برز الطلب على كفاءة الطاقة كقوة دافعة رئيسية لنمو سوق أنظمة الطاقة غير المنقطعة (UPS) في أوروبا. ومع تزايد اعتماد الشركات والصناعات على التكنولوجيا والبنية التحتية الرقمية، أصبحت الحاجة إلى مصادر طاقة موثوقة لحماية العمليات الحيوية أمرًا بالغ الأهمية. في هذا السياق، احتلت كفاءة الطاقة مركز الصدارة، حيث تسعى المؤسسات إلى حلول أنظمة الطاقة غير المنقطعة التي لا توفر طاقة غير منقطعة أثناء الانقطاعات فحسب، بل تقلل أيضًا من استهلاك الطاقة وتكاليف التشغيل. ومع تزايد المخاوف البيئية، تدرك الشركات أهمية تقليل بصمتها الكربونية وتحسين استخدام الطاقة. ونتيجة لذلك، يبتكر مصنعو أنظمة الطاقة غير المنقطعة لتطوير أنظمة أكثر كفاءة في استخدام الطاقة تتماشى مع أهداف الاستدامة، مما يجذب الشركات التي تسعى إلى حماية موثوقة للطاقة وخفض تكاليف الطاقة.

للاطلاع على التقرير الكامل، يُرجى زيارة الرابط التالي: https://www.databridgemarketresearch.com/reports/europe-uninterruptible-power-supply-ups-market

تشير تحليلات أبحاث سوق Data Bridge إلى أن سوق إمدادات الطاقة غير المنقطعة (UPS) في أوروبا من المتوقع أن يصل إلى 3.74 مليار دولار أمريكي بحلول عام 2031 من 2.38 مليار دولار أمريكي في عام 2023، بمعدل نمو سنوي مركب قدره 5.9٪ في الفترة المتوقعة من 2024 إلى 2031. ومع استمرار مراكز البيانات في التوسع ومواجهة الطلب المتزايد على الطاقة، يصبح من الضروري تقليل استهلاك الطاقة وتعزيز الكفاءة الكلية. بفضل تقنيات مثل وحدات إمداد الطاقة المحسنة (PSUs) ومنظمات الجهد المتقدمة ووحدات توزيع الطاقة الفعالة (PDUs)، فإن سوق إمدادات الطاقة غير المنقطعة (UPS) في وضع يسمح له بتلبية الحاجة الماسة إلى حلول موفرة للطاقة في المشهد سريع التطور لمراكز البيانات. لا يتماشى هذا الطلب مع أهداف الاستدامة البيئية فحسب، بل يتماشى أيضًا مع توفير التكاليف وتحسين العمليات، مما يجعل كفاءة الطاقة عاملاً حاسماً ومن المتوقع أن يشكل المسار المستقبلي لسوق إمدادات الطاقة غير المنقطعة (UPS) في أوروبا.

النتائج الرئيسية للدراسة

الطلب المتزايد على مراكز البيانات

أدى الطلب المتزايد على مراكز البيانات في جميع أنحاء أوروبا إلى نمو سوق أنظمة الطاقة غير المنقطعة (UPS) بشكل كبير. ومع تسابق الشركات والمؤسسات لتبني التحول الرقمي والاستفادة من قوة البيانات الضخمة، أصبحت الحاجة إلى بنية تحتية موثوقة ومرنة أكثر إلحاحًا من أي وقت مضى. تلعب أنظمة UPS دورًا محوريًا في ضمان استمرارية العمليات داخل مراكز البيانات، والتخفيف من مخاطر انقطاع التيار الكهربائي، وضمان الوصول المستمر إلى الخدمات الأساسية. ومع استمرار تطور المشهد الرقمي، من المتوقع أن تظل الاستثمارات في حلول أنظمة الطاقة غير المنقطعة (UPS) ضرورة استراتيجية لمشغلي مراكز البيانات، مما يُمكّنهم من تلبية المتطلبات المتزايدة لعالم قائم على البيانات مع الحفاظ على التميز التشغيلي ورضا العملاء.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

السنوات التاريخية

|

2022 (قابلة للتخصيص حتى 2016-2021)

|

الوحدات الكمية

|

الإيرادات بالملايين من الدولارات الأمريكية

|

القطاعات المغطاة

|

المكونات (الحلول والخدمات)، حجم المؤسسة (المؤسسات الكبيرة والمتوسطة والصغيرة)، النوع (عبر الإنترنت، دون اتصال، وتفاعلي عبر الإنترنت)، المخرجات (تيار متردد إلى تيار متردد، تيار مستمر إلى تيار مستمر، وتيار متردد إلى تيار مستمر)، الطوبولوجيا (تفاعلي عبر الإنترنت، وحامل)، التطبيق (النقل الصناعي، الأغذية المصنعة، الطاقة الكهرومائية، الطاقة الحرارية الأرضية، الدفيئات الزراعية، التحكم في المناخ، الخلاطات، القطع، وغيرها)، نطاق الطاقة (500-1200 كيلو فولت أمبير، 200-500 كيلو فولت أمبير، 20-200 كيلو فولت أمبير، 1200-1500 كيلو فولت أمبير، وأقل من 20 كيلو فولت أمبير)، مركز البيانات (السحابة، الموقع المشترك، المؤسسات، الحافة، وغيرها)، العمودي (الحكومة والقطاع العام، تكنولوجيا المعلومات ومركز البيانات، السكني، الطاقة والمرافق، الاتصالات، التصنيع، الرعاية الصحية، التجزئة، الخدمات المصرفية والمالية والتأمين، التعليم، وغيرها)، قناة المبيعات (مباشرة وغير مباشرة)

|

الدول المغطاة

|

ألمانيا، فرنسا، المملكة المتحدة، إيطاليا، إسبانيا، روسيا، تركيا، بلجيكا، هولندا، النرويج، فنلندا، سويسرا، الدنمارك، السويد، بولندا، وبقية أوروبا

|

الجهات الفاعلة في السوق المغطاة

|

شنايدر إلكتريك (فرنسا)، شركة جنرال إلكتريك (الولايات المتحدة)، شركة باندويت (الولايات المتحدة)، إيه بي بي (سويسرا)، إيه إي جي (هولندا)، دلتا إلكترونيكس (تايوان)، إيتون (أيرلندا)، شركة ميتسوبيشي إلكتريك (اليابان)، سيمنز (ألمانيا)، شركة فيرتيف جروب (الولايات المتحدة)، شركة توشيبا الدولية (ألمانيا)، نوردن (الولايات المتحدة)، لانغلي هولدينجز بي إل سي (المملكة المتحدة)، شركة شينزين كستار للعلوم والتكنولوجيا المحدودة (الولايات المتحدة)، آر بي إس سبا - عضو في مجموعة رييلو إلكترونيكا (اليابان)، ليجراند (اليابان)، سوكوميك (الولايات المتحدة)، سايبر باور سيستمز (الولايات المتحدة)، فورترون سورس جي إم بي إتش (مجموعة إف إس بي) (سويسرا)، وهواوي ديجيتال باور تكنولوجيز المحدودة (اليابان)، من بين شركات أخرى.

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى رؤى السوق مثل القيمة السوقية ومعدل النمو وشرائح السوق والتغطية الجغرافية والجهات الفاعلة في السوق وسيناريو السوق، فإن تقرير السوق الذي أعده فريق أبحاث سوق Data Bridge يتضمن تحليلًا متعمقًا من الخبراء وتحليل الاستيراد / التصدير وتحليل التسعير وتحليل استهلاك الإنتاج وتحليل المدقة.

|

تحليل القطاعات

يتم تقسيم سوق إمدادات الطاقة غير المنقطعة (UPS) في أوروبا إلى عشرة قطاعات بارزة، والتي تعتمد على المكونات وحجم المنظمة والنوع والإخراج والطوبولوجيا والتطبيق ونطاق الطاقة ومركز البيانات والقناة الرأسية والمبيعات.

- بناءً على المكونات، يُقسّم السوق إلى حلول وخدمات. ويُقسّم قطاع الحلول أيضًا حسب النوع إلى 50 كيلو فولت أمبير فأقل، و51-100 كيلو فولت أمبير، و101-250 كيلو فولت أمبير، و251-500 كيلو فولت أمبير، و501 كيلو فولت أمبير فأكثر. ويُقسّم قطاع الخدمات أيضًا حسب النوع إلى الدعم والصيانة، والتكامل والتنفيذ، والتدريب والتعليم والاستشارات.

في عام 2024، من المتوقع أن يهيمن قطاع الحلول على السوق

ومن المتوقع أن تهيمن شريحة الحلول على السوق في عام 2024 بحصة سوقية تبلغ 74.12% بسبب الطلب على الحزم الشاملة التي تدمج البرامج والخدمات والأجهزة، مما يضمن حلول النسخ الاحتياطي للطاقة الموثوقة والمصممة لتلبية احتياجات المستهلكين المتنوعة.

- على أساس حجم المنظمة، يتم تقسيم السوق إلى مؤسسة كبيرة، ومؤسسة متوسطة، ومؤسسة صغيرة.

في عام 2024، من المتوقع أن يهيمن قطاع المؤسسات الكبيرة على السوق

من المتوقع أن تهيمن شريحة المؤسسات الكبيرة على السوق في عام 2024 بحصة سوقية تبلغ 56.47%، ويرجع ذلك إلى الهيمنة المتزايدة على الكفاءة وقابلية التوسع والمرونة في أنظمة إدارة الطاقة عبر الصناعات، مما يعزز تفضيل حلول UPS المتكاملة.

- بناءً على النوع، يُقسّم السوق إلى: عبر الإنترنت، وخارجه، وتفاعلي. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع الإنترنت على السوق بحصة سوقية تبلغ ٤١.٠٧٪.

- بناءً على الإنتاج، يُقسّم السوق إلى تيار متردد إلى تيار متردد، وتيار مستمر إلى تيار مستمر، وتيار متردد إلى تيار مستمر. ويُقسّم التيار المتردد إلى تيار متردد أيضًا حسب النوع إلى ثلاثي الطور وأحادي الطور. ويُقسّم ثلاثي الطور أيضًا بناءً على نطاق القدرة إلى أعلى من 480 فولت، و240-480 فولت، وأقل من 240 فولت. ويُقسّم أحادي الطور أيضًا بناءً على القدرة إلى 5-10 كيلو فولت أمبير، وأقل من 5 كيلو فولت أمبير، وأعلى من 10 كيلو فولت أمبير. ومن المتوقع أن يهيمن قطاع التيار المتردد إلى تيار متردد على السوق بحصة سوقية تبلغ 40.94% في عام 2024.

- بناءً على الطوبولوجيا، يُقسّم السوق إلى تفاعلي خطي وحامل. في عام ٢٠٢٤، من المتوقع أن يهيمن قطاع التفاعل الخطي على السوق بحصة سوقية تبلغ ٥٨.٠٦٪.

- بناءً على التطبيق، يُقسّم السوق إلى قطاعات النقل الصناعي، والأغذية المُصنّعة، والطاقة الكهرومائية، والطاقة الحرارية الأرضية، والصوبات الزراعية، والتحكم في المناخ، والخلاطات، والقطع، وغيرها. في عام ٢٠٢٤، من المتوقع أن يُهيمن قطاع النقل الصناعي على السوق بحصة سوقية تبلغ ٢١.٠٠٪.

- بناءً على نطاق القدرة، يُقسّم السوق إلى فئات 500-1200 كيلو فولت أمبير، و200-500 كيلو فولت أمبير، و20-200 كيلو فولت أمبير، و1200-1500 كيلو فولت أمبير، وأقل من 20 كيلو فولت أمبير. في عام 2024، من المتوقع أن تهيمن فئة 500-1200 كيلو فولت أمبير على السوق بحصة سوقية تبلغ 31.53%.

- بناءً على مراكز البيانات، يُقسّم السوق إلى سحابية، وتشاركية، ومؤسسية، وحافة، وغيرها. في عام 2024، من المتوقع أن يهيمن قطاع السحابة على السوق بحصة سوقية تبلغ 37.06%.

- بناءً على القطاعات، تم تقسيم السوق إلى قطاعات حكومية وعامة، وتكنولوجيا المعلومات ومراكز البيانات، وقطاعات سكنية، وقطاعات الطاقة والمرافق، والاتصالات، والتصنيع، والرعاية الصحية، وتجارة التجزئة، وقطاعات الخدمات المصرفية والمالية والتأمين، والتعليم، وغيرها. وتُقسّم كل قطاع، باستثناء القطاعات الأخرى، بناءً على مكوناته إلى حلول وخدمات. ومن المتوقع أن يهيمن قطاع الحكومة والقطاع العام على السوق بحصة سوقية تبلغ 16.49% في عام 2024.

- بناءً على قنوات البيع، تم تقسيم السوق إلى مباشر وغير مباشر. أما القطاع غير المباشر، فقد تم تقسيمه بشكل أكبر بناءً على النوع إلى موزع/تاجر جملة، ومتجر متخصص، وغيرها. ومن المتوقع أن يهيمن القطاع المباشر على السوق بحصة سوقية تبلغ 65.87% في عام 2024.

اللاعبون الرئيسيون

قامت شركة Data Bridge Market Research بتحليل شركات Legrand (اليابان)، وFortron Source GmbH (FSP GROUP) (سويسرا)، وSiemens (ألمانيا)، وHuawei Digital Power Technologies Co., Ltd. (اليابان)، وGeneral Electric Company (الولايات المتحدة) باعتبارها الشركات الرئيسية العاملة في سوق إمدادات الطاقة غير المنقطعة (UPS) في أوروبا.

تطوير السوق

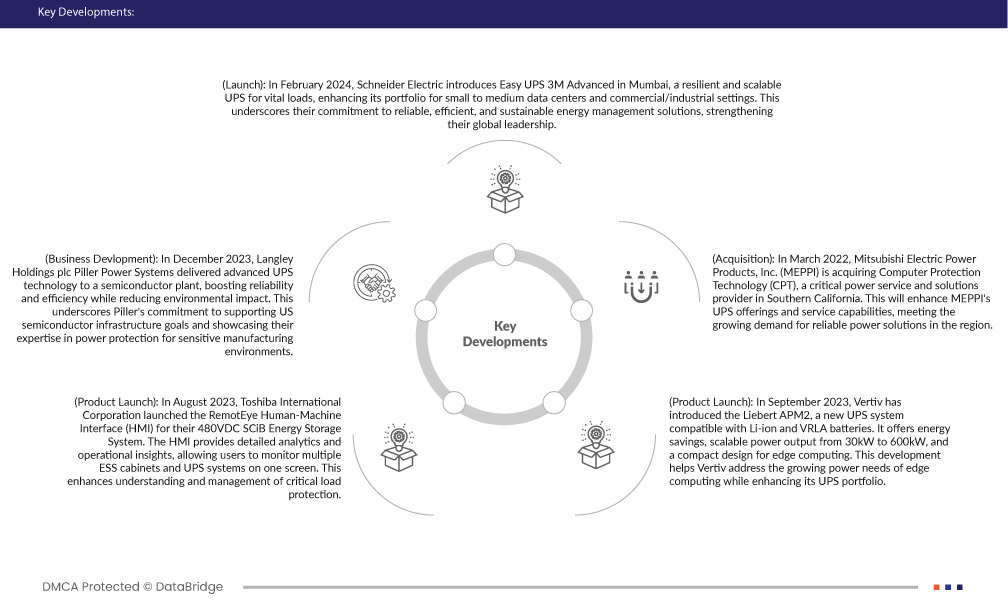

- في فبراير 2024، أطلقت شنايدر إلكتريك نظام Easy UPS 3M Advanced في مومباي، وهو نظام UPS مرن وقابل للتوسع للأحمال الحيوية، مما يعزز محفظتها لمراكز البيانات الصغيرة والمتوسطة والبيئات التجارية/الصناعية. ويؤكد هذا التزامها بحلول إدارة طاقة موثوقة وفعالة ومستدامة، مما يعزز ريادتها العالمية.

- في ديسمبر 2023، زوّدت شركة لانغلي هولدينغز بي إل سي بيلر باور سيستمز مصنع أشباه الموصلات بتكنولوجيا متطورة لأنظمة الطاقة غير المنقطعة (UPS)، مما عزز الموثوقية والكفاءة مع الحد من الأثر البيئي. ويؤكد هذا التزام بيلر بدعم أهداف البنية التحتية لأشباه الموصلات في الولايات المتحدة، وإبراز خبرتها في مجال حماية الطاقة في بيئات التصنيع الحساسة.

- في أغسطس 2023، أطلقت شركة توشيبا العالمية واجهة التحكم البشري والآلي (HMI) من RemotEye لنظام تخزين الطاقة SCiB بجهد 480 فولت تيار مستمر. توفر واجهة التحكم البشري والآلي تحليلات مفصلة ورؤى تشغيلية، مما يسمح للمستخدمين بمراقبة عدة خزانات تخزين طاقة وأنظمة UPS على شاشة واحدة. يُعزز هذا فهم وإدارة حماية الأحمال الحرجة.

- في سبتمبر 2023، طرحت شركة Vertiv نظام Liebert APM2، وهو نظام جديد لإمدادات الطاقة غير المنقطعة (UPS) متوافق مع بطاريات Li-ion وVRLA. يوفر هذا النظام توفيرًا في الطاقة، وقابليةً لتوسيع نطاق إنتاج الطاقة من 30 كيلوواط إلى 600 كيلوواط، وتصميمًا مدمجًا للحوسبة الطرفية. يُساعد هذا التطوير شركة Vertiv على تلبية احتياجات الطاقة المتزايدة للحوسبة الطرفية، مع تعزيز محفظة منتجاتها من أنظمة الإمداد غير المنقطعة.

- في مارس 2022، استحوذت شركة ميتسوبيشي إلكتريك باور برودكتس (MEPPI) على شركة تكنولوجيا حماية الحاسوب (CPT)، وهي شركة متخصصة في توفير خدمات وحلول الطاقة الحيوية في جنوب كاليفورنيا. سيعزز هذا من عروض MEPPI وقدراتها في مجال أنظمة UPS، مما يلبي الطلب المتزايد على حلول الطاقة الموثوقة في المنطقة.

التحليل الإقليمي

من الناحية الجغرافية، البلدان التي يغطيها تقرير سوق مدير البنية التحتية الافتراضية العالمية هي ألمانيا وفرنسا والمملكة المتحدة وإيطاليا وإسبانيا وروسيا وتركيا وبلجيكا وهولندا والنرويج وفنلندا وسويسرا والدنمارك والسويد وبولندا وبقية أوروبا.

وفقًا لتحليل Data Bridge Market Research:

من المتوقع أن تهيمن أوروبا وتصبح أسرع منطقة نموًا في سوق إمدادات الطاقة غير المنقطعة (UPS) في أوروبا

من المتوقع أن تهيمن ألمانيا على سوق أنظمة الطاقة غير المنقطعة (UPS) في أوروبا بفضل براعتها الهندسية المتينة وسمعتها المرموقة في الموثوقية، مما يجعل حلولها من أنظمة الطاقة غير المنقطعة مطلوبة بشدة في مختلف القطاعات. علاوة على ذلك، يتماشى تركيز ألمانيا على الابتكار والتزامها بالاستدامة مع الاحتياجات المتطورة للسوق، مما يعزز مكانتها الريادية.

لمزيد من المعلومات التفصيلية حول تقرير سوق إمدادات الطاقة غير المنقطعة (UPS) في أوروبا، انقر هنا - https://www.databridgemarketresearch.com/reports/europe-uninterruptible-power-supply-ups-market