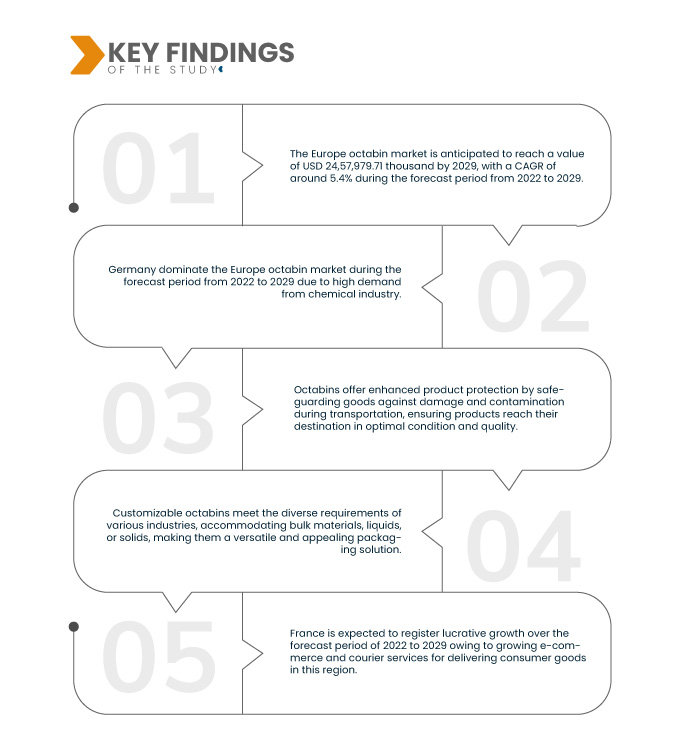

E-commerce has a positive impact on the consumer goods industry. E-commerce involves the selling of goods and services online with the use of the internet. Goods that are ordered online are delivered to the doorstep of the customers. The finished goods go through different packaging processes to make sure that no damage can occur to the goods during transit, and interests should be delivered safely without any defacement on the surface.

Octabins are preferred for their ease of handling in logistics operations. Their standardized dimensions and the ability to be securely stacked make them conducive to streamlined shipping processes. Couriers and delivery companies find octabins advantageous for optimizing space utilization in their vehicles, reducing the risk of damage during transit, and expediting loading and unloading operations. This alignment with the logistical needs of e-commerce enterprises cements octabins as a preferred packaging solution in the supply chain.

Access Full Report @ https://www.databridgemarketresearch.com/reports/europe-octabin-market

Data Bridge Market Research analyses that the Europe Octabin Market is expected to reach USD 750,262.18 thousand by 2031 from USD 504,206.70 thousand in 2023, growing with a CAGR of 5.1% in the forecast period of 2024 to 2031.

Key Findings of the Study

Increased Use in Agriculture and Food Processing

In recent years, there has been a notable surge in demand for octabins, which are large, cube-shaped containers, in agricultural and food processing applications. This uptick in usage can be attributed to the octabin's versatility and suitability for handling and transporting bulk quantities of agricultural production and processed food products.

The main reason for the increased adoption of octabins in agriculture is their ability to efficiently store and transport bulk quantities of crops, such as grains, fruits, and vegetables. Octabins provide a strong and stackable solution that ensures the product's safety, reducing the risk of damage. This is particularly crucial in the agricultural sector, where the preservation of crop quality is paramount. Furthermore, in the food processing sector, octabins play a vital role in storing and transporting processed food products. Their large capacity makes them ideal for handling bulk quantities of items such as frozen foods, dry goods, and ingredients. The durability of octabins ensures the safe transport of these products, contributing to the efficiency of the overall supply chain in the food processing industry.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016-2021)

|

|

Quantitative Units

|

Revenue in USD Thousand

|

|

Segments Covered

|

Product Type (Free Flow Base Octabin, Base Discharge Octabin, Self-Assembly Octabin, Standard Octabin, and Telescopic Octabin), Capacity (Customized and Standard), End-User (Chemical Industry, Food Industry, Consumer Goods, Pharmaceutical, and Others)

|

|

Country Covered

|

Germany, U.K., Italy, France, Spain, Poland, Netherlands, Belgium, Turkey, Finland, Switzerland, Russia, Austria, Sweden, Denmark, Norway, Czech Republic, Romania, Bulgaria, Lithuania, Estonia, Latvia, and Rest of Europe

|

|

Market Players Covered

|

DS Smith (U.K.), Smurfit Kappa (Ireland), VPK Group (Belgium), Mondi (U.K.), International Paper (U.S.), Quadwall (U.K.), WestRock Company (U.S.), Klingele Paper & Packaging SE & Co. KG (Germany), Rondo Ganahl AG (Austria), WEBER Paletten & Verpackung (Germany), S LESTER PACKING MATERIALS LTD. (U.K.), TRICOR AG (Germany), and Tape and Go Europe (Hungary) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand

|

Segment Analysis

Europe octabin market is segmented into three notable segments which are based on product type, capacity, and end user.

- On the basis of product type, the Europe octabin market is segmented into free flow base octabin, base discharge octabin, self-assembly octabin, standard octabin, and telescopic octabin

In 2024, the standard octabin segment is expected to dominate the Europe octabin market

In 2024, the standard octabin segment is expected to dominate the market with 44.05% market share because these octabins are cost-effective and environmentally friendly for transporting various types of goods.

- On the basis of capacity, the Europe octabin market is segmented into customized and standard

In 2024, the standard segment is expected to dominate the Europe octabin market

In 2024, the standard segment is expected to dominate the market with 63.53% market share as the standard capacity octabins are made from lightweight material which decreases the weight of the load and reduce shipping costs.

- On the basis of end-user, the Europe octabin market is segmented into chemical industry, food industry, consumer goods, pharmaceutical, and others. In 2024, chemical industry segment is expected to dominate the market with 39.01% market share

Major Players

Data Bridge Market Research analyzes DS Smith (U.K.), Smurfit Kappa (Ireland), VPK Group (Belgium), Mondi (U.K.), International Paper (U.S.) as the major players operating in the Europe octabin market.

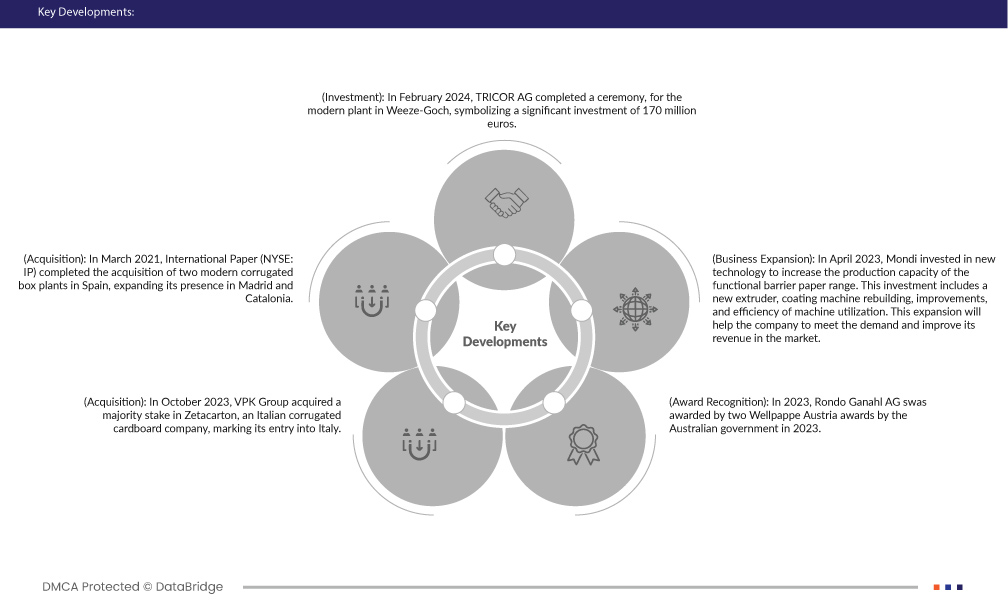

Recent Developments

- In February 2024, TRICOR AG completed a ceremony, for the modern plant in Weeze-Goch, symbolizing a significant investment of 170 million euros. The plant, constructed to the highest energy efficiency standards, employed over 200 people and featured a 3.3-megawatt photovoltaic system. The company emphasizes a sustainable and modern working environment. The strategic location near the Dutch border positions TRICOR AG as a leading European provider of industrial packaging. The plant, equipped with innovative technology, set new standards in heavy corrugated board manufacturing and processing

- In October 2023, VPK Group acquired a majority stake in Zetacarton, an Italian corrugated cardboard company, marking its entry into Italy. Zetacarton specializes in fanfold and big-box packaging, complementing VPK Group's fit2size offering. The move expands VPK's geographic coverage for Fanfold, catering to e-commerce logistics distribution centers across Europe. Zetacarton's recent investment in a new digital single-pass printer enhances its product range, contributing to its sustainable growth. The acquisition aligns with VPK Group's long-term strategy for sustainable expansion in the European market

- In December 2023, Klingele Paper & Packaging SE & Co. KG, finalized plans to introduce a Kyoto Group Heatcube at its Werne site. The Heatcube, an innovative molten salt thermal energy storage technology, aims to replace natural gas at the Werne plant and reduce CO2 emissions by over 3,400 tonnes annually. The signing of a term sheet outlined project details, with an engineering study starting in January 2024 and an intended purchase agreement for the Heatcube set for April 2024. The initiative helps the company to implement environmentally friendly practices in the paper and corrugated board industry which will help them to position the company among the market players in terms of sustainability

- In May 2023, Rondo Ganahl AG marked its 52nd anniversary by opening a new printing center in St. Ruprecht. With a USD 37.5 million investment, the facility aims to increase production by up to 30% annually, meeting the rising demand for eco-friendly corrugated board packaging, particularly from the food industry. The new print center, equipped with advanced technology, contributes to the company’s commitment to reducing environmental impact, utilizing solar energy for production, and generating 2.5 million kilowatt hours of clean energy annually in St. Ruprecht

- In April 2023, Mondi invested in new technology to increase the production capacity of the functional barrier paper range. This investment includes a new extruder, coating machine rebuilding, improvements, and efficiency of machine utilization. This expansion will help the company to meet the demand and improve its revenue in the market

Regional Analysis

Geographically, the countries covered in the Europe octabin market are Germany, U.K., Italy, France, Spain, Poland, Netherlands, Belgium, Turkey, Finland, Switzerland, Russia, Austria, Sweden, Denmark, Norway, Czech Republic, Romania, Bulgaria, Lithuania, Estonia, Latvia, and rest of Europe.

As per Data Bridge Market Research analysis:

Germany is expected to be the dominant and fastest growing country in Europe octabin market

Germany is expected to dominate and be the fastest growing country in the Europe octabin market due to the presence of a large number of major players in the region and the increase in initiatives such as acquisitions, collaborations, and product launches by manufacturers to distribute their products efficiently to the consumer.

For more detailed information about the Europe octabin market report, click here – https://www.databridgemarketresearch.com/reports/europe-octabin-market