Global Digital Payment Gateway Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

26.40 Billion

USD

106.88 Billion

2024

2032

USD

26.40 Billion

USD

106.88 Billion

2024

2032

| 2025 –2032 | |

| USD 26.40 Billion | |

| USD 106.88 Billion | |

|

|

|

|

Global Digital Payment Gateway Market Segmentation, By Type (Hosted and Non Hosted), Organization Size (SME's and Large Enterprises), End User (Travel, Retail, BFSI, Media and Entertainment, and Others) – Industry Trends and Forecast to 2032

Digital Payment Gateway Market Analysis

The global digital payment gateway Market has experienced significant growth driven by the increasing adoption of online shopping, mobile payments, and advancements in digital banking technologies. Payment gateways provide a secure platform for processing transactions, enabling businesses to accept payments via credit/debit cards, mobile wallets, and other digital methods. This convenience has contributed to the rise of e-commerce, with consumers increasingly opting for faster, secure, and contactless payment methods. Technological advancements in encryption, fraud detection, and tokenization are further enhancing the security and efficiency of payment gateways, making them more attractive to businesses across industries. The market is also benefitting from the rise of digital wallets, with companies such as PayPal, Stripe, and Apple Pay gaining significant traction. In addition, the emergence of Buy Now, Pay Later (BNPL) services are creating new revenue streams for payment gateways, expanding their capabilities. Regional expansion is another key factor, as businesses in emerging markets are adopting digital payment solutions to cater to a growing middle-class population. Overall, the Digital Payment Gateway Market is poised for continued growth, with innovations in mobile payments, AI, and blockchain set to redefine the payment landscape in the coming years.

Digital Payment Gateway Market Size

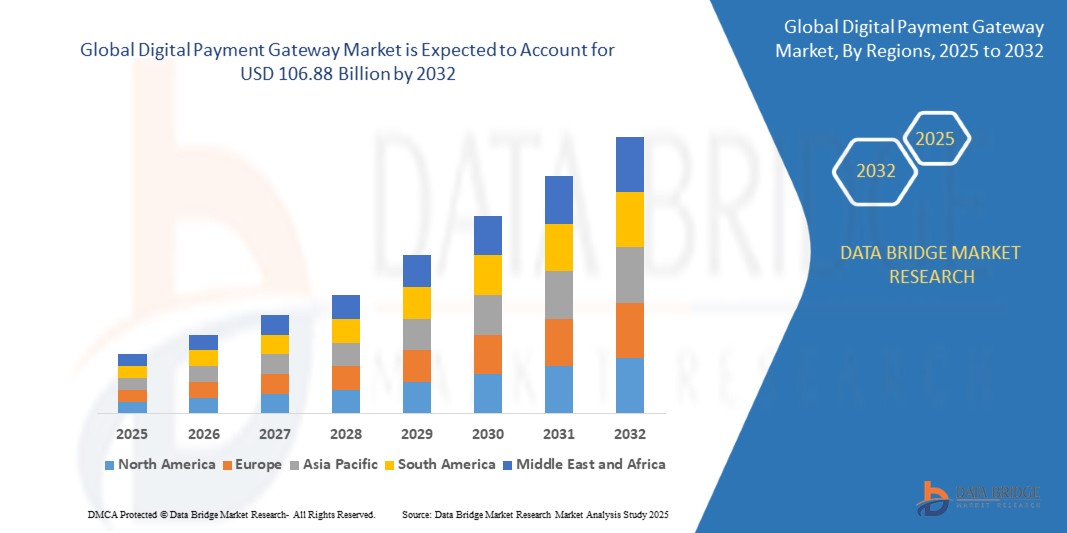

The global digital payment gateway market size was valued at USD 26.40 billion in 2024 and is projected to reach USD 106.88 billion by 2032, with a CAGR of 19.10% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Digital Payment Gateway Market Trends

“Growing Adoption of Mobile Wallets and Contactless Payments”

One of the key trends driving the Digital Payment Gateway Market is the growing adoption of mobile wallets and contactless payments. Consumers are increasingly shifting towards mobile payment solutions due to their convenience, speed, and enhanced security features. Companies such as Apple Pay, Google Pay, and Samsung Pay are gaining widespread popularity as they allow users to make instant payments using their smartphones, reducing the need for physical cards or cash. This trend is particularly prominent in regions such as North America and Europe, where mobile payment adoption is highest. For instance, in 2023, Apple Pay saw an increase in usage with retailers such as Walmart and McDonald's embracing the technology for seamless transactions. As the demand for mobile-first payment experiences rises, digital payment gateways are evolving to integrate with these mobile wallet platforms, enabling frictionless payments in retail, e-commerce, and even transportation services, thus further boosting market growth.

Report Scope and Digital Payment Gateway Market Segmentation

|

Attributes |

Digital Payment Gateway Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Amazon Payments, Inc. (U.S.), CCBill, LLC (U.S.), AsiaPay Limited (Hong Kong), MercadoLibre SRL (Argentina), Web Active Corporation (Australia), NAB Transact (Australia), e-Path (Australia), Cardstream Limited (U.K.), Svea Bank (Sweden), Certitrade (Sweden), ServiRed (Spain), Kiplepay Sdn Bhd (Malaysia), MyGate (South Africa), 99bill (China), PAGOS ONLINE S.A. (Colombia), WebMoney (Russia), PESOPAY (Philippines), GPUK LLP (U.K.), Klarna Bank AB (Sweden), Stripe, Inc. (U.S.), PayPal (U.S.), Beanstream (Canada), Worldpay LLC (U.K.), and Paytm (India) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Digital Payment Gateway Market Definition

A Digital Payment Gateway is an online service that facilitates secure transactions between buyers and sellers by processing payments made through digital channels. It acts as a bridge between the merchant’s website or application and the financial institution, ensuring that sensitive payment information, such as credit card details or bank account numbers, is securely encrypted.

Digital Payment Gateway Market Dynamics

Drivers

- Rapid Expansion of the E-Commerce Industry

The rapid expansion of the e-commerce industry is significantly driving the adoption of digital payment gateways, as these platforms enable secure, efficient, and seamless online transactions. With the global shift toward online shopping, businesses require reliable payment solutions to meet consumer demands for convenience and safety. For instance, major e-commerce platforms such as Amazon and eBay utilize gateways such as PayPal and Stripe to process millions of transactions daily, ensuring smooth financial exchanges across borders. In addition, the growing popularity of subscription-based services and online marketplaces has further intensified the demand for robust payment systems. This trend underscores the critical role digital payment gateways play in enhancing the user experience, improving transaction efficiency, and supporting the growth of the e-commerce ecosystem, firmly positioning it as a key market driver.

- Increasing Penetration of Smartphones

The increasing penetration of smartphones globally has revolutionized the digital payment landscape, enabling seamless integration of payment gateways into mobile applications for enhanced convenience. As smartphones become a primary tool for financial transactions, mobile wallets such as Google Pay and Apple Pay exemplify the ease and security of digital payments. These wallets utilize advanced technologies such as Near Field Communication (NFC) and tokenization to facilitate contactless payments, offering users a swift and secure checkout experience. For instance, in markets such as India, platforms such as Paytm have leveraged smartphone proliferation to enable widespread adoption of digital payments across urban and rural areas alike. This trend has transformed how businesses and consumers interact financially, reducing reliance on cash and traditional banking methods. The convergence of smartphone technology and digital payment gateways has thus emerged as a critical market driver, paving the way for greater financial inclusion and innovation in the payments ecosystem.

Opportunities

- Increasing Government Initiatives Aimed at Fostering Cashless Economies

Government initiatives aimed at fostering cashless economies are creating significant opportunities for the digital payment gateway market by encouraging the transition from cash to digital transactions. For instance, India's "Digital India" program has been instrumental in driving the adoption of digital payments through incentives, subsidies, and infrastructure enhancements. Under this initiative, the government has partnered with financial institutions and payment platforms to promote Unified Payments Interface (UPI)-based systems, making digital transactions accessible even in rural areas. Programs such as this boost the usage of gateways such as PhonePe and Paytm and attract global players such as Google Pay and Amazon Pay to expand their operations. Similarly, in countries such as Sweden and Singapore, government policies have strongly supported cashless ecosystems, encouraging businesses and consumers to adopt digital payments. These initiatives enhance the adoption of payment gateways, presenting a robust market opportunity as economies globally push for digital transformation in financial transactions.

- Rising Demand for Contactless Payments

The rising demand for contactless payments, propelled by the COVID-19 pandemic, has created a significant market opportunity for digital payment gateways. With health and safety concerns driving consumers and businesses to minimize physical contact, gateways have become essential in facilitating secure, touch-free transactions across retail, hospitality, and other service industries. For instance, payment solutions such as Apple Pay, Google Pay, and Samsung Pay allow users to complete purchases with a simple tap of their smartphone or wearable device, eliminating the need for cash or card swiping. This shift has been particularly prominent in grocery stores, restaurants, and public transport systems, where rapid and hygienic payment methods are a priority. According to industry reports, the global contactless payment market is expected to grow substantially, reflecting this increased reliance. As more businesses integrate contactless solutions, the demand for advanced payment gateways continues to rise, driving innovation and market expansion in the digital payments ecosystem.

Restraints/Challenges

- Security Concerns and Cyber Threats

Security concerns and cyber threats are critical challenges in the digital payment gateway market, as the increasing adoption of digital transactions has made payment systems prime targets for cybercriminals. High-profile incidents, such as the 2020 data breach affecting Paytm, where hackers reportedly accessed sensitive user data, highlight the vulnerability of digital payment platforms to sophisticated attacks. Such breaches can result in financial losses, reputational damage, and a loss of customer trust, which are difficult to recover from in a competitive market. Furthermore, ensuring compliance with global security standards such as PCI DSS and integrating advanced fraud detection technologies can be resource-intensive for providers, particularly startups and smaller players. This challenge is further amplified by the evolving nature of cyber threats, requiring continuous investment in security infrastructure. As a result, many potential users, especially in developing regions, remain hesitant to adopt digital payment gateways, perceiving them as less secure than traditional payment methods, ultimately impacting market growth.

- High Transaction Costs

High transaction costs are a significant challenge in the digital payment gateway market, particularly for small and medium-sized enterprises (SMEs) and businesses operating in price-sensitive regions. Payment gateway providers typically charge fees that include setup costs, per-transaction fees, and currency conversion charges for cross-border transactions, which can add up quickly. For instance, platforms such as PayPal charge a fee of 2.9% plus a fixed amount per transaction in the U.S., and international transactions incur additional cross-border and currency conversion fees. These costs can erode profit margins, making it difficult for smaller businesses to adopt or sustain digital payment solutions. In markets where customers are highly price-conscious, these fees may deter businesses from using gateways altogether, as they might pass on the added expense to customers, potentially driving them away. This creates a significant barrier to adoption and market expansion, as cost-effective alternatives or traditional cash transactions are often preferred in such scenarios.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Digital Payment Gateway Market Scope

The market is segmented on the basis of type, organisation size, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Hosted

- Non-Hosted

Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

End User

- Travel

- Retail

- Banking, Financial Services, and Insurance (BFSI)

- Media and Entertainment

- Others

Digital Payment Gateway Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, organisation size, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America dominates the global digital payment gateway market, driven by advanced technological infrastructure, widespread adoption of cashless payment solutions, and the presence of major market players. The region benefits from high internet penetration, increasing e-commerce activities, and strong consumer preference for secure and efficient online payment systems. This dominance is further supported by government initiatives promoting digital transactions and the integration of innovative technologies such as AI and blockchain into payment gateways.

Asia Pacific is anticipated to be the fastest-growing region in the digital payment gateway market during the forecast period. This growth is fueled by rapid digital transformation, increasing smartphone penetration, and the expansion of e-commerce in countries such as India, China, and Southeast Asia. Government initiatives promoting cashless economies, such as India’s Digital India program and China’s focus on mobile payment systems, further drive the adoption of digital payment gateways. The region's young, tech-savvy population and rising internet connectivity are also significant contributors to this growth trajectory.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Digital Payment Gateway Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Digital Payment Gateway Market Leaders Operating in the Market Are:

- Amazon Payments, Inc. (U.S.)

- CCBill, LLC (U.S.)

- AsiaPay Limited (Hong Kong)

- MercadoLibre SRL (Argentina)

- Web Active Corporation (Australia)

- NAB Transact (Australia)

- e-Path (Australia)

- Cardstream Limited (U.K.)

- Svea Bank (Sweden)

- Certitrade (Sweden)

- ServiRed (Spain)

- Kiplepay Sdn Bhd (Malaysia)

- MyGate (South Africa)

- 99bill (China)

- PAGOS ONLINE S.A. (Colombia)

- WebMoney (Russia)

- PESOPAY (Philippines)

- GPUK LLP (U.K.)

- Klarna Bank AB (Sweden)

- Stripe, Inc. (U.S.)

- PayPal (U.S.)

- Beanstream (Canada)

- Worldpay LLC (U.K.)

- Paytm (India)

Latest Developments in Digital Payment Gateway Market

- In February 2024, Adyen partnered with Billie to introduce Buy Now, Pay Later services for businesses across Europe. Billie's solution integrates seamlessly with Adyen, allowing shops to activate it with just a few clicks

- In May 2023, Stripe collaborated with Airbnb to enable bank payments for Airbnb guests through direct bank account transactions

- In September 2022, PhonePe, a Unified Payments Interface (UPI) leader, announced plans to launch its own payments gateway as an extension of its QR code-based UPI payments service and in-app transactions. The gateway was expected to debut in the first quarter of 2023

- In May 2022, MasterCard partnered with CRED to allow Mastercard credit cardholders to conduct simple, secure, and high-value transactions using the CRED app on any mobile device

- In October 2021, PayPal acquired Paidy, a leading payments platform and Buy Now, Pay Later solution provider in Japan. This acquisition aimed to enhance PayPal's capabilities and strengthen its presence in Japan's domestic payments market

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.