Global Hazardous Area Equipment Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

3.30 Billion

USD

6.70 Billion

2024

2032

USD

3.30 Billion

USD

6.70 Billion

2024

2032

| 2025 –2032 | |

| USD 3.30 Billion | |

| USD 6.70 Billion | |

|

|

|

|

Global Hazardous Area Equipment Market, By Product (Cable Glands and Accessories, Measurement Devices, Control Panel Products, Alarm Systems, Gas Detector, Fire Detector, Motors, and Lighting Products), By Industry (Oil & Gas, Chemical & Pharmaceuticals, Food & Beverages, Energy & Power, Mining, and Others), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) - Industry Trends and Forecast to 2032

Hazardous Area Equipment Market Size

-

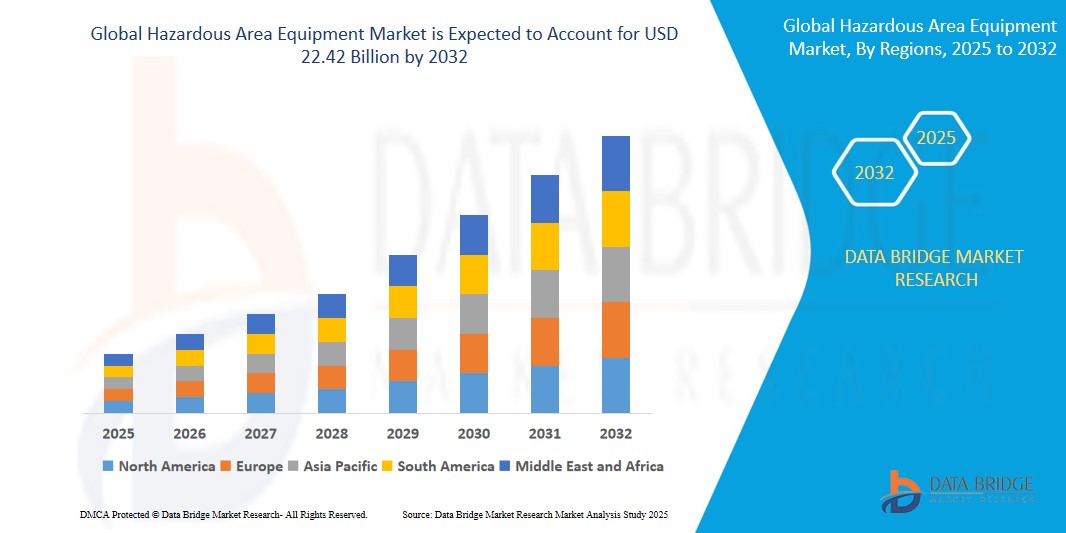

The Global Hazardous Area Equipment Market size was valued atUSD 13.75 billion in 2024 and is expected to reachUSD 22.42 billion by 2032, at aCAGR of 6.30%during the forecast period

- This growth is driven by factors such as the increased adoption of automation across industries

Hazardous Area Equipment Market Analysis

-

Hazardous area equipment refers to machinery, devices, and systems designed to operate safely in environments where there is a risk of explosion or fire due to the presence of flammable gases, vapours, or dust. These products are vital in industries such as oil and gas, chemical manufacturing, mining, pharmaceuticals, and others that deal with volatile substances.

- The demand for hazardous area equipment is significantly driven by the increasing number of industrial applications in potentially explosive environments, such as offshore oil rigs, mining sites, and chemical processing plants.

- North America is projected to dominate the global hazardous area equipment market due to its established industrial infrastructure and stringent safety regulations, which mandate the use of specialized equipment in hazardous environments. The U.S. is leading the market, with strong demand from industries such as oil and gas and chemicals.

- The Asia-Pacific region is expected to witness the fastest growth rate, driven by industrial expansion in China, India, and Southeast Asia. As these countries invest heavily in infrastructure development and energy production, the demand for hazardous area equipment is expected to rise substantially.

- The cable glands and accessories segment dominated the market with 56.23% market share. The increased adoption of automation across industries such as oil and gas, manufacturing, mining, and energy drives the demand for cable glands and accessories. These components are vital for ensuring safe and reliable electrical connections in automated systems.

Report Scope and Hazardous Area Equipment Market Segmentation

|

Attributes |

Hazardous Area Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hazardous Area Equipment Market Trends

“Integration of Smart Technologies and IoT in Hazardous Area Equipment”

- One of the key trends in the hazardous area equipment market is the growing integration of smart technologies, including IoT and AI, into safety equipment. These technologies enable real-time monitoring and predictive maintenance, reducing downtime and enhancing safety in hazardous environments

- For instance, In 2024, a leading gas detection company introduced IoT enabled gas detectors that send alerts directly to operators mobile devices, allowing for quicker responses to hazardous situations. This integration of smart technology is revolutionizing safety protocols in high-risk industries such as oil & gas, mining, and chemicals.

- These advancements not only provide more efficient monitoring but also facilitate better data analytics and reporting for compliance and safety audits

Hazardous Area Equipment Market Dynamics

Driver

“Growing Demand for Worker Safety and Regulatory Compliance”

- The primary driver for the hazardous area equipment market is the increasing focus on ensuring worker safety in environments with explosive or toxic substances. Industries such as oil & gas, chemicals, and mining are at the forefront of investing in explosion-proof equipment to meet stringent safety regulations.

- As regulatory bodies continue to tighten safety standards globally, there is a significant push toward the adoption of explosion-proof motors, lighting, gas detectors, and other safety equipment.

- For instance, March 2024, several major chemical manufacturing companies in Europe upgraded their hazardous area equipment to comply with the newly revised ATEX (ATmospheres EXplosibles) safety standards. This move significantly boosted demand for explosion-proof devices, including gas detectors and lighting systems, ensuring the safety of workers in environments with volatile chemicals and gases.

- The implementation of stricter workplace safety laws worldwide is further driving the demand for advanced hazardous area equipment, ensuring that companies comply with occupational health and safety standards.

Opportunity

“Growing Demand for Worker Safety and Regulatory Compliance”

- The ongoing trend toward automation and digitalization in hazardous industries presents a significant opportunity for the hazardous area equipment market. As industries move toward Industry 4.0, there is an increasing need for advanced, digitally connected safety equipment

- Equipment such as gas detectors and control systems are now being integrated with AI-driven analytics to enhance safety and efficiency. Automation in hazardous environments requires equipment that not only ensures safety but also facilitates remote monitoring and control

- For instance, In January 2025, a mining company in South Africa introduced automated systems integrated with explosion proof sensors to monitor conditions in underground mines. This automation is expected to reduce human error and improve safety protocols.

- As industries increasingly adopt automated solutions, vendors offering smart hazardous area equipment stand to benefit from rising demand for more advanced safety technology and digital solutions.

Restraint/Challenge

“High Initial Investment and Deployment Costs”

- One of the key challenges facing the hazardous area equipment market is the high initial cost of purchasing explosion-proof and safety-compliant equipment. Although these devices are critical for protecting lives and assets, their high upfront cost can deter smaller businesses or industries with limited budgets from upgrading to more advanced safety equipment

- Additionally, maintenance and calibration of hazardous area equipment require specialized knowledge and can be costly. This makes ongoing upkeep a challenge for companies operating in remote or resource-strapped environments

- For instance, In May 2024, a European mining firm had to undergo unplanned upgrades to its gas detection systems when new safety standards were introduced in the European Union. The company faced significant unexpected expenses in replacing outdated equipment to meet the new regulations, impacting its bottom line for the quarter.

- While the investment is necessary to ensure compliance and safety, the high costs and need for frequent maintenance can create financial strain on smaller companies, especially in developing markets where safety regulations are still evolving

Hazardous Area Equipment Market Scope

The market is segmented on the basis, product and industry.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Industry |

|

In 2025, Cable Glands and Accessories are projected to dominate the market, holding the largest share within the product segment.

The dominance of cable glands and accessories is primarily driven by the increasing demand for robust and reliable solutions to secure electrical cables in hazardous environments. These products are critical in ensuring that electrical connections are safely isolated, preventing the risk of explosions or fires in industries such as oil & gas, chemicals, mining, and pharmaceuticals, where volatile and toxic substances are prevalent.

The Oil & Gas industry is expected to account for the largest share in the industry segment during the forecast period.

The oil and gas industry, due to its high-risk nature and presence in hazardous environments, will continue to demand explosion-proof equipment, including gas detectors, control panels, and lighting products. Strict regulatory compliance requirements, such as those set by the Occupational Safety and Health Administration (OSHA) and other safety agencies, are pushing the oil and gas sector to implement the latest safety technologies to protect workers and maintain operations in hazardous areas.

Hazardous Area Equipment Market Regional Analysis

“North America Holds the Largest Share in the Hazardous Area Equipment Market”

- North America is projected to hold the largest share in the global hazardous area equipment market. The region's dominance can be attributed to its well-established industrial infrastructure, high demand for safety in critical sectors such as oil & gas, chemicals, and mining, and stringent regulatory frameworks.

- The U.S. is the driving force in the region, where ongoing industrial activities in hazardous zones, especially in the oil & gas and chemical sectors, necessitate reliable explosion-proof and safety equipment to meet safety standards.

“Asia-Pacific is Projected to Register the Highest CAGR in the Hazardous Area Equipment Market

- The Asia-Pacific region is expected to register the highest CAGR in the global hazardous area equipment market, driven by rapid industrialization, increased mining activities, and a rise in oil & gas exploration in countries such as China, India, and Australia. These nations are heavily investing in hazardous area equipment to meet safety requirements in their expanding industrial sectors, particularly in offshore and onshore oil & gas fields, chemical manufacturing, and mining operations.

- China and India are witnessing substantial growth in their petrochemical and energy industries, creating a heightened demand for explosion-proof lighting, motors, and gas detection equipment.

Hazardous Area Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ABB Ltd (Switzerland)

- Eaton Corporation (Ireland)

- Emerson Electric Co. (U.S.)

- E2S Warning Signals (U.K.)

- Honeywell International Inc (U.S.)

- WERMA Signaltechnik GmbH + Co. KG (Germany)

- Patlite Corporation (Japan)

- Rockwell Automation Inc (U.S.)

- R. Stahl AG (Germany)

- Siemens AG (Germany)

Latest Developments in Global Hazardous Area Equipment Market

- In March 2025, Honeywell launched its SafeGuard series of hazardous area equipment, designed to enhance safety and operational efficiency in explosive and toxic environments. This new range includes explosion-proof motors, lighting systems, and gas detectors equipped with advanced IoT capabilities for real-time monitoring. The product aims to offer high-level protection for workers in oil & gas, chemical, and mining industries by ensuring strict adherence to safety standards and enhancing regulatory compliance.

- In February 2025, Siemens and ExxonMobil announced a strategic partnership to enhance the safety and performance of operations in hazardous environments. The collaboration focuses on the deployment of Siemens' advanced hazardous area equipment, including gas detectors, alarm systems, and control panel products, in ExxonMobil’s offshore and onshore oil and gas sites. This partnership will improve real-time safety monitoring and enhance compliance with international safety regulations, ensuring safer working conditions for workers in high-risk environments.

- In January 2025, ABB completed the acquisition of GE Safety Systems, a leading provider of hazardous area equipment for industries such as oil & gas and chemicals, for USD 600 million. The acquisition is expected to expand ABB’s product portfolio, particularly in explosion-proof equipment and safety systems. By integrating GE’s advanced safety technologies, ABB aims to offer more comprehensive solutions for hazardous areas, improving safety, efficiency, and compliance with global safety standards.

- In December 2024, Schneider Electric introduced its Ex Safe Series, a new line of hazardous area lighting systems, designed to withstand extreme conditions and provide consistent performance in hazardous environments. These lighting systems incorporate smart connectivity features, allowing for remote monitoring and predictive maintenance. The innovation aims to reduce downtime in industrial facilities, minimize maintenance costs, and enhance worker safety by ensuring optimal lighting and visibility in explosive atmospheres.

- In November 2024, 3M announced its merger with RAE Systems, a leading provider of portable and fixed gas detection solutions. This strategic merger aims to strengthen 3M's position in the hazardous area equipment market by combining RAE’s expertise in gas detection with 3M’s extensive product portfolio. The merged entity will focus on the development of next generation gas detectors with advanced sensing technologies, aimed at enhancing worker safety and compliance in hazardous environments across industries such as chemicals, mining, and oil & gas.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.