Global Oncology Immunotherapy Biosimilars Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

891.00 Million

USD

1,828.16 Million

2025

2033

USD

891.00 Million

USD

1,828.16 Million

2025

2033

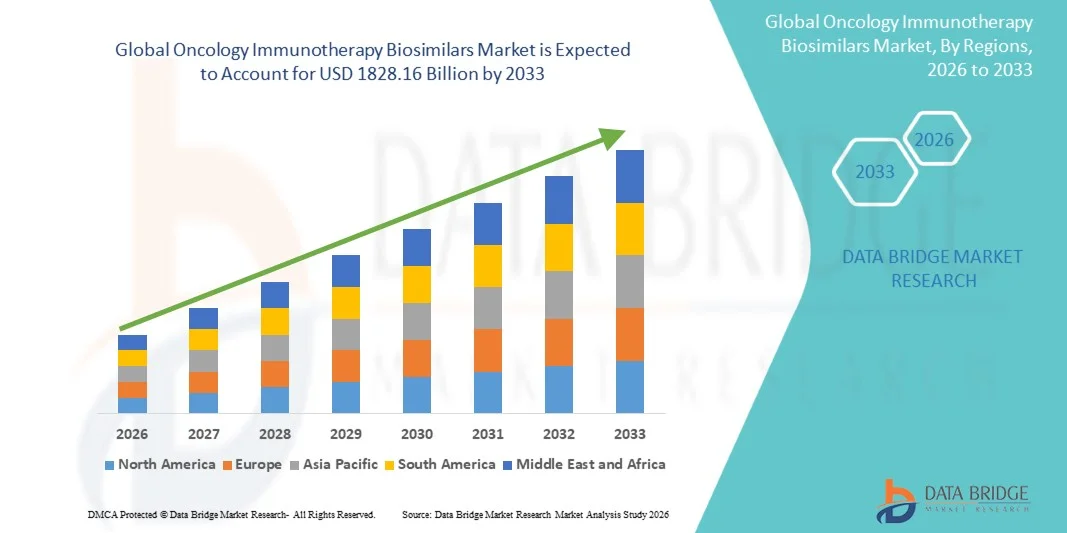

| 2026 –2033 | |

| USD 891.00 Million | |

| USD 1,828.16 Million | |

|

|

|

|

Global Oncology Immunotherapy Biosimilars Market Segmentation, By Product Type (Monoclonal Antibody Biosimilars, Checkpoint Inhibitor Biosimilars (PD-1, PD-L1, CTLA-4), Cytokine-Based Biosimilars, and Others), Indication (Lung Cancer, Breast Cancer, Colorectal Cancer, Melanoma, Lymphoma, and Other Solid & Hematological Malignancies) - Industry Trends and Forecast to 2033

Oncology Immunotherapy Biosimilars Market Size

- The global Oncology Immunotherapy Biosimilars market size was valued at USD 891 Million in 2025 and is expected to reach USD 1828.16 Million by 2033, at a CAGR of 9.40% during the forecast period

- The market growth is largely fueled by the increasing demand for cost-effective cancer treatment options, rising prevalence of oncology indications, and growing acceptance of biosimilars as safe and efficacious alternatives to reference immunotherapy drugs across healthcare systems

- Furthermore, expanding access to advanced cancer care, patent expirations of major immunotherapy biologics, supportive regulatory frameworks, and strong uptake of biosimilars by hospitals and oncology centers are accelerating the adoption of Oncology Immunotherapy Biosimilars, thereby significantly boosting overall market growth

Oncology Immunotherapy Biosimilars Market Analysis

- Oncology immunotherapy biosimilars, which are biologic medicines highly similar to approved reference immunotherapies, are becoming essential components of modern cancer treatment due to their comparable efficacy, safety, and significantly lower cost, improving patient access across hospital and oncology care settings

- The escalating demand for oncology immunotherapy biosimilars is primarily fueled by the rising global cancer burden, patent expirations of major immunotherapy biologics, increasing pressure to reduce oncology treatment costs, and growing confidence among clinicians in biosimilar adoption

- North America dominated the oncology immunotherapy biosimilars market with the largest revenue share of approximately 42.6% in 2025, supported by advanced oncology infrastructure, early adoption of biosimilars, strong reimbursement frameworks, and a high volume of cancer immunotherapy usage, with the U.S. witnessing substantial uptake of biosimilar checkpoint inhibitors across hospitals and cancer centers driven by cost-containment initiatives and favorable regulatory pathways

- Asia-Pacific is expected to be the fastest-growing region in the oncology immunotherapy biosimilars market during the forecast period, driven by a rapidly increasing cancer patient population, expanding access to oncology care, improving healthcare infrastructure, and rising adoption of cost-effective biosimilar therapies in countries such as China and India

- The Monoclonal Antibody Biosimilars segment dominated the largest market revenue share of 42.6% in 2025, driven by their widespread clinical adoption in oncology treatment protocols

Report Scope and Oncology Immunotherapy Biosimilars Market Segmentation

|

Attributes |

Oncology Immunotherapy Biosimilars Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Oncology Immunotherapy Biosimilars Market Trends

“Increasing Regulatory Approvals and Pipeline Expansion of Immunotherapy Biosimilars”

- A key and accelerating trend in the global Oncology Immunotherapy Biosimilars market is the expansion of biosimilar development pipelines targeting immune checkpoint inhibitors, including PD-1, PD-L1, and CTLA-4 inhibitors

- For instance, in August 2023, Biocon Biologics announced positive clinical outcomes for its biosimilar candidate to nivolumab, supporting its global regulatory filing strategy in oncology indications

- Pharmaceutical companies are increasingly focusing on biosimilars of blockbuster immunotherapy drugs as patents expire, creating opportunities for cost-effective alternatives in cancer care

- Growing acceptance of biosimilars among oncologists, supported by real-world evidence and post-marketing surveillance data, is strengthening market confidence

- In addition, partnerships between biosimilar developers and contract manufacturing organizations are accelerating commercialization timelines and global market reach

- This trend is reshaping competitive dynamics by increasing treatment accessibility while maintaining comparable efficacy and safety profiles to reference biologics

Oncology Immunotherapy Biosimilars Market Dynamics

Driver

“Rising Cancer Burden and Demand for Cost-Effective Immunotherapy Treatments”

- The increasing global incidence of cancer and the growing use of immunotherapy as a standard treatment modality are major drivers of the Oncology Immunotherapy Biosimilars market

- For instance, in May 2024, Celltrion Healthcare expanded the availability of its oncology biosimilars across multiple European countries to address rising demand for affordable cancer treatments

- Immunotherapy drugs are often associated with high treatment costs, limiting patient access, particularly in emerging economies and public healthcare systems

- Biosimilars offer a cost-effective alternative that enables broader patient access while helping healthcare systems manage escalating oncology expenditures.

- Government initiatives promoting biosimilar adoption, along with favorable reimbursement policies in regions such as Europe and Asia-Pacific, are further supporting market growth

- The growing number of oncology patients requiring long-term treatment is accelerating the shift toward biosimilars to ensure sustainable cancer care delivery

Restraint/Challenge

“Complex Regulatory Pathways and Physician Adoption Barriers”

- Despite strong growth potential, the Oncology Immunotherapy Biosimilars market faces challenges related to complex regulatory approval processes and slow physician adoption in certain regions

- For instance, regulatory requirements for demonstrating interchangeability and immunogenicity can prolong development timelines and increase costs for biosimilar manufacturers

- Concerns among clinicians regarding long-term efficacy, safety, and extrapolation of indications continue to limit biosimilar uptake in oncology practice

- In addition, strong brand loyalty toward reference biologics and aggressive pricing strategies by originator companies can restrict market penetration

- Educating healthcare professionals through clinical evidence, real-world data, and regulatory guidance is essential to overcoming adoption barriers

- Addressing these challenges through regulatory harmonization, transparent clinical data, and competitive pricing strategies will be critical for sustained market expansion

Oncology Immunotherapy Biosimilars Market Scope

The market is segmented on the basis of product type and indication.

• By Product Type

On the basis of product type, the Global Oncology Immunotherapy Biosimilars market is segmented into Monoclonal Antibody Biosimilars, Checkpoint Inhibitor Biosimilars (PD-1, PD-L1, CTLA-4), Cytokine-Based Biosimilars, and Others. The Monoclonal Antibody Biosimilars segment dominated the largest market revenue share of 42.6% in 2025, driven by their widespread clinical adoption in oncology treatment protocols. These biosimilars are extensively used due to proven efficacy, safety comparability with reference biologics, and broad regulatory approvals across major markets. High utilization in combination immunotherapy regimens supports demand. Cost advantages over originator biologics significantly increase adoption in both developed and emerging economies. Strong hospital procurement volumes reinforce dominance. Increasing cancer prevalence sustains treatment demand. Established manufacturing pipelines ensure stable supply. Physician confidence in monoclonal antibody biosimilars continues to rise. Favorable reimbursement policies support uptake. Expansion of biosimilar portfolios by leading pharma companies strengthens market position. Mature regulatory pathways accelerate approvals. Strong presence across multiple cancer indications reinforces leadership.

The Checkpoint Inhibitor Biosimilars segment is expected to witness the fastest CAGR of 18.9% from 2026 to 2033, driven by rising demand for PD-1, PD-L1, and CTLA-4 inhibitors. Rapid expiration of patents for key checkpoint inhibitors enables biosimilar entry. Growing use of immune checkpoint therapies in first-line cancer treatment accelerates adoption. Expanding clinical evidence supports biosimilar equivalence. Oncology guidelines increasingly include checkpoint inhibitors. Rising affordability improves patient access. Strong pipeline activity fuels market momentum. Increasing combination therapy usage boosts volume. Government initiatives promote biosimilar substitution. Emerging markets show strong uptake potential. Strategic partnerships accelerate commercialization. These factors collectively drive rapid growth.

• By Indication

On the basis of indication, the Global Oncology Immunotherapy Biosimilars market is segmented into Lung Cancer, Breast Cancer, Colorectal Cancer, Melanoma, Lymphoma, and Other Solid & Hematological Malignancies. The Lung Cancer segment dominated the market with a revenue share of 36.8% in 2025, owing to the high incidence of lung cancer globally and extensive use of immunotherapy. Checkpoint inhibitors and monoclonal antibodies are standard of care in non-small cell lung cancer. High patient volumes drive sustained demand. Routine use of PD-1 and PD-L1 therapies supports biosimilar adoption. Favorable reimbursement frameworks boost treatment access. Strong clinical outcomes reinforce physician confidence. Growing smoking-related cancer burden sustains dominance. Oncology centers prioritize lung cancer treatment. Increasing use of combination regimens increases therapy duration. Regulatory approvals across regions strengthen availability. Strong pharma focus on lung cancer pipelines reinforces leadership. Mature diagnostic infrastructure supports early treatment initiation.

The Melanoma segment is projected to grow at the fastest CAGR of 17.4% from 2026 to 2033, driven by high responsiveness of melanoma to immunotherapy. Immune checkpoint inhibitors are central to melanoma treatment. Rising awareness and early diagnosis improve patient outcomes. Expanding biosimilar availability reduces treatment costs. Increased clinical trial activity supports adoption. Strong survival benefits drive therapy preference. Oncology guidelines emphasize immunotherapy use. Growing access in emerging markets fuels demand. Precision oncology initiatives accelerate growth. Expansion of specialty cancer centers supports uptake. Improved reimbursement improves affordability. These drivers position melanoma as the fastest-growing indication segment.

Oncology Immunotherapy Biosimilars Market Regional Analysis

- North America dominated the oncology immunotherapy biosimilars market with the largest revenue share of approximately 42.6% in 2025

- Supported by advanced oncology infrastructure, early adoption of biosimilars, strong reimbursement frameworks, and a high volume of cancer immunotherapy usage

- The region benefits from well-established regulatory pathways and cost-containment initiatives that encourage the uptake of biosimilar immunotherapies across hospitals and cancer centers

U.S. Oncology Immunotherapy Biosimilars Market Insight

The U.S. oncology immunotherapy biosimilars market accounted for the majority share within North America in 2025, driven by substantial adoption of biosimilar checkpoint inhibitors in oncology treatment protocols. Growth is fueled by favorable FDA regulatory pathways, increasing pressure to reduce biologic drug costs, and widespread use of immunotherapy for cancers such as lung cancer, melanoma, and colorectal cancer. The strong presence of leading pharmaceutical and biotechnology companies, along with high clinical trial activity, further supports market expansion.

Europe Oncology Immunotherapy Biosimilars Market Insight

The Europe oncology immunotherapy biosimilars market is projected to expand at a considerable CAGR during the forecast period, driven by strong government support for biosimilar adoption, cost-containment policies, and increasing cancer prevalence. European healthcare systems are actively promoting biosimilars to improve treatment accessibility while reducing healthcare expenditure. Growing physician confidence in biosimilar efficacy and safety is further accelerating adoption across oncology care settings.

U.K. Oncology Immunotherapy Biosimilars Market Insight

The U.K. oncology immunotherapy biosimilars market is anticipated to grow at a steady CAGR during the forecast period, supported by centralized healthcare procurement, favorable pricing policies, and strong endorsement from regulatory bodies such as the NHS. Increasing use of biosimilar immunotherapies in national cancer treatment guidelines and efforts to expand patient access to advanced oncology therapies are key growth drivers.

Germany Oncology Immunotherapy Biosimilars Market Insight

The Germany oncology immunotherapy biosimilars market is expected to expand at a healthy CAGR, driven by high healthcare expenditure, strong biosimilar acceptance among clinicians, and a robust regulatory framework. Germany’s leadership in biosimilar adoption, combined with its advanced hospital infrastructure and emphasis on value-based care, supports sustained market growth in oncology immunotherapy biosimilars.

Asia-Pacific Oncology Immunotherapy Biosimilars Market Insight

The Asia-Pacific oncology immunotherapy biosimilars market is expected to grow at the fastest CAGR during the forecast period, driven by a rapidly increasing cancer patient population, expanding access to oncology care, and improving healthcare infrastructure. Rising adoption of cost-effective biosimilar therapies is enabling broader patient access to immunotherapy treatments across emerging economies.

China Oncology Immunotherapy Biosimilars Market Insight

The China oncology immunotherapy biosimilars market represents a significant share of the Asia-Pacific region, supported by a large cancer burden, expanding oncology treatment capacity, and strong government initiatives to promote domestic biosimilar development. Regulatory reforms and inclusion of biosimilars in national reimbursement lists are accelerating adoption across public hospitals and cancer centers.

India Oncology Immunotherapy Biosimilars Market Insight

The India oncology immunotherapy biosimilars market is expected to witness rapid growth during the forecast period, driven by rising cancer incidence, expanding hospital networks, and increasing availability of affordable biosimilar immunotherapies. Government initiatives to strengthen cancer care infrastructure and growing participation of domestic pharmaceutical companies in biosimilar manufacturing are further supporting market expansion.

Oncology Immunotherapy Biosimilars Market Share

The Oncology Immunotherapy Biosimilars industry is primarily led by well-established companies, including:

- Amgen (U.S.)

- Pfizer (U.S.)

- Sandoz (Switzerland)

- Samsung Bioepis (South Korea)

- Celltrion (South Korea)

- Biocon Biologics (India)

- Dr. Reddy’s Laboratories (India)

- Viatris (U.S.)

- Teva Pharmaceutical Industries (Israel)

- Fresenius Kabi (Germany)

- Boehringer Ingelheim (Germany)

- STADA Arzneimittel (Germany)

- Lupin (India)

- Zydus Lifesciences (India)

- Hetero Biopharma (India)

- Aurobindo Pharma (India)

- Shanghai Henlius Biotech (China)

- Innovent Biologics (China)

- Hisun Pharmaceutical (China)

- BioXpress Therapeutics (Ireland)

Latest Developments in Global Oncology Immunotherapy Biosimilars Market

- In October 2023, Amneal Pharmaceuticals, Inc. announced the addition of two denosumab biosimilars referencing Prolia and XGEVA to its U.S. biosimilar pipeline, expanding its oncology portfolio and reinforcing its aim to provide high-quality, affordable therapies for bone metastasis and cancer-related conditions through collaboration with mAbxience

- In April 2024, Amneal Pharmaceuticals, Inc. launched PEMRYDI RTU, the first ready-to-use injection formulation of pemetrexed for combination therapy in metastatic non-small cell lung cancer and malignant pleural mesothelioma, eliminating the need for reconstitution or refrigeration and facilitating pharmacy efficiency and patient care in oncology settings

- In April 2025, Biocon Biologics Ltd. announced that the U.S. FDA approved Jobevne (bevacizumab-nwgd), a biosimilar to Avastin®, expanding its oncology biosimilar portfolio in the U.S. and offering an additional treatment option for multiple cancer types through a lower-cost biologic alternative

- In June 2025, regulatory momentum continued for oncology biosimilars, as Biocon Biologics also received U.S. FDA approval for Denosumab biosimilars Bosaya and Aukelso, indicated for cancer-related bone disease and osteoporosis, enhancing patient access to key supportive care therapies in oncology

- In March 2025, Fresenius Kabi launched two denosumab biosimilars — Conexxence and Bomyntra — in the United States, approved for all indications of their reference products Prolia and Xgeva, representing continued expansion of biosimilar options for cancer patients needing bone-related therapies

- In January 2026, Biocon Biologics announced that it will unveil three new oncology biosimilars — Trastuzumab/Hyaluronidase, Nivolumab, and Pembrolizumab — at the 2026 J.P. Morgan Healthcare Conference, emphasizing its strategy to expand global access to high-impact immunotherapy biosimilars as major biologic patents expire

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.