North America Ophthalmology Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

31.77 Billion

USD

52.37 Billion

2024

2032

USD

31.77 Billion

USD

52.37 Billion

2024

2032

| 2025 –2032 | |

| USD 31.77 Billion | |

| USD 52.37 Billion | |

|

|

|

North America Ophthalmology Market Segmentation, By Products (Device, Drugs, and Others), Diseases (Cataract, Refractive Disorders, Glaucoma, Age-Related Macular Degeneration, Inflammatory Diseases, and Others), Comprehensive Eye Examination (Refraction, Visual Acuity Test, Intraocular Pressure, Anterior Segment and Pupillary Examination, Visual Fields Test, Color Vision Test, and Others), End User (Clinics, Hospitals, Home Healthcare, and Others), Distribution Channel (Retail Sales, Direct Tender, and Others) - Industry Trends and Forecast to 2032

North America Ophthalmology Market Analysis

The North America ophthalmology market has evolved significantly over the centuries, beginning with ancient treatments for eye conditions in Egypt and Greece. The field began to take shape in the 17th and 18th centuries, with the development of more advanced surgical techniques and tools. In the 19th century, innovations like the ophthalmoscope transformed diagnostic capabilities. The 20th century saw breakthroughs such as cataract surgery and the invention of intraocular lenses, along with the advent of LASIK surgery in the 1990s. The 21st century brought continued growth driven by an aging population, technological advancements, and the development of specialized diagnostic and surgical devices, including optical coherence tomography (OCT) and retinal imaging systems. Recent trends focus on the increasing use of artificial intelligence, telemedicine, and biologic therapies, such as gene therapy and stem cell treatments, further shaping the market's growth. Today, the ophthalmology market continues to expand due to rising eye disease prevalence, new technologies, and evolving treatment options.

North America Ophthalmology Market Size

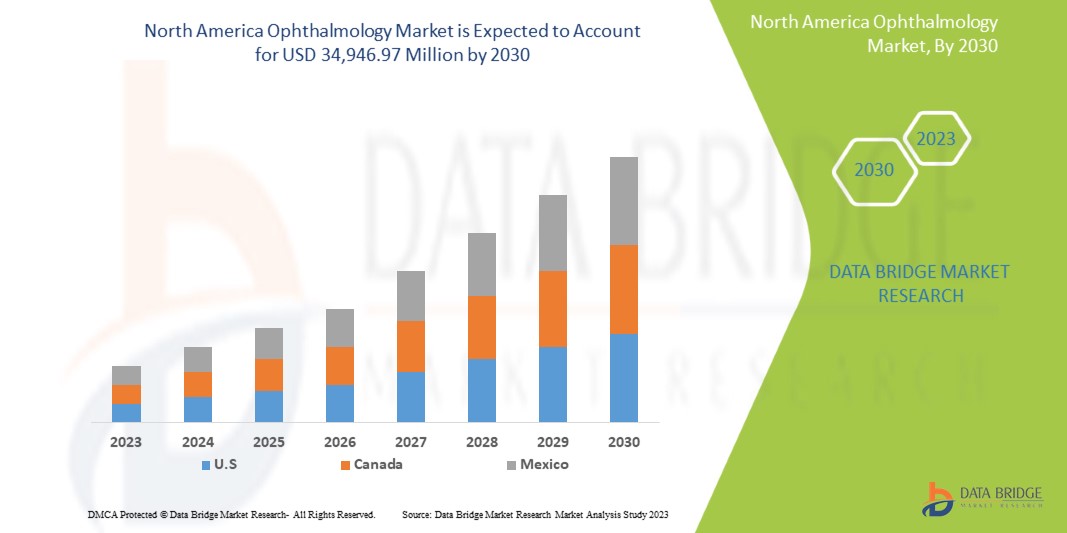

The North America ophthalmology market is expected to reach USD 52.37 billion by 2032 from USD 31.77 billion in 2024, growing at a CAGR of 6.5% in the forecast period of 2025 to 2032.

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

North America Ophthalmology Market Trends

“The Growing Adoption of Telemedicine and AI-Powered Diagnostic tools”

The North America ophthalmology market is the growing adoption of telemedicine and AI-powered diagnostic tools. These innovations are transforming the way eye care is delivered by enabling remote consultations and screenings, which increases accessibility, especially in underserved and rural areas. AI technologies, including machine learning algorithms, are being used to analyze retinal images, detect early signs of conditions like diabetic retinopathy, glaucoma, and macular degeneration, and provide faster, more accurate diagnoses. Telemedicine platforms allow patients to connect with ophthalmologists for follow-up consultations, reducing the need for in-person visits and making eye care more convenient and efficient. This trend is not only improving patient access to timely treatments but also enhancing the overall efficiency of healthcare systems, making it a key driver of market growth in the ophthalmology sector. As a result, the integration of these technologies is expected to continue expanding, particularly in emerging markets, where healthcare infrastructure is still developing.

Report Scope and North America Ophthalmology Market Segmentation

|

Attributes |

North America Ophthalmology Market Insights |

|

Segments Covered |

By Products: Device, Drugs, and Others By Diseases: Cataract, Refractive Disorders, Glaucoma, Age-Related Macular Degeneration, Inflammatory Diseases, and Others By Comprehensive Eye Examination: Refraction, Visual Acuity Test, Intraocular Pressure, Anterior Segment and Pupillary Examination, Visual Fields Test, Color Vision Test, and Others By End User: Clinics, Hospitals, Home Healthcare, and Others By Distribution Channel: Retail Sales, Direct Tender, and Others |

|

Region Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

Alcon (Switzerland), Bausch + Lomb (Canada), Carl Zeiss Meditec (Germany), Hoya Corporation (Japan), Johnson & Johnson Services, Inc. (U.S.), Essilor International (France), Topcon Corporation(Japan), Glaukos Corporation (U.S.), Haag-Streit Group (Switzerland), Nidek Co., Ltd (U.S.), Staar Surgical (California), Ziemer Ophthalmic Systems Ag (Switzerland), Cooper Companies (U.S.), Lumenis Be Ltd. (Israel), Reichert Inc. (New York), Bayer Ag (Germany), Novartis Ag (Switzerland), Abbvie Inc.(U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), Dompé (Italy), Santen Pharmaceutical Co. (Japan), Ltd among others. |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Ophthalmology Market Definition

Ophthalmology is a branch of medicine and surgery that focuses on the diagnosis, treatment, and prevention of eye disorders and diseases. It includes medical and surgical care for conditions affecting the eyes and visual systems, such as cataracts, glaucoma, macular degeneration, and diabetic retinopathy.

North America Ophthalmology Market Definition Dynamics

Drivers

- Increasing Prevalence of Eye Diseases

The increasing prevalence of eye conditions, such as cataracts, macular degeneration, and diabetic retinopathy, is a significant driver of the North America ophthalmology market. As the North America population ages, the incidence of these conditions is rise. Cataracts, which lead to blurred vision and blindness, demand an expanding market for surgeries and corrective treatments. Similarly, macular degeneration and diabetic retinopathy are contributing to the need for advanced diagnostic tools and specialized therapies. The growing number of affected individuals ensures sustained demand for eye care services, including surgeries, medications, and innovative diagnostic technologies. This surge in eye diseases directly drives market expansion, as healthcare providers and manufacturers strive to meet the growing need for effective treatments and solutions.

For instance,

- In July 2022, according to the article published by NCBI, The prevalence of blindness rises with age, increasing from 0.45% in those aged 50-59 to 11.62% in individuals 80 and older. Females (2.31%) and rural residents (2.14%) experience higher rates. Visual impairment also affects 26.68% of participants, showing similar trends. This growing burden of eye diseases, particularly among the elderly, drives demand for ophthalmic treatments and technologies, boosting the ophthalmology market

- In August 2023, according to the article published by WHO, North America, over 2.2 billion people suffer from vision impairment, with nearly 1 billion cases being preventable or untreated. This growing prevalence of vision issues highlights the increasing demand for eye care services, treatments, and corrective solutions. As more people seek medical attention for preventable or unresolved conditions, the rising burden of eye diseases acts as a significant driver for the ophthalmology market

The rising prevalence of age-related eye conditions like cataracts, macular degeneration, and diabetic retinopathy is fueling the North America ophthalmology market. As the population ages, these diseases become more common, increasing the demand for treatments, surgeries, and diagnostic tools. The need for advanced technologies and therapies grows as more people require care. This surge in eye conditions drives market growth, as healthcare providers and manufacturers aim to meet the rising demand for effective solutions.

- Focus on Preventative Eye Care

There is a growing emphasis on preventative eye care and early detection of vision-related issues, which is playing a significant role in driving the North America ophthalmology market. As awareness about the importance of eye health increases, more people are seeking routine eye checkups to detect conditions like glaucoma, diabetic retinopathy, and cataracts in their early stages. Early diagnosis allows for timely interventions, reducing the risk of vision loss and improving overall eye health. This proactive approach is not only improving patient outcomes but also fueling demand for ophthalmic services, diagnostic tools, and corrective treatments. The growing focus on preventative care is leading to a surge in investments in eye care technologies, ophthalmic devices, and services, thereby contributing to the market's expansion. This trend strongly acts as a driver for growth in the ophthalmology sector.

For instance,

- In October 2022, according to the article published by National Eye Institute, National Eye Health Education Program(NEHEP) collaborates with health professionals to promote awareness on early detection, treatment of eye diseases, and the benefits of vision rehabilitation. It also targets populations at high risk of eye disease and vision loss. This focus on preventative care encourages people to seek timely eye checkups and treatments, driving demand for ophthalmic services, diagnostic tools, and products, thereby fueling the ophthalmology market

- In October 2024, according to the article published by Directorate General of Health Services, The National Programme for Control of Blindness and Visual Impairment (NPCB&VI) aims to reduce blindness prevalence by identifying and treating curable blindness at all healthcare levels. By focusing on early detection and addressing avoidable blindness, the program highlights the importance of preventative care. This initiative drives demand for eye care services, diagnostic tools, and treatments, contributing significantly to the growth of the North America ophthalmology market

예방적 눈 관리와 조기 발견에 대한 집중이 증가하면서 북미 안과 시장이 크게 성장하고 있습니다. 눈 건강에 대한 인식이 높아짐에 따라 더 많은 사람들이 녹내장 및 백내장과 같은 질환을 조기에 식별하기 위해 정기적인 눈 검사를 선택하고 있습니다. 조기 발견은 추가적인 시력 상실을 예방하는 효과적인 치료를 가능하게 합니다. 이러한 선제적 접근 방식은 진단 도구, 안과 서비스 및 교정 치료에 대한 수요를 촉진하고 있습니다. 예방적 치료의 중요성이 커지면서 고급 눈 관리 기술에 대한 투자가 촉진되어 안과 시장의 전반적인 성장에 기여하고 지속적인 확장을 보장합니다.

기회

- 고령화 인구 증가

노령 인구의 증가는 북미 안과 시장에 상당한 기회를 제공합니다. 노인은 다양한 안구 질환과 질병에 더 취약하기 때문입니다. 백내장, 연령 관련 황반변성(AMD), 당뇨성 망막증, 녹내장과 같은 질환은 노인에게 흔하며, 안과 치료와 관리에 대한 상당한 수요가 발생합니다. 결과적으로 의료 시스템과 안과 제공자는 서비스를 확장하고, 진단 및 치료 옵션을 개선하며, 이 인구통계의 고유한 요구에 부응할 준비가 되었습니다. 이러한 증가하는 환자 기반은 수술적 개입과 첨단 약물 요법에서 시력 교정 제품에 이르기까지 다양한 솔루션을 필요로 하며, 안과 시술과 제품에 대한 꾸준하고 증가하는 수요를 보장합니다.

예를 들어,

- 2023년 3월, National Library of Medicine에 게재된 기사에 따르면, 백내장은 노년기 시력 장애의 주요 원인입니다. 렌즈 불투명화는 허약함, 낙상 위험, 우울증 및 인지 장애를 포함한 여러 노인성 질환과 관련이 있는 것으로 악명 높습니다. 게다가 같은 출처에 따르면, 2020년 50세 이상 환자의 실명의 주요 원인은 백내장이었고, 그 다음으로 녹내장, 교정 미달 굴절 이상, 연령 관련 황반 변성 및 당뇨성 망막증이었습니다.

- 2022년 8월 미국 안과학회에 발표된 기사에 따르면 AMD는 50세 이상 성인에게 흔히 발견되는 흔한 안구 질환입니다. 게다가 75세 이상 미국인의 절반이 백내장을 앓는다고 합니다.

또한 노령 인구의 눈 건강 요구를 해결하면 안과 분야에서 연구 개발에 대한 추가 투자를 자극할 수 있습니다. 제약 회사와 의료 기기 제조업체는 연령 관련 질환에 맞게 특별히 맞춤화된 혁신적인 솔루션을 만드는 데 주력하고 있으며, 잠재적으로 치료 프로토콜과 환자 치료에 획기적인 진전을 이룰 수 있습니다. 원격 안과 및 고급 영상 기술과 같은 새로운 기술을 통합하면 노인의 눈 건강을 보다 효과적으로 관리할 수 있어 원격으로 상태를 모니터링하고 치료하기가 더 쉬워집니다. 전반적으로 노령 인구는 기존 안과 서비스에 대한 필요성을 증폭시키고 북미 안과 시장에서 혁신과 성장을 위한 비옥한 토양을 제공합니다.

- 온라인 소매 및 전자 건강 플랫폼의 증가

온라인 소매 및 전자 건강 플랫폼의 부상은 소비자에게 광범위한 안과 제품 및 서비스에 대한 보다 쉬운 접근성을 제공함으로써 북미 안과 시장에 상당한 기회를 제공합니다. 전자 상거래의 채택이 증가함에 따라 환자는 처방 안경, 콘택트 렌즈 및 일반 의약품과 같은 품목을 집에서 편안하게 구매할 수 있습니다. 이러한 추세는 특히 젊고 기술에 정통한 소비자와 전통적인 광학 매장에 대한 접근성이 제한된 외딴 지역의 소비자에게 매력적입니다. 가격을 비교하고, 리뷰를 읽고, 온라인에서 더 광범위한 제품에 액세스할 수 있는 기능은 고객 만족도를 높이고 사용을 장려하여 안과 제품 부문의 성장을 촉진합니다.

예를 들어,

- 2023년 9월, 타임스 오브 인디아의 보도 기사에 따르면, '분홍 눈' 유행으로 인해 안과 약품 판매가 급증했습니다. 8월에는 두 달 연속으로 전년 대비 매출이 30% 가까이 급증했습니다. 전체 시장보다 거의 5배나 성장했습니다. 이 증가는 지난 몇 달 동안 전국적으로 결막염과 눈 합병증이 엄청나게 발생했음을 반영합니다.

- 2020년 4월, '안경 온라인 구매에 대한 환자의 견해'라는 기사에 따르면, 콘택트렌즈 온라인 구매가 증가하고 있습니다. 호주, 미국 및 영국의 콘택트렌즈 사용자의 10%~20%가 인터넷 구매 가능성을 고려하거나 조사했습니다.

소매 기회 외에도 e-헬스 플랫폼은 환자가 원격으로 안과 전문의와 상담할 수 있는 텔레헬스 서비스를 제공합니다. 일상적인 안과 검사, 후속 조치 및 더 심각한 질환에 대한 분류를 위한 가상 상담은 특히 노인이나 이동에 어려움이 있는 개인의 치료 접근성을 크게 개선할 수 있습니다. 이러한 플랫폼은 환자 참여와 안구 건강 권장 사항 준수를 강화하고 안과 의사가 지리적 경계의 제약 없이 더 광범위한 환자 기반에 도달할 수 있도록 합니다. 또한 안구 건강을 모니터링하거나 만성 질환을 관리하기 위한 모바일 앱과 같은 디지털 건강 도구를 통합하면 원활한 환자 경험을 만들고 사전 예방적 안구 관리를 촉진하여 안과 시장의 성장을 더욱 촉진할 수 있습니다.

제약/도전

- 안과 수술과 관련된 부작용 및 합병증

안과 치료의 상당한 발전에도 불구하고, 특정 안과 시술, 특히 수술적 개입은 감염, 흉터 또는 시력 장애와 같은 부작용 및 합병증의 위험을 안고 있습니다. 이러한 잠재적 위험은 환자가 특정 치료, 특히 침습적 시술을 포함하는 치료를 받는 것을 막을 수 있습니다. 시력 감소 또는 회복 기간 연장과 같은 부작용에 대한 두려움은 치료를 찾는 데 주저하게 만들어 특정 치료법의 전반적인 채택을 제한할 수 있습니다. 또한 수술로 인한 합병증은 추가 치료를 필요로 할 수 있으며, 이는 의료비를 더욱 증가시키고 진보된 치료에 대한 환자의 신뢰에 영향을 미칩니다. 부정적인 부작용의 가능성으로 인해 치료를 받는 것을 꺼리는 것은 새로운 기술과 치료법의 채택을 늦추어 안과 시장의 전반적인 성장을 제한합니다.

예를 들어,

- 2024년 10월, 하버드 헬스에서 발표한 기사에 따르면, 현대의 안과 수술은 백내장이나 녹내장과 같은 질환을 치료하는 데 효과적이지만, 타는 듯한 느낌, 자갈 같은 느낌, 가려운 느낌이 특징인 건조증과 같은 합병증을 유발하는 경우가 많습니다. 이러한 부작용은 환자에게 불편하고 낙담하게 만들 수 있으며, 일부는 안과 수술을 주저하거나 피하게 됩니다. 결과적으로 치료로 인한 합병증은 안과 시장 성장을 저해하는 요인으로 작용합니다.

- 2021년 7월 Medical News Today에 게재된 기사에 따르면, 레이저 눈 수술을 받은 사람의 최대 95%가 건조한 눈을 경험할 수 있고, 20%는 눈부심이나 후광과 같은 시각 장애를 보고했습니다. 또한 50명 중 1명은 시야가 흐릿하거나 "사하라의 모래" 증후군을 겪을 수 있습니다. 이러한 부작용은 환자가 수술을 선택하지 못하게 하고, 레이저 시술을 채택하는 것을 제한하며, 안과 시장 성장을 저해하는 요인으로 작용할 수 있습니다.

안과학의 발전에도 불구하고 일부 수술적 치료는 감염, 흉터 또는 시력 장애와 같은 위험을 안고 있습니다. 이러한 합병증은 환자가 특정 치료법, 특히 침습적 시술을 선택하지 못하게 만들 수 있습니다. 부작용과 추가 치료 비용에 대한 두려움은 환자가 치료를 받으려는 의지를 방해하여 새로운 치료법의 채택을 늦출 수 있습니다. 이러한 주저함은 북미 안과학 시장의 성장을 제한합니다.

- 농촌 지역에서 전문 안과 진료에 대한 접근성 제한

의료 인프라의 발전에도 불구하고, 농촌과 외딴 지역에서는 전문 안과 치료에 대한 접근성이 여전히 제한되어 있어 이 지역에서 안과 시장의 성장 잠재력이 크게 저해되고 있습니다. 많은 농촌 인구는 여전히 훈련된 안과 전문가 부족, 부적절한 시설, 고급 진단 및 치료 기술에 대한 접근성 제한과 같은 어려움에 직면해 있습니다. 그 결과, 이 지역의 개인은 종종 눈 질환에 대한 적시 진단 및 치료를 받는 데 어려움을 겪어 예방 가능한 실명과 시력 장애의 발생률이 높아집니다. 전문 치료의 가용성이 제한되어 고급 안과 치료 서비스 및 제품의 채택이 감소하여 시장 확장이 제한됩니다. 이러한 접근성 장벽은 북미 안과 시장의 전반적인 성장에 대한 주요 제약으로 계속 작용하고 있습니다.

예를 들어,

- NCBI가 발표한 기사에 따르면 2023년 2월 현재 인도의 대규모 농촌 인구는 충족되지 않은 상당한 안과 치료 요구에 직면해 있으며, 대부분의 시설과 전문가는 도시 및 준도시 지역에 집중되어 있습니다. 농촌과 도시 지역 간의 안과 치료 접근성의 격차는 여전히 문제로 남아 있으며, 치료 가용성을 제한합니다. 이러한 불평등한 의료 자원 분배는 농촌 지역에서 필수 서비스에 대한 광범위한 접근을 방해하여 북미 안과 시장의 성장을 제한합니다.

- Research Gate에서 발행한 기사에 따르면 2024년 3월, 원격 지역의 연결성과 숙련된 직원 부족으로 인해 성공적인 안과 캠프가 있더라도 지속적인 안과 진료를 받을 수 없습니다. 이 지역의 환자들은 적절한 인프라가 부족하여 후속 치료나 고급 치료를 받는 데 어려움을 겪습니다. 이러한 의료 서비스 제공의 격차는 안과 진료 프로그램의 도달 범위와 효과를 제한하여 북미 안과 시장 성장에 제약으로 작용합니다.

의료가 개선되었음에도 불구하고 농촌 지역에서는 전문 안과 진료에 대한 접근성이 여전히 제한적입니다. 안과 진료 전문가, 첨단 기술 및 시설의 부족으로 인해 시기적절한 치료와 진단이 불가능하여 피할 수 있는 실명의 비율이 높아집니다. 이러한 제한된 접근성은 이러한 지역에서 첨단 치료 및 서비스 채택을 제한하여 북미 안과 시장의 성장을 방해합니다.

북미 안과 시장 범위

시장은 제품, 질병, 포괄적인 눈 검사, 최종 사용자 및 유통 채널을 기준으로 세분화됩니다. 이러한 세그먼트 간의 성장은 산업의 빈약한 성장 세그먼트를 분석하고 사용자에게 귀중한 시장 개요와 시장 통찰력을 제공하여 핵심 시장 응용 프로그램을 식별하기 위한 전략적 결정을 내리는 데 도움이 됩니다.

제품별

- 장치

- 수술 장치

- 백내장 수술 장비

- 안과용 점탄성 장치

- 백내장 수술 장치

- 백내장 수술 레이저

- IOL 주입기

- 유리체망막 수술 기구

- 유리체절제술 기계

- 유리체망막팩

- 광응고 레이저

- 유리체 절제술 프로브

- 조명 장치

- 굴절 수술 장치

- 펨토초 레이저

- 엑시머 레이저

- 기타 굴절 수술 레이저

- 녹내장 수술 장비

- 녹내장 배액 장치

- 미세침습성 녹내장 수술 장비

- 녹내장 레이저 시스템

- 진단 장치

- 광 간섭 단층촬영(OCT) 스캐너

- 자동굴절계 및 각막계

- 안압계

- 포롭터

- 망막경

- 검안경

- 슬릿램프

- 경계선/시야 분석기

- 각막 지형 시스템

- 안저 카메라

- 안과 초음파 영상 시스템

- A- 스캔 이미징 시스템

- B-스캔 이미징 시스템

- 파키미터

- 초음파 생체현미경

- 렌즈미터

- 파면수차계

- 광학 생체측정 시스템

- 거울현미경

- 차트 프로젝터

- 안과 수술 액세서리

- 수술 도구 및 키트

- 안과용 집게

- 안과용 주걱

- 안과용 팁과 핸들

- 안과용 캐뉼라

- 안과 가위

- 기타 수술용 액세서리

- 안과 현미경

- 수술 장치

- 약물, 부산물

- 항VEGF 약물

- 라니비주맙

- 베바시주맙

- 망막질환 약물

- 항녹내장제

- 프로스타글란딘 유사체

- 라타노프로스트

- 비마토프로스트

- 트라보프로스트

- 타플루프로스트

- 라타노프로스틴

- 베타 아드레날린 길항제

- 티몰랄 말레에이트

- 베탁솔롤

- 알파 아드레날린 작용제

- 에피네프린

- 데피베프린

- 미오틱스

- 필로카르핀

- 에세린

- 프로스타글란딘 유사체

- 건조증약

- 항염제 약물

- 스테로이드 항염제

- 비스테로이드성 항염제

- 알레르기성 결막염 약물

- 기타

- 항VEGF 약물

- 약물, 약물 유형별

- 브랜드화

- 일반적인

- 약물, 처방 모드별

- 처방

- 카운터 너머

- 약물, 투여 경로별

- 뉴스 영화

- 눈약

- 눈 솔루션

- 크림 & 연고

- 젤라틴

- 기타

- 지역 안구

- 유리체내

- 결막하

- 후구부

- 내측

- 주사제

- 근육내 주사

- 정맥

- 기타

- 경구

- 태블릿

- 캡슐

- 기타

- 기타

- 뉴스 영화

- 기타

- 시력 관리 제품

- 안경

- 콘택트 렌즈

- 소프트 콘택트 렌즈

- 하이브리드 콘택트 렌즈

- 강성 가스 투과 렌즈

- 기타

- 시력 관리 제품

질병별로

- 백내장

- 굴절 장애

- 녹내장

- 연령 관련 황반변성

- 염증성 질환

- 기타

종합 안구 검사로

- 굴절

- 자동 굴절계

- 시험용 렌즈 세트

- 척수마비 약물

- 시험 프레임

- 자체 조명/거울 레티노스코프

- 잭슨 크로스 실린더

- 시력 검사

- 스넬렌 차트

- 근거리 시력 차트

- 안구 내압

- 토노미터(골드만, 토노펜, 퍼킨스, 시오츠)

- 기타

- 전방 부분 및 동공 검사

- 슬릿램프 생체현미경

- 토치 라이트

- 시야 테스트

- 중앙 30-2 풀 임계값 험프리 시각 필드 분석기

- Frequency Doubling Perimeter

- Goldmann Kinetic Perimeter

- Color Vision Test

- Others

By End User

- Clinics

- Hospitals

- Home Healthcare

- Others

By Distribution Channel

- Retail sales

- Retail Shops

- Hospital Pharmacy

- Online Pharmacy

- Direct Tender

- Others

North America Ophthalmology Market Regional Analysis

The market is segmented on the basis of products, diseases, comprehensive eye examination, end user, and distribution channel.

The countries covered in this market are U.S, Canada, and Mexico.

U.S. is expected to dominate the market due to advanced healthcare infrastructure, high healthcare spending, and a large aging population with a growing prevalence of eye diseases. Additionally, significant investments in research, development, and the adoption of cutting-edge technologies drive market leadership in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

North America Ophthalmology Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

North America Ophthalmology Market Leaders Operating in the Market Are:

- Alcon (Switzerland)

- Bausch + Lomb (Canada)

- Carl Zeiss Meditec( Germany)

- Hoya Corporation (Japan)

- Johnson & Johnson Services, Inc. (U.S.)

- Essilor International (France)

- Topcon Corporation(Japan)

- Glaukos Corporation (U.S.)

- Haag-Streit Group (Switzerland)

- Nidek Co., Ltd (U.S.)

- Staar Surgical (California)

- Ziemer Ophthalmic Systems Ag (Switzerland)

- Cooper Companies (U.S.)

- Lumenis Be Ltd. (Israel)

- Reichert Inc. (New York)

- Bayer Ag (Germany)

- Novartis Ag (Switzerland)

- Abbvie Inc. (U.S.)

- F. Hoffmann-La Roche Ltd.(Switzerland)

- Dompé (Italy)

- Santen Pharmaceutical Co.(Japan), Ltd

Latest Developments in North America Ophthalmology Market

- In October 2024, At the AAO 2024 meeting, Alcon showcased its innovations, including the Voyager DSLT for glaucoma treatment, UNIFEYE and UNIPEXY handheld gas delivery systems, and pivotal data for AR-15512, a dry eye treatment. These advancements aimed to improve outcomes and surgical efficiency

- In September 2024, EssilorLuxottica and Meta have extended their partnership, entering a long-term agreement to develop multi-generational smart eyewear products. Building on the success of Ray-Ban Meta glasses, the companies aim to shape the future of wearable technology together

- In OCTOBER 2024, Bausch + Lomb presented new scientific data and educational events at the 2024 AAO meeting in Chicago. Highlights included studies on the enVista Envy IOL, TENEO Excimer Laser, VYZULTA, and presentations on Blink Nutritears, MIEBO, and Xiidra

- In April 2024, AbbVie has completed its acquisition of Cerevel Therapeutics, enhancing its neuroscience portfolio. The acquisition includes Cerevel’s promising clinical-stage assets like Emraclidine for schizophrenia and Tavapadon for Parkinson's disease, strengthening AbbVie’s position in neurology and psychiatry

- In September, 2023, Novartis completed the divestment of its 'front of eye' ophthalmology assets to Bausch + Lomb for up to USD 2.5 billion, including USD 1.75 billion in upfront cash and potential milestone payments. The deal included Xiidra, SAF312, AcuStream, and OJL332. Novartis advanced its strategy to focus on prioritized therapeutic areas for future growth

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA OPHTHALMOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 NORTH AMERICA OPHTHALMOLOGY MARKET : REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING PREVALENCE OF EYE DISEASES

6.1.2 FOCUS ON PREVENTATIVE EYE CARE

6.1.3 GOVERNMENT EYECARE INITIATIVES

6.1.4 INNOVATIONS IN OPHTHALMIC SURGICAL TECHNIQUES

6.2 RESTRAINTS

6.2.1 SIDE EFFECTS AND COMPLICATIONS RELATED TO EYE SURGERIES

6.2.2 LIMITED ACCESS TO SPECIALIZED OPHTHALMIC CARE IN RURAL AREAS

6.3 OPPORTUNITIES

6.3.1 RISE IN THE AGING POPULATION

6.3.2 RISE IN ONLINE RETAIL AND E-HEALTH PLATFORMS

6.3.3 ENHANCED PATIENT EDUCATION

6.4 CHALLENGES

6.4.1 RISING COSTS OF OPHTHALMIC TREATMENTS

6.4.2 SHORTAGE OF EYE CARE PROFESSIONALS

7 NORTH AMERICA OPHTHALMOLOGY MARKETNORTH AMERICA OPHTHALMOLOGY MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 DEVICE

7.2.1 SURGICAL DEVICE

7.2.1.1 CATARACT SURGICAL DEVICES

7.2.1.2 OPHTHALMIC VISCOELASTIC DEVICES

7.2.1.2.1 PHACOEMULSIFICATION DEVICES

7.2.1.2.2 CATARACT SURGICAL LASERS

7.2.1.2.3 IOL INJECTORS

7.2.1.3 VITREORETINAL SURGICAL DEVICES

7.2.1.3.1 VITREORETINAL PACKS

7.2.1.3.2 VITRECTOMY MACHINES

7.2.1.3.3 VITRECTOMY PROBES

7.2.1.3.4 PHOTOCOAGULATION LASERS

7.2.1.3.5 ILLUMINATION DEVICES

7.2.1.4 REFRACTIVE SURGICAL DEVICES

7.2.1.4.1 FEMTOSECOND LASERS

7.2.1.4.2 EXCIMER LASERS

7.2.1.4.3 OTHER REFRACTIVE SURGICAL LASERS

7.2.1.5 GLAUCOMA SURGICAL DEVICES

7.2.1.5.1 GLAUCOMA DRAINAGE DEVICES

7.2.1.5.2 GLAUCOMA LASER SYSTEMS

7.2.1.5.3 MICRO INVASIVE GLAUCOMA SURGERY DEVICES

7.2.2 DIAGNOSTIC DEVICE

7.2.2.1 OPTICAL COHERENCE TOMOGRAPHY (OCT) SCANNERS

7.2.2.2 AUTOREFRACTORS & KERATOMETERS

7.2.2.3 TONOMETERS

7.2.2.4 PHOROPTERS

7.2.2.5 RETINOSCOPES

7.2.2.6 OPHTHALMOSCOPES

7.2.2.7 SLIT LAMPS

7.2.2.8 PERIMETERS/VISUAL FIELD ANALYZERS

7.2.2.9 CORNEAL TOPOGRAPHY SYSTEMS

7.2.2.10 FUNDUS CAMERAS

7.2.2.11 OPHTHALMIC ULTRASOUND IMAGING SYSTEMS

7.2.2.11.1 A- SCAN IMAGING SYSTEM

7.2.2.11.2 B-SCAN IMAGING SYSTEM

7.2.2.11.3 PACHYMETERS

7.2.2.11.4 ULTRASOUND BIOMICROSCOPES

7.2.2.12 LENSMETERS

7.2.2.13 WAVEFRONT ABERROMETERS

7.2.2.14 OPTICAL BIOMETRY SYSTEMS

7.2.2.15 SPECULAR MICROSCOPES

7.2.2.16 CHART PROJECTORS

7.2.3 OPHTHALMIC SURGICAL ACCESSORIES

7.2.3.1 SURGICAL INSTRUMENTS & KITS

7.2.3.2 OPHTHALMIC FORCEPS

7.2.3.3 OPHTHALMIC SPATULA

7.2.3.4 OPHTHALMIC TIPS AND HANDLES

7.2.3.5 OPHTHALMIC CANNULAS

7.2.3.6 OPHTHALMIC SCISSORS

7.2.3.7 OTHERS SURGICAL ACCESSORIES

7.2.4 OPHTHALMIC MICROSCOPES

7.3 DRUGS

7.3.1 ANTI-VEGF DRUGS

7.3.1.1 RANIBIZUMAB

7.3.1.2 BEVACIZUMAB

7.3.2 ANTI-GLAUCOMA DRUGS

7.3.2.1 PROSTAGLANDIN ANALOGS

7.3.2.1.1 LATANOPROST

7.3.2.1.2 BIMATOPROST

7.3.2.1.3 TRAVOPROST

7.3.2.1.4 TAFLUPROST

7.3.2.1.5 LATANOPROSTENE

7.3.2.2 BETA ADRENERGIC ANTAGONISTS

7.3.2.2.1 TIMOLAL MALEATE

7.3.2.2.2 BETAXOLOL

7.3.2.3 ALPHA ADRENERGIC AGONISTS

7.3.2.3.1 EPINEPHRINE

7.3.2.3.2 DEPIVEPRINE

7.3.2.4 MIOTICS

7.3.2.4.1 PILOCARPINE

7.3.2.4.2 ESERINE

7.3.3 ANTI-INFLAMMATION DRUGS

7.3.3.1 STEROIDAL ANTI-INFLAMMATORY DRUGS

7.3.3.2 NON-STEROIDAL ANTI-INFLAMMATORY DRUGS

7.3.4 RETINAL DISORDER DRUGS

7.3.5 DRY EYE DRUGS

7.3.6 ALLERGIC CONJUCTIVITIS DRUGS

7.3.7 OTHERS

7.3.7.1 BRANDED

7.3.7.2 GENERIC

7.3.7.3 PRESCRIPTION

7.3.7.4 OVER THE COUNTER

7.3.7.5 TOPICAL

7.3.7.6 LOCAL OCULAR

7.3.7.7 INJECTABLES

7.3.7.8 ORAL

7.3.7.9 OTHERS

7.3.7.10 EYE DROPS

7.3.7.11 EYE SOLUTION

7.3.7.12 CREAM & OINTMENTS

7.3.7.13 GEL

7.3.7.14 OTHERS

7.3.7.15 INTRAVITREAL

7.3.7.16 SUBCONJUNCTIVAL

7.3.7.17 RETROBULBAR

7.3.7.18 INTRACAMERAL

7.3.7.19 INTRAMUSCULAR

7.3.7.20 INTRAVENOUS

7.3.7.21 OTHERS

7.3.7.22 TABLET

7.3.7.23 CAPSULES

7.3.7.24 OTHERS

7.4 OTHERS

7.4.1 VISION CARE PRODUCTS

7.4.1.1 SPECTACLES

7.4.1.2 CONTACT LENSES

7.4.1.2.1 SOFT CONTACT LENSES

7.4.1.2.2 HYBRID CONTACT LENSES

7.4.1.2.3 RIGID GAS PERMEABLE LENSES

7.4.2 OTHERS

8 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISEASES

8.1 OVERVIEW

8.2 CATARACT

8.3 REFRACTIVE DISORDERS

8.4 GLAUCOMA

8.5 AGE-RELATED MACULAR DEGENERATION

8.6 INFLAMMATORY DISEASES

8.7 OTHERS

9 NORTH AMERICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION

9.1 OVERVIEW

9.2 REFRACTION

9.2.1 AUTOMATED REFRACTOMETERS

9.2.2 SET OF TRIAL LENSES

9.2.3 CYCLOPLEGIC DRUGS

9.2.4 TRIAL FRAME

9.2.5 SELF-ILLUMINATED/ MIRROR RETINOSCOPE

9.2.6 JACKSON CROSS CYLINDER

9.3 VISUAL ACUITY TEST

9.3.1 SNELLEN'S CHART

9.3.2 NEAR VISION CHARTS

9.4 INTRAOCULAR PRESSURE

9.4.1 TONOMETERS (GOLDMANN, TONO-PEN, PERKINS, SHIOTZ)

9.4.2 OTHERS

9.5 ANTERIOR SEGMENT AND PUPILLARY EXAMINATION

9.5.1 SLIT LAMP BIOMICROSCOPE

9.5.2 TORCH LIGHT

9.6 VISUAL FIELDS TEST

9.6.1 CENTRAL 30-2 FULL THRESHOLD HUMPHREY VISUAL FIELD ANALYZER

9.6.2 FREQUENCY DOUBLING PERIMETER

9.6.3 GOLDMANN KINETIC PERIMETER

9.7 COLOR VISION TEST

9.8 OTHERS

10 NORTH AMERICA OPHTHALMOLOGY MARKET, BY END USER

10.1 OVERVIEW

10.2 CLINICS

10.3 HOSPITALS

10.4 HOME HEALTHCARE

10.5 OTHERS

11 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 RETAIL SALES

11.2.1 RETAIL SHOPS

11.2.2 HOSPITAL PHARMACY

11.2.3 ONLINE PHARMACY

11.3 DIRECT TENDER

11.4 OTHERS

12 NORTH AMERICA OPHTHALMOLOGY MARKET BY GEOGRAPHY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA OPHTHALMOLOGY MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 ALCON

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 JOHNSON & JOHNSON SERVICES, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 ESSILOR LUXOTTICA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 NOVARTIS AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 BAUSCH + LOMB

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 REVENUE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENT

15.6 ABBVIE INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BAYER AG

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENT

15.8 CARL ZEISS MEDITEC AG

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 COOPER COMPANIES

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.1 DOMPÉ

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 F. HOFFMANN-LA ROCHE LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 GLAUKOS CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 HAAG-STREIT

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 HOYA CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 LUMENIS BE LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 NIDEK CO.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 REICHERT, INC

15.17.1 COMPANY SNAPSHOT

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENT

15.18 SANTEN PHARMACEUTICAL CO.

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENT

15.19 STAAR SURGICAL

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TOPCON CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 ZIEMER OPHTHALMIC SYSTEMS AG

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 NORTH AMERICA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 2 NORTH AMERICA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 3 NORTH AMERICA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 4 NORTH AMERICA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 5 NORTH AMERICA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 6 NORTH AMERICA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 7 NORTH AMERICA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 8 NORTH AMERICA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 9 NORTH AMERICA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 10 NORTH AMERICA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 11 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 12 NORTH AMERICA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 13 NORTH AMERICA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 14 NORTH AMERICA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 15 NORTH AMERICA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 16 NORTH AMERICA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 17 NORTH AMERICA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 18 NORTH AMERICA ANTI INFLAMMATION DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2021-2032 (USD MILLION)

TABLE 19 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 20 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 21 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 22 NORTH AMERICA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 23 NORTH AMERICA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 24 NORTH AMERICA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 25 NORTH AMERICA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 26 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 27 NORTH AMERICA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 28 NORTH AMERICA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 29 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 30 NORTH AMERICA CATARACT IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 31 NORTH AMERICA REFRACTIVE DISORDERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 32 NORTH AMERICA GLAUCOMA IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 33 NORTH AMERICA AGE-RELATED MACULAR DEGENERATION IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 34 NORTH AMERICA INFLAMMATORY DISEASES IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 36 NORTH AMERICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 37 NORTH AMERICA REFRACTION IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 38 NORTH AMERICA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 39 NORTH AMERICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 40 NORTH AMERICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 41 NORTH AMERICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 42 NORTH AMERICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 43 NORTH AMERICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 44 NORTH AMERICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 45 NORTH AMERICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 46 NORTH AMERICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 47 NORTH AMERICA COLOR VISION TEST IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 48 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 49 NORTH AMERICA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 50 NORTH AMERICA CLINICS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 51 NORTH AMERICA HOSPITALS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 52 NORTH AMERICA HOME HEALTHCARE IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 53 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 54 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 55 NORTH AMERICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 56 NORTH AMERICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 57 NORTH AMERICA DIRECT TENDER IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 58 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY REGION, 2018-2032 (USD MILLION)

TABLE 59 NORTH AMERICA OPHTHALMOLOGY MARKET, BY COUNTRY, 2018-2032 (USD MILLION)

TABLE 60 NORTH AMERICA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 61 NORTH AMERICA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 62 NORTH AMERICA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 63 NORTH AMERICA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 64 NORTH AMERICA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 65 NORTH AMERICA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 66 NORTH AMERICA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 67 NORTH AMERICA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 68 NORTH AMERICA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 69 NORTH AMERICA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 70 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 71 NORTH AMERICA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 72 NORTH AMERICA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 73 NORTH AMERICA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 74 NORTH AMERICA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 75 NORTH AMERICA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 76 NORTH AMERICA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 77 NORTH AMERICA ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 78 NORTH AMERICA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 79 NORTH AMERICA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 80 NORTH AMERICA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 81 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 82 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 83 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 84 NORTH AMERICA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 85 NORTH AMERICA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 86 NORTH AMERICA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 87 NORTH AMERICA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 88 NORTH AMERICA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 89 NORTH AMERICA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 90 NORTH AMERICA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 91 NORTH AMERICA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 92 NORTH AMERICA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 93 NORTH AMERICA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 94 NORTH AMERICA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 95 NORTH AMERICA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 96 NORTH AMERICA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 97 NORTH AMERICA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 98 U.S. OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 99 U.S. DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 100 U.S. SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 101 U.S. OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 102 U.S. VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 103 U.S. REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 104 U.S. GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 105 U.S. DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 106 U.S. OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 107 U.S. OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 108 U.S. DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 109 U.S. ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 110 U.S. ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 111 U.S. PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 112 U.S. BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 113 U.S. ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 114 U.S. MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 115 U.S. ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 116 U.S. OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 117 U.S. VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 118 U.S. CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 119 U.S. OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 120 U.S. DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 121 U.S. DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 122 U.S. DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 123 U.S. TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 124 U.S. LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 125 U.S. INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 126 U.S. ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 127 U.S. OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 128 U.S. REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 129 U.S. VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 130 U.S. INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 131 U.S. ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 132 U.S. VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 133 U.S. OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 134 U.S. OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 135 U.S. RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 136 CANADA OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 137 CANADA DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 138 CANADA SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 139 CANADA OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 140 CANADA VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 141 CANADA REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 142 CANADA GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 143 CANADA DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 144 CANADA OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 145 CANADA OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 146 CANADA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 147 CANADA ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 148 CANADA ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 149 CANADA PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 150 CANADA BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 151 CANADA ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 152 CANADA MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 153 CANADA ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 154 CANADA OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 155 CANADA VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 156 CANADA CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 157 CANADA OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 158 CANADA DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 159 CANADA DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 160 CANADA DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 161 CANADA TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 162 CANADA LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 163 CANADA INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 164 CANADA ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 165 CANADA OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 166 CANADA REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 167 CANADA VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 168 CANADA INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 169 CANADA ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 170 CANADA VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 171 CANADA OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 172 CANADA OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 173 CANADA RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 174 MEXICO OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 175 MEXICO DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 176 MEXICO SURGICAL DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

TABLE 177 MEXICO OPHTHALMIC VISCOELASTIC DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 178 MEXICO VITREORETINAL SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 179 MEXICO REFRACTIVE SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 180 MEXICO GLAUCOMA SURGICAL DEVICES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 181 MEXICO DIAGNOSTIC DEVICE IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 182 MEXICO OPHTHALMIC ULTRASOUND IMAGING SYSTEMS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 183 MEXICO OPHTHALMIC SURGICAL ACCESSORIES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 184 MEXICO DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 185 MEXICO ANTI-VEGF DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 186 MEXICO ANTI-GLAUCOMA DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 187 MEXICO PROSTAGLANDIN ANALOGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 188 MEXICO BETA ADRENERGIC ANTAGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 189 MEXICO ALPHA ADRENERGIC AGONISTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 190 MEXICO MIOTICS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 191 MEXICO ANTI-INFLAMMATORY DRUGS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 192 MEXICO OTHERS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 193 MEXICO VISION CARE PRODUCTS IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 194 MEXICO CONTACT LENSES IN OPHTHALMOLOGY MARKET, BY PRODUCTS, 2018-2032 (USD MILLION)

TABLE 195 MEXICO OPHTHALMOLOGY MARKET, BY DISEASES, 2018-2032 (USD MILLION)

TABLE 196 MEXICO DRUGS IN OPHTHALMOLOGY MARKET, BY DRUG TYPE, 2018-2032 (USD MILLION)

TABLE 197 MEXICO DRUGS IN OPHTHALMOLOGY MARKET, BY PRESCRIPTION MODE, 2018-2032 (USD MILLION)

TABLE 198 MEXICO DRUGS IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 199 MEXICO TOPICAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 200 MEXICO LOCAL OCULAR IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 201 MEXICO INJECTABLES IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 202 MEXICO ORAL IN OPHTHALMOLOGY MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD MILLION)

TABLE 203 MEXICO OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 204 MEXICO REFRACTION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 205 MEXICO VISUAL ACUITY TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 206 MEXICO INTRAOCULAR PRESSURE IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 207 MEXICO ANTERIOR SEGMENT AND PUPILLARY EXAMINATION IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 208 MEXICO VISUAL FIELDS TEST IN OPHTHALMOLOGY MARKET, BY COMPREHENSIVE EYE EXAMINATION, 2018-2032 (USD MILLION)

TABLE 209 MEXICO OPHTHALMOLOGY MARKET, BY END USER, 2018-2032 (USD MILLION)

TABLE 210 MEXICO OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

TABLE 211 MEXICO RETAIL SALES IN OPHTHALMOLOGY MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

그림 목록

FIGURE 1 NORTH AMERICA OPHTHALMOLOGY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA OPHTHALMOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA OPHTHALMOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA OPHTHALMOLOGY MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA OPHTHALMOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA OPHTHALMOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA OPHTHALMOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA OPHTHALMOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA OPHTHALMOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA OPHTHALMOLOGY MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE NORTH AMERICA OPHTHALMOLOGY MARKET, BY PRODUCTS

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 RISING INCIDENCE OF EYE DISORDERS IS DRIVING THE GROWTH OF THE NORTH AMERICA OPHTHALMOLOGY MARKET FROM 2025 TO 2032

FIGURE 15 THE PRODUCTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA OPHTHALMOLOGY MARKET IN 2025 AND 2032

FIGURE 16 DROC ANALYSIS

FIGURE 17 NORTH AMERICA OPHTHALMOLOGY MARKET: BY PRODUCTS, 2024

FIGURE 18 NORTH AMERICA OPHTHALMOLOGY MARKET: BY PRODUCTS, 2025-2032 (USD MILLION)

FIGURE 19 NORTH AMERICA OPHTHALMOLOGY MARKET: BY PRODUCTS, CAGR (2025-2032)

FIGURE 20 NORTH AMERICA OPHTHALMOLOGY MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 21 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISEASES, 2024

FIGURE 22 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISEASES, 2025-2032 (USD MILLION)

FIGURE 23 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISEASES, CAGR (2025-2032)

FIGURE 24 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISEASES, LIFELINE CURVE

FIGURE 25 NORTH AMERICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, 2024

FIGURE 26 NORTH AMERICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, 2025-2032 (USD MILLION)

FIGURE 27 NORTH AMERICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, CAGR (2025-2032)

FIGURE 28 NORTH AMERICA OPHTHALMOLOGY MARKET: BY COMPREHENSIVE EYE EXAMINATION, LIFELINE CURVE

FIGURE 29 NORTH AMERICA OPHTHALMOLOGY MARKET: BY END USER, 2024

FIGURE 30 NORTH AMERICA OPHTHALMOLOGY MARKET: BY END USER, 2025-2032 (USD MILLION)

FIGURE 31 NORTH AMERICA OPHTHALMOLOGY MARKET: BY END USER, CAGR (2025-2032)

FIGURE 32 NORTH AMERICA OPHTHALMOLOGY MARKET: BY END USER, LIFELINE CURVE

FIGURE 33 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL ,2024

FIGURE 34 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD MILLION)

FIGURE 35 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 36 NORTH AMERICA OPHTHALMOLOGY MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 NORTH AMERICA OPHTHALMOLOGY MARKET SNAPSHOT

FIGURE 38 NORTH AMERICA OPHTHALMOLOGY MARKET: COMPANY SHARE 2024 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.