Global Shisha Tobacco Market

Market Size in USD Billion

CAGR :

%

USD

1.08 Billion

USD

1.89 Billion

2024

2032

USD

1.08 Billion

USD

1.89 Billion

2024

2032

| 2025 –2032 | |

| USD 1.08 Billion | |

| USD 1.89 Billion | |

|

|

|

|

Shisha Tobacco Market Size

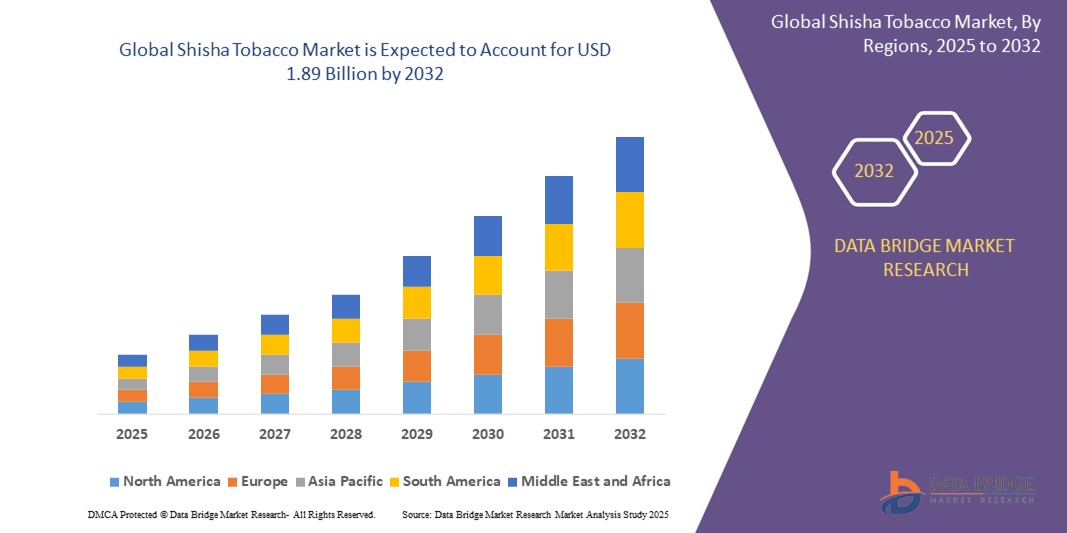

- The global shisha tobacco market size was valued at USD 1.08 billion in 2024 and is expected to reach USD 1.89 billion by 2032, at a CAGR of 7.2% during the forecast period

- Market growth is driven by increasing popularity of hookah culture, rising demand for flavored tobacco products, and growing social acceptance of shisha smoking in cafes and lounges

- Rising consumer preference for premium and diverse flavor profiles, coupled with growing disposable incomes, is boosting demand for shisha tobacco across both traditional and modern consumption settings

Shisha Tobacco Market Analysis

- The shisha tobacco market is experiencing robust growth due to the rising trend of hookah lounges, social smoking culture, and increasing demand for innovative flavor options that enhance the smoking experience

- Manufacturers are focusing on developing high-quality, low-nicotine, and organic shisha tobacco products to cater to health-conscious consumers and meet regulatory standards

- The Middle East and Africa dominate the shisha tobacco market, holding the largest revenue share of 38.5% in 2024, driven by a strong cultural affinity for hookah smoking and widespread presence of shisha lounges

- Asia-Pacific is anticipated to be the fastest-growing region during the forecast period, propelled by rapid urbanization, increasing youth population, and growing popularity of flavored shisha tobacco in countries such as India, China, and Southeast Asian nations

- The fruit flavor segment accounted for the largest market revenue share of 45.5% in 2024, fueled by its widespread appeal, refreshing taste, and availability in diverse variants such as apple, berry, and tropical blends. The growing demand for blended flavors, combining traditional and exotic tastes, is also contributing to market expansion.

Report Scope and Shisha Tobacco Market Segmentation

|

Attributes |

Shisha Tobacco Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Shisha Tobacco Market Trends

“Growing Demand for Exotic and Blended Flavor Profiles”

- Exotic and blended flavor profiles, such as fruit-mint combinations and beverage-inspired shisha tobacco, are increasingly popular due to their unique taste and enhanced smoking experience

- These flavors appeal to younger consumers and urban markets, driving demand in hookah lounges and social settings

- In regions such as the Middle East and Asia-Pacific, blended flavors such as apple-mint and coffee-caramel are favored for their refreshing and bold profiles

- Premium shisha brands are innovating with natural and organic ingredients to cater to health-conscious consumers seeking high-quality smoking experiences

- For instance, Al Fakher has introduced exotic flavor blends such as tropical fruit and herbal mint to attract a global customer base

- Hookah lounges are increasingly offering curated flavor menus featuring blended shisha tobacco to enhance customer appeal

Shisha Tobacco Market Dynamics

Driver

“Growing Popularity of Hookah Culture and Social Smoking”

- Increasing consumer interest in hookah culture, particularly among younger demographics, is driving demand for shisha tobacco in social settings such as cafes and lounges

- The appeal of diverse flavor profiles, such as fruit, mint, and blended options, enhances the social smoking experience, attracting a broader consumer base

- Urbanization and rising disposable incomes in regions such as the Middle East, Asia-Pacific, and North America are boosting the establishment of hookah lounges, fueling shisha tobacco consumption

- Manufacturers are innovating with premium, low-nicotine, and organic shisha tobacco to cater to health-conscious consumers, further supporting market growth

- For instance, Al Fakher has expanded its portfolio with organic flavor blends to meet rising demand for premium products in the U.A.E. and Saudi Arabia

Restraint/Challenge

“Stringent Anti-Tobacco Regulations and Public Smoking Bans”

- Stringent regulations on tobacco products, including shisha tobacco, limit market growth by imposing restrictions on production, distribution, and consumption

- Varying global laws, such as high taxation, mandatory health warnings, and bans on flavored tobacco, create challenges for manufacturers and distributors operating internationally

- Public smoking bans in many countries reduce opportunities for shisha consumption in social settings such as cafes and lounges, impacting market demand

- For instance, countries such as Australia and several European nations enforce strict anti-smoking laws, requiring shisha lounges to comply with designated smoking area regulations, limiting their operations

- These restrictive regulations discourage new consumers, increase compliance costs, and may result in fines for non-compliance, deterring market expansion in heavily regulated regions

Shisha Tobacco Market Scope

The market is segmented on the basis of product type, flavor, and distribution channel.

- By Product Type

On the basis of product type, the shisha tobacco market is segmented into strong shisha tobacco, mild shisha tobacco, and light shisha tobacco. The mild shisha tobacco segment holds the largest market revenue share of 55.5% in 2024, driven by its widespread appeal among both casual and regular consumers seeking a balanced smoking experience with moderate nicotine content. The growing demand for organic and low-nicotine options in this segment further supports its dominance.

The light shisha tobacco segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing consumer preference for low-nicotine and health-conscious products, particularly among younger demographics and new users. Light shisha tobacco is favored for its smooth taste and reduced health risks, making it popular in social settings such as hookah lounges.

- By Flavor

On the basis of flavor, the shisha tobacco market is segmented into fruit, mint, chocolate, caramel, beverages, and blended flavors. The fruit flavor segment accounted for the largest market revenue share of 45.5% in 2024, fueled by its widespread appeal, refreshing taste, and availability in diverse variants such as apple, berry, and tropical blends. The growing demand for blended flavors, combining traditional and exotic tastes, is also contributing to market expansion.

The blended flavors segment is projected to experience the fastest growth rate from 2025 to 2032, driven by rising demand for innovative combinations such as fruit-mint or coffee-caramel, which enhance the smoking experience and attract younger consumers seeking unique profiles.

- By Distribution Channel

On the basis of distribution channel, the shisha tobacco market is segmented into direct and indirect channels. The indirect channel segment, which includes retail stores, hookah lounges, and e-commerce platforms, accounted for the largest revenue share of 68.5% in 2024, driven by the widespread availability of shisha tobacco in specialty stores and online marketplaces. The growth of e-commerce has made it easier for consumers to access a variety of brands and flavors.

The direct channel segment is anticipated to grow at the fastest rate from 2025 to 2032, propelled by manufacturers’ increasing focus on direct-to-consumer sales through branded outlets and online platforms, offering premium and customized products to enhance customer loyalty.

Shisha Tobacco Market Regional Analysis

- The Middle East and Africa dominate the shisha tobacco market, holding the largest revenue share of 38.5% in 2024, driven by a strong cultural affinity for hookah smoking and widespread presence of shisha lounges

- Consumers in the region prioritize shisha tobacco for its social and recreational value, with a strong preference for premium and flavored whiskey products that enhance the smoking experience

- Growth is supported by innovations in flavor profiles, such as exotic and organic blends, alongside increasing adoption in both traditional and modern consumption settings, including upscale lounges and cafes

U.S. Shisha Tobacco Market Insight

The U.S shisha tobacco market is projected to experience rapid growth, fueled by the growing popularity of hookah lounges and strong demand for premium and flavored shisha tobacco. Increasing consumer awareness of diverse flavor profiles, such as fruit and blended options, drives market expansion. The trend toward social smoking and the rise of e-commerce platforms for tobacco sales complement traditional retail, creating a robust market ecosystem.

Europe Shisha Tobacco Market Insight

The Europe shisha tobacco market is expected to witness significant growth, supported by the rising popularity of hookah culture in urban areas and increasing demand for exotic and organic shisha tobacco. Consumers seek premium products that offer enhanced flavor and lower nicotine content. Growth is prominent in both traditional hookah lounges and modern cafes, with countries such as Germany and France showing notable adoption due to evolving consumer preferences and social trends.

U.K. Shisha Tobacco Market Insight

The U.K. shisha tobacco market is projected to experience rapid growth, driven by increasing demand for social smoking experiences in urban settings and growing consumer interest in flavored shisha tobacco. Awareness of premium and organic options, coupled with the appeal of unique flavor blends, encourages market adoption. Regulatory frameworks balancing public smoking restrictions with consumer preferences influence product choices and market dynamics.

Germany Shisha Tobacco Market Insight

Germany is expected to witness a high growth rate in the shisha tobacco market, attributed to its vibrant hookah culture and consumer preference for high-quality, innovative flavor profiles. The demand for organic and low-nicotine shisha tobacco is rising, driven by health-conscious consumers and the proliferation of upscale hookah lounges. The integration of premium shisha products in social venues and strong retail distribution supports sustained market growth.

Asia-Pacific Shisha Tobacco Market Insight

The Asia-Pacific region is anticipated to witness the fastest growth rate, propelled by rapid urbanization, increasing youth populations, and rising disposable incomes in countries such as China, India, and Southeast Asian nations. Growing awareness of shisha tobacco’s social and recreational appeal, along with demand for diverse flavor profiles, boosts market expansion. Government initiatives promoting regulated tobacco sales and e-commerce accessibility further encourage market growth.

Japan Shisha Tobacco Market Insight

Japan’s shisha tobacco market is expected to experience rapid growth due to strong consumer preference for premium and exotic flavor blends that enhance the social smoking experience. The presence of trendy hookah lounges and cafes, coupled with increasing interest in aftermarket customization of shisha products, accelerates market penetration. The integration of high-quality shisha tobacco in urban social settings supports sustained growth.

China Shisha Tobacco Market Insight

China holds the largest share of the Asia-Pacific shisha tobacco market, driven by rapid urbanization, growing disposable incomes, and increasing popularity of hookah culture among the youth. The demand for flavored and organic shisha tobacco is rising, supported by the country’s expanding middle class and focus on recreational social activities. Strong domestic production capabilities and competitive pricing enhance market accessibility and growth.

Shisha Tobacco Market Share

The shisha tobacco industry is primarily led by well-established companies, including:

- FUMARI (U.S.)

- Haze Tobacco (U.S.)

- Al Fakher Tobacco Factory (U.A.E.)

- SOCIALSMOKE (U.S.)

- Japan Tobacco Inc. (Japan)

- SOEX (Germany)

- Romman Shisha (U.S.)

- Mazaya (Kuwait)

- Ugly Hookah (U.S.)

- Cloud Tobacco (U.S.)

- Flavors of Americas S.A. (Paraguay)

- Al Amir Tobacco (U.A.E.)

- STARBUZZTOBACCO. (U.S.)

- Godfrey Phillips India Ltd. (India)

- The Eastern Company (U.S.)

Latest Developments in Global Shisha Tobacco Market

- In May 2025, DOJO launched the BLAST 10K in the UK, a high-capacity disposable e-cigarette featuring a unique pod combination. As a brand under Smoore, DOJO’s innovation aligns with regulatory standards while offering extended use and advanced design. The BLAST 10K delivers up to 10,000 puffs, integrating leak-resistant technology and a rechargeable battery for a seamless vaping experience. This launch strengthens DOJO’s position in the evolving UK e-cigarette and shisha-style market, catering to consumers seeking convenience and performance

- In January 2025, Starbuzz expanded its organic shisha tobacco line, introducing low-nicotine formulations made with natural ingredients. The new flavors, including organic apple and herbal mint, cater to growing health-conscious consumer preferences. This strategic move strengthens Starbuzz’s presence in the premium segment, particularly in North America and Europe, where demand for healthier alternatives is increasing. By offering innovative and refined blends, Starbuzz continues to lead the market in high-quality shisha products

- In December 2024, Fumari introduced a redesigned e-commerce platform, expanding its selection of premium shisha tobacco products, including popular fruit and dessert flavors. The platform enhances accessibility for consumers in North America and Europe, offering features such as subscription models and customizable flavor options. This strategic move strengthens Fumari’s direct-to-consumer sales channel, aligning with the growing trend of online shisha purchases. By improving convenience and personalization, Fumari aims to capture a larger market share and meet evolving consumer preferences.

- In October 2024, Mazaya, a leading shisha tobacco manufacturer, partnered with local distributors in India and Southeast Asia to strengthen its market presence. This collaboration focuses on distributing its popular fruit and mint flavor lines, catering to the region’s growing youth population and hookah lounge culture. By expanding its distribution network, Mazaya aims to capitalize on the rapid market growth in Asia-Pacific, reinforcing its position as a key player in the shisha tobacco industry

- In April 2022, Al Fakher Tobacco Trading introduced its Double Kick range exclusively through Dubai Duty-Free, expanding its presence in travel retail. This new line features three flavors—Two Apple, Mint, and Grape & Mint—each available in a 200g format. The Double Kick range offers double the nicotine content compared to standard Al Fakher products, catering to consumer demand for stronger shisha blends. This launch reinforces Al Fakher’s strategic focus on premium offerings in global travel retail markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.