Global Interstitial Lung Disease Treatment Market

Market Size in USD Billion

CAGR :

%

USD

8.96 Billion

USD

14.71 Billion

2025

2033

USD

8.96 Billion

USD

14.71 Billion

2025

2033

| 2026 –2033 | |

| USD 8.96 Billion | |

| USD 14.71 Billion | |

|

|

|

|

Interstitial Lung Disease Treatment Market Size

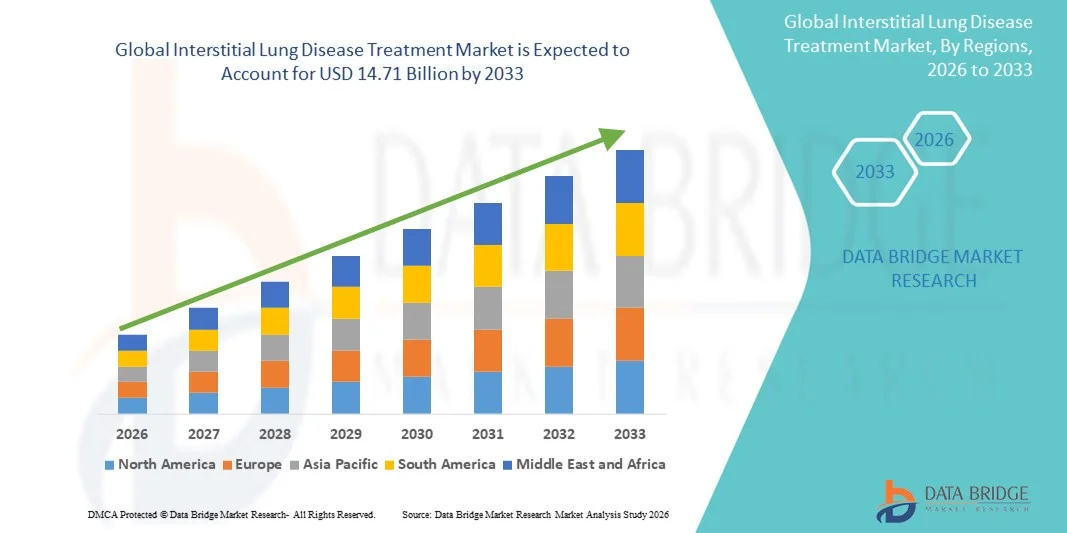

- The global interstitial lung disease treatment market size was valued at USD 8.96 billion in 2025 and is expected to reach USD 14.71 billion by 2033, at a CAGR of 6.40% during the forecast period

- The market growth is largely fueled by the increasing prevalence of ILDs, rising awareness among patients and healthcare providers, and higher diagnosis rates, leading to growing demand for effective treatment options

- Furthermore, advancements in therapeutic approaches, including antifibrotic drugs, immune‑modulating agents, and personalized medicine, are expanding treatment options and improving patient outcomes

Interstitial Lung Disease Treatment Market Analysis

- Interstitial lung disease treatment, including antifibrotic, immunosuppressive, and biologic therapies, is increasingly vital in modern respiratory care due to its potential to slow disease progression, improve lung function, and enhance quality of life for patients with various forms of ILD

- The escalating demand for interstitial lung disease treatment is primarily fueled by the rising prevalence of ILDs, growing awareness among patients and healthcare providers, and increasing emphasis on early diagnosis and personalized treatment approaches

- North America dominated the interstitial lung disease treatment market with the largest revenue share of 39.6% in 2025, characterized by advanced healthcare infrastructure, high patient awareness, and a strong presence of key pharmaceutical companies, with the U.S. experiencing substantial growth in treatment adoption, particularly for idiopathic pulmonary fibrosis and other chronic ILDs, driven by new drug approvals and innovative therapeutic options

- Asia-Pacific is expected to be the fastest-growing region in the interstitial lung disease treatment market during the forecast period due to increasing healthcare accessibility, growing geriatric population, and rising investment in respiratory healthcare infrastructure

- Antifibrotics segment dominated the interstitial lung disease treatment market with a market share of 43% in 2025, driven by its clinical efficacy in slowing fibrosis progression and widespread adoption in managing idiopathic pulmonary fibrosis and related interstitial lung diseases

Report Scope and Interstitial Lung Disease Treatment Market Segmentation

|

Attributes |

Interstitial Lung Disease Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Interstitial Lung Disease Treatment Market Trends

Advancements in Personalized and Targeted Therapies

- A significant and accelerating trend in the global interstitial lung disease treatment market is the development of personalized and targeted therapies, including antifibrotic and biologic agents tailored to specific ILD subtypes, significantly improving treatment outcomes and patient quality of life

- For instance, nintedanib and pirfenidone therapies are being increasingly prescribed for idiopathic pulmonary fibrosis, with ongoing research aimed at expanding indications to other fibrosing ILDs

- Precision medicine approaches in ILD treatment enable tailoring therapy based on genetic, biomarker, and clinical profiles, potentially reducing adverse effects and optimizing efficacy for individual patients

- Integration of digital health solutions, remote monitoring, and AI-driven patient data analysis facilitates continuous disease management, helping physicians make informed decisions and adjust treatments proactively

- Increased investment in clinical trials and R&D for novel ILD therapies, including combination regimens and gene-targeted treatments, is expanding the therapeutic pipeline and fostering innovation

- Expansion of telemedicine and virtual care platforms is enabling better access to specialized ILD care, particularly for patients in remote or underserved regions

- This trend towards more effective, individualized, and data-driven treatment strategies is fundamentally reshaping physician and patient expectations, driving pharmaceutical companies to innovate and invest in ILD-specific therapies

- The demand for interstitial lung disease treatment solutions that combine advanced therapeutics with digital support tools is growing rapidly across both developed and emerging markets as healthcare systems focus on chronic respiratory disease management

Interstitial Lung Disease Treatment Market Dynamics

Driver

Increasing Prevalence and Awareness of lung disease treatment solutions

- The rising prevalence of interstitial lung diseases worldwide, combined with growing awareness among healthcare providers and patients, is a significant driver for the heightened demand for effective ILD treatments

- For instance, recent epidemiological studies indicate a steady increase in idiopathic pulmonary fibrosis and other chronic ILDs, prompting higher diagnosis rates and treatment initiation

- As physicians and patients become more aware of disease progression risks and therapeutic options, the adoption of antifibrotic, immunosuppressive, and biologic treatments is accelerating

- Furthermore, government initiatives and patient advocacy programs aimed at early diagnosis and improved disease management are making ILD treatment a priority in healthcare planning

- The availability of advanced therapies and treatment guidelines, combined with increasing physician familiarity with ILD management protocols, is propelling the adoption of interstitial lung disease treatment globally

- Rising geriatric population and increasing incidence of age-related pulmonary complications are further fueling demand for ILD therapies

- Expansion of healthcare insurance coverage for chronic respiratory conditions in key markets is improving patient access to interstitial lung disease treatment, supporting market growth.

Restraint/Challenge

High Treatment Costs and Limited Access in Emerging Regions

- The high cost of antifibrotic and biologic therapies, coupled with limited healthcare infrastructure in emerging regions, poses a significant challenge to broader adoption of interstitial lung disease treatment

- For instance, pirfenidone and nintedanib therapies remain expensive in many developing countries, restricting access for price-sensitive patients despite clinical efficacy

- Limited availability of specialized pulmonologists, diagnostic facilities, and patient monitoring programs further complicates effective treatment delivery in under-resourced areas

- In addition, the chronic nature of ILDs requiring long-term treatment and monitoring can lead to patient non-compliance, reducing overall treatment effectiveness

- Regulatory hurdles and lengthy approval processes for new ILD drugs in some regions can delay market entry and limit treatment options

- Insufficient patient awareness about disease symptoms and early intervention strategies in emerging markets can result in late diagnosis, reducing the effectiveness of available therapies

- Overcoming these challenges through cost-reduction strategies, improved healthcare infrastructure, patient assistance programs, and awareness campaigns is crucial for expanding the global adoption of interstitial lung disease treatment

Interstitial Lung Disease Treatment Market Scope

The market is segmented on the basis of treatment, diagnosis, dosage, route of administration, end-users, and distribution channel.

- By Treatment

On the basis of treatment, the interstitial lung disease treatment market is segmented into antibiotics, corticosteroids, lung transplant, cytotoxic drugs, antifibrotics, pulmonary rehabilitation, oxygen therapy, and others. The antifibrotics segment dominated the market with the largest revenue share of 43% in 2025, driven by their proven efficacy in slowing fibrosis progression in idiopathic pulmonary fibrosis and other chronic ILDs. Antifibrotics are preferred due to their ability to improve lung function, reduce hospitalizations, and enhance patient quality of life. Strong physician adoption, growing patient awareness, and expanding approvals for new indications further reinforce this segment’s dominance. Continuous innovation, including combination therapies and personalized dosing regimens, supports sustained market share. The segment also benefits from increasing inclusion in clinical guidelines for ILD management. Increasing R&D investments and new drug launches are expected to maintain leadership in this segment.

The pulmonary rehabilitation segment is expected to witness the fastest growth rate of 8.9% from 2026 to 2035, fueled by increasing emphasis on non-pharmacological disease management. Pulmonary rehabilitation programs provide exercise training, education, and breathing techniques that complement pharmacological therapy. Integration of home-based and tele-rehabilitation services is improving accessibility for patients in remote or underserved areas. Rising awareness of lifestyle interventions and long-term disease management is driving demand. Healthcare providers are increasingly recommending pulmonary rehabilitation as part of standard care protocols. The segment growth is also supported by government and insurance initiatives promoting outpatient and community-based care programs.

- By Diagnosis

On the basis of diagnosis, the market is segmented into biopsy, bronchoscopy, lung function test, blood test, X-ray, CT scan, and others. The CT scan segment dominated the market in 2025 due to its high sensitivity and ability to accurately detect ILD patterns. CT scans are widely used for early diagnosis, monitoring treatment response, and differentiating between ILD subtypes. High-resolution CT imaging has enhanced diagnostic precision, enabling better patient stratification for targeted therapies. The segment also benefits from adoption in clinical trials for new ILD therapies. Increasing access to advanced imaging centers in hospitals contributes to continued dominance. CT scans provide non-invasive, repeatable assessments crucial for long-term disease management.

The lung function test segment is expected to witness the fastest growth during the forecast period due to its non-invasive and cost-effective nature. Regular spirometry and diffusion capacity assessments allow physicians to monitor disease progression and adjust treatments accordingly. Portable and home-based lung function devices are expanding accessibility in outpatient and community care settings. Growing awareness of early detection and preventive monitoring is boosting adoption. Lung function tests complement pharmacological and rehabilitation therapies, improving patient outcomes. Technological advancements in digital monitoring and AI-driven analytics are accelerating uptake in both developed and emerging markets.

- By Dosage

On the basis of dosage, the market is segmented into tablet, injection, and others. The tablet segment dominated the market in 2025 due to convenience, outpatient administration, and strong adoption of oral antifibrotics and corticosteroids. Tablets improve patient adherence and enable long-term management of chronic ILDs. Extended-release and combination tablets further enhance compliance and efficacy. Physician preference for oral therapy as a first-line treatment contributes to market leadership. Cost-effectiveness and ease of storage also support widespread use. Tablets are increasingly integrated into home care programs for chronic respiratory disease management.

The injection segment is expected to witness the fastest growth from 2026 to 2035 due to rising biologic and immunomodulatory therapies requiring parenteral administration. IV or subcutaneous injections provide precise dosing and rapid therapeutic effects. Injectable therapies are essential for severe or rapidly progressing ILDs. Growth is driven by new approvals and increasing clinical trial activity. Hospital-based and outpatient infusion centers are expanding access to injectable treatments. Rising physician awareness and adoption of biologics in ILD management are accelerating growth in this segment.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, intravenous, and others. The oral segment dominated in 2025 due to widespread use of oral antifibrotics and corticosteroids for outpatient management. Oral administration improves patient adherence and allows long-term disease management without frequent hospital visits. Physicians prefer oral routes for convenience and flexibility. Pharmaceutical innovation in sustained-release and combination oral formulations strengthens this segment. Tablets and capsules are integrated into standard care protocols globally. Patient preference for non-invasive treatment further supports dominance.

The intravenous segment is expected to witness the fastest growth due to the rise of biologics and advanced immunosuppressive therapies. IV administration ensures controlled, high-bioavailability delivery critical for severe ILDs. Hospitals and infusion centers are primary points of care for IV therapies. The segment growth is supported by new approvals and expanding patient populations. Integration with clinical monitoring improves patient safety and outcomes. Rising R&D in novel IV formulations is expected to drive long-term growth. Healthcare systems in developed markets are increasingly adopting IV therapies for comprehensive ILD management.

- By End-Users

On the basis of end-users, the market is segmented into clinics, hospitals, and others. The hospital segment dominated the market with the largest revenue share in 2025 due to advanced diagnostic tools, specialized pulmonologists, and the capacity to deliver complex therapies such as IV biologics and lung transplants. Hospitals provide comprehensive ILD management, including rehabilitation and oxygen therapy. High patient inflow and multidisciplinary teams support robust adoption. Hospitals are preferred for clinical trials and novel therapy administration. Infrastructure for long-term monitoring and follow-up contributes to dominance. Hospitals also facilitate patient education and support programs.

The clinic segment is expected to witness the fastest growth during forecast period, due to the rising trend of outpatient and home-based ILD management. Clinics provide regular monitoring, early intervention, and telehealth-based follow-ups. Outpatient rehabilitation and chronic care programs are increasingly delivered through clinics. Rising patient awareness and convenience of community-based care drive adoption. Clinics also reduce the burden on hospitals for non-critical management. Integration with digital health platforms enhances treatment adherence.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated in 2025 due to direct availability of specialized ILD therapies for inpatients and outpatient programs. Hospitals ensure regulated and safe dispensing of high-cost antifibrotics and biologics. They also provide access to therapy monitoring and dose adjustments. The segment benefits from established hospital networks and physician prescriptions. Hospitals act as primary distribution channels for critical and chronic therapies. Coordination with clinical care teams enhances patient compliance.

The online pharmacy segment is expected to witness the fastest growth during forecast period, due to rising e-pharmacy penetration, convenience of home delivery, and increasing digital adoption. Online pharmacies improve access for patients in remote areas or with mobility challenges. Subscription-based and home-delivery models increase adherence to chronic ILD therapies. The segment benefits from growing patient awareness and telehealth integration. Increasing trust in e-pharmacy platforms and competitive pricing are driving growth. Online distribution is particularly appealing for long-term, high-cost treatments such as antifibrotics.

Interstitial Lung Disease Treatment Market Regional Analysis

- North America dominated the interstitial lung disease treatment market with the largest revenue share of 39.6% in 2025, characterized by advanced healthcare infrastructure, high patient awareness, and a strong presence of key pharmaceutical companies

- The region benefits from early adoption of novel therapies, availability of specialized pulmonologists, and access to high-quality diagnostic tools such as high-resolution CT scans and lung function testing

- Widespread reimbursement policies, strong healthcare expenditure, and the presence of leading pharmaceutical companies facilitating the introduction of antifibrotic and biologic therapies further support market dominance

U.S. Interstitial Lung Disease Treatment Market Insight

The U.S. interstitial lung disease treatment market captured the largest revenue share of 82% in 2025 within North America, fueled by the high prevalence of ILDs and advanced healthcare infrastructure. Patients and healthcare providers are increasingly prioritizing early diagnosis and access to antifibrotic and biologic therapies. The growing focus on personalized treatment approaches, combined with strong adoption of telemedicine and remote patient monitoring, further propels the ILD treatment market. Moreover, increasing clinical trials, new drug approvals, and integration of digital health platforms significantly contribute to market expansion. Rising awareness campaigns and patient advocacy programs are also enhancing treatment uptake.

Europe Interstitial Lung Disease Treatment Market Insight

The Europe interstitial lung disease treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing incidence of ILDs and robust healthcare infrastructure. Growing awareness among physicians and patients about early diagnosis and effective therapies is fostering market adoption. Countries are implementing chronic disease management programs that encourage standardized ILD care. Rising urbanization, coupled with enhanced access to advanced diagnostics such as high-resolution CT and pulmonary function tests, is supporting treatment uptake. The region is experiencing significant growth across hospitals, specialized clinics, and rehabilitation centers, with ILD therapies being incorporated into both new treatment protocols and updated clinical guidelines.

U.K. Interstitial Lung Disease Treatment Market Insight

The U.K. interstitial lung disease treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of ILDs and the need for early intervention. Increasing demand for advanced therapies such as antifibrotics and biologics is fueling market growth. The country’s strong healthcare system, adoption of personalized medicine approaches, and integration of telehealth platforms are expected to continue stimulating market expansion. Concerns regarding disease progression and mortality are encouraging patients and healthcare providers to pursue timely treatment. In addition, the U.K.’s established clinical research infrastructure supports continuous drug development and adoption of novel therapies.

Germany Interstitial Lung Disease Treatment Market Insight

The Germany interstitial lung disease treatment market is expected to expand at a considerable CAGR during the forecast period, fueled by high patient awareness, advanced healthcare infrastructure, and the presence of key pharmaceutical players. Germany emphasizes evidence-based treatment protocols and innovative therapy adoption, particularly in hospitals and specialized pulmonary centers. Rising prevalence of chronic respiratory diseases and increasing focus on early diagnosis and personalized treatment approaches support market growth. Integration of ILD management with digital health platforms is becoming increasingly prevalent. Patient preference for hospital-based treatment and multidisciplinary care programs further contributes to market expansion.

Asia-Pacific Interstitial Lung Disease Treatment Market Insight

The Asia-Pacific interstitial lung disease treatment market is poised to grow at the fastest CAGR of 9.5% during the forecast period of 2026 to 2035, driven by increasing prevalence of ILDs, growing healthcare access, and rising awareness among patients. Countries such as China, Japan, and India are witnessing technological advancements in diagnostics and therapy, enhancing early detection and treatment adoption. Government initiatives promoting respiratory healthcare and chronic disease management are further supporting market growth. The region’s growing inclination toward specialty care centers and home-based monitoring is boosting adoption of ILD therapies. In addition, rising disposable incomes and improving insurance coverage are increasing accessibility of antifibrotic and biologic treatments.

Japan Interstitial Lung Disease Treatment Market Insight

The Japan interstitial lung disease treatment market is gaining momentum due to the country’s high prevalence of ILDs, advanced healthcare infrastructure, and growing geriatric population. Patients and physicians emphasize early diagnosis and personalized treatment approaches. The integration of digital health platforms, telemedicine, and advanced diagnostics such as high-resolution CT scans is fueling growth. Moreover, government-led initiatives and insurance coverage for chronic respiratory diseases are expanding patient access to treatment. Increasing awareness of pulmonary rehabilitation and oxygen therapy as complementary treatments is further enhancing market adoption.

India Interstitial Lung Disease Treatment Market Insight

The India interstitial lung disease treatment market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the rising prevalence of ILDs, increasing healthcare access, and growing patient awareness. India’s expanding middle class, rapid urbanization, and improving diagnostic infrastructure support early detection and treatment uptake. The push towards digital health adoption, telemedicine, and affordable treatment options is further propelling the market. Domestic pharmaceutical players are actively introducing antifibrotic and biologic therapies, expanding availability. Rising initiatives for chronic respiratory disease management and patient education programs are key factors driving market growth.

Interstitial Lung Disease Treatment Market Share

The Interstitial Lung Disease Treatment industry is primarily led by well-established companies, including:

- F. Hoffmann-La Roche Ltd (Switzerland)

- Boehringer Ingelheim International GmbH (Germany)

- Bristol-Myers Squibb Company (U.S.)

- Novartis AG (Switzerland)

- GSK plc (U.K.)

- Sanofi (France)

- Merck & Co., Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Biogen Inc. (U.S.)

- AstraZeneca (U.K.)

- Genentech, Inc. (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Bayer AG (Germany)

- AbbVie Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- J.B. Chemicals & Pharmaceutical Ltd. (India)

- Galecto Inc. (Denmark)

- Cipla Ltd (India)

- Glenmark Pharma (India)

What are the Recent Developments in Global Interstitial Lung Disease Treatment Market?

- In October 2025, the U.S. FDA approved nerandomilast (Jascayd) for treating Idiopathic Pulmonary Fibrosis (IPF), marking the first newly approved IPF therapy in over 10 years. This approval is significant because IPF traditionally has very limited treatment options, with only two major antifibrotics dominating care for more than a decade. Jascayd’s approval followed strong clinical evidence showing reduced lung function decline and a favorable safety profile

- In June 2025, Insilico Medicine announced its intention to start late-stage clinical trials for Rentosertib following its encouraging mid-stage results. The upcoming trials aim to further validate Rentosertib’s potential as a novel treatment for IPF by assessing long-term efficacy and safety across diverse patient populations

- In March 2025, the nonproprietary name Rentosertib was officially assigned to ISM001-055, highlighting the progress of this first-in-class TNIK inhibitor as it moved forward in clinical pipelines. Receiving an official name is a regulatory milestone indicating significant advancement in the drug’s development. Rentosertib also became notable as one of the world’s first small-molecule drugs entirely discovered using generative AI

- In November 2024, Insilico Medicine announced positive topline results from its Phase IIa trial of ISM001-055 (later named Rentosertib) for IPF. The trial demonstrated that the drug was safe, well-tolerated, and showed a dose-dependent improvement in forced vital capacity (FVC) over 12 weeks a key indicator of slowed disease progression

- In September 2024, Boehringer Ingelheim reported that its FIBRONEER-IPF Phase III trial for nerandomilast achieved its primary endpoint, demonstrating a statistically significant difference in FVC decline compared to placebo over 52 weeks. This success strengthened the clinical foundation for subsequent regulatory filings and ultimately contributed to the drug’s approval in 2025

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.