Technological advancements have revolutionized the Canada chemical distribution market the integration of advanced technologies, such as automation, IoT, and cloud-based systems, has significantly enhanced supply chain management, logistics, and inventory management in the chemical distribution sector. This has led to improved efficiency, cost-effectiveness, and real-time monitoring of operations. Additionally, digitalization has facilitated seamless communication, enhanced visibility, and optimized decision-making processes, driving growth in the Canadian chemical distribution market. Adopting technology-driven solutions continues to reshape the industry and provide competitive advantages to market players.

Access Full Report @ https://www.databridgemarketresearch.com/reports/canada-chemical-distribution-market

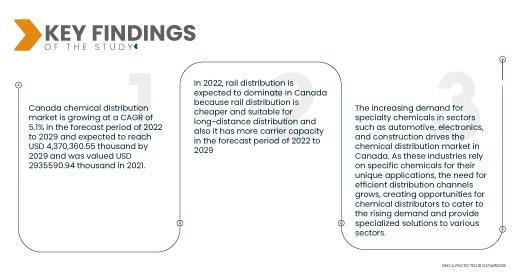

Data Bridge Market Research analyses that the Canada Chemical Distribution Market is growing at a CAGR of 5.1% in the forecast period of 2022 to 2029 and expected to reach USD 4,370,360.55 thousand by 2029 and was valued USD 29,35,590.94 thousand in 2021. The expansion of industries like manufacturing, oil and gas, pharmaceuticals, and agriculture in Canada drives the chemical distribution market by increasing the demand for chemicals needed in these sectors.

Key Findings of the Study

Stringent regulations and compliance requirements in Canada are expected to drive the market's growth rate

Stringent regulations and compliance requirements in Canada regarding the handling, storage, and transportation of chemicals play a crucial role in driving the chemical distribution market. These regulations ensure safety and environmental protection, making it necessary for industries to engage specialized chemical distributors who have the expertise and capabilities to meet these standards. The demand for compliant distributors drives the market as businesses seek partners who can navigate the complex regulatory landscape and provide assurance of adherence to safety and environmental regulations.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD thousand, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Chemical Type (Commodity Chemicals, Specialty Chemicals), Distribution Channel (B2B, Third Party Distribution, E-commerce and Others), Distribution Method (Airways Distribution, Rail Distribution, Road Distribution, and Shipping Distribution), Chemical Packaging (Drums, Intermediate Bulk Container (IBC), Flexitanks and Others), Packaging Size (100 to 250 Liters, 250 to 500 Liters and above 500 Liters)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Market Players Covered

|

Brenntag SE - (Germany), Univar Solutions Inc. - (U.S.), IMCD Group - (Netherlands), Azelis - (Belgium), Barentz - (Netherlands), Caldic B.V. - (Netherlands), Safic-Alcan - (France)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

Canada chemical distribution market is segmented of the basis into the chemical type, distribution channel, distribution method, chemical packaging, and packaging size.

- On the basis of chemical type, the chemical distribution market is segmented into commodity chemicals and specialty chemicals. In 2022, commodity chemicals segment is expected to dominate in Canada because commodity chemicals are multi-purpose and are used by many different businesses and industries in the forecast period of 2022 to 2029

In 2022, the commodity chemicals segment is expected to dominate in Canada chemical distribution market

In 2022, the commodity chemicals segment is expected to dominate Canada's chemical distribution market because Commodity chemicals are versatile and widely used across various industries, making them in high demand. They serve as essential raw materials in manufacturing processes and find applications in automotive, construction, and consumer goods sectors. The multi-purpose nature of commodity chemicals attracts a diverse range of businesses, leading to their dominance in the Canadian market in the forecast period of 2022 to 2029

- On the basis of distribution channel, the chemical distribution market is segmented into B2B, third party distribution, e-commerce, and others. In 2022, B2B is expected to dominate in Canada because it provides convenience, higher profits, and improved security to buyers and sellers in the forecast period of 2022 to 2029.

- On the basis of distribution method, the chemical distribution market is segmented into airways distribution, rail distribution, road distribution, and shipping distribution. In 2022, rail distribution is expected to dominate in Canada because rail distribution is cheaper and suitable for long-distance distribution, and also it has more carrier capacity in the forecast period of 2022 to 2029.

- On the basis of chemical packaging, the chemical distribution market is segmented into drums, Intermediate Bulk Container (IBC), flexitanks, and others. In 2022, Intermediate Bulk Containers (IBC) is expected to dominate in Canada because it is most suitable in case of bulk chemical distribution and IBC has zero wastage quality in the forecast period of 2022 to 2029.

- On the basis of packaging size, the chemical distribution market is segmented into 100 to 250 liters, 250 to 500 liters and above 500 liters. In 2022, 250 to 500 liters is expected to dominate in Canada because it is suitable for international and domestic transporting in bulk in the forecast period of 2022 to 2029.

In 2022, 250 to 500 liters segment is expected to dominate in Canada chemical distribution market

In 2022, 250 to 500 liters segment is expected to dominate in Canada chemical distribution market due to size range is well-suited for both international and domestic transportation in bulk. It offers a balance between volume and manageability, providing convenience and cost-effectiveness for chemical distributors and end-users. The 250 to 500 liters packaging size is favored for its ability to meet transportation needs efficiently, contributing to its dominance in the Canadian market in the forecast period of 2022 to 2029

Major Players

Data Bridge Market Research recognizes the following companies as the major Canada chemical distribution market players in Canada chemical distribution market are Brenntag SE - (Germany), Univar Solutions Inc. - (U.S.), IMCD Group - (Netherlands), Azelis - (Belgium), Barentz - (Netherlands), Caldic B.V. - (Netherlands), Safic-Alcan - (France)

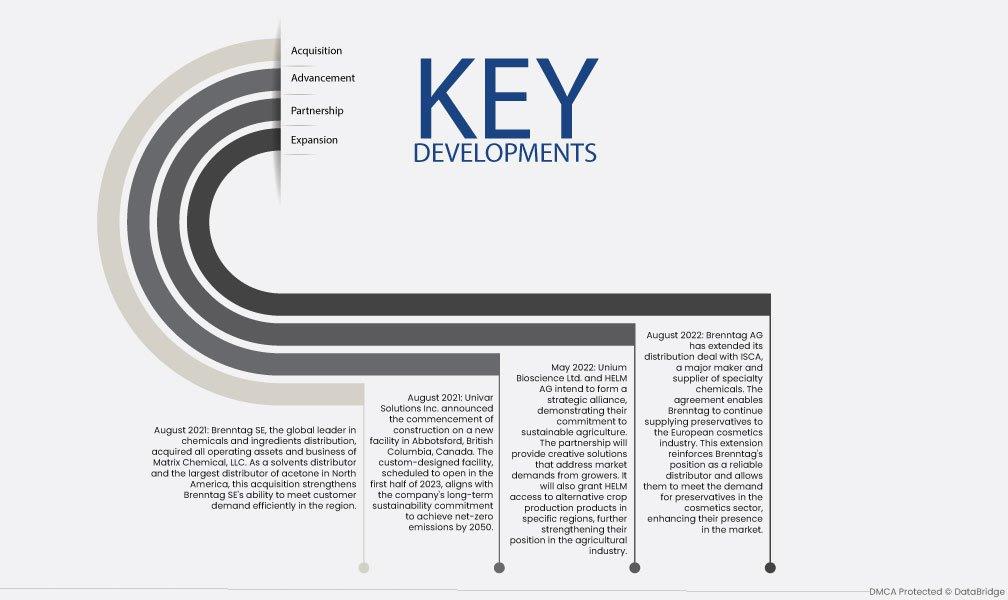

Market Development

- In August 2021, Brenntag SE, the global leader in chemicals and ingredients distribution, acquired all operating assets and business of Matrix Chemical, LLC. As a solvents distributor and the largest distributor of acetone in North America, this acquisition strengthens Brenntag SE's ability to meet customer demand efficiently in the region.

- In August 2021, Univar Solutions Inc. announced the commencement of construction on a new facility in Abbotsford, British Columbia, Canada. The custom-designed facility, scheduled to open in the first half of 2023, aligns with the company's long-term sustainability commitment to achieve net-zero emissions by 2050.

- In May 2022, Unium Bioscience Ltd. and HELM AG intend to form a strategic alliance, demonstrating their commitment to sustainable agriculture. The partnership will provide creative solutions that address market demands from growers. It will also grant HELM access to alternative crop production products in specific regions, further strengthening their position in the agricultural industry.

- In August 2022, Brenntag AG has extended its distribution deal with ISCA, a major maker and supplier of specialty chemicals. The agreement enables Brenntag to continue supplying preservatives to the European cosmetics industry. This extension reinforces Brenntag's position as a reliable distributor and allows them to meet the demand for preservatives in the cosmetics sector, enhancing their presence in the market.

Regional Analysis

For more detailed information about the Canada chemical distribution market report, click here – https://www.databridgemarketresearch.com/reports/canada-chemical-distribution-market