Cleaners and degreasers are specialized chemical compounds or solutions designed for the efficient removal of dirt, grime, oil, grease, and other contaminants from various surfaces and objects. These cleaning agents work by breaking down and dissolving unwanted substances, making it easier to wipe or rinse them away. Cleaners typically encompass a wide range of products, catering to specific cleaning needs, while degreasers specifically target the removal of oily residues and greasy build-ups. They find extensive use in both domestic and industrial settings, ensuring cleanliness, hygiene, and optimal performance of equipment, machinery, appliances, and surfaces. These substances play a vital role in maintaining cleanliness, safety, and functionality in diverse environments, from kitchens and automotive workshops to manufacturing facilities and households.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-and-us-cleaner-and-degreaser-market

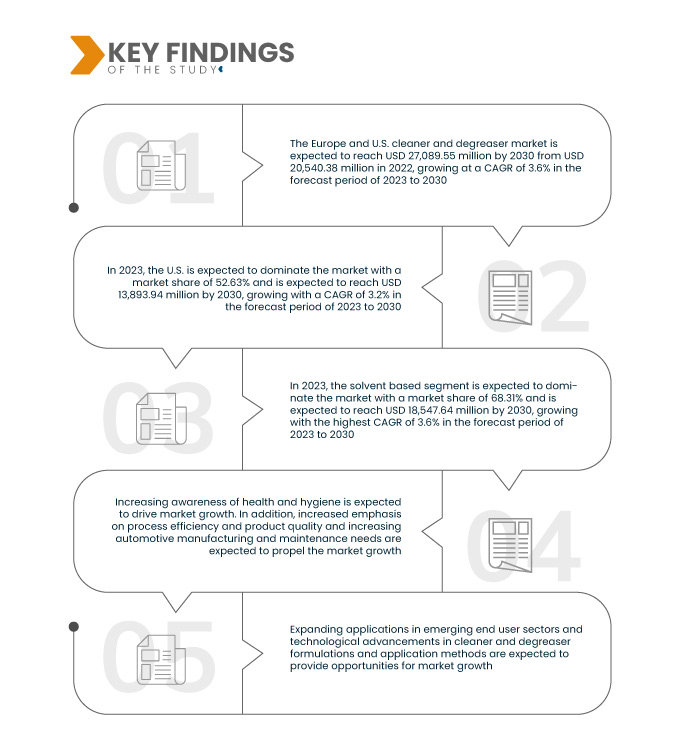

The Europe and U.S. Cleaner and Degreaser Market is expected to reach USD 27,089.55 million by 2030 from USD 20,540.38 million in 2022, growing with a substantial CAGR of 3.6% in the forecast period of 2023 to 2030.

Key Findings of the Study

Increasing Awareness towards Health and Hygiene is Expected to Drive the Market Growth

The increasing awareness towards health and hygiene is poised to drive the cleaner and degreaser market in both Europe and the U.S. This heightened awareness is largely attributed to various factors, including the ongoing global health concerns, environmental consciousness, and regulatory initiatives aimed at ensuring safer and cleaner working and living environments.

Individuals, businesses, and institutions have become acutely aware of the need to maintain clean and sanitized spaces to reduce the risk of infection. As a result, the demand for effective cleaning and degreasing products has surged, and this trend is expected to persist as hygiene consciousness remains a priority. Furthermore, the growing emphasis on environmental sustainability and the use of eco-friendly products is driving the demand for greener, biodegradable, and non-toxic cleaning and degreasing solutions. Consumers in Europe and the U.S. are increasingly seeking products that not only ensure cleanliness but also align with their environmental values. This shift in consumer preferences has led to innovations in the cleaner and degreaser market, with manufacturers developing eco-friendly formulations that meet stringent environmental standards.

In conclusion, the increasing awareness of health and hygiene is a potent driver for market growth. This awareness, fuelled by the pandemic, environmental concerns, regulatory changes, and institutional demand, is expected to result in sustained market growth as consumers and businesses alike prioritize cleanliness and safety in their environments. Companies that offer effective, eco-friendly, and compliant cleaning and degreasing solutions are poised to benefit from this trend.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volume in Million Liters, and Pricing in USD Million

|

|

Segments Covered

|

Product Type (Solvent Based and Water Based), Type (Heavy Duty Degreasers/Cleaners, Butyl Degreasers/Cleaners, Non-Butyl Degreasers/Cleaners, Natural Degreasers/Cleaners, and Others), Raw Material (Petroleum-Based Degreasers/Cleaners, Ammonia-Based Degreasers/Cleaners, Environmentally Compatible Degreasers/Cleaners, and Others), Form (Liquid, Solid, and Foam), Degreasing or Cleaning Methods (Manual and Automated), Packaging (Drum, Pail, Spray Bottle, Aerosol Cans, and Others), End Use (General Manufacturing, Automotive, Food & Beverages, Electrical/Utility, Building & Construction, Aviation/Aerospace, Marine, Mining, Agriculture, and Others), Sales Channel (B2B and B2C)

|

|

Countries Covered

|

U.S., Germany, France, U.K., Italy, Russia, Spain, Netherlands, Belgium, Switzerland, Turkey, Denmark, Sweden, Poland, Norway, Finland, and Rest of Europe

|

|

Market Players Covered

|

BASF SE (Germany), Dow (U.S.), BP p.l.c. (U.K.), 3M (U.S.), DuPont (U.S.), Adolf Würth GmbH & Co. KG (Germany), Stepan Company (U.S.), Valvoline Global Operations (U.S.), Superior Industries, Inc. (U.S.), FUCHS (Germany), Zep Inc. (U.S.), Betco (U.S.), Nyco Products Company (U.S.), B'laster LLC (U.S.), Carroll Company (U.S.), The Claire Manufacturing Company (U.S.), AIROSOL COMPANY, INC (U.S.), and CHAMÄLEON GMBH (Germany)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The Europe and U.S. cleaner and degreaser market is segmented into eight notable segments based on product type, type, raw material, form, degreasing/cleaning methods, packaging, end use, and sales channel.

- On the basis of product type, the market is segmented into solvent based and water based

In 2023, the solvent based segment is expected to dominate the Europe and U.S. cleaner and degreaser market

In 2023, the solvent based is expected to dominate the market with a market share of 68.31% as this is the most convenient label as it shows the wholesome data. It is also due to their effective grease and oil removal properties and historical industry reliance on these products.

- On the basis of type, the market is segmented into heavy duty degreasers/cleaners, butyl degreasers/cleaners, non-butyl degreasers/cleaners, natural degreasers/cleaners, and others

In 2023, the heavy duty degreasers/cleaners segment is expected to dominate the Europe and U.S. cleaner and degreaser market

In 2023, the heavy duty degreasers/cleaners segment is expected to dominate the market with market share of 35.59% due to high industrial activity, stringent cleanliness standards, and the need for effective solutions in manufacturing and automotive sectors.

- On the basis of raw material, the market is segmented into petroleum-based degreasers/cleaners, ammonia-based degreasers/cleaners, environmentally compatible degreasers/cleaners, and others. In 2023, the petroleum-based degreasers/cleaners segment is expected to dominate the market with market share of 37.05%

- On the basis of form, the market is segmented into liquid, powder, and foam. In 2023, the liquid segment is expected to dominate the market with market share of 42.58%

- On the basis of degreasing or cleaning methods, the market is segmented into manual and automated. In 2023, the manual segment is expected to dominate the market with 76.76% market share

- On the basis of packaging, the market is segmented into drum, pail, spray bottle, aerosol cans, and others. In 2023, drum segment is expected to dominate the market with market share of 44.39%

- On the basis of end use, the market is segmented into general manufacturing, automotive, food & beverages, electrical/utility, building & construction, aviation/aerospace, marine, mining, agriculture, and others. In 2023, the general manufacturing segment is expected to dominate the market with market share of 30.37%

- On the basis of sales channel, the market is segmented into B2B and B2C. In 2023, the B2B segment is expected to dominate the market with market share of 79.05%

Major Players

Data Bridge Market Research analyses BASF SE (Germany), Dow (U.S.), BP p.l.c. (U.K.), 3M (U.S.), and DuPont (U.S.) as major market players in the market.

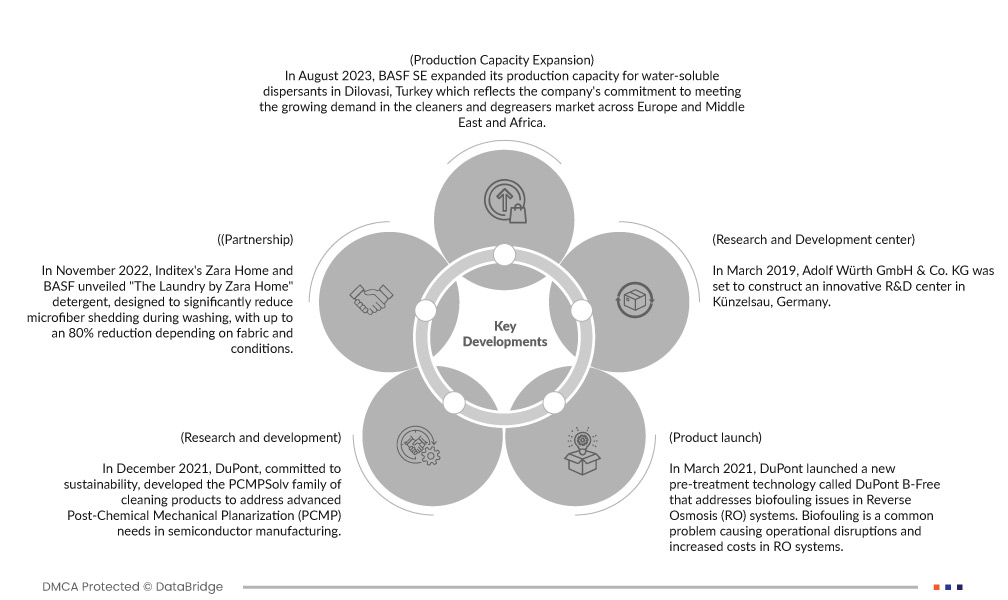

Recent Developments

- In August 2023, BASF SE expanded its production capacity for water-soluble dispersants in Dilovasi, Turkey which reflects the company's commitment to meeting the growing demand in the cleaners and degreasers market across Europe and Middle East and Africa. The Sokalan dispersants, marketed by BASF's Care Chemicals division, including Sokalan PA, Sokalan CP, and Sokalan NR grades, play a crucial role in improving cleaning efficiency, preventing lime deposits, and facilitating technical processes in modern formulations

- In November 2022, Inditex's Zara Home and BASF unveiled "The Laundry by Zara Home" detergent, designed to significantly reduce microfiber shedding during washing, with up to an 80% reduction depending on fabric and conditions. This innovative formula not only cleans effectively in cold water, reducing carbon emissions but also extends textile lifespan. Available in over 25 markets, including Spain and Germany, this solution is poised to revolutionize the cleaners and degreasers market while offering the potential for broader industry adoption

- In December 2021, DuPont, committed to sustainability, developed the PCMPSolv family of cleaning products to address advanced Post-Chemical Mechanical Planarization (PCMP) needs in semiconductor manufacturing. These products are designed to clean residues and byproducts generated during the CMP process, ensuring device reliability and yield. As the semiconductor industry evolves with smaller devices and new materials, PCMP cleaning becomes more complex. DuPont's PCMPSolv products incorporate safer-by-design and green chemistry principles, replacing aggressive cleans with carefully selected raw materials. These cleaners offer the same performance and corrosion control while being highly concentrated, resulting in cost savings through efficient dilution. Customers can inquire about these products through their account managers

- In March 2021, DuPont launched a new pre-treatment technology called DuPont B-Free that addresses biofouling issues in Reverse Osmosis (RO) systems. Biofouling is a common problem causing operational disruptions and increased costs in RO systems. This technology, developed after years of research, creates a biostatic environment in RO systems without using chemicals, making it sustainable and reliable. DuPont B-Free reduces the need for Cleaning-In-Place (CIP) by up to 75%, potentially doubling the lifespan of RO membranes and filters, and lowering operational downtime by up to 50%. This innovation improved plant reliability and aligns with sustainability goals, addressing water scarcity challenges

- In March 2019, Adolf Würth GmbH & Co. KG was set to construct an innovative R&D center in Künzelsau, Germany. This investment will provide state-of-the-art laboratories and workshops covering 15,000 square meters. This cutting-edge facility will house advanced equipment including 3D printers and seismic test rigs, enhancing their research capabilities. Collaborations with esteemed institutions such as Karlsruhe Institute of Technology and universities in Innsbruck and Stuttgart will foster knowledge exchange. The innovation center showed the company's focus towards innovation and offering customers valuable solutions in various sectors including the cleaners and degreasers sector

Regional Analysis

On the basis of geography, the market is segmented into U.S., Germany, France, U.K., Italy, Russia, Spain, Netherlands, Belgium, Switzerland, Turkey, Denmark, Sweden, Poland, Norway, Finland, and rest of Europe.

As per Data Bridge Market Research analysis:

U.S is expected to dominate the Europe and U.S. cleaner and degreaser market

In 2023, the U.S. is expected to dominate the market due to its robust chemical industry and extensive manufacturing capabilities, resulting in a wide range of product offerings and competitive pricing.

Europe is expected to be the fastest-growing region in the Europe and U.S. cleaner and degreaser market

In 2023 Europe is expected to grow with the highest CAGR due to stringent environmental regulations in both regions, which have driven the demand for eco-friendly and sustainable cleaning solutions, an area where European manufacturers excel.

For more detailed information about the Europe and U.S. cleaner and degreaser market report, click here – https://www.databridgemarketresearch.com/reports/europe-and-us-cleaner-and-degreaser-market