North America Swing Door Operators Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

2.41 Billion

USD

3.79 Billion

2025

2033

USD

2.41 Billion

USD

3.79 Billion

2025

2033

| 2026 –2033 | |

| USD 2.41 Billion | |

| USD 3.79 Billion | |

|

|

|

|

North America Swing Door Operators Market Segmentation, By Product (Universal Swing Door Operators and Slim Swing Door Operators), Type (Full Energy Swing Door Operators, Low Energy Swing Door Operators, and Power Assist Swing Door Operators), Application (Commercial, Residential, Institution & Hospitals, and Others) - Industry Trends and Forecast to 2033

What is the North America Swing Door Operators Market Size and Growth Rate?

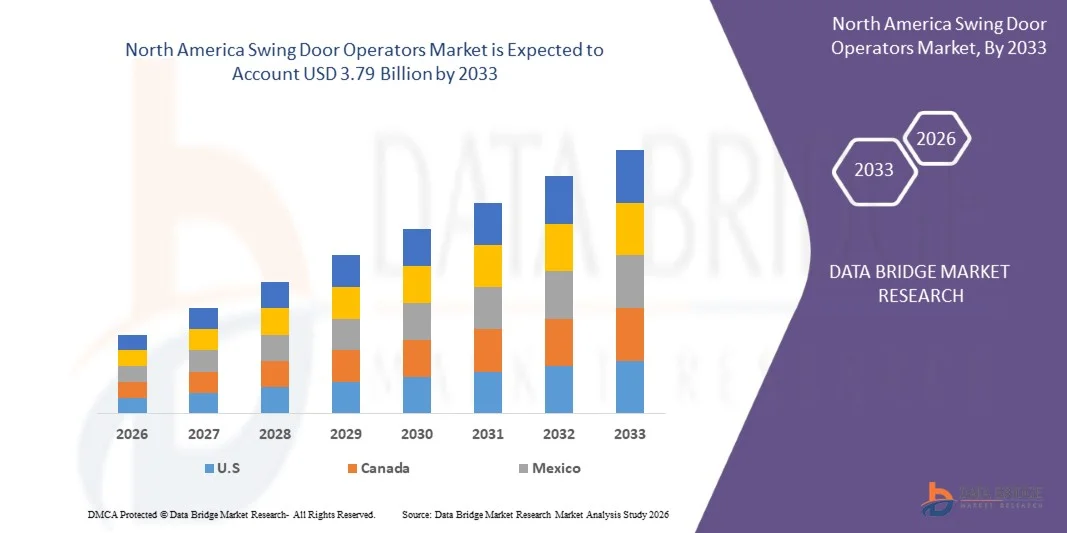

- The North America Swing Door Operators Market size was valued at USD 2.41 billion in 2025 and is expected to reach USD 3.79 billion by 2033, at a CAGR of 5.80% during the forecast period

- Growing adoption of swing door operators in commercial and residential sectors, acts as a driver for North America Swing Door Operators Market. However, the high cost for maintenance and spare parts is restraining the North America Swing Door Operators Market growth

What are the Major Takeaways of North America Swing Door Operators Market?

- Rapid technological advancements in swing door operators acts as an opportunity for the North America Swing Door Operators Market. Furthermore, the regular requirement of uninterrupted electricity supply acts as challenge for the North America Swing Door Operators Market

- U.S. dominated the North America Swing Door Operators Market with an estimated 45.9% revenue share in 2025, driven by strong adoption across commercial buildings, healthcare facilities, airports, retail complexes, and government infrastructure

- Canada is projected to register a fastest CAGR of 9.32% during the forecast period, driven by increasing investments in healthcare infrastructure, commercial buildings, and public facilities

- The Universal Swing Door Operators segment dominated the market in 2025, accounting for an estimated 62.4% market share, driven by their broad compatibility with different door sizes, weights, and configurations

Report Scope and North America Swing Door Operators Market Segmentation

|

Attributes |

North America Swing Door Operators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the North America Swing Door Operators Market?

“Rising Demand for Enhanced Security and Efficient Access Control”

- Increasing concerns over public safety, unauthorized access, and security breaches are significantly influencing the North America Swing Door Operators Market. Swing door operators are gaining traction due to their ability to provide controlled, automated, and secure entry and exit in high-footfall environments. This trend is driving adoption across airports, government buildings, healthcare facilities, and commercial infrastructure, encouraging manufacturers to develop more reliable, durable, and security-oriented operator system

- Growing emphasis on efficient pedestrian flow, hands-free access, and reduced congestion is accelerating demand for swing door operators in transportation hubs and public facilities. Advanced operator technologies, including sensor-based activation, access control integration, and fail-safe mechanisms, enable smooth and non-intrusive movement while maintaining security compliance. This has also led to collaborations between automation providers and building management system vendors to enhance operational efficiency

- Integration of smart technologies, IoT-enabled monitoring, and AI-based predictive maintenance is influencing purchasing decisions, with manufacturers focusing on reliability, safety, and low downtime. These features help differentiate products in a competitive market while ensuring compliance with international building and safety standards. Companies are increasingly highlighting these technological capabilities in marketing strategies to strengthen brand positioning among infrastructure developers and facility manager

- For instance, in 2024, ASSA ABLOY (Sweden) expanded its swing door operator portfolio by introducing smart, sensor-driven, and access-controlled solutions designed for high-security and high-traffic environments. These systems were deployed across airports, hospitals, and government buildings, supporting safer, faster, and more efficient pedestrian access while meeting global regulatory requirement

- While demand for swing door operators continues to rise, sustained market growth depends on continuous R&D, cost-effective manufacturing, and adherence to evolving safety regulations. Manufacturers are also prioritizing modular designs, software upgrades, and energy-efficient solutions to balance performance, affordability, and long-term scalability for broader adoption

What are the Key Drivers of North America Swing Door Operators Market?

- Rising concerns related to security, controlled access, and compliance with building safety norms are major drivers of the North America Swing Door Operators Market. Facilities such as airports, hospitals, government offices, and commercial complexes are increasingly adopting automated door systems to improve safety, accessibility, and operational efficiency. This trend is also stimulating investment in innovation to enhance durability, sensor accuracy, and system responsiveness

- Expanding applications across transportation infrastructure, healthcare facilities, commercial buildings, and public institutions are supporting market growth. Swing door operators improve accessibility for elderly and disabled individuals, reduce manual operation, and ensure smooth pedestrian movement, enabling operators to comply with stringent accessibility and safety standards. Increasing urbanization and infrastructure development globally further reinforce this driver

- Automation and access control solution providers are actively promoting smart, connected, and energy-efficient swing door operators through product launches, strategic partnerships, and compliance certifications. These initiatives align with growing demand for reliable, low-maintenance, and secure entry systems, encouraging collaborations between door automation manufacturers and building technology providers

- For instance, in 2023, Dormakaba (Switzerland) reported increased adoption of its automated swing door operators equipped with sensor-based activation and access control integration across healthcare and transportation facilities. The company emphasized safety, efficiency, and regulatory compliance to strengthen customer trust and drive repeat installation

- Although strong demand drivers support market expansion, wider adoption depends on cost optimization, regulatory approvals, and scalable production capabilities. Continued investment in smart software integration, manufacturing efficiency, and technological innovation will remain critical for addressing global demand and maintaining long-term competitive advantage

Which Factor is Challenging the Growth of the North America Swing Door Operators Market?

- The relatively high initial cost of swing door operators compared to manual door systems remains a key challenge, particularly for small commercial buildings, residential facilities, and budget-constrained institutions. Advanced features such as sensor-based activation, access control integration, safety compliance mechanisms, and smart connectivity increase overall system costs. In addition, varying building codes and accessibility regulations across regions can complicate standardization and slow adoption

- Limited awareness and technical expertise among facility managers and installers also restrains market growth. Improper installation, incorrect configuration, or lack of understanding of safety standards can lead to suboptimal performance and reduced system lifespan. This challenge is more pronounced in emerging markets, where access to trained professionals, certification programs, and after-sales technical support remains limited

- Installation complexity and ongoing maintenance requirements further impact adoption. Swing door operators must comply with strict safety, accessibility, and performance standards, requiring precise calibration, periodic inspections, and software updates. These factors increase long-term operational costs and discourage adoption among users seeking low-maintenance solutions

- For instance, in 2024, several mid-sized commercial buildings and healthcare facilities in Europe reported delayed deployment of automated swing door systems due to high installation costs, lack of trained technicians, and extended approval timelines for regulatory compliance. Budget limitations and maintenance concerns also led some facility operators to postpone automation upgrades

- Addressing these challenges will require cost optimization, simplified system designs, and expanded training initiatives for installers and operators. Greater collaboration between manufacturers, regulatory bodies, and building technology providers can streamline compliance and improve adoption. Developing affordable, modular, and user-friendly swing door operators will be critical for unlocking long-term market growth globally

How is the North America Swing Door Operators Market Segmented?

The market is segmented on the basis of product, type, and application.

• By Product

On the basis of product, the North America Swing Door Operators Market is segmented into Universal Swing Door Operators and Slim Swing Door Operators. The Universal Swing Door Operators segment dominated the market in 2025, accounting for an estimated 62.4% market share, driven by their broad compatibility with different door sizes, weights, and configurations. These operators are widely deployed across commercial buildings, hospitals, airports, and institutional facilities due to their flexibility, durability, and ability to support high-traffic environments. Universal swing door operators are also preferred for retrofit applications, as they can be easily integrated with existing door systems, access control solutions, and safety sensors, enhancing their adoption across developed and emerging markets.

The Slim swing door operators segment is expected to witness the fastest growth from 2026 to 2033, supported by increasing demand for compact, aesthetically appealing, and space-saving automation solutions. Slim operators are gaining traction in modern commercial spaces, premium residential buildings, and healthcare facilities where minimal visual impact and quiet operation are critical. Advancements in compact motor technology and lightweight materials are further accelerating growth of this segment.

• By Type

On the basis of type, the North America Swing Door Operators Market is segmented into Full Energy Swing Door Operators, Low Energy Swing Door Operators, and Power Assist Swing Door Operators. The Low Energy Swing Door Operators segment held the largest market revenue share in 2025, estimated at 48.7%, owing to its widespread adoption in healthcare facilities, educational institutions, and public buildings. Low energy operators comply with accessibility standards such as ADA and EN regulations, offering controlled speed, reduced force, and enhanced user safety. Their suitability for elderly and disabled users, combined with lower installation and operational costs, has reinforced their dominant position.

The Power Assist swing door operators segment is projected to register the fastest growth from 2026 to 2033, driven by rising demand for semi-automated solutions in residential and light commercial applications. Power assist systems provide ease of use with manual control support, making them attractive for retrofit installations and cost-sensitive projects. Growing awareness of accessibility requirements and home automation trends is further supporting segment growth.

• By Application

On the basis of application, the North America Swing Door Operators Market is segmented into Commercial, Residential, Institution & Hospitals, and Others. The Commercial segment dominated the market in 2025, accounting for approximately 45.9% of total revenue, driven by extensive deployment in offices, retail complexes, airports, hotels, and transportation hubs. Commercial facilities prioritize automated swing doors to enhance pedestrian flow, improve accessibility, and comply with safety regulations. High footfall, integration with access control systems, and energy-efficient building initiatives continue to support strong adoption in this segment.

The Institution & Hospitals segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing investments in healthcare infrastructure and rising demand for hygienic, touchless access solutions. Hospitals and institutional buildings rely on swing door operators to improve infection control, patient mobility, and operational efficiency. Regulatory emphasis on accessibility and safety standards is further accelerating adoption across this segment.

Which Region Holds the Largest Share of the North America Swing Door Operators Market?

- U.S. dominated the North America Swing Door Operators Market with an estimated 45.9% revenue share in 2025, driven by strong adoption across commercial buildings, healthcare facilities, airports, retail complexes, and government infrastructure. High emphasis on accessibility compliance, building automation, and pedestrian safety, along with widespread deployment of automated entry solutions in high-footfall environments, continues to support regional growth

- Presence of advanced manufacturing capabilities, strong R&D investments, and early adoption of smart building technologies across the U.S. has accelerated integration of sensor-based, access-controlled, and IoT-enabled swing door operators. Leading manufacturers actively invest in product innovation, energy efficiency, and regulatory compliance to strengthen market penetration

- Growing focus on ADA compliance, contactless access, and operational efficiency, combined with rising investments in transportation hubs, hospitals, and commercial real estate renovation projects, continues to drive swing door operator adoption

Canada North America Swing Door Operators Market Insight

Canada is projected to register a fastest CAGR of 9.32% during the forecast period, driven by increasing investments in healthcare infrastructure, commercial buildings, and public facilities. Supportive accessibility regulations, rising adoption of automated and energy-efficient door systems, and ongoing modernization of airports and healthcare institutions are contributing to sustained market expansion across the country.

Mexico North America Swing Door Operators Market Insight

Mexico is witnessing moderate but consistent growth in the North America Swing Door Operators Market, supported by expanding commercial construction, airport infrastructure development, and industrial facility upgrades. Growing government focus on building safety, accessibility compliance, and automation in logistics, manufacturing, and public facilities is expected to drive long-term market development.

Which are the Top Companies in North America Swing Door Operators Market?

The swing door operators industry is primarily led by well-established companies, including:

- ASSA ABLOY (Sweden)

- KONE Corporation (Finland)

- dormakaba Group (Switzerland)

- GEZE GmbH (Germany)

- FAAC Group (Italy)

- DoorHan Group Of Companies (Russia)

- record (Switzerland)

- PORTALP FRANCE SAS (France)

- TORMAX (Switzerland)

- Security Door Controls (U.S.)

- Skylinkhome (Canada)

- NABCO Entrances Inc. (U.S.)

- Horton Automatics (U.S.)

- Terra Universal, Inc. (U.S.)

- STANLEY Access Technologies LLC (U.S.)

- QUAD SYSTEMS LLC (U.S.)

- Belco Doors (U.S.)

- CFS Canada (Canada)

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.