Middle East And Africa Antiblock Additive Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

409.69 Million

USD

620.06 Million

2024

2032

USD

409.69 Million

USD

620.06 Million

2024

2032

| 2025 –2032 | |

| USD 409.69 Million | |

| USD 620.06 Million | |

|

|

|

Middle East and Africa Antiblock Additive Market Segmentation, By Form (Inorganic, and Organic), Target Polymer (Polyethylene (PE), Polyvinyl Chloride (PVC), Biaxially-Oriented Polypropylene (BOPP), Polyethylene Terephthalate (PET), Polystyrene (PS), and Others), End-Use Industry (Packaging, Industrial, Agriculture, Medical and Healthcare, Electronics and Solar, Printing and Optics and Others), Countries (Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest Of Middle East And Africa) – Industry Trends and Forecast to 2032

Middle East and Africa Antiblock Additive Market Analysis

The Middle East and Africa antiblock additive market is experiencing robust growth, driven by growing demand for plastic packaging. As the global antiblock additive industry continues to expand, the surge in innovations and advancements in polymer packaging has increased. Growing demand for development of bio-based antiblock additives are creating opportunities for the market. Market dynamics are also influenced by fluctuating raw material prices. Overall, the market is expected to continue expanding, with a focus on innovation and sustainability to meet evolving industrial demands.

Middle East and Africa Antiblock Additive Market Size

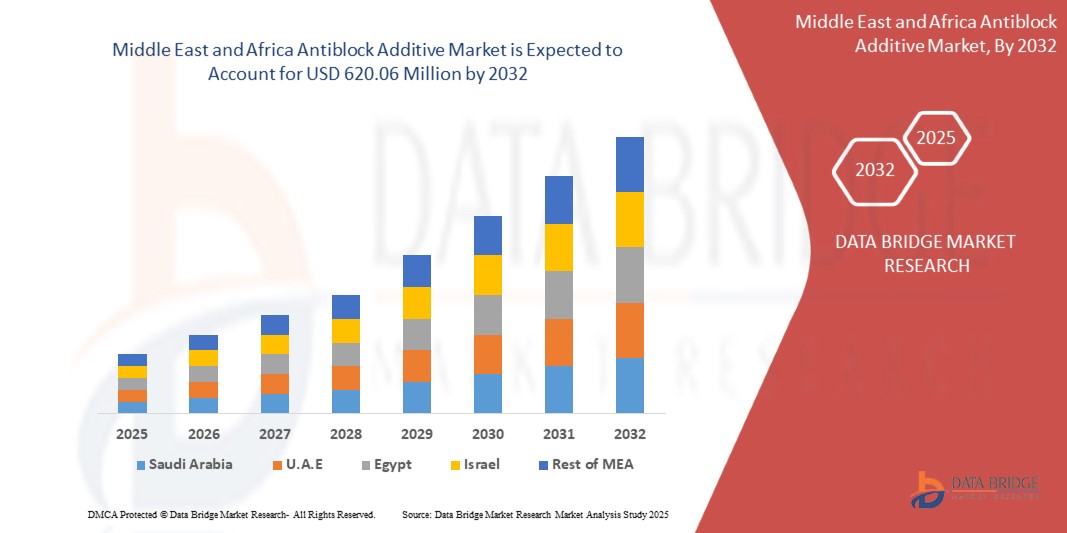

Middle East and Africa antiblock additive market size was valued at USD 409.69 million in 2024 and is projected to reach USD 620.06 million by 2032, with a CAGR of 5.33% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Middle East and Africa Antiblock Additive Market Trends

“Growing Demand for Plastic Packaging”

The growing demand for plastic packaging is a significant driver for the global antiblock additive market. As industries such as food and beverage, pharmaceuticals, consumer goods, and e-commerce expand, the need for efficient, durable, and functional packaging solutions increases. Plastic packaging, being lightweight, cost-effective, and versatile, has become the preferred choice across various sectors. This increased reliance on plastic packaging drives the demand for additives that enhance the performance of plastic materials. Antiblock additives play a critical role in improving the processing and performance of plastic films used in packaging. These additives prevent the layers of plastic films from sticking together during manufacturing, handling, and storage. Without antiblock agents, plastic films would adhere to one another, leading to production issues, compromised packaging integrity, and inefficiencies. By reducing such problems, antiblock additives ensure smooth production processes, higher quality products, and more efficient packaging systems.

The surge in demand for flexible plastic packaging, especially in the food industry, further propels the growth of the antiblock additive market. With consumers demanding longer shelf lives, better product preservation, and user-friendly packaging, antiblock additives contribute to improving the functionality and appeal of plastic packaging. In addition, as sustainability becomes a growing concern, the development of environmentally friendly antiblock additives further supports this trend, providing opportunities for innovation in the packaging sector.

Report Scope and Market Segmentation

|

Attributes |

Middle East and Africa Antiblock Additive Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Saudi Arabia, U.A.E., South Africa, Egypt, Israel, and Rest of Middle East and Africa |

|

Key Market Players |

Imerys (France), Ampacet CORPORATION (U.S.), ALTANA (Germany), Dow (U.S.), Lyondellbasell Industries Holdings B.V. (Netherlands), Astra Polymers (Saudi Arabia), Avient Corporation (U.S.), BASF (Germany), Cargill, Incorporated (U.S.), Covia Holdings LLC. (U.S.), Evonik (Germany), Fine Organic Industries Limited (India), Honeywell International Inc (U.S.), Inerals Technologies Inc. (U.S.), Momentive Performance Materials (U.S.), National Plastics Color, Inc. (U.S.), plasmix pvt ltd (India), SABIC (Saudi Arabia), Sukano AG (Switzerland), W. R. Grace & Co.-Conn (U.S.), and Wells Plastics (U.K.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Antiblock Additive Market Definition

Antiblock additives are chemical compounds used in polymer films, particularly in polyethylene and polypropylene, to reduce the adhesion between film layers. These additives work by creating microscopic rough surfaces that minimize the contact area between layers, preventing them from sticking together. Common antiblock agents include silica, talc, and synthetic silicates. They are widely used in packaging films, agricultural films, and industrial applications to improve handling, processing, and machinability. By reducing blocking, these additives enhance productivity, facilitate film separation, and ensure efficient packaging operations without compromising transparency, mechanical properties, or printability of the final plastic film product.

Middle East and Africa Antiblock Additive Market Dynamics

Drivers

- Booming Automotive and Industrial Sectors

Antiblock additives, which are primarily used in plastic films to prevent them from sticking together during processing, are increasingly vital as industries such as automotive and manufacturing expand. In the automotive sector, there is a growing demand for lightweight, durable, and cost-effective materials for packaging, interiors, and automotive components. Antiblock additives are used in the production of plastic films, which find applications in automotive packaging, protective coatings, and composite materials. With the increasing production of vehicles globally, manufacturers are focusing on improving the performance and appearance of automotive plastics, further boosting the need for antiblock additives. The automotive industry's demand for more efficient, recyclable, and functional materials directly contributes to the market's growth.

Similarly, the industrial sector, which encompasses a wide range of applications, including packaging, construction, and machinery, is a significant driver. As industries demand high-quality plastic films for packaging and machinery, the need for antiblock additives has surged. In the packaging industry, antiblock additives are essential for preventing film layers from sticking together, enhancing the ease of processing, and improving the end product's quality. Furthermore, antiblock additives are integral to industrial packaging solutions, especially in sectors dealing with bulk goods and sensitive materials.

For instance,

- In May 2022, according to an article published by Squarespace, The blog explores the use of plastics in automotive applications, highlighting both the benefits and environmental challenges. Plastics make vehicles lightweight, fuel-efficient, and customizable, but issues such as toxic PVC and poor recyclability can harm the environment. The article calls for more sustainable polymers to address these concerns.

- In May 2023, according to an article published by American Chemistry Council, Inc. A 2023 report from the American Chemistry Council highlights how plastics in automobiles have increased by 16% from 2012 to 2021. Plastics improve fuel efficiency, safety, and performance, especially in Electric Vehicles (EVs), by offsetting the weight of batteries. The report emphasizes plastics' role in sustainability and recycling efforts.

Both sectors' emphasis on reducing costs, improving material properties, and ensuring sustainability leads to increased adoption of antiblock additives. As global automotive and industrial production continues to rise, the demand for these additives is expected to follow suit, reinforcing the positive growth trajectory for the antiblock additive market in the coming years.

- Innovations and Advancements in Polymer Packaging

Innovations in polymer packaging have significantly influenced the growth of the antilock additives market, driving new developments in packaging materials and enhancing product performance. Antilock additives, primarily used in packaging to improve the durability, stability, and performance of polymers, are seeing increased demand due to the evolving needs of the packaging industry. As packaging requirements shift towards more sustainable, efficient, and high-performance materials, antilock additives are playing a key role in enhancing polymer formulations. One of the primary drivers is the growing demand for polymers that are more resistant to friction and wear. Antilock additives help reduce friction between polymer surfaces, minimizing the risk of damage during the packaging process, particularly in industries such as food and pharmaceuticals, where product integrity is crucial. These additives also improve the processing characteristics of polymers, allowing for smoother production processes and extending the life of packaging materials.

As sustainability becomes a critical focus, there is a rise in demand for biodegradable or recyclable packaging materials. Antilock additives are helping make these eco-friendly polymers more effective and durable, ensuring they perform well without compromising the environment. This shift towards greener packaging solutions has led to innovations in the formulation of antilock additives that are not only efficient in reducing friction but also safe for the environment. In addition, the rise of e-commerce has heightened the need for robust packaging solutions that can withstand the rigors of global shipping. Antilock additives contribute to this by improving the performance of polymer packaging, ensuring that products remain intact during transit while reducing the risk of packaging failure.

For instance,

- According to an article published by CarePac., The Packaging Polymers Guide provides detailed insights into various types of polymer packaging materials, including synthetic and biodegradable plastics. It explores common polymers such as polyethylene, PET, and bioplastics, their applications, benefits, risks, and environmental impacts while emphasizing the shift towards sustainable, eco-friendly alternatives in the packaging industry.

- In 2020, according to an article published by Elsevier B.V., This chapter explores food packaging materials, focusing on conventional polymers, bioplastics, and nanopolymers. It highlights the advantages of bioplastics—such as renewability and biodegradability—while addressing challenges such as nonrenewability in traditional polymers. The research aims to improve packaging solutions through technological advancements such as nanotechnology to enhance material performance.

- In February 2024, according to an article published by Michigan State University, This article from Michigan State University examines plastic and polymer-based packaging, highlighting its benefits such as protection, cost-effectiveness, and versatility. It addresses concerns about potential health risks, microplastics, and environmental impact while emphasizing ongoing research to improve packaging materials, sustainability, and consumer safety.

- In January 2024, according to an article published by Polymart, PolyMart provides a comprehensive overview of polymers used in food packaging, highlighting their types, properties, and benefits, such as protecting food, extending shelf life, and being cost-effective. The platform offers seamless procurement options through its Buyer App, connecting buyers with trusted suppliers and providing real-time price trends.

Innovations in polymer packaging, driven by advances in antilock additives, are meeting the growing demand for high-performance, sustainable, and durable packaging solutions, thus fostering the expansion of the antilock additives market.

Opportunities

- Advancements in Bio-Based Antiblock Additives

생물 기반 안티블록 첨가제의 개발은 폴리머 가공 분야에서 상당한 진전을 나타내며, 특히 필름 접착과 관련된 과제를 해결하는 데 있어서 그렇습니다. 전통적으로 실리카나 활석과 같은 무기 안티블록 첨가제는 폴리머 필름 층이 바람직하지 않게 서로 달라붙는 블로킹을 완화하는 데 사용되었습니다. 이러한 무기 첨가제는 효과적이지만, 특히 고농도에서 필름의 광학적 투명도를 손상시킬 수 있습니다. 반면 생물 기반 안티블록 첨가제는 지속 가능하고 효율적인 대안을 제공하여 투명도를 희생하지 않고 필름 성능을 향상시킵니다.

천연 아미드에서 파생된 것과 같은 생물 기반 안티블록 첨가제는 폴리머 표면으로 이동하여 필름 층 사이의 마찰 계수를 줄이는 윤활 층을 형성하여 기능합니다. 이 메커니즘은 차단을 방지할 뿐만 아니라 필름의 투명성을 유지하는데, 이는 제품 가시성이 중요한 식품 포장과 같은 응용 분야에 필수적입니다.

생물 기반 솔루션으로의 전환은 또한 환경적 고려 사항에 의해 주도됩니다. 산업이 생태적 발자국을 줄이려고 노력함에 따라 지속 가능한 첨가제에 대한 수요가 증가했습니다. 재생 가능한 자원에서 파생된 생물 기반 안티블록 첨가제는 이러한 지속 가능성 목표와 일치합니다. Fine Organics와 같은 회사는 폴리올레핀 기반 필름에서 최적의 안티블록 특성을 제공하는 정제된 식물성 베헤나마이드인 Finawax B와 같은 제품을 개발했습니다. 적절한 용량으로 무기 안티블록제와 함께 사용하면 성능과 환경적 책임의 균형을 효과적으로 맞춥니다.

예를 들어,

- Cargill, Incorporated에서 게시한 블로그에 따르면 Optislip™ BR(베헤나미드)은 폴리머 필름용으로 설계된 생물 기반 안티블록 첨가제입니다. 필름 투명도를 유지하면서 윤활 표면 층을 형성하여 블록킹을 줄입니다. 다양한 폴리머에 적합하며, 무기 첨가제에 대한 지속 가능한 대안을 제공하여 고성능 및 친환경 포장 솔루션에 대한 산업의 요구에 부합합니다.

- Fine Organic Industries Limited에 따르면, 식물성 베헤나미드인 Finawax B는 폴리올레핀 필름을 위한 효과적인 생물 기반 안티블록 첨가제입니다. 이 제품은 투명성을 유지하면서 필름 접착력을 최소화하여 무기 안티블록제에 대한 의존도를 줄입니다. 이 지속 가능한 솔루션은 포장 성능을 향상시키고 환경 친화적인 폴리머 첨가제로의 산업의 전환과 일치합니다.

생물 기반 안티블록 첨가제의 개발은 폴리머 첨가제 기술의 중심적인 전환을 나타냅니다. 필름 선명도를 손상시키지 않고 지속 가능성 이니셔티브를 지원하는 효과적인 안티블록 솔루션을 제공함으로써 이러한 첨가제는 폴리머 필름에 의존하는 포장 및 기타 산업의 미래에서 중요한 역할을 할 준비가 되었습니다.

- 온라인 쇼핑의 급증과 전자상거래 패키징의 성장

전자상거래의 급속한 확장은 소비자의 구매 행동을 크게 변화시켜 온라인 쇼핑이 크게 증가하게 되었습니다. 이러한 급증은 제품이 손상되지 않고 보기 좋게 전달되도록 보장하는 효율적이고 신뢰할 수 있는 포장 솔루션이 필요합니다. 결과적으로 필름 층이 서로 달라붙어 포장 과정을 방해하고 제품 무결성을 손상시키는 블로킹과 같은 문제를 방지하는 고품질 포장 필름에 대한 수요가 증가하고 있습니다.

블록 방지 첨가제는 필름 층 사이의 접착력을 줄여 이러한 과제를 해결하는 데 중요한 역할을 하며, 이를 통해 포장 작업의 효율성을 향상시킵니다. 이러한 첨가제는 폴리머 필름에 통합되어 미세 거친 표면을 만들어 층 사이의 접촉 지점을 최소화하고 제조 및 제품 포장 중에 더 부드러운 취급을 용이하게 합니다.

이러한 성장은 특히 전자상거래 생태계의 필수 구성 요소인 식품, 음료 및 제약 산업에서 포장 상품의 소비가 증가한 데 기인합니다. 소비자가 구매를 위해 온라인 플랫폼에 점점 더 의존함에 따라 운송 중에 제품 품질과 안전을 유지하는 포장 필름에 대한 수요가 가장 중요해졌습니다.

예를 들어,

- Plastiblends에 따르면, Polyaddit Anti-Block Masterbatch는 미세한 입자를 도입하여 미세한 거친 표면을 만들어 층 간의 접촉을 줄임으로써 필름 접착을 방지합니다. 이를 통해 제조 및 포장 중에 취급 효율이 향상되어 식품 포장, 제약 및 소비재와 같은 산업에서 더 매끄러운 가공과 향상된 제품 성능이 보장됩니다.

- 2024년 3월 Flex-Pack Engineering, Inc.의 기사에 따르면, 온라인 쇼핑의 급증과 전자상거래의 성장으로 효율적이고 신뢰할 수 있는 포장 솔루션에 대한 수요가 크게 증가했습니다. 유연한 플라스틱 필름은 가볍고 보호적인 특성으로 인해 포장에 일반적으로 사용됩니다. 그러나 이러한 필름은 서로 달라붙을 수 있습니다. 이를 "블로킹"이라고 하며, 포장 공정을 방해하고 제품 품질에 영향을 미칠 수 있습니다. 이 문제를 해결하기 위해, 안티 블로킹 첨가제를 플라스틱 필름에 통합하여 미세한 거친 표면을 만들어 필름 층 간의 접착력을 줄이고 더 부드러운 취급 및 가공을 용이하게 합니다. 이러한 향상은 전자상거래에서 일반적인 고속 포장 작업의 효율성을 유지하는 데 필수적입니다.

- 2019년 11월 Furion Analytics Research & Consulting LLP에서 발행한 기사에 따르면, 식품 및 음료, 제약, 소비재와 같은 부문에서 포장 필름에 대한 수요가 증가하면서 포장 필름 시장이 확대되는 주요 원동력이 되었습니다. 이러한 성장은 특히 필름의 취급 및 성능에 필수적인 안티블록 첨가제에 대한 수요를 증가시켰습니다. 특히, 블록킹 문제가 발생하기 쉬운 폴리에틸렌(PE) 및 폴리프로필렌(PP)과 같은 폴리올레핀 필름의 수요가 증가했습니다.

결론적으로, 온라인 쇼핑의 급증과 그에 따른 전자상거래 포장의 성장은 안티블록 첨가제 시장에 중요한 기회입니다. 전자상거래 부문이 계속 확장됨에 따라 제품 무결성과 고객 만족을 보장하는 효과적인 포장 솔루션의 중요성은 더욱 커질 것이며, 포장 산업에서 안티블록 첨가제의 중요한 역할을 강조합니다.

제약/도전

- 대체 첨가제 및 솔루션의 가용성

대체 첨가제와 솔루션의 가용성은 글로벌 잠금 방지 첨가제 시장에서 상당한 제약으로 작용합니다. 새로운 기술과 소재가 등장함에 따라 제조업체는 종종 비용 효율성, 지속 가능성 및 성능 개선에 대한 욕구에 의해 주도되는 기존 잠금 방지 첨가제에 대한 대안을 점점 더 모색하고 있습니다. 유사하거나 향상된 특성을 제공할 수 있는 이러한 대체 첨가제는 기존 잠금 방지 솔루션에 대한 수요에 도전하여 경쟁이 증가하고 기존 제품의 시장 점유율이 감소합니다.

대안의 가용성으로 인해 제기된 주요 제약 중 하나는 친환경 또는 생분해성 첨가제에 대한 선호도가 변하고 있다는 것입니다. 지속 가능성이 많은 산업에서 점점 더 큰 관심사가 되면서 제조업체는 환경 영향을 최소화하는 솔루션을 모색하고 있습니다. 기존의 잠금 방지 첨가제가 효과적이지만 천연 기반 또는 생물 유래 첨가제와 같은 대안이 인기를 얻고 있어 시장 수요에 잠재적인 변화가 일어나고 있습니다. 이러한 대안은 종종 환경적으로 더 책임감 있는 것으로 인식되어 기존의 화학 첨가제보다 선호도가 높습니다. 게다가 재료 과학의 발전으로 인해 기존의 잠금 방지 첨가제가 필요 없이 향상된 마찰 감소 특성을 제공하는 혁신적인 폴리머 기반 솔루션이 개발되었습니다. 이러한 새로운 솔루션은 우수한 성능을 제공하여 첨가제에 대한 의존도를 줄이고 결과적으로 잠금 방지 제품에 대한 수요에 영향을 미칠 수 있습니다.

또한 비용 고려 사항도 역할을 합니다. 제조업체는 특히 가격 민감도가 높은 지역에서 비용 효율성이 더 높으면 대체 첨가제를 선택할 수 있습니다. 대체 솔루션이 더 낮은 비용으로 동등하거나 더 우수한 성능을 보이는 경우 이러한 가격 주도적 변화가 악화될 수 있습니다.

예를 들어,

- Plastics Technology에 게재된 기사에 따르면, 2019년 5월 DuPont는 PE 필름 가공을 개선하기 위해 안티블록 및 슬립 첨가제를 결합한 Dow Corning AMB-12235 마스터배치를 출시했습니다. 이 실리콘 기반 제형은 마찰 계수를 낮추고, 필름 블로킹을 방지하며, 마이그레이션을 줄이며, 모두 낮은 적재량(4-6%)으로 생산을 간소화하고, 복잡성을 줄이며, 공급망에서 공간을 절약합니다.

- According to an article published by ChemPoint., Momentive Tospearl silicone beads are advanced antiblock and slip additives for polyolefin films, designed to prevent adhesion between layers and reduce the coefficient of friction during extrusion. These additives improve film clarity, and processing efficiency, and reduce downtime while being FDA-approved for food contact applications and thermally stable up to 400°C.

Overall, the availability of alternative additives and solutions poses a challenge to the growth of the antilock additives market, as manufacturers may prioritize newer, more sustainable, or cost-efficient options, limiting the market potential for traditional antilock products.

- Regulatory Compliance and Testing Standards

The antiblock additive market is subject to stringent regulatory compliance and testing standards to ensure product safety and environmental protection. In the United States, the Food and Drug Administration (FDA) oversees substances intended for food contact, including antiblock additives used in packaging materials. Manufacturers must demonstrate that these additives are safe for their intended use, which involves thorough evaluations of raw materials and potential migration into food products.

In Europe, the European Chemicals Agency (ECHA) and the European Food Safety Authority (EFSA) play pivotal roles in assessing the safety of chemical substances, including antiblock additives. The REACH regulation mandates that manufacturers and importers register chemicals, including their intended uses and safety data. This rigorous regulatory environment ensures that all materials in contact with food are safe and do not jeopardize public health.

The regulatory framework surrounding antiblock additives is crucial for ensuring product safety, environmental protection, and compliance with industry standards. Antiblock additives are typically used in packaging materials, particularly in polyethylene films, to prevent sheets from sticking together, which can greatly enhance usability and product quality. However, their widespread usage has necessitated the development of comprehensive regulatory guidelines to govern their use.

Different countries and regions have established their regulatory guidelines. In the United States, for example, the Food and Drug Administration (FDA) oversees the use of substances intended to come into contact with food, including additives used in food packaging. The FDA requires that all food contact substances be safe for their intended use, which includes a thorough review of the raw materials and potential migration of additives into food products.

For instance,

- In January 2025, according to a blog published by the European Food Safety Authority, EFSA provided in-depth information on food additives, focusing on safety evaluations and regulatory frameworks in the European Union. Their assessments help ensure that additives used in food packaging, such as antiblock agents, are safe for consumers and comply with stringent environmental and health standards to protect public well-being.

- The European Chemicals Agency (ECHA) provides a comprehensive overview of legislation for active and intelligent materials intended for food contact. This includes regulations ensuring the safety of materials, such as antiblock agents, used in packaging. ECHA's framework helps safeguard consumer health and ensures compliance with EU standards for food safety.

Adherence to regulatory compliance and testing standards is essential for the antiblock additive market to ensure product safety, environmental sustainability, and consumer health. Strict oversight by authorities such as the FDA, ECHA, and EFSA helps maintain industry integrity, fostering safer and more effective use of additives in packaging materials.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Middle East and Africa Antiblock Additive Market Scope

The market is segmented on the basis of type, target polymer, and end-use industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Form

- Inorganic

- Organic

Target Polymer

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Biaxially-Oriented Polypropylene (BOPP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Others

End-Use Industry

- Packaging

- Industrial

- Agriculture

- Medical and Healthcare

- Electronics and Solar

- Printing and Optics

- Others

Middle East and Africa Antiblock Additive Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, target polymer, and end-use industry as referenced above.

The countries covered in the market are Saudi Arabia, U.A.E., South Africa, Egypt, Israel, and Rest of Middle East and Africa.

Saudi Arabia is poised to dominate the market due to its rapidly expanding agricultural sector and increasing demand for high-performance films. Government initiatives, water conservation efforts, and advanced farming technologies drive growth, ensuring improved crop yield, sustainability, and enhanced agricultural efficiency.

Saudi Arabia is the fastest-growing country in the region due to large-scale investments in agriculture, infrastructure, and industrial sectors. Government initiatives such as Vision 2030, technological advancements, and increasing demand for high-performance materials drive market expansion, fostering innovation and economic diversification.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Middle East and Africa Antiblock Additive Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Middle East and Africa Antiblock Additive Market Leaders Operating in the Market Are:

- Imerys (France)

- Ampacet CORPORATION (U.S.)

- ALTANA (Germany)

- Dow (U.S.)

- Lyondellbasell Industries Holdings B.V. (Netherlands)

- Astra Polymers (Saudi Arabia)

- Avient Corporation (U.S.)

- BASF (Germany)

- Cargill, Incorporated (U.S.)

- Covia Holdings LLC. (U.S.)

- Evonik (Germany)

- Fine Organic Industries Limited (India)

- Honeywell International Inc (U.S.)

- Inerals Technologies Inc. (U.S.)

- Momentive Performance Materials (U.S.)

- National Plastics Color, Inc. (U.S.)

- plasmix pvt ltd (India)

- SABIC (Saudi Arabia)

- Sukano AG (Switzerland)

- W. R. Grace & Co.-Conn (U.S.)

- Wells Plastics (U.K.)

Latest Developments in Middle East and Africa Antiblock Additive Market

- In December 2024, SABIC introduced LNP ELCRES CXL polycarbonate copolymer resins, offering exceptional chemical resistance, ideal for mobility, electronics, industrial, and infrastructure applications. These materials provide improved durability, weatherability, and low-temperature impact resistance. Available in bio-renewable versions under SABIC's TRUCIRCLE program, they contribute to sustainability and enhance part performance, even under harsh chemical exposure

- In November2024, SABIC has renewed its honorary strategic partnership with the Boao Forum for Asia (BFA), marking 17 consecutive years of sponsorship. This partnership highlights SABIC's commitment to sustainable development through cross-regional collaboration. The company continues to leverage BFA as a platform for enhancing influence and driving inclusive development globally

- In January 2025, Evonik Industries AG and Fuhua Tongda Chemicals Companyhave established a joint venture in Leshan, China, to produce specialty hydrogen peroxide (H2O2) for applications such as solar panels, semiconductors, and food packaging. With Evonik holding 51% and Fuhua 49%, the venture will start supplying the market in 2026. This partnership strengthens Evonik's presence in the Asia Pacific region

- On June 2024, Covia Holdings LLC finalized the separation of its Energy and Industrial businesses into two independent entities: Covia Energy, LLC, headquartered in The Woodlands, Texas, and Covia Solutions, based in Independence, Ohio. This strategic move allows each company to focus on its respective market opportunities

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 ENVIRONMENTAL FACTORS

4.1.6 LEGAL FACTORS

4.2 PORTER’S FIVE FORCES ANALYSIS

4.2.1 THREAT OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREAT OF SUBSTITUTES

4.2.5 INTERNAL COMPETITION

4.3 VENDOR SELECTION CRITERIA

4.3.1 QUALITY AND CONSISTENCY

4.3.2 TECHNICAL EXPERTISE

4.3.3 SUPPLY CHAIN RELIABILITY

4.3.4 COMPLIANCE AND SUSTAINABILITY

4.3.5 COST AND PRICING STRUCTURE

4.3.6 FINANCIAL STABILITY

4.3.7 FLEXIBILITY AND CUSTOMIZATION

4.3.8 RISK MANAGEMENT AND CONTINGENCY PLANS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING DEMAND FOR PLASTIC PACKAGING

5.1.2 BOOMING AUTOMOTIVE AND INDUSTRIAL SECTORS

5.1.3 INNOVATIONS AND ADVANCEMENTS IN POLYMER PACKAGING

5.1.4 FAST EXPANDING AGRICULTURAL SECTOR AND RISING NEED FOR HIGH-PERFORMANCE FILMS

5.2 RESTRAINTS

5.2.1 FLUCTUATING RAW MATERIAL PRICES

5.2.2 AVAILABILITY OF ALTERNATIVE ADDITIVES AND SOLUTIONS

5.3 OPPORTUNITIES

5.3.1 ADVANCEMENTS IN BIO-BASED ANTIBLOCK ADDITIVES

5.3.2 SURGE IN ONLINE SHOPPING AND GROWTH IN E-COMMERCE PACKAGING

5.4 CHALLENGES

5.4.1 REGULATORY COMPLIANCE AND TESTING STANDARDS

5.4.2 SHIFTING CONSUMER FOCUS TOWARD PAPER-BASED PACKAGING

6 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY FORM

6.1 OVERVIEW

6.2 INORGANIC

6.2.1 INORGANIC, BY TYPE

6.2.2 INORGANIC, BY PARTICLE SIZE

6.3 ORGANIC

6.3.1 ORGANIC, BY FORM

7 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER

7.1 OVERVIEW

7.2 POLYETHYLENE(PE)

7.2.1 POLYETHYLENE (PE), BY TARGET POLYMER

7.3 POLYVINYL CHLORIDE (PVC)

7.4 BIAXIALLY-ORIENTED POLYPROPYLENE (BOPP)

7.5 POLYETHYLENE TEREPHTHALATE (PET)

7.6 POLYSTYRENE (PS)

7.7 OTHERS

8 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY

8.1 OVERVIEW

8.2 PACKAGING

8.3 INDUSTRIAL

8.4 AGRICULTURE

8.5 MEDICAL AND HEALTHCARE

8.6 ELECTRONICS AND SOLAR

8.7 PRINTING AND OPTICS

8.8 OTHERS

9 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY REGION

9.1 MIDDLE EAST AND AFRICA

9.1.1 SAUDI ARABIA

9.1.2 U.A.E

9.1.3 SOUTH AFRICA

9.1.4 EGYPT

9.1.5 ISRAEL

9.1.6 REST OF MIDDLE EAST AND AFRICA

10 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 IMERYS

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENT

12.2 AMPACET CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT DEVELOPMENTS

12.3 ALTANA

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 DOW

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 RECENT DEVELOPMENTS

12.5 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

12.5.1 COMPANY SNAPSHOT

12.5.2 REVENUE ANALYSIS

12.5.3 COMPANY SHARE ANALYSIS

12.5.4 PRODUCT PORTFOLIO

12.5.5 RECENT DEVELOPMENT

12.6 ASTRA POLYMERS

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT/BRAND PORTFOLIO

12.6.3 RECENT DEVELOPMENTS

12.7 AVIENT CORPORATION

12.7.1 COMPANY SNAPSHOT

12.7.2 REVENUE ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENT

12.8 BASF

12.8.1 COMPANY SNAPSHOT

12.8.2 REVENUE ANALYSIS

12.8.3 PRODUCT PORTFOLIO

12.8.4 RECENT DEVELOPMENT

12.9 CARGILL, INCORPORATED

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENTS

12.1 COVIA HOLDINGS LLC.

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 EVONIK

12.11.1 COMPANY SNAPSHOT

12.11.2 REVENUE ANALYSIS

12.11.3 PRODUCT PORTFOLIO

12.11.4 RECENT DEVELOPMENTS

12.12 FINE ORGANIC INDUSTRIES LIMITED

12.12.1 COMPANY SNAPSHOT

12.12.2 REVENUE ANALYSIS

12.12.3 PRODUCT PORTFOLIO

12.12.4 RECENT DEVELOPMENTS

12.13 HONEYWELL INTERNATIONAL INC

12.13.1 COMPANY SNAPSHOT

12.13.2 REVENUE ANALYSIS

12.13.3 PRODUCT PORTFOLIO

12.13.4 RECENT DEVELOPMENTS

12.14 INERALS TECHNOLOGIES INC.

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT DEVELOPMENT

12.15 MOMENTIVE PERFORMANCE MATERIALS

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENTS

12.16 NATIONAL PLASTICS COLOR, INC.

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENTS

12.17 PLASMIX PVT LTD

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 SABIC

12.18.1 COMPANY SNAPSHOT

12.18.2 REVENUE ANALYSIS

12.18.3 PRODUCT PORTFOLIO

12.18.4 RECENT DEVELOPMENTS

12.19 SUKANO AG

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT/BRAND PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

12.2 W. R. GRACE & CO.-CONN

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENTS

12.21 WELLS PLASTICS

12.21.1 COMPANY SNAPSHOT

12.21.2 PRODUCT PORTFOLIO

12.21.3 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

표 목록

TABLE 1 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 2 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 3 MIDDLE EAST AND AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (TONS)

TABLE 5 MIDDLE EAST AND AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 7 MIDDLE EAST AND AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SIZE, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SIZE, 2018-2032 (TONS)

TABLE 9 MIDDLE EAST AND AFRICA ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (TONS)

TABLE 11 MIDDLE EAST AND AFRICA ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 13 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 15 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (TONS)

TABLE 17 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 19 MIDDLE EAST AND AFRICA POLYVINYL CHLORIDE (PVC) IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA POLYVINYL CHLORIDE (PVC) IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (TONS)

TABLE 21 MIDDLE EAST AND AFRICA BIAXIALLY-ORIENTED POLYPROPYLENE (BOPP) IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA BIAXIALLY-ORIENTED POLYPROPYLENE (BOPP) IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (TONS)

TABLE 23 MIDDLE EAST AND AFRICA POLYETHYLENE TEREPHTHALATE (PET) IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA POLYETHYLENE TEREPHTHALATE (PET) IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (TONS)

TABLE 25 MIDDLE EAST AND AFRICA POLYSTYRENE (PS) IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA POLYSTYRENE (PS) IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (TONS)

TABLE 27 MIDDLE EAST AND AFRICA OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 29 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (TONS)

TABLE 31 MIDDLE EAST AND AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 33 MIDDLE EAST AND AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 35 MIDDLE EAST AND AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 37 MIDDLE EAST AND AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 39 MIDDLE EAST AND AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 41 MIDDLE EAST AND AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 43 MIDDLE EAST AND AFRICA AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 45 MIDDLE EAST AND AFRICA AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 47 MIDDLE EAST AND AFRICA MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 49 MIDDLE EAST AND AFRICA MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 51 MIDDLE EAST AND AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 53 MIDDLE EAST AND AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 55 MIDDLE EAST AND AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 57 MIDDLE EAST AND AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 59 MIDDLE EAST AND AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 61 MIDDLE EAST AND AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 63 MIDDLE EAST AND AFRICA OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 64 MIDDLE EAST AND AFRICA OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY REGION, 2018-2032 (TONS)

TABLE 65 MIDDLE EAST AND AFRICA OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 66 MIDDLE EAST AND AFRICA OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 67 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 68 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY COUNTRY, 2018-2032 (TONS)

TABLE 69 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 70 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 71 MIDDLE EAST AND AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 MIDDLE EAST AND AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 73 MIDDLE EAST AND AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 74 MIDDLE EAST AND AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SHAPE, 2018-2032 (TONS)

TABLE 75 MIDDLE EAST AND AFRICA ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 76 MIDDLE EAST AND AFRICA ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 77 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 78 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 79 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 80 MIDDLE EAST AND AFRICA POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 81 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 82 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (TONS)

TABLE 83 MIDDLE EAST AND AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 MIDDLE EAST AND AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 85 MIDDLE EAST AND AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 86 MIDDLE EAST AND AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 87 MIDDLE EAST AND AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 MIDDLE EAST AND AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 89 MIDDLE EAST AND AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 90 MIDDLE EAST AND AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 91 MIDDLE EAST AND AFRICA AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 92 MIDDLE EAST AND AFRICA AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 93 MIDDLE EAST AND AFRICA MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 94 MIDDLE EAST AND AFRICA MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 95 MIDDLE EAST AND AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 MIDDLE EAST AND AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 97 MIDDLE EAST AND AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 98 MIDDLE EAST AND AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 99 MIDDLE EAST AND AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 MIDDLE EAST AND AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 101 MIDDLE EAST AND AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 102 MIDDLE EAST AND AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 103 MIDDLE EAST AND AFRICA OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 104 MIDDLE EAST AND AFRICA OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 105 SAUDI ARABIA ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 106 SAUDI ARABIA ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 107 SAUDI ARABIA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SAUDI ARABIA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 109 SAUDI ARABIA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 110 SAUDI ARABIA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SHAPE, 2018-2032 (TONS)

TABLE 111 SAUDI ARABIA ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 112 SAUDI ARABIA ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 113 SAUDI ARABIA ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 114 SAUDI ARABIA ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 115 SAUDI ARABIA POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 116 SAUDI ARABIA POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 117 SAUDI ARABIA ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 118 SAUDI ARABIA ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (TONS)

TABLE 119 SAUDI ARABIA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 SAUDI ARABIA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 121 SAUDI ARABIA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 122 SAUDI ARABIA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 123 SAUDI ARABIA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 SAUDI ARABIA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 125 SAUDI ARABIA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 126 SAUDI ARABIA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 127 SAUDI ARABIA AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 128 SAUDI ARABIA AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 129 SAUDI ARABIA MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 130 SAUDI ARABIA MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 131 SAUDI ARABIA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 SAUDI ARABIA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 133 SAUDI ARABIA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 134 SAUDI ARABIA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 135 SAUDI ARABIA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 SAUDI ARABIA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 137 SAUDI ARABIA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 138 SAUDI ARABIA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 139 SAUDI ARABIA OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 140 SAUDI ARABIA OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 141 U.A.E ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 142 U.A.E ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 143 U.A.E INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 U.A.E INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 145 U.A.E INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 146 U.A.E INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SHAPE, 2018-2032 (TONS)

TABLE 147 U.A.E ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 148 U.A.E ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 149 U.A.E ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 150 U.A.E ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 151 U.A.E POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 152 U.A.E POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 153 U.A.E ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 154 U.A.E ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (TONS)

TABLE 155 U.A.E PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 U.A.E PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 157 U.A.E PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 158 U.A.E PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 159 U.A.E INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 U.A.E INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 161 U.A.E INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 162 U.A.E INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 163 U.A.E AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 164 U.A.E AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 165 U.A.E MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 166 U.A.E MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 167 U.A.E ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 U.A.E ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 169 U.A.E ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 170 U.A.E ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 171 U.A.E PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 172 U.A.E PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 173 U.A.E PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 174 U.A.E PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 175 U.A.E OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 176 U.A.E OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 177 SOUTH AFRICA ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 178 SOUTH AFRICA ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 179 SOUTH AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 SOUTH AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 181 SOUTH AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 182 SOUTH AFRICA INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SHAPE, 2018-2032 (TONS)

TABLE 183 SOUTH AFRICA ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 184 SOUTH AFRICA ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 185 SOUTH AFRICA ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 186 SOUTH AFRICA ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 187 SOUTH AFRICA POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 188 SOUTH AFRICA POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 189 SOUTH AFRICA ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 190 SOUTH AFRICA ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (TONS)

TABLE 191 SOUTH AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 SOUTH AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 193 SOUTH AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 194 SOUTH AFRICA PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 195 SOUTH AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 SOUTH AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 197 SOUTH AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 198 SOUTH AFRICA INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 199 SOUTH AFRICA AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 200 SOUTH AFRICA AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 201 SOUTH AFRICA MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 202 SOUTH AFRICA MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 203 SOUTH AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 204 SOUTH AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 205 SOUTH AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 206 SOUTH AFRICA ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 207 SOUTH AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 208 SOUTH AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 209 SOUTH AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 210 SOUTH AFRICA PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 211 SOUTH AFRICA OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 212 SOUTH AFRICA OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 213 EGYPT ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 214 EGYPT ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 215 EGYPT INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 216 EGYPT INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 217 EGYPT INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 218 EGYPT INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SHAPE, 2018-2032 (TONS)

TABLE 219 EGYPT ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 220 EGYPT ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 221 EGYPT ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 222 EGYPT ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 223 EGYPT POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 224 EGYPT POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 225 EGYPT ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 226 EGYPT ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (TONS)

TABLE 227 EGYPT PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 228 EGYPT PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 229 EGYPT PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 230 EGYPT PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 231 EGYPT INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 232 EGYPT INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 233 EGYPT INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 234 EGYPT INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 235 EGYPT AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 236 EGYPT AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 237 EGYPT MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 238 EGYPT MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 239 EGYPT ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 240 EGYPT ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 241 EGYPT ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 242 EGYPT ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 243 EGYPT PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 244 EGYPT PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 245 EGYPT PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 246 EGYPT PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 247 EGYPT OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 248 EGYPT OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 249 ISRAEL ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 250 ISRAEL ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 251 ISRAEL INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 252 ISRAEL INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 253 ISRAEL INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SHAPE, 2018-2032 (USD THOUSAND)

TABLE 254 ISRAEL INORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY PARTICLE SHAPE, 2018-2032 (TONS)

TABLE 255 ISRAEL ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 256 ISRAEL ORGANIC IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 257 ISRAEL ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 258 ISRAEL ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 259 ISRAEL POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (USD THOUSAND)

TABLE 260 ISRAEL POLYETHYLENE (PE) IN ANTIBLOCK ADDITIVE MARKET, BY TARGET POLYMER, 2018-2032 (TONS)

TABLE 261 ISRAEL ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 262 ISRAEL ANTIBLOCK ADDITIVE MARKET, BY END USE INDUSTRY, 2018-2032 (TONS)

TABLE 263 ISRAEL PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 264 ISRAEL PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 265 ISRAEL PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 266 ISRAEL PACKAGING IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 267 ISRAEL INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 268 ISRAEL INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 269 ISRAEL INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 270 ISRAEL INDUSTRIAL IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 271 ISRAEL AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 272 ISRAEL AGRICULTURE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 273 ISRAEL MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 274 ISRAEL MEDICAL AND HEALTHCARE IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 275 ISRAEL ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 276 ISRAEL ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 277 ISRAEL ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 278 ISRAEL ELECTRONICS AND SOLAR IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 279 ISRAEL PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 280 ISRAEL PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY TYPE, 2018-2032 (TONS)

TABLE 281 ISRAEL PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 282 ISRAEL PRINTING AND OPTICS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 283 ISRAEL OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 284 ISRAEL OTHERS IN ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

TABLE 285 REST OF MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 286 REST OF MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY FORM, 2018-2032 (TONS)

그림 목록

FIGURE 1 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET

FIGURE 2 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: MULTIVARIATE MODELLING

FIGURE 7 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: SEGMENTATION

FIGURE 11 TWO SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET, BY FORM (2024)

FIGURE 12 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: EXECUTIVE SUMMARY

FIGURE 13 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: STRATEGIC DECISIONS

FIGURE 14 GROWING DEMAND FOR PLASTIC PACKAGING MIDDLE EAST AND AFRICA LY IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 15 THE INORGANIC SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET IN 2025 AND 2032

FIGURE 16 PESTEL ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET

FIGURE 20 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: BY FORM, 2024

FIGURE 21 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: BY TARGET POLYMER, 2024

FIGURE 22 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: BY END USE INDUSTRY, 2024

FIGURE 23 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: SNAPSHOT (2024)

FIGURE 24 MIDDLE EAST AND AFRICA ANTIBLOCK ADDITIVE MARKET: COMPANY SHARE 2024 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.