Middle East And Africa Foundry Chemicals Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

218.69 Million

USD

285.76 Million

2025

2033

USD

218.69 Million

USD

285.76 Million

2025

2033

| 2026 –2033 | |

| USD 218.69 Million | |

| USD 285.76 Million | |

|

|

|

|

Middle East and Africa Foundry Chemicals Market Segmentation, By Type (Benzene, Formaldehyde, Naphthalene, Phenol, Xylene, and Others), Product Type (Binders, Additive Agents, Coatings, Fluxes, and Others), Foundry Type (Ferrous and Non-Ferrous), Foundry Tool Type (Showel, Trowels, Lifter, Hand Riddle, Vent Wire, Rammers, Swab, Sprue Pins and Cutters, and Others), Foundry Process Type (Thermal galvanization and Electro Less Nickel Plating), Foundry System Type (Sand Cast Systems and Chemically Bonded Sand Cast Systems), Application (Cast Iron, Steel, Aluminium, and Others), Distribution Channel (E-Commerce, Specialty Stores, B2B/Third Party Distributors, and Others) - Industry Trends and Forecast to 2033

What is the Middle East and Africa Foundry Chemicals Market Size and Growth Rate?

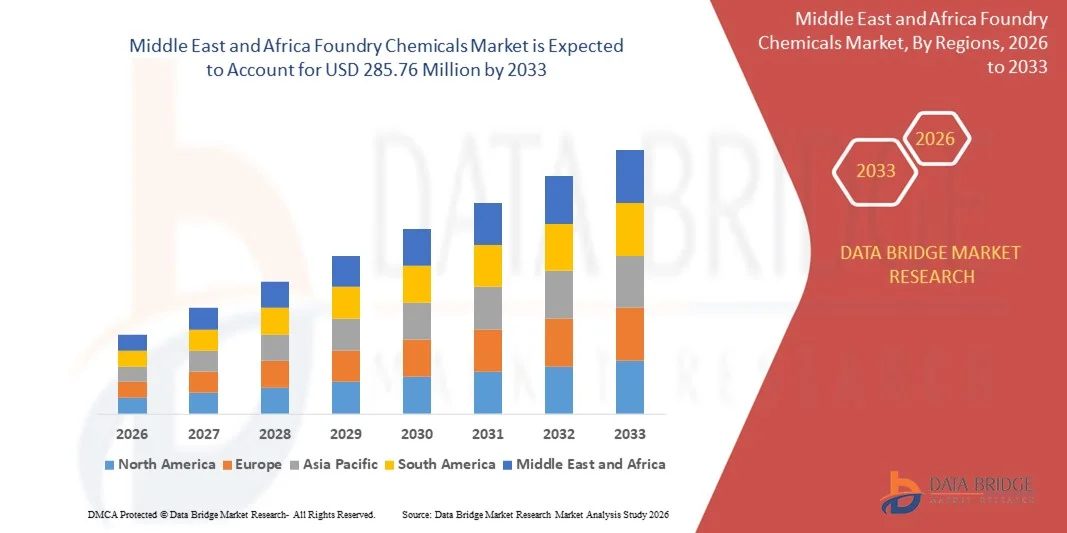

- The Middle East and Africa foundry chemicals market size was valued at USD 218.69 million in 2025 and is expected to reach USD 285.76 million by 2033, at a CAGR of 3.4% during the forecast period

- The growing demand for metal casting in the manufacturing of heavy machinery is boosting the foundry chemicals market growth

- Corrodibility of ferrous metals under environmental conditions is hampering the demand for the foundry chemicals market

What are the Major Takeaways of Foundry Chemicals Market?

- Increasing demand for steel in the market is acting as an opportunity for the foundry chemicals market. The stringent environmental regulation regarding chemicals released from foundries is acting as a challenge for hampering the demand of the foundry chemicals market

- Saudi Arabia dominated the Middle East and Africa foundry chemicals market with an estimated 39.7% revenue share in 2025, driven by large-scale industrial projects, automotive and machinery manufacturing, and high adoption in construction, renewable energy, and heavy equipment sectors

- South Africa is projected to register the fastest CAGR of 10.8% from 2026 to 2033, driven by rising use in automotive, mining, and industrial machinery applications

- The Formaldehyde segment dominated the market with an estimated 41.2% share in 2025, driven by its high reactivity, excellent binding properties, and wide application across ferrous and non-ferrous casting industries

Report Scope and Foundry Chemicals Market Segmentation

|

Attributes |

Foundry Chemicals Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Foundry Chemicals Market?

Rising Adoption of Advanced, Lightweight, and High-Durability Foundry Chemicals

- The foundry chemicals market is experiencing growing demand for lightweight, corrosion-resistant, and high-performance materials used in automotive, aerospace, industrial machinery, and renewable energy sectors

- Manufacturers are increasingly introducing polymer composites, PTFE-coated alloys, and fiber-reinforced metal-ceramic solutions to improve wear resistance, load capacity, and operational reliability

- Emphasis on energy efficiency, reduced maintenance, and longer lifecycle performance is driving adoption in high-stress and continuous operation environments

- For instance, companies such as SKF, Schaeffler, Trelleborg, GGB, and RBC Bearings are expanding their portfolio of advanced composite bearings and friction-reducing coatings for EVs, wind turbines, industrial automation, and heavy equipment

- High uptake of Foundry Chemicals in electric vehicles, industrial robotics, fluid-handling, and aerospace components is sustaining market expansion

- As industries focus on durability, weight optimization, and lifecycle cost reduction, foundry chemicals are expected to remain critical in next-generation mechanical and industrial systems

What are the Key Drivers of Foundry Chemicals Market?

- Rising demand for maintenance-free, lubrication-free, and high-load capable bearings is significantly boosting foundry chemicals adoption across automotive, aerospace, and industrial sectors

- For instance, during 2024–2025, SKF, Schaeffler, and Trelleborg launched advanced composite and polymer-based solutions designed for extreme temperatures, heavy loads, and extended operating life

- Growing deployment of EVs, wind energy systems, automated machinery, and industrial robots is increasing need for lightweight, durable, and energy-efficient bearings

- Advances in polymer engineering, material composites, and precision manufacturing are enhancing friction resistance, wear performance, and load-bearing capabilities

- Increasing focus on sustainability and energy savings is promoting replacement of conventional metal bearings with composite or polymer alternatives

- Supported by industrial automation, renewable energy expansion, and infrastructure growth, the foundry chemicals market is poised for steady long-term growth

Which Factor is Challenging the Growth of the Foundry Chemicals Market?

- Higher costs of advanced polymers, fibers, and precision-fabricated materials limit adoption in price-sensitive applications

- Volatility in raw material prices and supply-chain disruptions during 2024–2025 increased operational costs for key manufacturers

- Performance constraints under extreme shock loads or misalignment conditions may restrict application in certain heavy-duty industrial systems

- Limited awareness among small-scale manufacturers about lifecycle benefits and long-term cost efficiency slows market penetration

- Competition from traditional metal bearings and low-cost substitutes exerts pricing pressure and reduces differentiation

- To overcome these challenges, companies are focusing on cost-efficient designs, targeted applications, and customer education to drive broader adoption of Foundry Chemicals

How is the Foundry Chemicals Market Segmented?

The market is segmented on the basis of type, product type, foundry type, foundry tool type, foundry process type, foundry system type, distribution channel, and application.

- By Type

The Foundry Chemicals market is segmented into Benzene, Formaldehyde, Naphthalene, Phenol, Xylene, and Others. The Formaldehyde segment dominated the market with an estimated 41.2% share in 2025, driven by its high reactivity, excellent binding properties, and wide application across ferrous and non-ferrous casting industries. Formaldehyde-based chemicals are extensively used in resin formulations, coatings, and core binders, providing strength and durability in high-temperature operations.

The Phenol segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for phenolic resins in advanced casting processes, aerospace, and automotive applications. Its superior heat resistance, chemical stability, and ability to produce low-emission cores are accelerating adoption. Increasing focus on sustainable production and improved casting quality further reinforces growth opportunities for phenol-based Foundry Chemicals globally.

- By Product Type

On the basis of product type, the market is segmented into Binders, Additive Agents, Coatings, Fluxes, and Others. The Binders segment dominated with 38.5% share in 2025, supported by strong demand in sand casting, core making, and chemically bonded sand systems. Binders enhance mold strength, reduce defects, and improve surface finish across automotive, construction, and industrial applications.

The Coatings segment is expected to register the fastest CAGR from 2026 to 2033, driven by increasing adoption of heat-resistant and protective coatings in high-precision castings, aerospace, and industrial machinery. Technological advancements in coating formulations that improve thermal insulation, wear resistance, and defect reduction are further strengthening market expansion globally.

- By Foundry Type

Based on foundry type, the market is segmented into Ferrous and Non-Ferrous. The Ferrous segment dominated the market with a 56.7% share in 2025, attributed to its extensive use in steel, iron, and alloy castings for automotive, construction, and heavy machinery sectors. Ferrous foundries require robust chemical solutions for high-temperature molding, binder performance, and surface finish quality.

The Non-Ferrous segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising aluminum, copper, and specialty alloy casting in electronics, aerospace, and lightweight automotive applications. Growing industrialization and demand for precision, lightweight components further support non-ferrous Foundry Chemicals adoption.

- By Foundry Tool Type

On the basis of tool type, the market is segmented into Shovel, Trowels, Lifter, Hand Riddle, Vent Wire, Rammers, Swab, Sprue Pins & Cutters, and Others. The Rammers segment dominated with 33.4% share in 2025, widely used for compacting molds and cores in high-quality casting operations. Rammers ensure uniform density, reduced defects, and better mold strength, particularly in heavy-duty industrial and automotive foundries.

The Swab segment is projected to grow at the fastest CAGR from 2026 to 2033 due to rising use in core coating, precision cleaning, and defect-free mold preparation in ferrous and non-ferrous casting. Increasing automation and demand for high-quality castings accelerate swab adoption.

- By Foundry Process Type

On the basis of process type, the market is segmented into Thermal Galvanization and Electro Less Nickel Plating. The Thermal Galvanization segment dominated with a 59.1% share in 2025, driven by strong application in corrosion protection, surface hardening, and high-temperature resistance for industrial components.

The Electro Less Nickel Plating segment is expected to grow at the fastest CAGR from 2026 to 2033, due to its uniform deposition, enhanced wear resistance, and wide adoption in aerospace, automotive, and precision engineering castings. Regulatory emphasis on sustainability and improved coating technologies further supports growth.

- By Foundry System Type

The market is segmented into Sand Cast Systems and Chemically Bonded Sand Cast Systems. The Sand Cast Systems segment dominated with 52.6% share in 2025, owing to its widespread use in ferrous and non-ferrous metal casting, cost-effectiveness, and compatibility with traditional foundries.

The Chemically Bonded Sand Cast Systems segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for high-precision, low-defect castings in automotive, aerospace, and industrial machinery. Advanced binder technologies and high-performance chemicals are accelerating adoption.

- By Application

Based on application, the market is segmented into Cast Iron, Steel, Aluminium, and Others. The Cast Iron segment dominated with a 44.3% share in 2025, driven by extensive use in automotive engines, industrial machinery, and heavy equipment. Cast iron foundries require high-performance binders, coatings, and fluxes for precision, thermal stability, and defect-free output.

The Aluminium segment is expected to grow at the fastest CAGR from 2026 to 2033 due to increasing lightweight automotive and aerospace components, rising industrial automation, and demand for sustainable, high-precision castings.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into E-Commerce, Specialty Stores, B2B/Third Party Distributors, and Others. The B2B/Third Party Distributors segment dominated with 61.8% share in 2025, owing to strong supplier relationships, bulk procurement by industrial users, and customized solutions for high-volume foundries.

The E-Commerce segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by increasing digitalization, online access to standard and specialty chemicals, and adoption by small and medium-scale foundries. Faster delivery, competitive pricing, and wider product availability support market expansion globally.

Which Region Holds the Largest Share of the Foundry Chemicals Market?

- Saudi Arabia dominated the Middle East and Africa foundry chemicals market with an estimated 39.7% revenue share in 2025, driven by large-scale industrial projects, automotive and machinery manufacturing, and high adoption in construction, renewable energy, and heavy equipment sectors

- Rising demand for high-performance, durable, and low-maintenance foundry chemicals reinforces Saudi Arabia’s market leadership. Strong OEM collaborations, advanced manufacturing capabilities, and continuous R&D investments further strengthen long-term growth prospects

UAE Foundry Chemicals Market Insight

In the U.A.E., market growth is fueled by construction, oil & gas, and renewable energy projects. Foundry Chemicals are increasingly used in heavy machinery, precision casting, and industrial equipment due to low friction, high wear resistance, and maintenance-free performance. Focus on energy efficiency, sustainable manufacturing, and strong partnerships with OEMs supports steady adoption and ensures long-term market expansion in key industrial sectors.

South Africa Foundry Chemicals Market Insight

South Africa is projected to register the fastest CAGR of 10.8% from 2026 to 2033, driven by rising use in automotive, mining, and industrial machinery applications. Increasing adoption of energy-efficient production methods, renewable energy initiatives, and advanced industrial automation accelerates demand for fiber and metal matrix foundry chemicals. Expansion of domestic manufacturing hubs and export-oriented industrial growth further supports long-term market development.

Egypt Foundry Chemicals Market Insight

In Egypt, growth is supported by investments in automotive, construction, and industrial sectors, where foundry chemicals are preferred for high-load, wear-resistant, and low-maintenance applications. Adoption in renewable energy installations, infrastructure projects, and heavy machinery manufacturing is rising due to modernization programs and government incentives. Collaborations between local manufacturers, OEMs, and research institutions enhance innovation and competitiveness in the regional market.

Morocco Foundry Chemicals Market Insight

Morocco shows steady growth driven by construction, automotive, and industrial equipment projects. Foundry Chemicals are increasingly used in heavy machinery, casting, and renewable energy applications to improve durability, operational efficiency, and service life. Government-supported industrial upgrades, energy-efficient initiatives, and expansion of local manufacturing capabilities encourage adoption. Growth in exports and regional industrial collaborations further strengthens long-term market development.

Which are the Top Companies in Foundry Chemicals Market?

The foundry chemicals industry is primarily led by well-established companies, including:

- Vesuvius (U.K.)

- Imerys (France)

- Saint Gobain Performance Ceramics & Refractories (France)

- Georgia Pacific Chemicals (U.S.)

- DuPont (U.S.)

- ASK Chemicals (U.S.)

- Shandong Crownchem Industries Co., Ltd (China)

- Compax Industrial Systems Pvt. Ltd (India)

- CS ADDITIVE GMBH (Germany)

- CAGroup (U.A.E.)

- Ultraseal India Pvt. Ltd. (India)

- Hüttenes Albertus (Germany)

- CERAFLUX INDIA PVT.LTD. (India)

- Forace Polymers (P) Ltd. (India)

- Scottish Chemical (U.K.)

What are the Recent Developments in Global Foundry Chemicals Market?

- In August 2025, Vesuvius acquired Morgan Advanced’s Molten Metal Systems to strengthen its non-ferrous revenue to 27%, focusing on expansion in India with cost synergies expected to deliver over 50% EBITDA uplift, reinforcing the company’s global market position

- In March 2025, ASK Chemicals launched a new range of low-emission cold-box binders, reducing VOC outputs by 30% to promote sustainable foundry operations in automotive applications, supporting environmentally responsible production practices

- In January 2024, Hüttenes-Albertus International developed bio-based release agents in alignment with EU green directives, targeting growth in the construction sector, further enhancing the company’s commitment to sustainable and eco-friendly solutions

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.