Global Liquid Chromatography Devices Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

4.22 Billion

USD

5.73 Billion

2024

2032

USD

4.22 Billion

USD

5.73 Billion

2024

2032

| 2025 –2032 | |

| USD 4.22 Billion | |

| USD 5.73 Billion | |

|

|

|

|

Global Liquid Chromatography Devices Market Segmentation, By Technique (High Performance Liquid Chromatography (HPLC), Ultra High Pressure Liquid Chromatography (UHPLC), Low Pressure Liquid Chromatography (LPLC), Fast Protein Liquid Chromatography (FPLC), and Others), Type (Instruments and Consumables and Services), Accessories (Columns, Auto-Sampler Accessories, and Others), Application (Pharma and Bio, Public, Industry, and Others), End-User (Pharmaceutical Companies, Academics and Research Institutes, Hospitals, Agriculture Industry, and Others)- Industry Trends and Forecast to 2032

Liquid Chromatography Devices Market Size

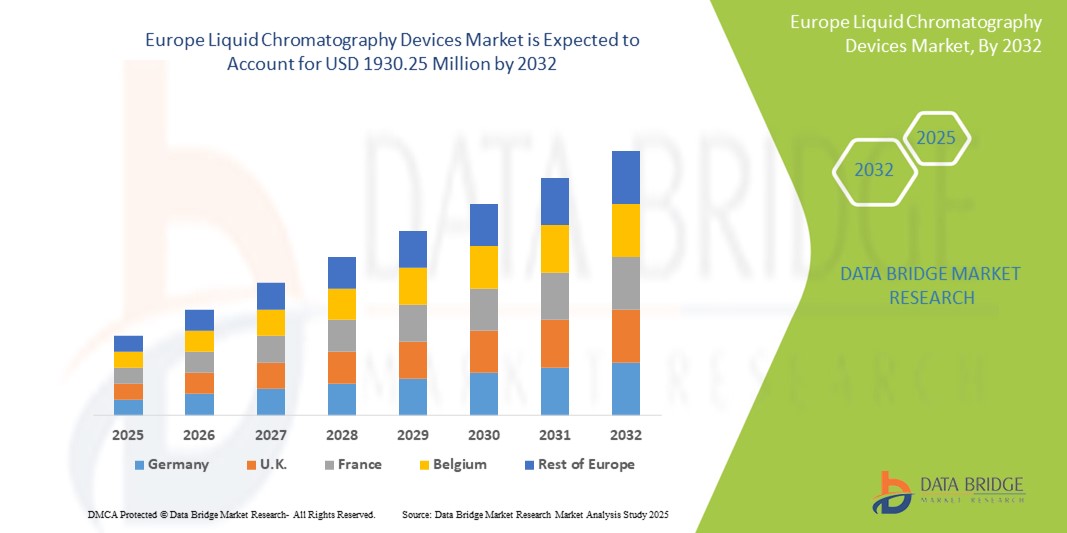

- The global liquid chromatography devices market size was valued atUSD 4.22 billion in 2024and is expected to reachUSD 5.73 billion by 2032, at aCAGR of 3.90%during the forecast period

- This growth is driven by factors such as the increasing demand for analytical testing across pharmaceuticals, biotechnology, food safety, and environmental monitoring sectors, advancements in chromatography technologies

Liquid Chromatography Devices Market Analysis

- The term "liquid chromatography" basically refers to a chromatographic technique for separating ions or molecules that are dissolved in a solvent.

- It entails the separation of biomolecules based on their size, type, and other characteristics, and it necessitates the use of stationary phase, mobile phase, and elutants to complete the separation technique

- North America is expected to dominate the liquid chromatography devices market with 32.3% due to rapid expansion of the pharmaceutical industry, substantial investment in research and development, and the rising demand for clinical diagnostic applications

- Asia-pacific is expected to be the fastest growing region in the liquid chromatography devices market during the forecast period due to significant innovations in healthcare infrastructure and technology

- Instruments segment is expected to dominate the market with a market share of 48.7% due to increasing dominance of integrated HPLC systems and the availability of advanced detectors. Manufacturers in this sector concentrate on developing systems that provide enhanced productivity and application specificity

Report Scope and Liquid Chromatography Devices Market Segmentation

|

Attributes |

Liquid Chromatography Devices KeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Liquid Chromatography Devices Market Trends

“Advancements in Chromatography Technologies”

- The development of compact, automated liquid chromatography systems is enhancing throughput and efficiency, making them suitable for point-of-care diagnostics and field applications

- Combining liquid chromatography with mass spectrometry (LC-MS) is providing higher sensitivity and specificity in complex sample analyses, particularly in proteomics and metabolomics

- UHPLC systems offer faster analysis times and improved resolution, catering to the increasing demand for rapid and detailed analytical results in pharmaceutical and clinical research

- The incorporation of AI and ML algorithms in chromatography systems is enabling real-time data analysis and predictive maintenance, thereby enhancing operational efficiency

- Emerging portable chromatography devices are facilitating on-site testing in environmental monitoring and food safety applications, expanding the reach of analytical capabilities

Liquid Chromatography Devices Market Dynamics

Driver

“Increasing Demand in Pharmaceuticals and Biotechnology”

- Significant investments in pharmaceutical and biotechnology research are driving the need for advanced analytical tools such as liquid chromatography to support drug discovery and development

- Stringent regulatory requirements for drug purity and quality control are necessitating the use of reliable and precise analytical techniques such as liquid chromatography

- The rise of personalized medicine approaches is increasing the demand for detailed biomarker analysis, where liquid chromatography plays a crucial role

- The growing biopharmaceutical sector requires robust analytical methods for the characterization and quality assurance of biologics, further propelling the adoption of liquid chromatography

- International health organizations' focus on combating diseases is leading to increased funding for research, thereby boosting the need for advanced analytical instrumentation

Opportunity

“Expansion into Emerging Markets and Applications”

- Rapid industrialization and healthcare infrastructure development in emerging economies are creating new markets for liquid chromatography devices

- Growing concerns over environmental pollution are driving the need for advanced analytical tools to detect contaminants, where liquid chromatography is extensively used

- Increasing consumer awareness and regulatory pressures are pushing the food industry to adopt liquid chromatography for quality assurance and safety testing

- The application of liquid chromatography in forensic investigations is expanding, offering opportunities for market growth in legal and criminal analysis

- The need for pesticide residue analysis and quality control in agriculture is fostering the adoption of liquid chromatography techniques in the agricultural sector

Restraint/Challenge

“High Costs and Operational Complexity”

- The high initial investment and ongoing maintenance expenses associated with liquid chromatography systems can be prohibitive for smaller laboratories and institutions

- Operating and maintaining liquid chromatography systems require specialized training and expertise, which may not be readily available, especially in developing regions

- The intricate nature of chromatographic techniques necessitates meticulous method development and validation, which can be time-consuming and resource-intensive

- Adhering to stringent regulatory standards and ensuring consistent performance across diverse applications can pose significant challenges for manufacturers and users

- The availability and adoption of alternative analytical methods, such as mass spectrometry and gas chromatography, may limit the growth prospects of the liquid chromatography market

Liquid Chromatography Devices Market Scope

The market is segmented on the basis of technique, type, accessories, application, and end-user

|

Segmentation |

Sub-Segmentation |

|

By Technique |

|

|

By Type |

|

|

By Accessories |

|

|

By Application |

|

|

By End-User |

|

In 2025, the instrument is projected to dominate the market with a largest share in type segment

The instruments segment is expected to dominate the liquid chromatography devices market with the largest share of 48.7% in 2025 due to increasing dominance of integrated HPLC systems and the availability of advanced detectors. Manufacturers in this sector concentrate on developing systems that provide enhanced productivity and application specificity

Thepharmaceutical Companiesis expected to account for the largest share during the forecast period in end-user market

In 2025, the pharmaceutical Companies segment is expected to dominate the market with the largest market share of 41.4% due to within these companies, HPLC methods are employed for various applications, including quality control, drug purity determination, characterization of drug candidates, and evaluation of the stability of active ingredients in pharmaceuticals.

Liquid Chromatography Devices Market Regional Analysis

“North America Holds the Largest Share in the Liquid Chromatography Devices Market”

- North America holds a substantial market share of approximately 32.3% in the global liquid chromatography devices market

- This dominance is attributed to the region's advanced healthcare infrastructure, leading pharmaceutical and biotechnology sectors, and significant R&D investments

- The presence of major market players in the U.S., such as Thermo Fisher Scientific and Waters Corporation, contributes to continuous innovations in chromatography technologies, enhancing the region's leadership position

- Stringent regulatory requirements and a strong focus on analytical testing, particularly in the pharmaceutical and environmental sectors, drive the demand for liquid chromatography devices in North America

- The U.S. boasts an extensive network of research institutions and high adoption rates of advanced LC technologies in drug development, clinical research, and quality control, further reinforcing its dominance

“Asia-Pacific is Projected to Register the HighestCAGR in the Liquid Chromatography Devices Market”

- Asia Pacific is the fastest-growing region in the liquid chromatography devices market,

- Countries such as China, India, Japan, and South Korea have witnessed significant development in their pharmaceutical, biologics, and chemicals sectors, driving the demand for chromatography instruments, consumables, and services

- Governments in Asian countries have prioritized the development of domestic healthcare industries through incentives and initiatives aimed at boosting manufacturing and R&D capabilities

- The rise of contract research and manufacturing organizations (CRMO) in the region has attracted business from global pharmaceutical companies, further boosting regional chromatography usage

- The Asia Pacific region is projected to maintain rapid growth during the forecast period, with significant demand from drug discovery, clinical research, and environmental testing

Liquid Chromatography Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Gilson Incorporated(U.S)

- Phenomenex Inc.,(U.S)

- Waters Corporation(U.S)

- Shimadzu Corporation(Japan)

- Tosoh Bioscience(Japan)

- Thermo Fisher Scientific. (U.S)

- Hitachi Ltd., (Japan)

- PerkinElmer, Inc. (U.S)

- General Electric Company (U.S)

- Merck KGaA (Germany)

- Bio-Rad Laboratories, Inc. (U.S)

- B.D. (U.S)

- Bio-Rad Laboratories, Inc. (U.S)

- Showa Denko K.K (Japan)

- JASCO (U.S)

- SIELC Technologies (U.S)

- Orochem Technologies Inc. (U.S.)

- YMC Co. Ltd. (Japan)

- Restek Corporation (U.S.)

- Trajan Scientific (Australia)

- Hamilton Company (U.S)

Latest Developments in Liquid Chromatography Devices Market

- In April 2024,Waters Corporationhas introduced the Alliance iS Bio HPLC System, designed to tackle the operational and analytical challenges faced by biopharma quality control (QC) laboratories. This innovative HPLC system integrates advanced bio-separation technology with built-in instrument intelligence features, aimed at enhancing efficiency for biopharma QC analysts

- In April 2022,Shimadzu unveiledLabSolutions MD software, which aids in the creation of analytical methods for high-performance liquid chromatography (HPLC). The program allows automated column and solvent screening and provides capabilities for established technique scouting

- In August 2021, anultra-highperformance liquid chromatography (UHPLC) and automated high performance liquid chromatography (HPLC) method development system was introduced by Thermo Fisher Scientific and ChromSword as a result of their collaboration. This system allows chromatographers to deliver robust and validated methods with greater assurance and in less time

- In February 2021,Shimadzu Corporation'slaunch of the new i-Series LC-2050/LC-2060 integrated HPLC systems. These systems feature high-speed sampling capabilities and minimal carryover, making them suitable for quality control applications

- In November 2020, PerkinElmer Inc.introduced a novel HPLC, UHPLC, and software solution, LC 300TM platform and Simplicity ChromTM software

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.