Global Cdk46 Inhibitor Drug Class Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

15.52 Billion

USD

31.61 Billion

2025

2033

USD

15.52 Billion

USD

31.61 Billion

2025

2033

| 2026 –2033 | |

| USD 15.52 Billion | |

| USD 31.61 Billion | |

|

|

|

|

Global CDK4/6 Inhibitor Drug Class Market Segmentation, By Drug Type (Palbociclib, Ribociclib, Abemaciclib, and Others), Application (Hormone Receptor-Positive (HR+), Human Epidermal Growth Factor Receptor 2-Negative (HER2-) Breast Cancer, and Others), End User (Hospitals, Cancer Treatment Centers, Specialty Clinics, and Others) - Industry Trends and Forecast to 2033

CDK4/6 Inhibitor Drug Class Market Size

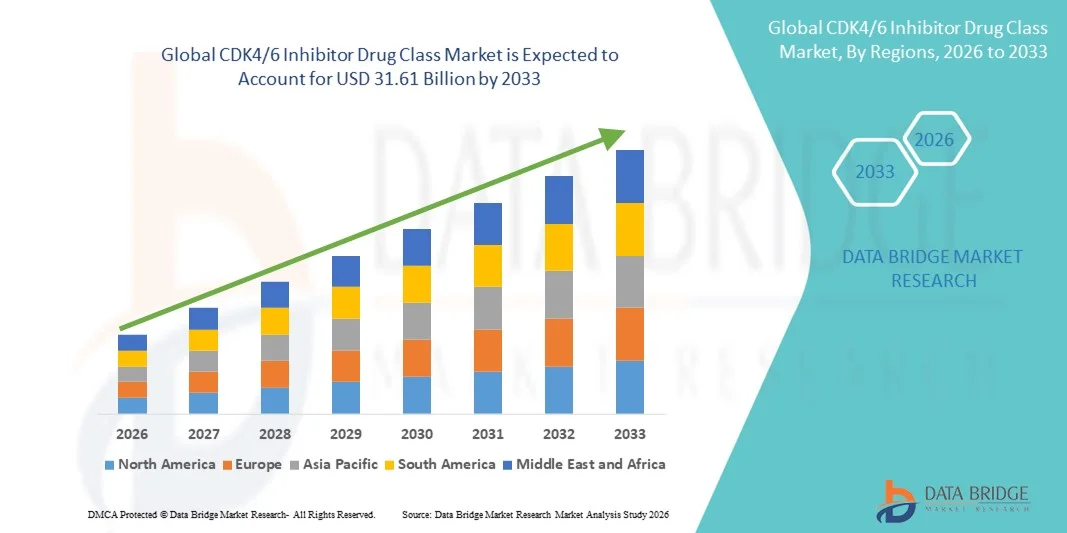

- The global CDK4/6 inhibitor drug class market size was valued at USD 15.52 billion in 2025 and is expected to reach USD 31.61 billion by 2033, at a CAGR of9.30% during the forecast period

- The market growth is largely fueled by the growing adoption of targeted cancer therapies and advancements in oncology drug development, leading to increased use of CDK4/6 inhibitors in breast cancer treatment and other emerging indications

- Furthermore, rising demand from oncologists and healthcare providers for more effective, patient-friendly, and personalized treatment options is establishing CDK4/6 inhibitor drug class therapies as a preferred choice for hormone receptor-positive (HR+), HER2-negative breast cancer patients. These converging factors are accelerating the uptake of CDK4/6 inhibitor drug class solutions, thereby significantly boosting the industry's growth

CDK4/6 Inhibitor Drug Class Market Analysis

- CDK4/6 inhibitors, which are targeted oral therapies used primarily in hormone receptor-positive (HR+), HER2-negative breast cancer, are increasingly vital in modern oncology treatment protocols due to their ability to slow tumor progression, improve survival outcomes, and enhance patient quality of life

- The escalating demand for CDK4/6 inhibitor therapies is primarily fueled by rising breast cancer incidence, growing adoption of precision oncology, and increasing preference for targeted treatments that offer better efficacy and manageable side-effect profiles compared to traditional chemotherapy

- North America dominated the CDK4/6 Inhibitor Drug Class market with the largest revenue share of 42.5% in 2025, supported by advanced oncology infrastructure, high healthcare spending, strong presence of leading pharmaceutical companies, and widespread adoption of targeted cancer therapies, with the U.S. accounting for a major portion of regional demand

- Asia-Pacific is expected to be the fastest-growing region in the CDK4/6 Inhibitor Drug Class market during the forecast period, driven by increasing breast cancer prevalence, expanding access to oncology care, rising healthcare investments, and growing adoption of targeted therapies in emerging economies

- The HR+, HER2- breast cancer segment dominated the largest market revenue share of 72.0% in 2025, owing to the high prevalence of this breast cancer subtype and the established role of CDK4/6 inhibitors as standard-of-care therapy

Report Scope and CDK4/6 Inhibitor Drug Class Market Segmentation

|

Attributes |

CDK4/6 Inhibitor Drug Class Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

CDK4/6 Inhibitor Drug Class Market Trends

Enhanced Focus on Combination Therapies and Biomarker-Driven Treatment

- A significant trend in the global CDK4/6 inhibitor drug class market is the increasing adoption of combination therapies with endocrine therapy and other targeted agents. This approach aims to improve patient outcomes and overcome resistance in HR+/HER2- advanced breast cancer

- For instance, Pfizer’s Ibrance (palbociclib) and Novartis’ Kisqali (ribociclib) have been widely studied in combination with AI-driven biomarker diagnostics and personalized treatment regimens, enabling oncologists to tailor therapy based on patient-specific factors

- Research and clinical trials are focusing on combining CDK4/6 inhibitors with PI3K inhibitors, mTOR inhibitors, and immunotherapy, to expand indications beyond breast cancer

- The emphasis on biomarker-driven treatment, such as monitoring RB1 gene status and cyclin D1 expression, is helping in identifying patients who will benefit most from CDK4/6 inhibitors

- This trend is expected to accelerate due to the growing adoption of precision oncology, increased clinical trial activity, and better understanding of tumor biology

- The shift toward personalized therapy is reshaping treatment protocols and improving long-term disease management outcomes

CDK4/6 Inhibitor Drug Class Market Dynamics

Driver

Rising Incidence of Hormone Receptor Positive Breast Cancer

- The growing prevalence of HR+/HER2- breast cancer globally is a major driver for the CDK4/6 inhibitor market, as these drugs have become the standard of care in advanced and metastatic settings

- For instance, in January 2024, the National Cancer Institute reported a continued rise in breast cancer incidence globally, especially in developed regions, supporting higher demand for targeted therapies like CDK4/6 inhibitors

- Increasing awareness and screening programs have led to early diagnosis, creating higher demand for advanced therapeutic options such as CDK4/6 inhibitors

- The growing number of elderly and high-risk patients also increases the need for effective, targeted treatments with better safety profiles

- Expansion of CDK4/6 inhibitor usage into earlier lines of therapy and adjuvant settings is fueling market growth

- Strong clinical evidence from major trials (PALOMA, MONALEESA, MONARCH) continues to support wider adoption

Restraint/Challenge

High Cost and Reimbursement Constraints

- The high cost of CDK4/6 inhibitors remains a major restraint, especially in low- and middle-income countries where access and reimbursement are limited

- For instance, in March 2022, several countries including India and Brazil faced reimbursement delays for CDK4/6 inhibitors due to high pricing, restricting patient access and limiting market expansion

- Many healthcare systems restrict coverage to specific indications or require prior authorization, which delays treatment initiation

- In addition, high out-of-pocket expenses reduce patient compliance and adherence to long-term therapy

- The presence of generics in some regions creates pricing pressure and affects revenue growth for branded products

- Limited access to diagnostic tools for biomarker testing also restricts the effective use of CDK4/6 inhibitors

- Addressing affordability through pricing strategies, patient assistance programs, and reimbursement expansion is essential for market growth

CDK4/6 Inhibitor Drug Class Market Scope

The market is segmented on the basis of drug type, application, and end user.

- By Drug Type

On the basis of drug type, the CDK4/6 inhibitor drug class market is segmented into Palbociclib, Ribociclib, Abemaciclib, and Others. The Palbociclib segment dominated the largest market revenue share of 45.0% in 2025, driven by its early approval, strong clinical adoption, and extensive real-world evidence supporting its efficacy in HR+/HER2- breast cancer. Palbociclib’s established safety profile, multiple dosage strengths, and high physician preference contribute to its leading position. The segment benefits from strong reimbursement support in major markets, making it widely accessible across hospitals and cancer treatment centers. Increasing breast cancer incidence and rising demand for targeted therapies further support its dominance. Palbociclib’s long-standing market presence and patient assistance programs enhance treatment adherence. In addition, strong brand recognition and large-scale clinical studies continue to reinforce its leadership. The segment remains the primary revenue contributor due to its broad adoption and established treatment protocols.

The Abemaciclib segment is anticipated to witness the fastest growth rate of 14.0% CAGR from 2026 to 2033, driven by expanding indications and increasing clinical acceptance. Abemaciclib offers continuous dosing and improved outcomes in high-risk early breast cancer, which supports its growing preference among oncologists. The segment benefits from ongoing clinical trials exploring new indications and combination therapies, which are expected to broaden its market base. Rising awareness of personalized cancer treatment and growing adoption in emerging markets further drive growth. Improved access to oncology care and strong investments in cancer research also support the segment’s expansion. Abemaciclib’s favorable efficacy profile, particularly in patients with aggressive tumor characteristics, contributes to its rapid adoption. The segment is expected to gain market share due to increasing treatment demand and label expansions. Overall, Abemaciclib is projected to be the fastest-growing drug type in the forecast period.

- By Application

On the basis of application, the CDK4/6 inhibitor drug class market is segmented into Hormone Receptor-Positive (HR+), Human Epidermal Growth Factor Receptor 2-Negative (HER2-) breast cancer, and Others. The HR+, HER2- breast cancer segment dominated the largest market revenue share of 72.0% in 2025, owing to the high prevalence of this breast cancer subtype and the established role of CDK4/6 inhibitors as standard-of-care therapy. Clinical guidelines recommend CDK4/6 inhibitors in first-line and subsequent treatment settings, which drives strong adoption across hospitals and cancer centers. The segment benefits from increasing breast cancer screening, early diagnosis, and rising patient awareness. Strong clinical evidence demonstrating improved progression-free survival and overall outcomes supports continuous use. Growing healthcare expenditure and improved access to oncology drugs further strengthen market dominance. In addition, the large patient population and expanding treatment protocols ensure sustained demand for CDK4/6 therapies.

The Others segment is expected to witness the fastest CAGR of 13.5% from 2026 to 2033, driven by expanding research and emerging indications beyond HR+, HER2- breast cancer. Clinical trials exploring CDK4/6 inhibitors in other cancer types such as lung, ovarian, and pancreatic cancers are expected to broaden the therapeutic scope. Rising investments in oncology research and precision medicine support the development of new applications. Increased use in combination therapies with immunotherapy and targeted agents further boosts adoption. Growing demand for personalized cancer treatment and biomarker-driven therapy is expected to propel growth. As regulatory approvals expand globally, the segment is anticipated to gain momentum across emerging markets. Overall, the “Others” application segment is projected to grow rapidly due to broader clinical opportunities and increasing research activity.

- By End User

On the basis of end user, the CDK4/6 inhibitor drug class market is segmented into Hospitals, Cancer Treatment Centers, Specialty Clinics, and Others. The Hospitals segment dominated the largest market revenue share of 55.0% in 2025, driven by the high volume of oncology treatments delivered in hospital settings. Hospitals provide comprehensive cancer care services including diagnosis, treatment, and follow-up, making them the primary point of care for CDK4/6 therapy. The presence of specialized oncology departments, advanced infrastructure, and access to multidisciplinary teams supports high adoption. Strong reimbursement and structured treatment pathways further contribute to the segment’s dominance. Increasing hospital admissions for breast cancer treatment and rising demand for targeted therapies also support growth.

The Cancer Treatment Centers segment is expected to witness the fastest CAGR of 12.8% from 2026 to 2033, driven by the rising number of specialized oncology centers and dedicated cancer care facilities. These centers focus on targeted therapies and advanced treatment protocols, attracting more patients seeking specialized care. Growing investments in oncology infrastructure and increasing outpatient treatment preference support segment growth. Cancer treatment centers provide patient-centric services with advanced diagnostics and personalized treatment plans. As more centers adopt CDK4/6 inhibitors as part of standard care, demand is expected to increase. The segment’s rapid growth is also supported by improved access to specialized oncology care in emerging markets.

CDK4/6 Inhibitor Drug Class Market Regional Analysis

- North America dominated the CDK4/6 inhibitor drug class market with the largest revenue share of 42.5% in 2025, supported by advanced oncology infrastructure, high healthcare spending, strong presence of leading pharmaceutical companies, and widespread adoption of targeted cancer therapies. The U.S. accounts for a major portion of regional demand, driven by high breast cancer incidence and strong access to innovative treatments

- The presence of established healthcare reimbursement systems and robust clinical trial activity further supports market growth. The region’s strong healthcare infrastructure enables early diagnosis and rapid treatment initiation, increasing CDK4/6 inhibitor adoption

- In addition, high patient awareness and physician preference for targeted therapies contribute to the segment’s dominance. The continuous introduction of new treatment guidelines and supportive government initiatives further boost demand in North America

U.S. CDK4/6 Inhibitor Drug Class Market Insight

The U.S. CDK4/6 inhibitor drug class market captured the largest revenue share in 2025 within North America, driven by the rapid adoption of targeted cancer therapies and strong clinical evidence supporting CDK4/6 inhibitors in HR+/HER2- breast cancer. The U.S. benefits from high healthcare expenditure, extensive oncology infrastructure, and strong pharmaceutical R&D presence. High patient awareness and widespread screening programs contribute to early diagnosis and increased treatment rates. Moreover, robust reimbursement policies and a well-established oncology ecosystem enable quick uptake of new therapies. The U.S. also leads in clinical trials and innovation, which continuously expands treatment options and drives market growth. Increasing use of combination therapies and personalized treatment approaches further supports the market expansion in the country.

Europe CDK4/6 Inhibitor Drug Class Market Insight

The Europe CDK4/6 inhibitor drug class market is projected to expand at a substantial CAGR throughout the forecast period, driven by increasing breast cancer incidence, growing healthcare investments, and rising adoption of targeted therapies across key European countries. The region benefits from well-established oncology centers, improved access to cancer care, and supportive reimbursement policies. In addition, growing awareness about personalized medicine and ongoing clinical research support market growth. The demand for CDK4/6 inhibitors is rising due to strong clinical evidence and expanding treatment guidelines. Urbanization and increasing healthcare infrastructure modernization further contribute to market expansion. Overall, Europe is expected to remain a key market for CDK4/6 inhibitors, with consistent growth across major countries.

U.K. CDK4/6 Inhibitor Drug Class Market Insight

The U.K. CDK4/6 inhibitor drug class market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong oncology infrastructure, government-led cancer care initiatives, and high adoption of targeted therapies. The country has well-developed healthcare systems and extensive cancer treatment networks. Increasing breast cancer prevalence and improved diagnosis rates drive the demand for CDK4/6 inhibitors. The U.K.’s focus on advanced cancer therapies and continuous updates to treatment guidelines further support market expansion. In addition, rising patient awareness and access to innovative drugs through national healthcare programs contribute to growth. The U.K. market is expected to maintain steady expansion due to ongoing advancements in oncology care and strong clinical research activities.

Germany CDK4/6 Inhibitor Drug Class Market Insight

The Germany CDK4/6 inhibitor drug class market is expected to expand at a considerable CAGR during the forecast period, fueled by high healthcare expenditure, advanced medical infrastructure, and strong focus on oncology innovation. Germany’s well-established healthcare system and strong pharmaceutical industry promote adoption of targeted cancer therapies. Increasing breast cancer incidence and strong clinical evidence supporting CDK4/6 inhibitors drive market growth. In addition, ongoing clinical trials and high patient access to innovative therapies support expansion. Germany’s emphasis on quality healthcare and early cancer diagnosis further boosts demand. The integration of advanced treatment protocols and supportive reimbursement policies make Germany a key market in Europe for CDK4/6 inhibitors.

Asia-Pacific CDK4/6 Inhibitor Drug Class Market Insight

The Asia-Pacific CDK4/6 inhibitor drug class market is expected to be the fastest-growing region during the forecast period, driven by increasing breast cancer prevalence, expanding access to oncology care, rising healthcare investments, and growing adoption of targeted therapies in emerging economies. Rapid urbanization and improving healthcare infrastructure in countries such as China, India, Japan, and South Korea support market growth. Increasing awareness of advanced cancer treatments and growing patient affordability contribute to higher adoption. Government initiatives promoting cancer care and rising clinical trial activity further support expansion. The region is also witnessing improvements in diagnostic facilities and oncology treatment centers, increasing treatment penetration. Overall, APAC is projected to experience strong growth due to rising demand for innovative cancer therapies and expanding healthcare access.

Japan CDK4/6 Inhibitor Drug Class Market Insight

The Japan CDK4/6 inhibitor drug class market is gaining momentum due to high healthcare standards, increasing breast cancer prevalence, and strong adoption of advanced cancer therapies. Japan’s focus on innovation and high access to oncology treatments supports the uptake of CDK4/6 inhibitors. Growing awareness about personalized medicine and expanding clinical research further drive market growth. In addition, government support for cancer care and robust healthcare infrastructure contribute to increased adoption. Japan’s aging population and rising demand for effective cancer treatments are expected to further support market expansion. The country is projected to maintain steady growth as targeted therapies become more widely adopted.

China CDK4/6 Inhibitor Drug Class Market Insight

The China CDK4/6 inhibitor drug class market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by increasing breast cancer incidence, expanding healthcare infrastructure, and rising access to advanced oncology treatments. The country’s growing middle class and rising healthcare expenditure support the adoption of targeted therapies. Government initiatives to improve cancer care and expanding oncology centers further support market growth. China’s focus on innovation and increasing clinical trial activity also contribute to rapid market expansion. In addition, improving reimbursement policies and patient access to innovative drugs drive demand. As awareness of targeted therapies increases, CDK4/6 inhibitors are expected to see higher adoption across hospitals and cancer treatment centers in China.

CDK4/6 Inhibitor Drug Class Market Share

The CDK4/6 Inhibitor Drug Class industry is primarily led by well-established companies, including:

• Pfizer (U.S.)

• Novartis (Switzerland)

• Eli Lilly and Company (U.S.)

• G1 Therapeutics (U.S.)

• Merck & Co., Inc. (U.S.)

• AstraZeneca (U.K.)

• Bristol-Myers Squibb (U.S.)

• Roche (Switzerland)

• Takeda Pharmaceutical Company (Japan)

• AbbVie (U.S.)

• Sanofi (France)

• GlaxoSmithKline (U.K.)

• Amgen (U.S.)

• Bayer (Germany)

• Daiichi Sankyo (Japan)

• Seagen (U.S.)

• Incyte Corporation (U.S.)

• BeiGene (China)

• Zai Lab (China)

• Biogen (U.S.)

Latest Developments in Global CDK4/6 Inhibitor Drug Class Market

- In March 2023, the U.S. Food and Drug Administration approved abemaciclib (Verzenio) in combination with endocrine therapy for the adjuvant treatment of hormone receptor-positive (HR+), HER2-negative, node-positive early breast cancer at high risk of recurrence, marking one of the first approvals expanding CDK4/6 inhibitor use into early-stage breast cancer beyond metastatic settings and supporting broader clinical adoption

- In November 2023, the FDA approved TRUQAP (capivasertib) in combination with FASLODEX for patients with advanced HR+/HER2- breast cancer exhibiting specific biomarker alterations (PIK3CA, AKT1, or PTEN), a novel targeted therapy approved alongside standard regimens that often include CDK4/6 inhibitors, reflecting evolving combination strategies in this class

- In September 2024, the FDA approved Novartis’ ribociclib (Kisqali) in combination with a non-steroidal aromatase inhibitor for the adjuvant treatment of adults with HR+, HER2-negative stage II and III early breast cancer at high risk of recurrence, becoming one of the few CDK4/6 inhibitors authorized for early-stage use and significantly expanding treatment options for high-risk patients

- In January 2025, the FDA approved DATROWAY for patients with unresectable or metastatic HR+, HER2- breast cancer who had previously undergone endocrine-based therapy and chemotherapy, adding another CDK4/6-targeted treatment option to the market and supporting broader patient access in later lines of therapy

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.