North America Tax It Software Market

시장 규모 (USD 10억)

연평균 성장률 :

%

USD

7.45 Billion

USD

15.65 Billion

2024

2032

USD

7.45 Billion

USD

15.65 Billion

2024

2032

| 2025 –2032 | |

| USD 7.45 Billion | |

| USD 15.65 Billion | |

|

|

|

North America Tax IT Software Market Segmentation, By Offering (Software and Services), Tax Type (Income Tax, Corporate Tax, and Property Tax), Deployment Mode (Cloud and On-Premises), Organization Size (Small & Medium-Sized Enterprises and Large Enterprises), Revenue Model (One-Time Purchase and Subscription Based), Industry (Banking, Financial Services, And Insurance (BFSI), IT & Telecommunications, Manufacturing, Retail & Consumer Goods, Healthcare, Energy & Utilities, and Media & Entertainment) - Industry Trends and Forecast to 2032

North America Tax IT Software Market Analysis

The North America tax IT software market is growing rapidly, driven by the increasing complexity of North America tax regulations and the need for businesses to ensure compliance across multiple jurisdictions. This market encompasses solutions that automate tax calculations, reporting, and filing processes while integrating with enterprise systems to reduce manual efforts and minimize errors. Advancements in technologies like AI and cloud computing are enhancing software capabilities, offering real-time updates, scalability, and improved accuracy. The market is further bolstered by rising adoption among SMEs and large enterprises seeking operational efficiency.

North America Tax IT Software Market Size

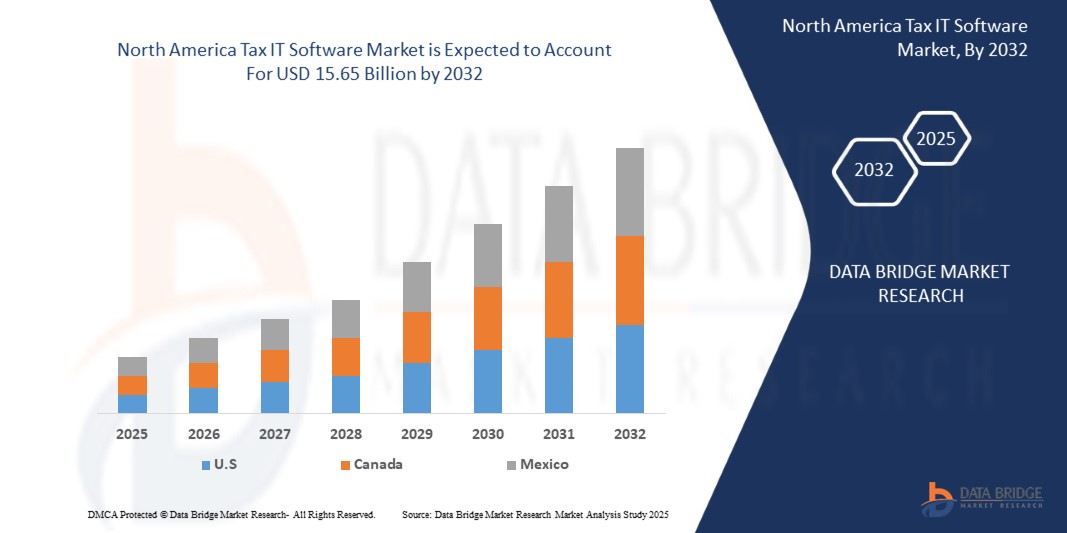

Data Bridge Market Research analyses that the tax the North America tax IT software market is expected to reach USD 15.65 billion by 2032 from USD 7.45 billion in 2024 growing with a CAGR of 9.8% in the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

North America Tax IT Software Market Trends

“Increased Financial Crimes Detection Efforts”

Increased financial crimes detection efforts have intensified scrutiny on anti-money laundering (AML) measures, focusing on enhancing compliance and monitoring systems. Financial institutions are implementing more rigorous procedures to identify suspicious transactions and patterns indicative of money laundering. These measures include strengthening internal controls, improving transaction reporting practices, and enhancing collaboration with regulatory bodies. The push for greater transparency and accountability aims to disrupt financial crime networks and reduce illicit financial flows. By adopting comprehensive AML frameworks, organizations seek to mitigate risks and protect the integrity of the financial system. This proactive approach reflects a broader commitment to combatting financial crime and maintaining regulatory compliance.

Report Scope and North America Tax IT Software Market Segmentation

|

Report Metric |

North America Tax IT Software Market Insights |

|

Segments Covered |

IT & Telecommunications, Manufacturing, Retail & Consumer Goods, Healthcare, Energy & Utilities, and Media & Entertainment |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

Microsoft (U.S.), ADP, Inc. (U.S.), Yayoi Co., Ltd. (Japan), Wolters Kluwer N.V (Netherland), Stripe (U.S.), SAP (U.S.), Thomson Reuters (U.S.), Oracle (U.S.), NTT data (Japan), QUICKBOOKS (INTUIT INC.) (U.S.), SAGE GROUP PLC (U.K.), Vertex (U.S.), TKC Corporation (Japan), SOVOS Compliance, LLC (U.S.), Avalara (U.S.), Money Forward, Inc.(Japan), freee K.K (Japan), TaxDiva (India), Esker (France), PCA Corporation (Japan), and Epicor Software Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

North America Tax IT Software Market Definition

The tax IT software refers to specialized technology solutions designed to automate and streamline tax management processes, including tax calculation, compliance, reporting, and filing. These systems integrate with enterprise platforms to ensure accurate handling of sales tax, use tax, VAT, and other tax types across multiple jurisdictions. By leveraging advanced features such as real-time rate updates, exemption certificate management, and detailed reporting, Tax IT Software reduces manual workloads, minimizes compliance risks, and enhances operational efficiency for businesses navigating complex tax regulations.

North America Tax IT Software Market Dynamics

Drivers

- Increasing Adoption of Tax IT Software among Small and Medium-Sized Businesses

As SMBs face increasing complexities in managing tax compliance, they are turning to automated solutions that simplify processes, reduce errors, and ensure accuracy. The need for these businesses to navigate varying tax regulations, including sales tax, VAT, and other local tax laws, has led to a surge in the use of tax IT software. These solutions streamline tax calculations and also integrate seamlessly with financial systems, offering a more efficient way to manage taxes while staying compliant with ever-evolving regulations.

Moreover, the growing shift toward digitalization and cloud-based solutions is accelerating the adoption of tax IT software in the SMB sector. These businesses are increasingly seeking scalable, cost-effective solutions that allow them to manage tax operations without the need for extensive in-house resources. By automating routine tax tasks such as reporting, filing, and compliance monitoring, SMBs can reduce administrative burdens, save time, and focus on strategic growth initiatives. This trend is expected to continue as tax IT software becomes more accessible, user-friendly, and integrated into broader financial management platforms, making it an essential tool for SMBs worldwide.

For instance,

In November 2024, according to an article published by The Indian Express, a Deloitte India survey shows that 81% of small organizations plan to digitize their tax operations within the next five years, highlighting a shift toward technology-driven tax functions. Despite challenges such as integration issues and a shortage of tax tech professionals, there is a strong push for adopting tax IT solutions supported by government digitalization initiatives. This growing interest among small businesses to modernize their tax processes signals an increasing demand for tax IT software, driving market growth and innovation to meet the specific needs of smaller organizations.

- AI and Machine Learning Integration in Tax and Accounting Software

The integration of AI and machine learning (ML) into tax and accounting software is transforming the tax IT software market by automating complex processes and enhancing decision-making capabilities. AI-powered tools simplify tasks such as data extraction, tax calculation, and compliance monitoring, reducing the reliance on manual intervention. ML algorithms improve the accuracy of tax audits and fraud detection by analyzing large datasets and identifying anomalies in real-time. These advancements help businesses ensure compliance with ever-changing tax regulations while streamlining their operations and saving time.

The adoption of AI and ML in tax software is particularly advantageous for addressing regulatory complexities faced by businesses of all sizes. Small and medium-sized businesses (SMBs) benefit from intelligent features such as predictive analytics and adaptive tax planning, enabling them to make informed decisions and optimize their financial strategies. This shift toward smarter, AI-driven tax solutions is driving the market's growth as companies increasingly prioritize efficiency, accuracy, and scalability in their tax management processes.

For instance,

In May 2024, according to an article published by Arizent, Wolters Kluwer has introduced an AI-powered corporate performance management platform, CCH Tagetik. The platform includes features such as Ask AI, AI Automapping, AI Anomaly Detection, and AI Driver-Based Analysis to improve reporting, data governance, and financial analysis. This marks a significant shift towards AI and machine learning in tax and accounting software, enhancing automation, data integrity, and analytical efficiency, which aligns with the growing demand for AI-driven solutions in the Tax IT Software industry.

Opportunities

- Expansion of Cloud Services for Business

As businesses continue to embrace digital transformation, the demand for scalable, flexible, and cost-effective solutions has driven the growth of cloud-based platforms. Cloud services allow tax professionals and businesses to access advanced tools and software without the need for heavy infrastructure investments. This flexibility enables companies to quickly adapt to changing regulatory requirements, streamline operations, and improve overall efficiency. Furthermore, cloud platforms offer real-time data access, collaboration, and seamless integration with other enterprise systems, making them increasingly attractive to firms seeking to enhance their tax and accounting functions.

The rise of cloud-based tax IT solutions also addresses critical concerns such as data security, compliance, and scalability. Cloud service providers invest heavily in robust security measures, ensuring that sensitive tax data is protected while complying with local and international data privacy regulations. This makes cloud services a viable option for businesses looking to mitigate risks and focus on their core operations. As more businesses transition to the cloud, the Tax IT Software Market is likely to witness increased adoption, with providers continuing to innovate and offer specialized solutions tailored to the evolving needs of the industry.

For instance,

In October 2020, according to an article published by the Economic Times, cloud computing and Everything-as-a-Service (XaaS) are reshaping the tax landscape, introducing complexities for businesses in terms of taxation and compliance with evolving regulations. This shift opens up opportunities for the expansion of cloud services for businesses in the tax IT software market, as companies require advanced tax software solutions to manage the unique challenges of cloud-based services and ensure compliance with North America tax laws.

- Rising Government Initiatives to Promote Digital Compliance Software Adoption Across Businesses

Governments worldwide are increasingly promoting the use of digital compliance software, with policies encouraging businesses to adopt digital tools for tax reporting and compliance. These initiatives often include incentives, subsidies, or mandates for businesses to transition from manual processes to digital platforms. The push for digital transformation is particularly strong in industries with complex regulatory requirements, where businesses must manage taxes across multiple jurisdictions.

This growing governmental support presents a significant opportunity for the tax IT software market, as businesses seek software solutions to comply with new regulations and standards. As governments implement stricter tax compliance and reporting rules, businesses are increasingly adopting digital tools to ensure accurate, timely, and efficient tax processes. This shift toward digital compliance software is expected to drive demand for innovative solutions, benefiting software providers and increasing the overall market potential.

For instance,

According to an article published by PKF Smith Cooper, The UK's Making Tax Digital (MTD) initiative requires businesses, self-employed individuals, and landlords to maintain digital records and use third-party software for tax submissions. MTD for Income Tax Self-Assessments (ITSA) will be phased in by 2026, with income thresholds for compliance. This initiative creates an opportunity for Tax IT Software providers, as businesses will need digital solutions to meet the evolving tax regulations.

Restraints/Challenges

- High Costs and Initial Investment Restrictions for the Use of Advanced Tax and Accounting Software

Although modern tax and accounting software has many advantages, the high costs of obtaining, deploying, and maintaining these systems can be a substantial obstacle, especially for small and medium-sized businesses (SMEs). As organizations seek to streamline their financial operations and remain competitive, the initial investment necessary for such software might dissuade many, particularly when extra customization and integration fees are included.

For SMEs, the large initial expenditure necessary to acquire and deploy complex tax and accounting software is frequently a substantial barrier. These systems, which are built to perform complicated financial activities, are often quite expensive. Furthermore, modification to fit individual company demands, as well as connection with current enterprise resource planning (ERP) or customer relationship management (CRM) systems, might increase expenses. For many smaller organizations, these costs might be prohibitively expensive, restricting their capacity to implement complex solutions and impeding their development potential. This difficulty is especially acute for businesses with limited resources, which may choose less expensive, off-the-shelf solutions over extensive, custom-built systems.

For instance,

In May 2024, according to an article published by Attract Group, ERP software development costs, ranging from USD 25,000 to USD 350,000, play a crucial role in modern business efficiency by streamlining operations. These costs are shaped by factors such as complexity, customization, deployment models, and integration requirements. In contrast, ERP systems provide long-term operational advantages, but their high development and implementation expenses present challenges, particularly for small and medium-sized enterprises (SMEs). The significant initial investments, along with ongoing costs for customization, integration, maintenance, upgrades, and licensing, create financial hurdles. These barriers are a notable restraint for the adoption of advanced tax and accounting software, especially among budget-sensitive businesses.

- Cybersecurity and Data Privacy Concerns Hinder Adoption of Tax and Accounting Software

As firms digitize their financial operations, cybersecurity concerns have become a major impediment to the use of modern tax and accounting software. Businesses face increased risks of data breaches, cyberattacks, and privacy violations as they rely more heavily on digital platforms to manage sensitive financial data. These issues frequently prevent businesses from completely adopting digital financial management systems.

In addition, the rising digitalization of financial data, although providing speed and convenience, raises severe issues about data privacy and security. Businesses must safeguard sensitive financial information, such as tax records, employee payroll data, and other secret information, against potential cyber-attacks. Data breaches and cyberattacks may result in significant financial losses, reputational harm, and legal ramifications for companies that fail to comply with data security requirements. As a result, businesses may be hesitant to use tax and accounting software that does not fulfill high security standards, limiting the widespread adoption of digital financial solutions. Furthermore, the absence of proper security measures, such as encryption and safe authentication procedures, might erode trust in the software.

For instance,

- In March 2024, according to an article published by the Association of International Certified Professional Accountants, the growing challenges faced by CPAs and businesses in protecting client data are exacerbated by increasing cybersecurity threats, regulatory changes, and evolving privacy standards. These concerns, including the complexity of maintaining compliance with global data privacy laws and the risks of cyberattacks, highlight the restraint "Cybersecurity and data privacy concerns hinder adoption of tax and accounting software" in the Tax IT Software Market, as firms hesitate to adopt new technologies due to fears of data breaches, compliance costs, and maintaining trust

North America Tax IT Software Market Scope

The tax IT software market is segmented six notable segments on the basis of offering, tax type, deployment mode, organization size, revenue model, and industry. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- Software

- Services

- Type

- Training and Consulting

- Support

Tax Type

- Income Tax

- Corporate Tax

- Property Tax

- Others

Deployment Mode

- Cloud

- On-Premises

Organization Size

- Large Enterprises

- Small-and Medium-Sized Enterprises

Revenue Model

- Subscription Based

- One-Time Purchase

Industry

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecommunications

- Manufacturing

- Retail and Consumer Goods

- Healthcare

- Media and Entertainment

- Energy and Utilities

- Others

North America Tax IT Software Market Regional Analysis

The tax IT software market is segmented six notable segments on the basis of country, offering, tax type, deployment mode, organization size, revenue model, and industry.

The countries covered in the tax IT software market report as U.S., Canada, and Mexico.

The U.S. leads the Tax IT software market in North America due to its complex tax structures, high adoption of advanced technologies, and increasing demand for automation in tax compliance. The presence of major software providers and robust investment in digital solutions further solidify its dominance. Its fast growth is driven by the surge in cloud-based tax software and evolving regulatory requirements.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America aerospace adhesive - sealants brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

North America Tax It Software Market Share

Tax IT software market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to North America tax IT software market .

North America Tax IT Software Market Leaders Operating in the Market are:

- Microsoft (U.S.)

- ADP, Inc. (U.S.)

- Yayoi Co., Ltd. (Japan)

- Wolters Kluwer N.V (Netherland)

- Stripe (U.S.)

- SAP (U.S.)

- Thomson Reuters (U.S.)

- Oracle (U.S.)

- NTT data (Japan)

- QUICKBOOKS (INTUIT INC.) (U.S.)

- SAGE GROUP PLC (U.K.)

- Vertex (U.S.)

- TKC Corporation (Japan)

- SOVOS Compliance, LLC (U.S.)

- Avalara (U.S.)

- Money Forward, Inc.(Japan)

- freee K.K (Japan)

- TaxDiva (India)

- Esker (France)

- PCA Corporation (Japan)

- Epicor Software Corporation (U.S.)

Latest Developments in North America Tax IT Software Market

- In September 2024, Wolters Kluwer has partnered with OneTeam Services Group to enhance CCH Integrator. The collaboration will expand tax compliance, data management, and collaborative workflows, improving efficiency for tax firms and corporations across multiple tax domains

- In October, ADP has acquired Workforce Software, a leading provider of workforce management solutions for global enterprises. This acquisition expands ADP's offerings, enhancing global workforce management capabilities and driving future innovation to meet evolving business needs

- In June, Stripe appears to be signaling preparations for an IPO, despite non-committal statements from its co-founders. Actions such as publishing financial performance reports and conducting tender offers have fueled speculation. These developments drive Stripe to enhance transparency and financial reporting, bolstering trust in its Tax and Accounting Software solutions and aligning with its mission to help businesses streamline compliance, potentially attracting a broader user base

- In June, Avalara has enhanced its presence in India to support the country’s export ambitions by providing cloud-based tax compliance solutions that simplify cross-border tax processes. This move bolsters Avalara’s position in the tax and accounting software market by expanding its footprint in a rapidly growing region, catering to diverse industries, and demonstrating its proficiency in automating global indirect tax compliance

SKU-

세계 최초의 시장 정보 클라우드 보고서에 온라인으로 접속하세요

- 대화형 데이터 분석 대시보드

- 높은 성장 잠재력 기회를 위한 회사 분석 대시보드

- 사용자 정의 및 질의를 위한 리서치 분석가 액세스

- 대화형 대시보드를 통한 경쟁자 분석

- 최신 뉴스, 업데이트 및 추세 분석

- 포괄적인 경쟁자 추적을 위한 벤치마크 분석의 힘 활용

목차

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TAX IT SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY STANDARDS

4.2 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2.1 INDUSTRY ANALYSIS

4.2.2 FUTURISTIC SCENARIO

4.2.3 COMPETITIVE LANDSCAPE

4.3 PENETRATION AND GROWTH PROSPECT MAPPING

4.4 TECHNOLOGY ANALYSIS

4.5 COMPANY COMPARATIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF TAX IT SOFTWARE AMONG SMALL AND MEDIUM-SIZED BUSINESSES

5.1.2 AI AND MACHINE LEARNING INTEGRATION IN TAX AND ACCOUNTING SOFTWARE

5.1.3 GROWING NEED FOR STREAMLINING ACCOUNTING OPERATIONS TO REDUCE MANUAL ERRORS

5.1.4 RISING DEMAND FOR REAL-TIME FINANCIAL INSIGHTS

5.2 RESTRAINTS

5.2.1 HIGH COSTS AND INITIAL INVESTMENT RESTRICTIONS FOR THE USE OF ADVANCED TAX AND ACCOUNTING SOFTWARE

5.2.2 CYBERSECURITY AND DATA PRIVACY CONCERNS HINDER ADOPTION OF TAX AND ACCOUNTING SOFTWARE

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF CLOUD SERVICES FOR BUSINESS

5.3.2 RISING GOVERNMENT INITIATIVES TO PROMOTE DIGITAL COMPLIANCE SOFTWARE ADOPTION ACROSS BUSINESSES

5.4 CHALLENGES

5.4.1 FREQUENT TAX UPDATES CREATE CHALLENGES FOR SOFTWARE

5.4.2 CHALLENGES IN INTEGRATING LEGACY SYSTEMS FOR BUSINESSES NORTH AMERICA LY

6 NORTH AMERICA TAX IT SOFTWARE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.3 SERVICES

6.3.1 SERVICE, BY TYPE

6.4 TRAINING AND CONSULTING

6.5 SUPPORT

7 NORTH AMERICA TAX IT SOFTWARE MARKET, BY TAX TYPE

7.1 OVERVIEW

7.2 INCOME TAX

7.3 CORPORATE TAX

7.4 PROPERTY TAX

7.5 OTHERS

8 NORTH AMERICA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISES

9 NORTH AMERICA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

10 NORTH AMERICA TAX IT SOFTWARE MARKET, BY REVENUE MODEL

10.1 OVERVIEW

10.2 SUBSCRIPTION-BASED

10.3 ONE-TIME PURCHASE

11 NORTH AMERICA TAX IT SOFTWARE MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

11.3 IT AND TELECOMMUNICATIONS

11.4 MANUFACTURING

11.5 RETAIL AND CONSUMER GOODS

11.6 HEALTHCARE

11.7 MEDIA AND ENTERTAINMENT

11.8 ENERGY AND UTILITIES

11.9 OTHERS

12 NORTH AMERICA TAX IT SOFTWARE MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA TAX IT SOFTWARE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 MICROSOFT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SERVICE PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 ADP,INC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 YAYOI CO., LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 WOLTERS KLUWER N.V.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 STRIPE, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 SERVICE PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AVALARA, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 EPICOR SOFTWARE CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ESKER

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 SOLUTION PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 FREEE KK

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 INTUIT INC

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 MONEY FORWARD, INC

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 NTT DATA GROUP CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 SERVICE PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 ORACLE

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 SERVICE PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 PCA CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 SAGE GROUP PLC

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 SAP SE

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 SOVOS COMPLIANCE, LLC

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 TAXDIVA

15.18.1 COMPANY SNAPSHOT

15.18.2 SERVICE PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 THOMSON REUTERS

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 SERVICE PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TKC CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 VERTEX, INC

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 SERVICE PORTFOLIO

15.21.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

표 목록

TABLE 1 REGULATIONS AND STANDARDS FOR NORTH AMERICA TAX IT SOFTWARE MARKET

TABLE 2 AWI TAX CONSULTING TAX SOFTWARE PRICE (IN USD)

TABLE 3 TRENDS IN THE TOTAL SALES OF THE MANUFACTURING INDUSTRY (IN USD BILLION)

TABLE 4 TECHNOLOGY MATRIX

TABLE 5 COMPARATIVE ANALYSIS

TABLE 6 THE OVERALL ERP IMPLEMENTATION PRICING

TABLE 7 NORTH AMERICA TAX IT SOFTWARE MARKET, BY OFFERING 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA SOFTWARE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA SERVICES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA INCOME TAX IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA CORPORATE TAX IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA PROPERTY TAX IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHERS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA CLOUD IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA ON-PREMISE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA LARGE ENTERPRISES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA SMALL AND MEDIUM-SIZED ENTERPRISES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA SUBSCRIPTION BASED IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA ONE-TIME PURCHASE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI), BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA IT AND TELECOMMUNICATIONS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA MANUFACTURING IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA RETAIL AND CONSUMER GOODS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA HEALTHCARE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA MEDIA AND ENTERTAINMENT IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA ENERGY AND UTILITIES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA OTHERS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA TAX IT SOFTWARE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 42 U.S. TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 43 U.S. SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 U.S. TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 U.S. TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 46 U.S. TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 47 U.S. TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 48 U.S. TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 49 CANADA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 50 CANADA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 CANADA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 CANADA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 53 CANADA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 54 CANADA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 55 CANADA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 56 MEXICO TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 57 MEXICO SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MEXICO TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 MEXICO TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 60 MEXICO TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 61 MEXICO TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 62 MEXICO TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

그림 목록

FIGURE 1 NORTH AMERICA TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TAX IT SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TAX IT SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TAX IT SOFTWARE MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TAX IT SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TAX IT SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TAX IT SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA TAX IT SOFTWARE MARKET: MULTIVARIATE MODELING

FIGURE 9 NORTH AMERICA TAX IT SOFTWARE MARKET: OFFERING TIMELINE CURVE

FIGURE 10 NORTH AMERICA TAX IT SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 12 NORTH AMERICA TAX IT SOFTWARE MARKET: EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE NORTH AMERICA TAX IT SOFTWARE MARKET:

FIGURE 14 NORTH AMERICA TAX IT SOFTWARE MARKET: STRATEGIC DECISIONS

FIGURE 15 INCREASING ADOPTION OF TAX IT SOFTWARE AMONG SMALL AND MEDIUM-SIZED BUSINESSES IS EXPECTED TO DRIVE THE NORTH AMERICA TAX IT SOFTWARE MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TAX IT SOFTWARE MARKET IN 2025 & 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA TAX IT SOFTWARE MARKET

FIGURE 18 NORTH AMERICA TAX IT SOFTWARE MARKET: BY OFFERING, 2024

FIGURE 19 NORTH AMERICA TAX IT SOFTWARE MARKET: BY TAX TYPE, 2024

FIGURE 20 NORTH AMERICA TAX IT SOFTWARE MARKET: BY DEPLOYMENT MODE, 2024

FIGURE 21 NORTH AMERICA TAX IT SOFTWARE MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 22 NORTH AMERICA TAX IT SOFTWARE MARKET: BY REVENUE MODEL, 2024

FIGURE 23 NORTH AMERICA TAX IT SOFTWARE MARKET: BY INDUSTRY, 2024

FIGURE 24 NORTH AMERICA TAX IT SOFTWARE MARKET: SNAPSHOT (2024)

FIGURE 25 NORTH AMERICA TAX IT SOFTWARE MARKET: COMPANY SHARE 2024 (%)

연구 방법론

데이터 수집 및 기준 연도 분석은 대규모 샘플 크기의 데이터 수집 모듈을 사용하여 수행됩니다. 이 단계에는 다양한 소스와 전략을 통해 시장 정보 또는 관련 데이터를 얻는 것이 포함됩니다. 여기에는 과거에 수집한 모든 데이터를 미리 검토하고 계획하는 것이 포함됩니다. 또한 다양한 정보 소스에서 발견되는 정보 불일치를 검토하는 것도 포함됩니다. 시장 데이터는 시장 통계 및 일관된 모델을 사용하여 분석하고 추정합니다. 또한 시장 점유율 분석 및 주요 추세 분석은 시장 보고서의 주요 성공 요인입니다. 자세한 내용은 분석가에게 전화를 요청하거나 문의 사항을 드롭하세요.

DBMR 연구팀에서 사용하는 주요 연구 방법론은 데이터 마이닝, 시장에 대한 데이터 변수의 영향 분석 및 주요(산업 전문가) 검증을 포함하는 데이터 삼각 측량입니다. 데이터 모델에는 공급업체 포지셔닝 그리드, 시장 타임라인 분석, 시장 개요 및 가이드, 회사 포지셔닝 그리드, 특허 분석, 가격 분석, 회사 시장 점유율 분석, 측정 기준, 글로벌 대 지역 및 공급업체 점유율 분석이 포함됩니다. 연구 방법론에 대해 자세히 알아보려면 문의를 통해 업계 전문가에게 문의하세요.

사용자 정의 가능

Data Bridge Market Research는 고급 형성 연구 분야의 선두 주자입니다. 저희는 기존 및 신규 고객에게 목표에 맞는 데이터와 분석을 제공하는 데 자부심을 느낍니다. 보고서는 추가 국가에 대한 시장 이해(국가 목록 요청), 임상 시험 결과 데이터, 문헌 검토, 재생 시장 및 제품 기반 분석을 포함하도록 사용자 정의할 수 있습니다. 기술 기반 분석에서 시장 포트폴리오 전략에 이르기까지 타겟 경쟁업체의 시장 분석을 분석할 수 있습니다. 귀하가 원하는 형식과 데이터 스타일로 필요한 만큼 많은 경쟁자를 추가할 수 있습니다. 저희 분석가 팀은 또한 원시 엑셀 파일 피벗 테이블(팩트북)로 데이터를 제공하거나 보고서에서 사용 가능한 데이터 세트에서 프레젠테이션을 만드는 데 도움을 줄 수 있습니다.