North America Medical Device Reprocessing Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

2.51 Billion

USD

8.17 Billion

2025

2033

USD

2.51 Billion

USD

8.17 Billion

2025

2033

| 2026 –2033 | |

| USD 2.51 Billion | |

| USD 8.17 Billion | |

|

|

|

|

북미 의료기기 재처리 시장 세분화: 유형별(효소 및 비효소 세척제), 제품 및 서비스별(재처리 지원 및 서비스, 재처리된 의료기기), 공정별(사전 침지, 수동 세척, 자동 세척, 소독), 기기 유형별(중요 기기, 준중요 기기, 비중요 기기), 적용 분야별(기기 및 액세서리), 최종 사용자별(병원, 진료소, 가정 의료, 진단 센터, 제조업체, 외래 수술 센터 등) - 산업 동향 및 2033년까지의 전망

북미 의료기기 재처리 시장 규모

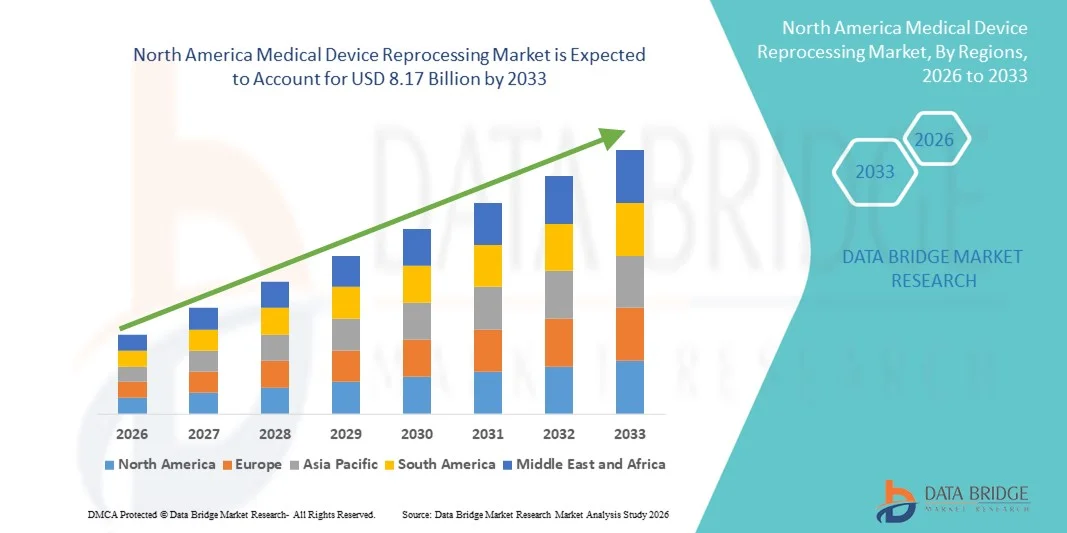

- 북미 의료기기 재처리 시장 규모는 2025년 25억 1천만 달러 였으며, 예측 기간 동안 연평균 성장률(CAGR) 15.90% 로 성장하여 2033년에는 81억 7천만 달러 에 이를 것으로 예상됩니다 .

- 시장 성장은 주로 의료 서비스 제공업체의 비용 절감 압력 증가와 지속 가능한 의료 관행의 도입 확대, 그리고 안전한 재처리를 지원하는 엄격한 규제 체계에 의해 주도되고 있습니다.

- 더욱이, 감염 관리, 환경적 이점, 의료 폐기물 감소에 대한 병원들의 인식이 높아짐에 따라 의료기기 재처리는 일회용 기기에 대한 신뢰할 수 있고 비용 효율적인 대안으로 자리매김하고 있습니다. 이러한 요인들이 종합적으로 재처리 의료기기 도입을 가속화하여 해당 지역 시장 성장을 크게 뒷받침하고 있습니다.

북미 의료기기 재처리 시장 분석

- 재사용 및 재처리 가능한 의료기기의 세척, 소독 및 멸균을 포함하는 의료기기 재처리는 시술 비용 절감, 환자 안전 향상, 그리고 환경적으로 지속 가능한 의료 관행 지원에 중요한 역할을 하므로 현대 의료 시스템에서 점점 더 필수적인 요소가 되고 있습니다.

- 의료기기 재처리 수요 증가의 주요 원인은 의료비 지출 증가, 엄격한 규제 요건, 감염 예방에 대한 강조 증가, 그리고 의료 폐기물 감소 및 자원 활용 최적화에 대한 의료기관의 압력 증가입니다.

- 미국은 고도로 발달된 의료 인프라, 엄격한 FDA 규제 감독, 그리고 대형 병원 네트워크 전반에 걸친 광범위한 도입에 힘입어 2025년까지 의료기기 재처리 시장에서 72.5%의 매출 점유율로 최대 1위를 차지할 것으로 예상됩니다. 특히 비용 절감 전략과 표준화된 멸균 처리 방식에 따른 재처리 서비스 이용률이 높은 것이 이러한 성장을 뒷받침하고 있습니다.

- 캐나다는 의료비 지출 증가, 지속 가능한 의료 관행에 대한 인식 제고, 공공 및 민간 의료 시설 전반에 걸친 재처리 프로그램 도입 확대에 힘입어 예측 기간 동안 북미 의료기기 재처리 시장에서 가장 빠르게 성장하는 국가가 될 것으로 예상됩니다.

- 재처리 지원 및 서비스 부문은 전문적인 제3자 서비스 제공업체에 대한 의존도 증가, 규제 준수 요건, 검증되고 고품질의 재처리 워크플로우에 대한 필요성 등에 힘입어 2025년까지 시장 점유율 55%로 시장을 주도할 것으로 예상됩니다.

보고서 범위 및 북미 의료기기 재처리 시장 세분화

|

속성 |

북미 의료기기 재처리 주요 시장 분석 |

|

포함되는 부문 |

|

|

대상 국가 |

북아메리카

|

|

주요 시장 참여자 |

|

|

시장 기회 |

|

|

부가가치 데이터 정보세트 |

데이터 브리지 마켓 리서치에서 제공하는 시장 보고서는 시장 가치, 성장률, 시장 세분화, 지역별 시장 범위, 주요 기업 등 시장 시나리오에 대한 심층적인 분석 외에도 전문가 분석, 환자 역학, 파이프라인 분석, 가격 분석, 규제 프레임워크에 대한 정보를 포함합니다. |

북미 의료기기 재처리 시장 동향

의료 서비스 분야에서 지속가능성과 비용 최적화에 대한 중요성이 점점 커지고 있다

- A significant and accelerating trend in the North America medical device reprocessing market is the growing emphasis on sustainable healthcare practices combined with the need to reduce operational and procedural costs across hospitals and healthcare facilities

- Medical device reprocessing programs are increasingly being adopted as hospitals seek to lower procurement expenses while minimizing environmental impact by reducing single-use medical waste generated during surgical and diagnostic procedures

- For instance, large hospital networks in the United States are expanding centralized sterile processing departments and partnering with third-party reprocessing service providers to standardize workflows, ensure regulatory compliance, and achieve consistent cost savings

- Advancements in cleaning technologies, including automated cleaning systems and validated disinfection protocols, are enhancing the safety, reliability, and scalability of reprocessed medical devices across critical and semi-critical device categories

- The integration of reprocessing programs within broader hospital sustainability initiatives is enabling healthcare providers to align cost-efficiency goals with environmental, social, and governance objectives, particularly in publicly funded healthcare systems

- Increasing collaboration between hospitals and specialized reprocessing service providers is improving access to expertise, infrastructure, and validated processes, supporting broader market penetration

- This growing focus on efficiency, compliance, and environmental responsibility is reshaping purchasing and utilization strategies, encouraging long-term adoption of medical device reprocessing across North America

North America Medical Device Reprocessing Market Dynamics

Driver

Growing Pressure to Reduce Healthcare Costs and Medical Waste

- The increasing pressure on healthcare systems to reduce overall treatment costs while maintaining high standards of patient safety is a major driver fueling the adoption of medical device reprocessing across North America

- Rising surgical volumes, high prices of single-use medical devices, and constrained hospital budgets are prompting healthcare providers to seek cost-effective alternatives such as reprocessed devices

- For instance, hospitals adopting structured reprocessing programs have reported significant reductions in annual supply chain expenditures while maintaining compliance with strict regulatory and quality standards

- Furthermore, heightened awareness of environmental sustainability and regulatory encouragement to reduce medical waste are reinforcing the role of reprocessing as a viable long-term solution

- The growing acceptance of reprocessed devices among clinicians, supported by validated safety data and standardized protocols, is further accelerating market growth across hospitals and ambulatory surgical centers

- Supportive reimbursement frameworks and institutional purchasing policies are also contributing to increased adoption of reprocessing solutions across large healthcare systems

- The expansion of value-based care models is strengthening demand for reprocessing by prioritizing cost efficiency, waste reduction, and optimized resource utilization

Restraint/Challenge

Regulatory Complexity and Safety Compliance Concerns

- The stringent regulatory requirements governing the cleaning, disinfection, and reuse of medical devices present a significant challenge to the widespread adoption of medical device reprocessing

- Compliance with complex regulatory frameworks, documentation requirements, and validation protocols can be resource-intensive, particularly for smaller healthcare facilities lacking advanced sterile processing infrastructure

- For instance, meeting detailed regulatory expectations related to device traceability, performance testing, and quality assurance may limit adoption among clinics and smaller diagnostic centers

- In addition, concerns among some clinicians regarding infection risks and device performance, despite strong evidence supporting reprocessed devices, can slow acceptance in certain care settings

- The need for continuous staff training and strict adherence to evolving regulatory standards further increases operational complexity for healthcare providers

- Limited internal expertise and capital investment requirements for in-house reprocessing capabilities can act as barriers for smaller end users

- Addressing these challenges through standardized guidelines, continued clinical education, and investments in advanced reprocessing technologies will be essential to ensure sustained growth of the medical device reprocessing market in North America

North America Medical Device Reprocessing Market Scope

The market is segmented on the basis of type, product & service, process, device type, application, and end user.

- By Type

On the basis of type, the market is segmented into enzymatic and non-enzymatic detergent. The enzymatic segment dominated the market with the largest revenue share in 2025. Enzymatic detergents are highly effective in breaking down organic residues, ensuring surgical instruments and critical devices are thoroughly cleaned before sterilization. Hospitals and large healthcare facilities prefer enzymatic detergents due to their validated efficacy, which reduces infection risks and complies with FDA and CDC guidelines. They are compatible with automated cleaning systems, allowing high-volume processing and improving operational efficiency. The detergents also shorten turnaround time, supporting faster surgical schedules and reducing instrument downtime. Their long-standing reputation for reliability and safety in critical and semi-critical device reprocessing reinforces their market leadership.

The non-enzymatic detergent segment is expected to witness the fastest growth during the forecast period. Non-enzymatic detergents are more cost-effective and easier to handle, making them suitable for smaller clinics, outpatient centers, and home healthcare providers. Growing awareness of affordable reprocessing solutions and adoption of automated and semi-automated cleaning systems is boosting demand. They can be used on a wide variety of instruments and accessories, including non-critical devices. Rising focus on operational efficiency and sustainability in smaller healthcare facilities contributes to rapid growth. Increasing support from service providers for standardized workflows using non-enzymatic detergents is also driving adoption.

- By Product & Service

On the basis of product & service, the market is segmented into reprocessing support & services and reprocessed medical devices. The reprocessing support & services segment dominated the market in 2025 with a market share of 55%. Large hospitals and surgical centers increasingly outsource complex reprocessing operations to third-party providers to ensure compliance, maintain quality standards, and reduce internal workload. Providers offer validated workflows, advanced cleaning technologies, and traceability solutions that are critical for high-volume facilities. Hospitals value service contracts for consistency, audit support, and liability management. Rising awareness of cost savings and sustainability benefits strengthens adoption. The segment’s leadership is further supported by the high demand from multi-hospital networks and ambulatory surgical centers.

The reprocessed medical devices segment is expected to witness the fastest growth during the forecast period. Hospitals are increasingly adopting reprocessed devices to optimize procurement costs and reduce waste. Growing confidence in the clinical safety of reprocessed instruments, validated workflows, and FDA oversight fuels market expansion. Reprocessed devices are gaining popularity in cardiovascular, orthopedic, and general surgical applications. High surgical volumes and procurement cost pressures accelerate adoption across hospitals and clinics. Sustainability initiatives also drive facilities to prefer reprocessed devices for environmental benefits.

- By Process

On the basis of process, the market is segmented into presoak, manual cleaning, automatic cleaning, and disinfection. The automatic cleaning segment dominated the market in 2025. Hospitals prefer automated systems for efficiency, consistency, and reduced human error. Automated cleaning ensures uniform results for critical and semi-critical devices, helping facilities meet regulatory standards and prevent infections. Integration with enzymatic detergents further improves cleaning performance. Automated washers also save labor and enable high-volume processing in centralized sterile processing departments. Advanced automation technologies support scalability for large healthcare facilities.

The disinfection segment is expected to witness the fastest growth during the forecast period. Chemical disinfection solutions are increasingly adopted in outpatient centers, smaller clinics, and home healthcare settings due to lower capital requirements and operational simplicity. Disinfection processes enable faster device turnaround and maintain hygiene standards. Growing awareness of infection control, cost reduction, and sustainability in smaller facilities is fueling demand. Disinfection is also critical for semi-critical and non-critical devices that do not require full sterilization. Partnerships with service providers offering portable disinfection solutions accelerate adoption.

- By Devices Type

On the basis of device type, the market is segmented into critical, semi-critical, and non-critical devices. The critical devices segment dominated the market in 2025. Hospitals prioritize reprocessing of surgical instruments, endoscopes, and life-critical devices due to the high risk of infections. Regulatory compliance and safety standards make critical device reprocessing a key operational priority. Advanced cleaning and sterilization technologies ensure consistent performance and patient safety. High surgical volumes further reinforce demand. Adoption of automated and validated workflows strengthens market dominance.

The non-critical devices segment is expected to witness the fastest growth during the forecast period. Growing outpatient procedures, home healthcare services, and smaller clinics are increasing the demand for cost-effective reprocessing of low-risk devices. Rising awareness of hygiene and infection control supports adoption. These devices often include reusable accessories and instruments that require disinfection rather than full sterilization. Non-critical device reprocessing provides operational cost benefits and environmental sustainability. Technology adoption in smaller facilities also supports growth.

- By Application

On the basis of application, the market is segmented into devices and accessories. The devices segment dominated the market in 2025. Reprocessing of surgical instruments, cardiovascular devices, and diagnostic tools directly reduces procurement costs and supports high-volume surgical operations. Hospitals focus on devices because they have the highest clinical and economic impact. Validated cleaning and sterilization workflows enhance adoption. Traceability systems ensure regulatory compliance and patient safety. High turnover of critical devices further reinforces market leadership.

The accessories segment is expected to witness the fastest growth during the forecast period. Reusable instrument accessories such as tubing, connectors, and surgical trays are increasingly reprocessed in clinics, outpatient centers, and home healthcare. Efficient reprocessing reduces operational costs and medical waste. Awareness of environmental sustainability is encouraging adoption. Smaller healthcare facilities benefit from cost-effective accessory reprocessing. Technological advancements and third-party service support further accelerate market growth.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, home healthcare, diagnostic centers, manufacturers, ambulatory surgical centers, and others. The hospitals segment dominated the market in 2025. Hospitals have centralized sterile processing departments, high surgical volumes, and strict regulatory standards. They benefit from automated cleaning, advanced reprocessing services, and validated workflows. Cost savings, safety, and regulatory compliance drive adoption. Multi-hospital networks increasingly prefer outsourcing support services. Hospitals’ preference for critical and semi-critical device reprocessing reinforces dominance.

The home healthcare segment is expected to witness the fastest growth during the forecast period. Increasing use of reusable medical devices in chronic disease management, infusion therapy, and outpatient care is driving adoption. Awareness of hygiene, safety, and cost reduction supports expansion. Efficient, validated reprocessing solutions are crucial for home healthcare providers. Growing patient populations and adoption of sustainable practices are contributing factors. Service providers offering portable and affordable solutions further accelerate growth.

North America Medical Device Reprocessing Market Regional Analysis

- The United States dominated the medical device reprocessing market with the largest revenue share of 72.5% in 2025, supported by a highly developed healthcare infrastructure, strict FDA regulatory oversight, and widespread adoption across large hospital networks, with strong utilization of reprocessing services driven by cost-containment strategies and standardized sterile processing practices

- Healthcare providers in the region prioritize patient safety, cost efficiency, and regulatory compliance, making reprocessing of critical and semi-critical devices a key operational strategy. Advanced sterile processing departments and validated workflows support the widespread use of reprocessed medical devices

- This strong adoption is further supported by increasing healthcare expenditures, growing awareness of sustainable practices, and the integration of reprocessing programs into hospital operational strategies, establishing reprocessing solutions as a preferred approach for both large hospital networks and ambulatory surgical centers

The U.S. Medical Device Reprocessing Market Insight

The U.S. medical device reprocessing market captured the largest revenue share of 72.5% in 2025 within North America, driven by the well-established healthcare infrastructure, stringent FDA regulations, and high adoption of reprocessing practices in hospitals and ambulatory surgical centers. Healthcare providers prioritize patient safety, cost containment, and operational efficiency, making reprocessing critical and semi-critical devices a standard practice. The growing focus on sustainability and reducing medical waste further supports market expansion. Large hospital networks increasingly outsource reprocessing support & services to third-party providers, ensuring validated workflows and regulatory compliance. Moreover, advancements in automated cleaning, disinfection, and tracking systems are enhancing reliability and efficiency, fueling adoption across high-volume surgical departments.

Canada Medical Device Reprocessing Market Insight

The Canada medical device reprocessing market is expected to be the fastest-growing country in North America during the forecast period, driven by increasing healthcare investments and rising awareness of cost-effective, sustainable medical practices. Hospitals and clinics are implementing standardized reprocessing programs for critical and semi-critical devices to reduce procurement costs and medical waste. The adoption of automated cleaning systems, enzymatic detergents, and validated disinfection protocols is rising steadily across both public and private healthcare facilities. For instance, Canadian hospitals are increasingly partnering with third-party service providers to ensure regulatory compliance and maintain operational efficiency. Growing government initiatives promoting sustainable healthcare and environmentally responsible practices further accelerate market growth. The combination of rising surgical volumes and the need for cost-efficient device utilization positions Canada as a rapidly expanding market within the region.

Mexico Medical Device Reprocessing Market Insight

The Mexico medical device reprocessing market is witnessing gradual growth due to increasing investment in healthcare infrastructure and the expansion of private hospitals and surgical centers. Hospitals are adopting reprocessing practices to reduce reliance on expensive single-use devices while ensuring patient safety and compliance with national healthcare regulations. Automated cleaning and disinfection systems are gaining traction in high-volume facilities, supported by growing awareness of operational efficiency and sustainability benefits. For instance, some private hospital chains in Mexico have implemented third-party reprocessing services to standardize workflows and improve device turnaround time. Rising government focus on sustainable healthcare practices and increased training for sterile processing personnel are contributing to market development. The expanding private healthcare sector and increased demand for affordable, safe reprocessing solutions are driving steady market adoption

North America Medical Device Reprocessing Market Share

The North America Medical Device Reprocessing industry is primarily led by well-established companies, including:

- NEScientific, Inc. (U.S.)

- Innovative Health (U.S.)

- Medline Industries, Inc. (U.S.)

- Stryker (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- SterilMed, Inc. (U.S.)

- ReNu Medical (Arjo) (U.S.)

- SureTek Medical LLC (U.S.)

- Device Science, Inc. (U.S.)

- MD Reprocess, Inc. (U.S.)

- SteriPro Canada, Inc. (Canada)

- Cardinal Health, Inc. (U.S.)

- Healthmark Industries Co., Ltd. (U.S.)

- Centurion Medical Products Corp. (U.S.)

- Avante Health Solutions (U.S.)

- UVC Solutions, Inc. (Canada)

- Medline ReNewal (U.S.)

- HYGIA Health Services, Inc. (U.S.)

- SureTek Medical (U.S.)

- STERIS (U.S.)

What are the Recent Developments in North America Medical Device Reprocessing Market?

- In June 2025, the U.S. Food and Drug Administration (FDA) released updated guidance concerning the reprocessing of single‑use medical devices (SUDs), clarifying and tightening expectations around how hospitals and third‑party reprocessors should safely reuse these devices while maintaining regulatory compliance and patient safety

- In May 2025, a U.S. federal jury awarded USD 147 million in damages to Innovative Health after finding that Johnson & Johnson’s Biosense Webster unit violated antitrust laws by restricting clinical support for hospitals using Innovative Health’s FDA‑regulated reprocessed cardiac catheters. This landmark verdict was widely seen as a significant legal win for the medical device reprocessing industry, reinforcing hospitals’ rights to choose lower‑cost, reprocessed alternatives and highlighting competitive challenges in the reprocessing market

- In August 2024, the FDA launched online resources and guidance for reprocessed single‑use medical devices to help healthcare facilities better understand regulatory requirements, safety practices, and compliance expectations for these devices

- 2024년 4월, Ambu는 ERCP 시술용으로 설계된 aScope Duodeno 2 및 aBox 2 기기에 대해 FDA 510(k) 승인을 획득하여, 재처리 관행에 영향을 미치는 첨단 내시경 솔루션의 도입을 더욱 강화했습니다.

- 2023년 8월, 의료기기 재처리업체 협회(AMDR)는 비즈니스와이어를 통해 병원과 환경 관련 의사결정자들이 재처리된 일회용 의료기기 사용을 늘려 온실가스 배출량과 운영 비용을 절감할 수 있도록 지원하는 새로운 도구와 교육 자료를 발표했다고 밝혔습니다.

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.