Global Hexamethylenediamine Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

122.04 Million

USD

174.22 Million

2024

2032

USD

122.04 Million

USD

174.22 Million

2024

2032

| 2025 –2032 | |

| USD 122.04 Million | |

| USD 174.22 Million | |

|

|

|

|

Global Hexamethylenediamine Market Segmentation, By Application (Nylon Synthesis, Curing Agents, Water Treatment Chemicals, Chemical Synthesis, Medical Applications, Adhesives, and Others), End User (Automotive, Textile, Paints and Coatings, Petrochemical, and Others) - Industry Trends and Forecast to 2032

Hexamethylenediamine Market Size

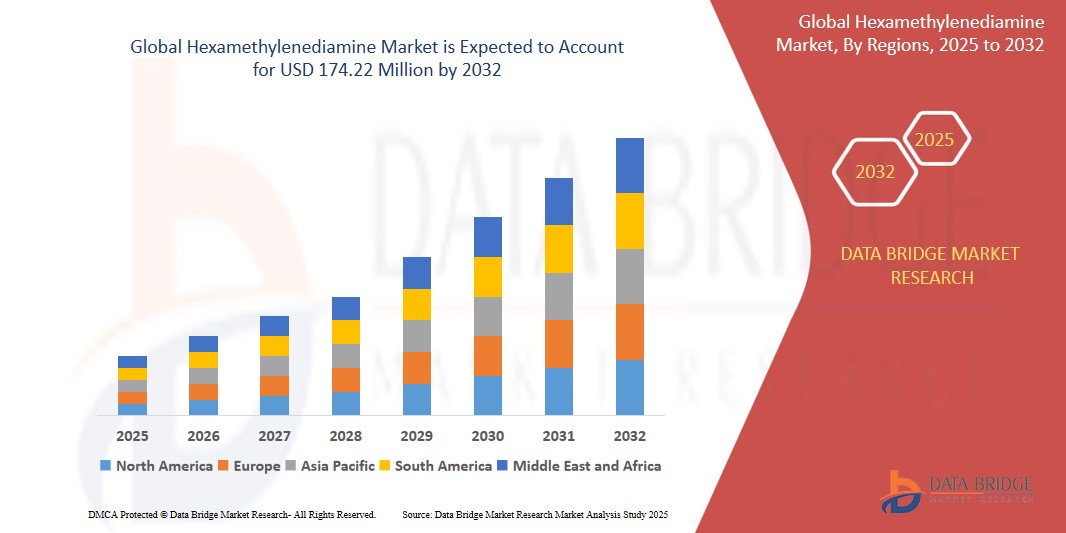

- The global Hexamethylenediamine market was valued atUSD 122.04 Million in 2024 and is expected to reachUSD 174.22 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 4.6%, primarily driven by the increasing demand for nylon 6,6

- This growth is driven by increasingly utilizing nylon 6,6 for manufacturing lightweight components such as radiator end tanks, air intake manifolds, and rocker covers.

Hexamethylenediamine Market Analysis

- Hexamethylenediamine (HMDA) is widely used in the production of nylon, coatings, and adhesives. The demand for these applications in automotive, textiles, and construction industries is driving growth in the global HMDA market.

- With increasing environmental regulations, there is a growing focus on developing bio-based or sustainable production methods for HMDA. Companies are investing in green technologies to meet sustainability targets and appeal to eco-conscious consumers.

- Rapid industrialization in emerging economies, particularly in Asia Pacific, has led to increased demand for hexamethylenediamine, especially in the automotive and textile sectors. This region is expected to contribute significantly to the global market expansion.

Report Scope and Hexamethylenediamine Market Segmentation

|

Attributes |

Hexamethylenediamine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Hexamethylenediamine Market Trends

“Rising Demand for Bio-Based Hexamethylenediamine”

- The global shift towards sustainable and eco-friendly products is propelling the demand for bio-based HMDA.

- Consumers and industries alike are seeking greener alternatives, leading to increased interest in renewable HMDA sources.

- Major chemical companies are forming strategic partnerships to develop and commercialize bio-based HMDA.

- Innovations in biotechnology are enabling more efficient and cost-effective production of bio-based HMDA.

- For instance, Asahi Kasei and Genomatica have collaborated to produce renewably-sourced nylon 6,6 using bio-based HMDA

- The increasing demand for bio-based HMDA is a significant trend in the global market, driven by sustainability goals, industry collaborations, technological innovations, and supportive regulations. This trend is expected to continue, shaping the future of HMDA production and application.

Hexamethylenediamine Market Dynamics

Driver

“Increasing Demand for Nylon 6,6”

- The automotive sector is increasingly utilizing nylon 6,6 for manufacturing lightweight components such as radiator end tanks, air intake manifolds, and rocker covers.

- This shift aims to enhance fuel efficiency and reduce emissions, thereby boosting HMDA demand.

- Nylon 6,6 fibers are favored in the textile industry for their strength, durability, and resistance to abrasion.

- The growing demand for high-quality textiles in clothing, home furnishings, and technical applications is driving the need for HMDA.

- For instance, Companies like Ford and BMW have been increasingly using nylon 6,6 components to reduce vehicle weight and improve fuel efficiency, replacing heavier metal parts with durable, lighter nylon-based parts.

- The multifaceted applications of nylon 6,6 across various industries underscore the critical role of HMDA as a foundational chemical, positioning it as a key driver in the global market's growth trajectory.

Opportunity

“Increasing Application in High-Performance Coatings and Adhesives Across Various Industries”

- HMDA-based epoxy curing agents are gaining traction due to their ability to enhance the durability and corrosion resistance of coatings, making them ideal for construction and industrial applications.

- Innovations in epoxy resin formulations have improved the performance of HMDA-based adhesives, offering better mechanical properties and chemical resistance, which are essential for demanding applications.

- The automotive and aerospace sectors are increasingly adopting HMDA-based coatings and adhesives for lightweight and high-strength bonding solutions, contributing to fuel efficiency and performance.

- HMDA-based products are being developed to meet stringent environmental regulations, including low volatile organic compound (VOC) emissions, aligning with global sustainability goals.

- For instance, Companies like Huntsman Corporation and Evonik Industries have developed epoxy curing agents based on HMDA derivatives (like IPDA – isophorone diamine) for industrial floor coatings and protective marine coatings, offering high chemical resistance and durability.

- The expanding use of HMDA in advanced coatings and adhesives presents a significant growth opportunity, driven by technological advancements and the demand for high-performance, sustainable solutions across multiple industries.

Restraint/Challenge

“Volatility in Raw Material Prices”

- Regulatory bodies like the FDA and EMA require detailed justification for the inclusion of excipients in pharmaceutical formulations. This includes demonstrating safety, efficacy, and necessity, which can be time-consuming and resource-intensive for manufacturers.

- The rigorous standards set by regulatory agencies have led to a shortage of FDA-approved manufacturing sites for sugar-based excipients.

- This limitation restricts production capacity and can delay the introduction of new products to the market.

- Manufacturers must adhere to strict quality control procedures to ensure product consistency and safety. These demands can increase operational costs and require significant investment in quality assurance infrastructure.

- Navigating the complex regulatory landscape is a major challenge for the sugar-based excipients market. While these regulations are essential for ensuring product safety and efficacy, they can also impede market growth and innovation.

Hexamethylenediamine Market Scope

The market is segmented on the basis of application and end user.

|

Segmentation |

Sub-Segmentation |

|

By Application |

|

|

By End User |

|

Hexamethylenediamine Market Regional Analysis

“North America is the Dominant Region in the Hexamethylenediamine Market ”

- North America dominates the hexamethylenediamine market, driven by its strong automotive, construction, and textile industries, which drive high demand for nylon 66, a major application

- U.S. holds a significant share due to advanced chemical manufacturing infrastructure, abundant raw materials, and significant investments in research and development, supporting consistent production and innovation in hexamethylenediamine applications.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific region is expected to witness the highest growth rate in the hexamethylenediamine market, driven by increasing demand for HMDA in nylon production and polymer applications

- China is growing with highest CAGR in the region due to affordable labor, access to raw materials, and strategic investments by global players further bolster regional growth

Hexamethylenediamine Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Evonik Industries AG (Germany)

- BASF SE (Germany)

- Asahi Kasei Corporation (Japan)

- Solvay (Belgium)

- Ashland (U.S.)

- Merck KGaA (Germany)

- DuPont (U.S.)

- TORAY INDUSTRIES, INC. (Japan)

- INVISTA (U.S.)

- Radici Partecipazioni SpA (Italy)

- DAEJUNGCHE CHEMICAL & METALS CO., LTD. (South Korea)

- Genomatica, Inc (U.S.)

- Junsei Chemical Co.,Ltd. (Japan)

- Suzhou Sichang Learning Technology Co., Ltd. (China)

- Alfa Aesar, Thermo Fisher Scientific (U.S.)

- Eastman Chemical Company (U.S.)

- Arkema (France)

- Ascend Performance Materials (U.S.)

- Formosa Plastics Corporation (Taiwan)

- Huntsman International LLC (U.S.)

Latest Developments in Global Hexamethylenediamine Market

- In March 2025, DOMO Chemicals announced it would cease production of hexamethylene diamine (HMD) and base polyamide 66 (PA66) at its Belle-Etoile facility in Saint-Fons, France, to focus on downstream processes and engineered materials. The closure is in response to tough market conditions in the polyamide sector, including rising costs and lower demand. Production of PA66 will continue at the company’s Blanes, Spain, and Valence, France, sites. The shutdown is expected to be completed by summer 2025, although DOMO Chemicals has not yet issued an official statement.

- In February 2025, Fujian Haichen Chemical Co., Ltd. marked the inauguration of the gasification purification section of its 400,000-ton annual adiponitrile production and raw material support project at the Gulei Petrochemical Base in Zhangzhou. This event signifies the transition of the project into its construction phase, following an investment of USD 2.02 billion. The project will utilize coal as its primary raw material and establish a full production chain that includes ethylene cracking, butadiene, adiponitrile, hexamethylenediamine, and nylon 66, enhancing the resource distribution of Fujian Energy and Chemical Group.

- In March 2022, Asahi Kasei Corporation formed a partnership with Genomatica Inc. to commercialize renewable nylon 6.6 derived from bio-based hexamethylenediamine building blocks. This collaboration is intended to further strengthen Asahi Kasei's position in the market.

- In January 2022, BASF SE announced plans to build a new hexamethylenediamine plant in Chlaampe, France. This facility will increase BASF's annual production capacity of hexamethylenediamine to 260,000 metric tons, with production expected to begin in 2024.

- In October 2024, Ascend Performance Materials celebrated the opening of its hexamethylene diamine (HMD) plant in Lianyungang, China, with a ribbon-cutting ceremony attended by government officials, customers, and suppliers. This marks Ascend's first chemical production site and its largest investment outside the U.S. The plant’s capacity increases the company’s total HMD output by about 50%, complementing its two existing plants in Decatur, Alabama, and Pensacola, Florida. HMD is a key ingredient in polyamide 66 production, and the plant will also manufacture Ascend’s FlexaTram specialty amines, used in industries like coatings, pharmaceuticals, and oil and gas.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.