North America Interventional Neurology Devices Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

3.10 Billion

USD

5.80 Billion

2024

2032

USD

3.10 Billion

USD

5.80 Billion

2024

2032

| 2025 –2032 | |

| USD 3.10 Billion | |

| USD 5.80 Billion | |

|

|

|

|

North America Interventional Neurology Devices Market Segmentation By Product Type (Embolic Coils, Flow Diversion Devices, Liquid Embolic Devices, Carotid Artery Stents, Embolic Protection Systems, Micro Support Devices, Microguidewires, Microcatheters, Neurothrombectomy Devices, CLOT Retrieval Devices, Suction and Aspiration Devices, Snares), Applications (Arteriovenous Malformation and Fistulas, Cerebral Aneurysms, Schemic Strokes, Intracranial Atherosclerotic Disease), Techniques (Angioplasty and Stenting, Neurothrombectomy, Pre OperativerTumor Embolization, Vertebroplasty, Stroke Therapy), End Use (Ambulatory Care Centers, Hospitals, Neurology Clinics)- Industry Trends and Forecast to 2032

Interventional Neurology Devices Market Size

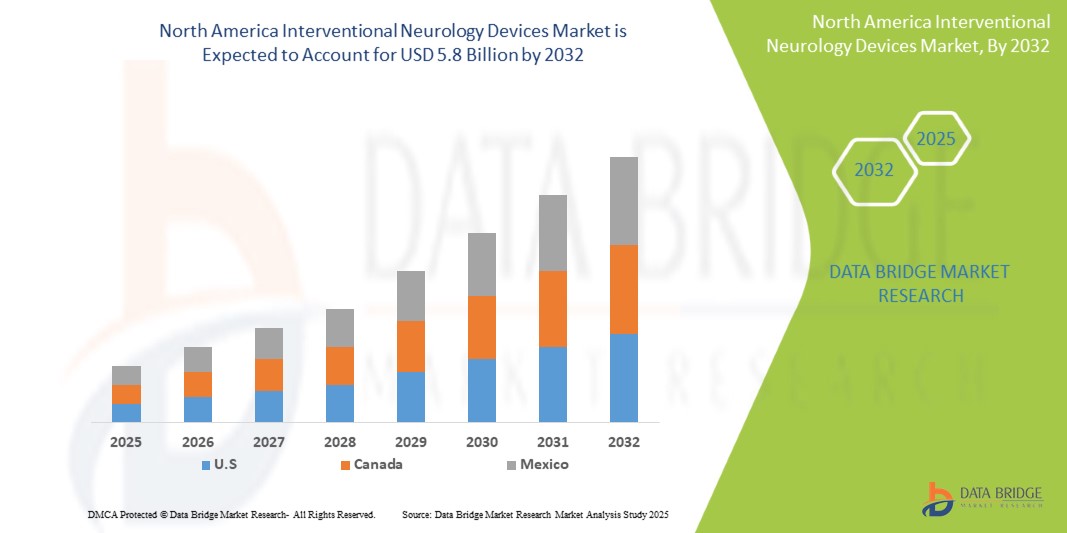

- The North America Interventional Neurology Devices Market was valued atUSD 3.1 Billion in 2024and is expected to reachUSD 5.8 Billion by 2032,at aCAGR of 7.1%during the forecast period.

- The growth of the North America Interventional Neurology Devices Market is primarily driven by the rising prevalence of neurovascular disorders such as stroke, cerebral aneurysms, and arteriovenous malformations, fueled by an aging population and increasing incidence of lifestyle-related conditions like hypertension and diabetes. Technological advancements in minimally invasive neurointerventional procedures, including the development of innovative devices like stent retrievers, embolic coils, and flow diverters, are significantly enhancing treatment outcomes and driving adoption.

North America Interventional Neurology Devices Market Analysis

- Interventional neurology devices are essential in the minimally invasive treatment of neurovascular disorders such as ischemic stroke, intracranial aneurysms, arteriovenous malformations (AVMs), and carotid artery disease. These devices—including clot retrieval systems, embolic coils, stent retrievers, balloon catheters, and flow diversion devices—enable precise navigation and treatment within the cerebral vasculature, significantly improving patient outcomes. They are commonly used in hospitals, neuro-specialty centers, and ambulatory surgical units.

- The demand for interventional neurology devices in North America is primarily driven by the rising incidence of stroke and other cerebrovascular diseases, which are closely associated with an aging population, hypertension, diabetes, and sedentary lifestyles. The region also sees strong adoption due to growing awareness of early intervention benefits, increased screening rates, and the high burden of neurovascular-related morbidity and mortality.

- U.S. dominates the North America interventional neurology devices market, supported by advanced healthcare systems, the presence of leading medical device companies, and widespread adoption of cutting-edge neurosurgical technologies. The United States, in particular, holds a leading market share, driven by favorable reimbursement policies, high healthcare expenditure, and robust clinical research and innovation pipelines.

Report ScopeInterventional Neurology DevicesMarket Segmentation

|

Attributes |

Interventional Neurology DevicesKeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Interventional Neurology Devices Market Trends

“Technological Innovation and Expanding Clinical Applications”

- Advancements in neuroimaging and catheter-based technologies are transforming interventional neurology by enabling more precise navigation and targeted therapy within the brain’s complex vasculature. Innovations such as next-generation stent retrievers, embolic coils, and flow diverters are improving clinical outcomes and procedural safety.

- Growing adoption of minimally invasive endovascular procedures is a major trend, driven by increased physician and patient preference for non-surgical approaches to treating conditions like ischemic stroke, aneurysms, and arteriovenous malformations.

- For instance, the U.S. has seen increased use of thrombectomy devices for acute ischemic stroke treatment, encouraged by updated American Heart Association guidelines and growing physician preference for minimally invasive endovascular procedures.

- Integration of artificial intelligence (AI) and robotics in neurointerventional procedures is enhancing decision-making, reducing procedure time, and improving real-time visualization. These technologies are supporting the shift toward precision medicine in neurology.

- Expansion of mechanical thrombectomy as a standard of care for acute ischemic stroke is shaping product development and procedural protocols, supported by favorable clinical guidelines and improved reimbursement frameworks.

- Rising focus on personalized and image-guided therapies is encouraging the development of patient-specific solutions and hybrid devices, tailored to individual anatomical and pathological needs, particularly in complex neurovascular cases.

Interventional Neurology Devices Market Dynamics

Driver

““High Adoption of Advanced Neurointerventional Technologies”

- The North America Interventional Neurology Devices Market is primarily driven by the increasing adoption of advanced neurointerventional technologies aimed at improving diagnosis and treatment of acute neurological conditions such as ischemic stroke, cerebral aneurysms, and arteriovenous malformations. Devices like stent retrievers, embolic coils, and flow diverters are gaining widespread acceptance due to their ability to enable minimally invasive, precise interventions with faster recovery times and improved patient outcomes.

- Government-backed healthcare initiatives across the U.S. and Canada, including stroke awareness campaigns, NIH-funded neurovascular research, and expanding reimbursement coverage for endovascular procedures, are accelerating the adoption of interventional neurology devices in clinical practice.

- The presence of leading neuroscience research institutions, high procedural volumes in advanced stroke centers, and increasing investments in surgical robotics and AI-driven imaging are further fueling innovation and clinical integration across the region.

- Moreover, the post-COVID-19 emphasis on enhancing critical care infrastructure has reinforced the importance of rapid and effective stroke intervention technologies, contributing to continued growth in neurointerventional device deployment across hospitals and specialized neurology centers.

For instance,

- According to the American Heart Association, mechanical thrombectomy procedures for acute ischemic stroke have increased significantly in the U.S. since the 2018 guidelines expanded the treatment window for eligible patients.

- In January 2024, Stryker announced a 15% year-over-year growth in its neurovascular segment, driven by strong demand for its advanced thrombectomy and access device systems across North American stroke centers

- This trend is further supported by rising public awareness of stroke symptoms, improvements in tele-neurology and remote diagnostic support, and government investments to expand comprehensive stroke care networks throughout North America.

Opportunity

“Expansion of Interventional Neurology into Ambulatory and Community-Based Care Settings”

- he ongoing shift toward decentralized healthcare delivery is creating strong opportunities for the expansion of interventional neurology services into ambulatory surgical centers (ASCs), outpatient stroke units, and tele-neurology-enabled facilities across North America.

- Growing demand for timely, minimally invasive treatment of neurological emergencies—especially strokes—is fueling interest in bringing advanced neurointerventional capabilities closer to patients in community hospitals, mobile stroke units, and rural settings through portable imaging and catheter-based systems.

For instance,

- In February 2024, the American College of Radiology (ACR) reported a marked increase in the use of mobile stroke units equipped with CT scanners and telemedicine platforms, enabling faster diagnosis and initiation of endovascular therapies in pre-hospital environments.

- Penumbra Inc. announced the expansion of its Lightning™ Aspiration System into outpatient and regional care centers across the U.S., highlighting the growing decentralization of neurovascular care

- This trend is further supported by healthcare providers’ growing need for rapid, precise interventions, especially in stroke management, coupled with regulatory efforts to expand access to thrombectomy-capable centers. These developments are attracting significant investment in compact, AI-powered imaging tools and next-generation catheter systems designed for use in lower-acuity or remote care settings throughout North America.

Restraint/Challenge

“High Costs of Neurointerventional Devices and Regulatory Complexity”

- Interventional neurology devices—such as stent retrievers, embolic coils, flow diverters, and navigation systems—are often high-cost technologies that require substantial capital investment for acquisition, operation, and maintenance. These costs pose a challenge for smaller healthcare facilities, particularly in rural and resource-limited areas of North America, limiting widespread adoption.

- Stringent regulatory pathways mandated by agencies like the U.S. Food and Drug Administration (FDA) and Health Canada require extensive clinical validation, safety trials, and post-market surveillance, which can delay the launch of new neurointerventional products and significantly increase time-to-market for manufacturers.

For instance,

- In October 2024, a white paper by the Medical Device Innovation Consortium (MDIC) revealed that the total cost of developing and commercializing a new neurovascular device in the U.S. can exceed USD 120 million, with regulatory compliance and clinical testing accounting for over 40% of that figure.

- Smaller medtech companies face additional hurdles due to limited resources for navigating the complex approval processes and scaling manufacturing to meet safety and efficacy standards

- These high financial and procedural burdens can hinder innovation, restrict access to cutting-edge stroke care technologies in underserved regions, and intensify competitive pressures—especially for startups and mid-sized firms operating in the North America interventional neurology devices market

Interventional Neurology Devices Market Scope

The market is segmented on the basis, product type, techniques, application and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Techniques |

|

|

By Application |

|

|

ByEnd User

|

|

In 2025, the Neurothrombectomy is projected to dominate the market with a largest share in application segment

In 2025, neurothrombectomy devices segment is expected to dominate the North America Interventional Neurology Devices Market, with the largest share of 37.22% in 2025 due to increasing use in the treatment of acute ischemic stroke. The strong clinical efficacy of mechanical thrombectomy procedures—especially when performed within the extended therapeutic window recommended by updated guidelines—has significantly expanded their adoption across stroke centers and tertiary care hospitals. The rapid development of innovative stent retrievers, aspiration catheters, and clot retrieval systems, along with favorable reimbursement policies in the U.S. and Canada, is reinforcing the leadership of this segment. Additionally, advancements in device design for better navigability, reduced procedural times, and improved outcomes are encouraging both neurologists and interventional radiologists to adopt these tools as frontline treatment options for eligible stroke patients.

The hospitals is expected to account for the largest share during the forecast period in end user market

In 2025, the hospitals and surgical centers segment is expected to dominate the market with the largest market share of 23.31%. This dominance is attributed to their central role in performing complex neurointerventional procedures, including thrombectomy, aneurysm coiling, and flow diversion. These facilities benefit from high patient volumes, access to trained specialists, and advanced infrastructure, making them key hubs for the deployment of cutting-edge neurovascular technologies. Moreover, the rise in comprehensive stroke centers and neurocritical care units across the region is expanding the reach and utilization of interventional neurology devices. The push for better stroke outcomes, integration of hybrid operating rooms, and the availability of 24/7 neurointervention teams are further positioning hospitals as the primary drivers of growth in this segment.

Interventional Neurology Devices Market Regional Analysis

“U.S. is the Dominant Country in the Interventional Neurology Devices Market”

- The U.S. leads the North America Interventional Neurology Devices Market, accounting for the largest share due to its highly advanced healthcare infrastructure, a robust medical device market, and substantial investments in life sciences research. The country’s well-established healthcare system, coupled with widespread adoption of cutting-edge medical technologies, positions it as the dominant player in this sector.

- The growing incidence of neurological disorders such as stroke, cerebral aneurysms, and arteriovenous malformations is driving significant demand for neurointerventional devices. With a high burden of cardiovascular and cerebrovascular diseases, the need for effective and timely interventions is pushing the adoption of advanced devices like stent retrievers, aspiration catheters, and thrombectomy systems.

- Key industry players such as Medtronic, Stryker, Johnson & Johnson (Cerenovus), and Penumbra contribute to the region's technological leadership, offering innovative neurovascular solutions and expanding the availability of cutting-edge devices in hospitals and surgical centers.

- Favorable reimbursement policies and increasing government and private healthcare funding in the U.S. continue to drive market growth. The establishment of comprehensive stroke centers and advancements in stroke care protocols are contributing to the country’s leadership position in the interventional neurology devices market.

“Canada is Projected to Register the Highest Growth Rate”

- Canada is expected to witness the highest growth rate in the North America Interventional Neurology Devices Market, driven by its universal healthcare system and a national focus on improving disease surveillance, early diagnosis, and neurointerventional care. The Canadian healthcare model, which emphasizes equitable access to medical services, is positioning the country for strong growth in advanced neurovascular procedures.

- Strategic government investments in neurovascular research and molecular diagnostics are contributing to the growing adoption of interventional neurology technologies. Initiatives such as funding for stroke care programs and research into new neurointerventional techniques are enhancing Canada’s capacity to treat complex neurological conditions, further supporting the demand for neurovascular devices.

- The expansion of personalized medicine and genomics programs, such as those led by Genome Canada, is fostering greater use of image-guided and minimally invasive neurosurgical solutions. As personalized treatments for conditions like stroke and aneurysms become more prevalent, demand for tailored neurointerventional devices is set to grow.

- Increased collaborations between Canadian academic research centers, medical device companies, and healthcare institutions are promoting innovation in neurointerventional technologies. The growing awareness of stroke symptoms, coupled with enhanced public health education, is driving greater patient and physician engagement in neurovascular care

Interventional Neurology Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Abbott Laboratories (U.S.)

- Balt USA (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Johnson & Johnson (Cerenovus) (U.S.)

- Medtronic plc (U.S.)

- MicroVention, Inc. (U.S.)

- Penumbra, Inc. (U.S.)

- Stryker Corporation (U.S.)

Latest Developments in North America Interventional Neurology Devices Market

- In March 2023, Johnson & Johnson launched its new CEREPAK Detachable Coils in the U.S. The coils offer three distinct shapes and multiple sizes, providing physicians with various options to treat brain aneurysms. These coils are designed for concentric aneurysm filling, contributing large volumetric filling to enhance treatment outcomes and improve patient care.

- In June 2023, BIOTRONIK, a leading medical device company, introduced the limited release of its Oscar (One Solution: Cross. Adjust. Restore) multifunctional peripheral catheter. This catheter offers innovative features for vascular procedures, allowing physicians to cross, adjust, and restore vascular access efficiently. It aims to improve procedural efficiency and patient outcomes in peripheral artery disease treatments

- In April 2022, Integer Holdings Corporation acquired Connemara Biomedical Holdings Teoranta, including its subsidiaries Aran Biomedical and Proxy Biomedical. This acquisition enhances Integer’s portfolio, enabling it to offer comprehensive solutions for complex delivery and therapeutic devices. The move strengthens Integer’s presence in high-growth markets like neurovascular, cardiovascular, and general surgery, advancing their medical device capabilities.

- In December 2020, Terumo Corporation announced the release of their WEBTM Embolization System, which is a novel intravascular device that can be used to treat intracranial wide neck bifurcation aneurysms that cannot be surgically clipped.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.