Anti-Money Laundering (AML) solutions are used to detect and warn institutions regarding money laundering, terrorist financing, fraud, electronic crime, bribery and corruption, tax evasion, embezzlement, information security, and illegal cross border transactions among others that hugely impact the economy of the country and can hamper its reputation. AML is a term that is generally used to depict the fight against money laundering & financial crimes. Anti-Money Laundering (AML) solutions comply with various policies, laws, and regulations that help prevent financial crimes. These guidelines, policies, and laws are set by global and local regulators, which aim to strengthen the functioning of AML solutions.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-and-asia-pacific-anti-money-laundering-market

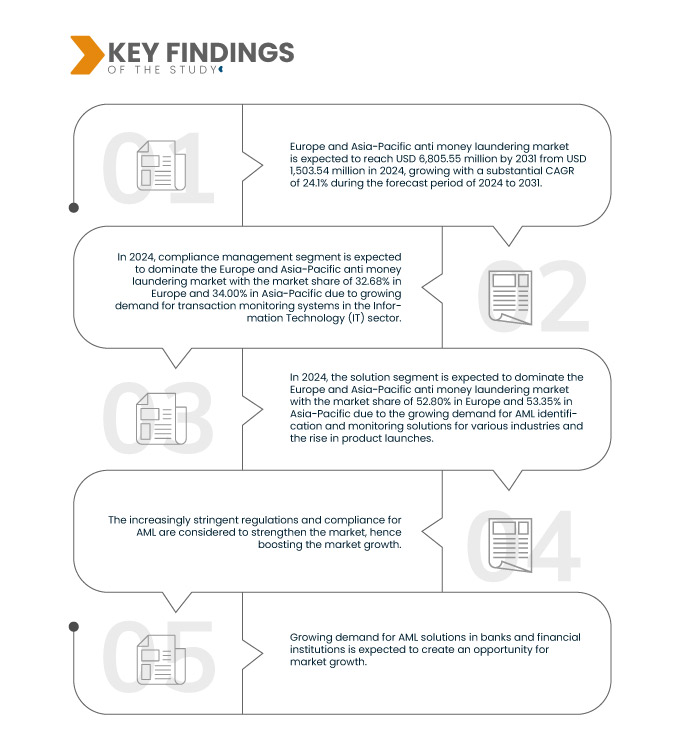

Data Bridge Market Research analyzes that the Europe and Asia-Pacific Anti Money Laundering Market is expected to reach USD 6,805.55 million by 2031 from USD 1,335.24 million in 2023, growing with a substantial CAGR of 24.1% during the forecast period from 2024 to 2031.

Key Findings of the Study

Increasing Stringent Regulations and Compliance for AML

An anti-money laundering compliance program is a set of regulations or rules a financial institution must follow to prevent and detect money laundering and terrorist funding activities. In recent times, financial crime against financial institutions such as banks and credit unions has significantly increased. There was a 50%- 60% increment in financial fraud cases in 2019 from 2021, which is expected to grow in coming years. The losses incurred by banks across the globe are quite significant. According to a survey conducted by Merchant Savvy in 2020, global losses from payment fraud were around USD 32.39 billion in 2020, and banking fraud losses in the U.K. were estimated to be around USD 205.00 million. To tackle these financial crimes in banks, credit unions, and other financial institutions, there is a requirement to develop anti-money laundering (AML) compliance programs.

Thus, the increasingly stringent regulations and compliance for AML are considered to strengthen the market, hence boosting the market growth.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016–2021)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Offering (Solution and Services), Function (Compliance Management, Customer Identity Management, Transaction Monitoring, and Currency Transaction Reporting), Deployment (Cloud and On-Premise), Enterprise Size (Large Enterprises and Small & Medium Enterprises), End Use (Banks & Financial Institutions and Insurance Providers)

|

|

Countries Covered

|

Germany, U.K., France, Italy, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Rest of Europe, China, Japan, South Korea, India, Australia & New Zealand, Singapore, Malaysia, Taiwan, Indonesia, Thailand, Philippines, Vietnam, and Rest of Asia-Pacific

|

|

Market Players Covered

|

Accenture (Ireland), ACI Worldwide (U.S.), Cognizant (U.S.), Comarch SA (Poland), ComplyAdvantage (U.K.), Experian Information Solutions, Inc. ( subsidiary of Experian PLC) (U.S.), FIS (U.S.), FICO (U.S.), Fiserv, Inc. (U.S.), GB Group plc (‘GBG’) (U.K.), IBM Corporation (U.S.), Jumio (U.S.), Lexisnexis Risk Solutions (U.S.), Microsoft (U.S.), NICE (Israel), Open Text Corporation (Canada), Oracle (U.S.), SAP SE (Germany), SAS Institute Inc. (U.S.), SAIGroup (U.S.), Tata Consultancy Services Limited (India), Temenos Headquarters SA (Switzerland), Trulioo (Canada), Wolters Kluwer N.V. (Netherland), and WorkFusion, Inc. (U.S.) among others

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis

The Europe and Asia-Pacific anti money laundering market is segmented into five notable segments based on offering, function, deployment, enterprise size, and end use.

- On the basis of offering, the Europe and Asia-Pacific anti money laundering market is segmented into solution and services.

In 2024, the solution segment is expected to dominate the Europe and Asia-Pacific anti money laundering market

In 2024, the solution segment is expected to dominate the market with the market share of 52.80% in Europe and 53.35% in Asia-Pacific due to the growing demand for AML identification and monitoring solutions for various industries and the rise in product launches.

- On the basis of function, the Europe and Asia-Pacific anti money laundering market is segmented into compliance management, currency transaction reporting, customer identity management, and transaction monitoring

In 2024, the compliance management segment is expected to dominate the Europe and Asia-Pacific anti money laundering market

In 2024, the compliance management segment is expected to dominate the market with the market share of 32.68% in Europe and 34.00% in Asia-Pacific due to an increase in stringent regulations and compliances for AML to strengthen the solution.

- On the basis of deployment, the Europe and Asia-Pacific anti money laundering market is segmented into on-premise and cloud. In 2024, the cloud segment is expected to dominate the market with the market share of 52.63% in Europe and 53.41% in Asia-Pacific

- On the basis of enterprise size, the Europe and Asia-Pacific anti money laundering market is segmented into small & medium-sized enterprises and large enterprises. In 2024, the large enterprises segment is expected to dominate the market with the market share of 55.91% in Europe and 56.46% in Asia-Pacific

- On the basis of end use, the Europe and Asia-Pacific anti money laundering market is segmented into banks & financial institutions and insurance providers. In 2024, the banks & financial institutions are expected to dominate the market with the market share of 73.95% in Europe and 73.12% in Asia-Pacific

Major Players

Data Bridge Market Research analyzes Temenos Headquarters SA (Switzerland), Accenture (Ireland), ACI Worldwide (U.S.), IBM Corporation (U.S.), and FIS (U.S.) as the major players of the Europe anti money laundering market.

Data Bridge Market Research analyzes Fiserv, Inc. (U.S.), Jumio (U.S.), and Temenos Headquarters SA (Switzerland), Accenture (Ireland), Cognizant (U.S.) as the major players of the Asia-Pacific anti money laundering market.

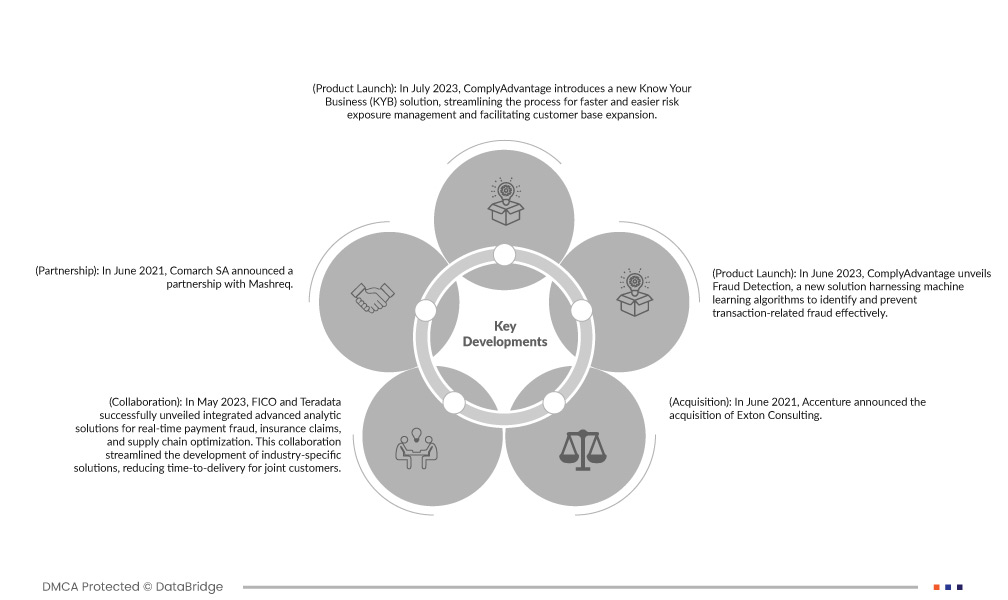

Market Developments

- In July 2023, ComplyAdvantage introduced a new Know Your Business (KYB) solution, streamlining the process for faster and easier risk exposure management and facilitating customer base expansion

- In May 2023, FICO and Teradata successfully unveiled integrated advanced analytic solutions for real-time payment fraud, insurance claims, and supply chain optimization. This collaboration streamlined the development of industry-specific solutions, reducing time-to-delivery for joint customers. The global partnership is set to deliver cost reductions, enhanced profits, improved risk mitigation, and heightened customer satisfaction, harnessing the core competencies of Teradata and FICO to foster innovation in the AI-driven landscape

- In June 2021, Accenture announced the acquisition of Exton Consulting. This acquisition strengthened Accenture’s capabilities to help clients accelerate and scale their transformation projects in the financial services industry. This acquisition will help Accenture to strengthen its market position in Europe

- In June 2021, Comarch SA announced a partnership with Mashreq. This partnership took place to digitize wealth management solutions for the convenience of both companies' customers. This partnership will help the companies strengthen their workforce and help diversify their solution portfolio for their customer base

- In June 2023, ComplyAdvantage unveils Fraud Detection, a new solution harnessing machine learning algorithms to identify and prevent transaction-related fraud effectively

Regional Analysis

The countries covered in the Europe and Asia-Pacific anti money laundering market report are Germany, U.K., France, Italy, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, Norway, Finland, Denmark, Sweden, Poland, Rest of Europe, China, Japan, South Korea, India, Australia & New Zealand, Singapore, Malaysia, Taiwan, Indonesia, Thailand, Philippines, Vietnam, and Rest of Asia-Pacific.

As per Data Bridge Market Research analysis:

Europe is estimated to be the fastest growing and dominant region in the Europe and Asia-Pacific anti money laundering market.

Europe is expected to dominate the market globally as the region has the highest demand for transaction monitoring systems that assess financial crime patterns and the maximum number of industries such as financial, banking, and insurance, where these technologies can be deployed which subsequently increases the need for anti-money laundering solutions.

For more detailed information about the Europe and Asia-Pacific anti money laundering market report, click here – https://www.databridgemarketresearch.com/reports/europe-and-asia-pacific-anti-money-laundering-market