe Canned Alcoholic Beverages Market Insight

The Europe canned alcoholic beverages market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by evolving consumer lifestyles, increased on-the-go consumption, and rising demand for RTD alcoholic drinks. Urbanization, coupled with the influence of social media and lifestyle trends, is fostering market adoption. European consumers also appreciate the environmental benefits of aluminum packaging and the ease of storage, supporting strong growth across beer, cider, and cocktail segments.

U.K. Canned Alcoholic Beverages Market Insight

The U.K. canned alcoholic beverages market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising popularity of RTD cocktails and flavored alcoholic beverages. Concerns regarding portion control, convenience, and sustainability are encouraging both retailers and consumers to favor canned formats. The U.K.’s strong e-commerce penetration and retail infrastructure, combined with a growing trend toward premium and craft beverages, is expected to continue propelling market expansion.

Germany Canned Alcoholic Beverages Market Insight

The Germany canned alcoholic beverages market is expected to witness the fastest growth rate from 2026 to 2033, fueled by growing interest in craft beers, innovative flavors, and sustainable packaging. Consumers increasingly value high-quality ingredients, premium taste experiences, and environmentally friendly packaging solutions. The integration of RTD beverages and flavored alcoholic drinks into social events, festivals, and outdoor occasions supports adoption in both urban and suburban regions.

Asia-Pacific Canned Alcoholic Beverages Market Insight

The Asia-Pacific canned alcoholic beverages market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising disposable incomes, urbanization, and increasing exposure to Western drinking trends in countries such as China, Japan, and India. Growing preference for convenient, ready-to-drink options, supported by expanding retail and e-commerce channels, is fueling adoption. In addition, the rising number of social gatherings, outdoor events, and premiumization trends is contributing to the region’s market growth.

Japan Canned Alcoholic Beverages Market Insight

The Japan canned alcoholic beverages market is expected to witness the fastest growth rate from 2026 to 2033 due to high urbanization, a strong culture of on-the-go consumption, and preference for innovative flavors. Consumers are increasingly adopting RTD cocktails and canned craft beers for convenience and variety. The popularity of compact, easy-to-carry packaging and the integration of beverages into social events and outdoor activities is driving market expansion.

China Canned Alcoholic Beverages Market Insight

The China canned alcoholic beverages market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the expanding middle class, rapid urbanization, and high acceptance of Western drinking trends. Ready-to-drink cocktails, flavored malt beverages, and canned craft beers are gaining traction across urban centers. Government initiatives supporting modern retail, along with strong domestic manufacturers offering affordable and diverse product options, are key factors propelling market growth in China.

Canned Alcoholic Beverages Market Share

The Canned Alcoholic Beverages industry is primarily led by well-established companies, including:

• Bacardi Limited (Bermuda)

• Diageo (U.K.)

• Brown-Forman (U.S.)

• Anheuser-Busch InBev (Belgium)

• Treasury Wine Estates (Australia)

• Union Wine Company (U.S.)

• E. & J. Gallo Winery (U.S.)

• Asahi Group Holdings, Ltd. (Japan)

• Pernod Ricard (France)

• Integrated Beverage Group LLC (IBG) (U.S.)

• Sula Vineyards (India)

• Kona Brewing Co. (U.S.)

• Suntory Holdings Limited (Japan)

• Barefoot Cellars (U.S.)

• Constellation Brands (U.S.)

Latest Developments in Global Canned Alcoholic Beverages Market

- In October 2025, Boston Beer Company launched a marketing campaign targeting millennial consumers, highlighting artisanal flavors and unique drinking experiences. The campaign focuses on quality and craftsmanship to differentiate the brand in a competitive canned beverage market. This approach aims to attract a loyal customer base that values premium and innovative products

- In September 2025, Heineken introduced a line of eco-friendly canned beverages made from 100% recyclable materials. This initiative addresses increasing consumer demand for sustainable products and reinforces Heineken’s commitment to environmental responsibility. The launch is expected to strengthen brand loyalty and enhance market share among eco-conscious consumers

- In August 2025, Constellation Brands implemented an AI-driven platform to optimize its production processes. The technology is designed to improve operational efficiency, reduce waste, and support sustainability initiatives. This strategic move positions Constellation Brands as a forward-thinking leader in production innovation within the canned alcoholic beverages market

- In August 2025, Diageo launched Baileys canned espresso martinis in the U.S. and U.K., targeting premium RTD coffee cocktail consumers. The product caters to the growing demand for convenient, ready-to-drink cocktails during the holiday season. It strengthens Diageo’s high-end RTD portfolio and enhances its presence in key international markets

- In June 2025, Constellation Brands expanded its High Noon brand with the introduction of the Tequila Seltzer Variety Pack in North America. The launch targets consumers seeking convenient, on-the-go RTD options and strengthens the company’s competitive position in the tequila-based RTD segment. It also addresses growing demand for variety and flavor innovation

- In May 2025, AB InBev’s Cutwater Spirits released a zero-sugar Mojito canned cocktail. The product meets consumer demand for low-calorie, better-for-you alcoholic beverages. By refreshing its summer portfolio with healthier options, the brand aims to appeal to health-conscious drinkers while maintaining relevance in the RTD market

- In March 2025, Heineken unveiled its first canned Gin & Tonic RTD through the Desperados brand in Spain, France, and Germany. This launch targets Gen Z consumers seeking trendy, convenient beverages. The product expands Heineken’s premium RTD offerings and supports the brand’s presence in the growing European canned cocktail market

- In January 2025, Molson Coors partnered with Coca-Cola to develop new Topo Chico Hard Seltzer flavors in Mexico and the U.S. The collaboration focuses on product innovation to meet rising demand for RTD seltzers. It enhances the brand’s market share and strengthens its presence in key North American regions

- In July 2022, Diageo partnered with The Vita Coco Company to launch a premium line of canned cocktails combining Captain Morgan rum with coconut water. The product appeals to health-conscious and flavor-seeking consumers. This collaboration strengthens Diageo’s RTD portfolio and expands its reach in the premium canned cocktail segment

- In May 2021, Bacardi expanded its canned cocktail range with BACARDÍ Sunset Punch, Bahama Mama, and Mojito. These gluten-free beverages use real ingredients and natural flavors, catering to health-conscious consumers. The launch reinforces Bacardi’s position in the growing RTD market and responds to evolving consumer preferences

- In March 2021, Koninklijke Grolsch, a subsidiary of Asahi Group, introduced “Viper” hard seltzer in cans and bottles, the first in the Netherlands. The product targets consumers seeking convenient, low-calorie alcoholic beverages. This launch expands the RTD market footprint and positions Grolsch as an innovator in the Dutch hard seltzer segment

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.