X-ray inspection systems are used for non-destructive inspection of a sample area. X-ray inspection systems are used to detect defects in materials by non-destructive methods. The benefits of X-ray inspection systems include better quality control mechanisms, easy verification of missing products, improved data collection, reduced risk of product recalls, and much more. In an X-ray inspection system, the object that is to be inspected, and its image is produced using X-rays. In turn, it is processed through image processing software to verify missing items, draw shape analysis, verify the package integrity, and detect any contamination.

Access Full Report @ https://www.databridgemarketresearch.com/reports/china-x-ray-inspection-system-market

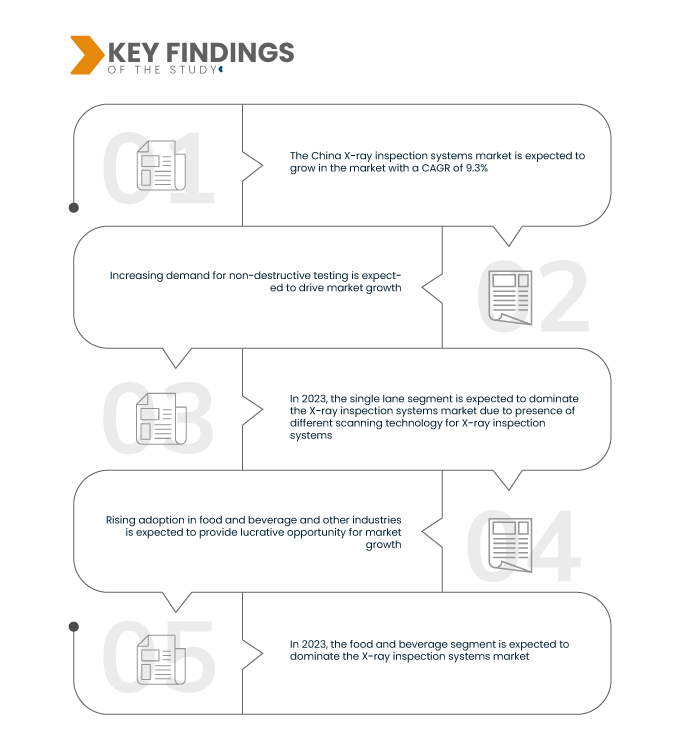

Data Bridge Market Research analyses that the China X-Ray Inspection Systems Market is expected to grow at a CAGR of 9.3% in the forecast period of 2023 to 2030 and is expected to reach USD 115,734.45 thousand by 2030. The development of portable and mobile inspection systems is expected to drive market growth.

Key Findings of the Study

High Increase in Automation Across Various Application is Expected to Drive the Market

Automation has become a key focus for many industries, including automotive, electronics, and aerospace, as it offers several benefits, including increased productivity, improved quality control, and reduced labor costs. X-ray inspection systems play a critical role in automation by providing non-destructive testing of products and components during the manufacturing process. The increasing demand for automation is thus affecting positively the demand for X-ray inspection systems across the globe including in China. The market players in the China X-ray inspection systems market are responding by increasing their product portfolio for inspection systems

Thus, the increasing demand for automation is expected to drive the China X-ray inspection system market. Market players are responding to this demand by investing in the development of new and advanced automated X-ray inspection systems that offer improved speed, accuracy, and efficiency. This is expected to lead to increased adoption of X-ray inspection systems in various industries, which will create immense opportunities and is expected to boost the market growth.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Offering (Hardware, Software, and Services), Imaging Technique (Film Based Imaging and Digital Imaging), Dimension (2D, 3d), Product Type (Packaged Products, Un-Packaged Products, Pumped, and Others), Scanning Technology (HD Technology, Ultra-HD Technology, and Others), Number of Lanes (Single Lane, Multi-Lane, and Others), End-User (Oil & Gas, Power Generation, Government Infrastructure, Food & Beverage, Aerospace, Automotive, Pharmaceuticals & Nutraceuticals, and Others)

|

|

Countries Covered

|

China

|

|

Market Players Covered

|

Sesotec GmbH (Germany), ISHIDA CO.LTD. (Japan), Loma Systems (U.K.), Mekitec group (U.S.), ANRITSU CORPORATIONA(Japan), METTLER TOLEDO (U.S.), Shimadzu Corporation (Japan), SYSTEM SQUARE INC. (Japan), Viscom AG (Germany), North Star Imaging Inc. (U.S.), Nikon Corporation (U.S.), A&D Company, Limited (Japan), Smiths Detection Group Ltd. (U.K.), and Scienscope (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The China X-ray inspection systems market is segmented into seven notable segments which are based on offering, imaging technique, dimension, product type, scanning technology, number of lanes, and end-user.

- On the basis of offering, the China X-ray inspection systems market is segmented into hardware, software, and services.

In 2023, the hardware segment is expected to dominate the China X-ray inspection systems market

In 2023, the hardware segment is expected to dominate the China X-ray inspection systems market owing to the increasing demand for non-destructive testing. Hardware is expected to dominate the market with a market share of 57.66%

- On the basis of imaging techniques, the China X-ray inspection systems market is segmented into film-based imaging and digital imaging.

In 2023, the digital imaging segment is expected to dominate the China X-ray inspection systems market

In 2023, digital imaging is expected to dominate the X-ray inspection systems market with market share of 68.44% as most of the advanced form of X-ray inspection which produces a digital radiographic image instantly on a computer.

- On the basis of dimension, the China X-ray inspection systems market is segmented into 2D and 3D. In 2023, 2D is expected to dominate the China X-ray inspection systems market growing with the highest market share of 58.26%

- On the basis of product type, the China X-ray inspection systems market is segmented into packaged products, un-packaged products, pumped, and others. In 2023, packaged products inspection systems is expected to dominate the China X-ray inspection systems market with the market share of 46.59%

- On the basis of scanning technology, the China X-ray inspection systems market is segmented into HD technology, Ultra-HD technology, and others. In 2023, HD technology is expected to dominate the China X-ray inspection systems market with the market share of 54.06%

- On the basis of number of lanes, the China X-ray inspection systems market is segmented into single lane, dual lane, and multi-lane. In 2023, single lane is expected to dominate the China X-ray inspection systems market with the market share of 42.25%

- On the basis of end-use, the China X-ray inspection systems market is segmented into oil & gas, power generation, government infrastructure, food & beverage, aerospace, automotive, pharmaceuticals & nutraceuticals, and others. In 2023, food & beverage is expected to dominate the China X-ray inspection systems market with the market share of 24.53%

Major Players

Data Bridge Market Research recognizes the following companies as the major market players in China X-ray inspection systems market are METTLER TOLEDO (U.S.), SHIMADZU CORPORATION (Japan), Smiths Detection Group Ltd (U.K.), Nikon Metrology Inc. (U.S.), and ANRITSU CORPORATION (Japan) among others.

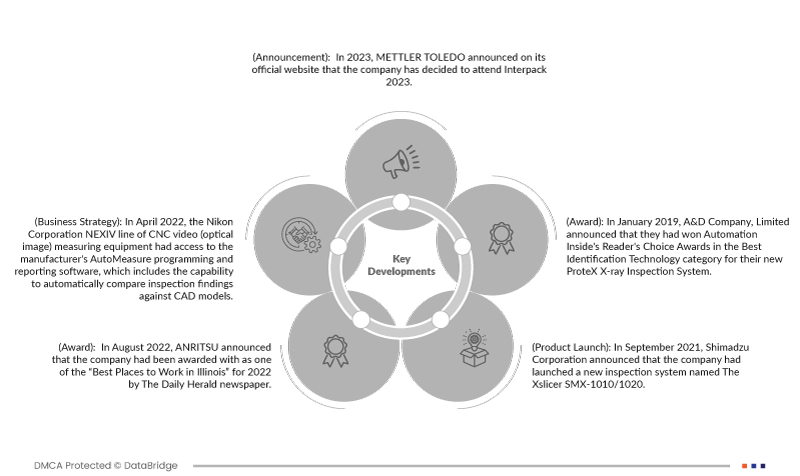

Recent Developments

- In 2023, METTLER TOLEDO announced on its official website that the company had decided to attend Interpack 2023. The company is aiming to incline potential clients for its product portfolio and expand its recognition with this step under the China X-Ray inspection systems market

- In April 2022, the Nikon Corporation NEXIV line of CNC video (optical image) measuring equipment had access to the manufacturer's AutoMeasure programming and reporting software, which includes the capability to automatically compare inspection findings against CAD models. Two new capabilities in the most recent release of the program, AutoMeasure version 13, enable even inexperienced users to get the best performance out of the systems. They give a manufacturing company or inspection bureau a competitive edge by lowering operational expenses and increasing productivity

- In August 2022, ANRITSU announced that the company had been awarded with as one of the “Best Places to Work in Illinois” for 2022 by The Daily Herald newspaper. The company has received this recognition and used it to promote its company culture and product portfolio across the U.S. region. This has allowed the company to gain revenue by increasing its product sales under the China X-Ray inspection systems market

- In September 2021, Shimadzu Corporation announced that the company had launched a new inspection system named The Xslicer SMX-1010/1020. This product offers better image quality, and detector acquisition speed has also increased in the product. This launch has boosted the company presence in the China X-ray inspection systems market

- In January 2019, A&D Company, Limited announced that they had won Automation Inside's Reader's Choice Awards in the Best Identification Technology category for their new ProteX X-ray Inspection System. The ProteX X-ray system was nominated due to its host of useful features that are designed to ensure maximum efficiency, all while simplifying the inspection process Company focuses on a wide and diverse range of measurement, weighing, and medical equipment with analog and digital conversion as its core technology. This recognition made a significant impact on the growth of the company

For more detailed information about the China X-ray inspection systems market report, click here – https://www.databridgemarketresearch.com/reports/china-x-ray-inspection-system-market