Europe Uninterruptible Power Supply Ups Market

Market Size in USD Billion

CAGR :

%

USD

2.50 Billion

USD

3.98 Billion

2024

2032

USD

2.50 Billion

USD

3.98 Billion

2024

2032

| 2025 –2032 | |

| USD 2.50 Billion | |

| USD 3.98 Billion | |

|

|

|

|

Uninterruptible Power Supply (UPS) Market Size

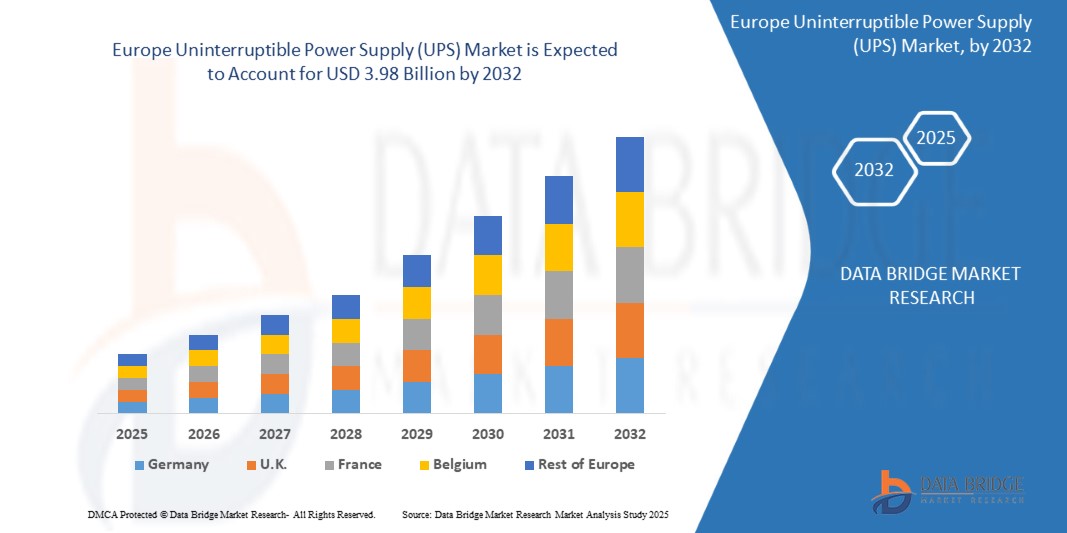

- The Europe Uninterruptible Power Supply (UPS) Market size was valued at USD 2.50 billion in 2024 and is expected to reach USD 3.98 billion by 2032, at a CAGR of 6.1% during the forecast period

- The Europe Uninterruptible Power Supply (UPS) market is undergoing significant growth, driven by increasing demand for continuous power across critical sectors such as healthcare, manufacturing, transportation, and commercial infrastructure

- With the rise in digital transformation, smart grid deployment, and expanding data consumption, the need for reliable and energy-efficient power backup systems has become essential

Uninterruptible Power Supply (UPS) Market Analysis

- An Uninterruptible Power Supply (UPS), also known as a battery backup, provides backup power when the regular power source fails or power range drops to an unacceptable level. A UPS allows for the safe, orderly shutdown of a computer and connected equipment. The size and design of a UPS determine how long it will supply power

- A UPS contains a battery that "kicks in" when the device senses a loss of power from the primary source. If an end user is working on the computer when the UPS notifies of the power loss, they have time to save any data they are working on, and exit before the secondary power source (the battery) runs out. When all power runs out, any data in the computer's Random-Access Memory (RAM) is erased. When power surges occur, a UPS intercepts the surge so that it does not damage the computer

- Germany dominated the market with the share of 19.88% in 2024. due to its robust engineering prowess and reputation for reliability, making its UPS solutions highly sought-after across industries. In addition, Germany's focus on innovation and commitment to sustainability align with the evolving needs of the market, further solidifying its leadership position

- Germany is expected to witness the highest compound annual growth rate (CAGR) in the Uninterruptible Power Supply (UPS) Market during the forecast period, due to its strong engineering legacy, exceptional product reliability, and commitment to innovation and sustainability.

- Solutions segment dominated the Uninterruptible Power Supply (UPS) Market with a market share of 75.55% in 2024, due to the solution offerings include installation, maintenance, and technical support services

Report Scope and Uninterruptible Power Supply (UPS) Market Segmentation

|

Attributes |

Uninterruptable Power Supply (UPS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Uninterruptible Power Supply (UPS) Market Trends

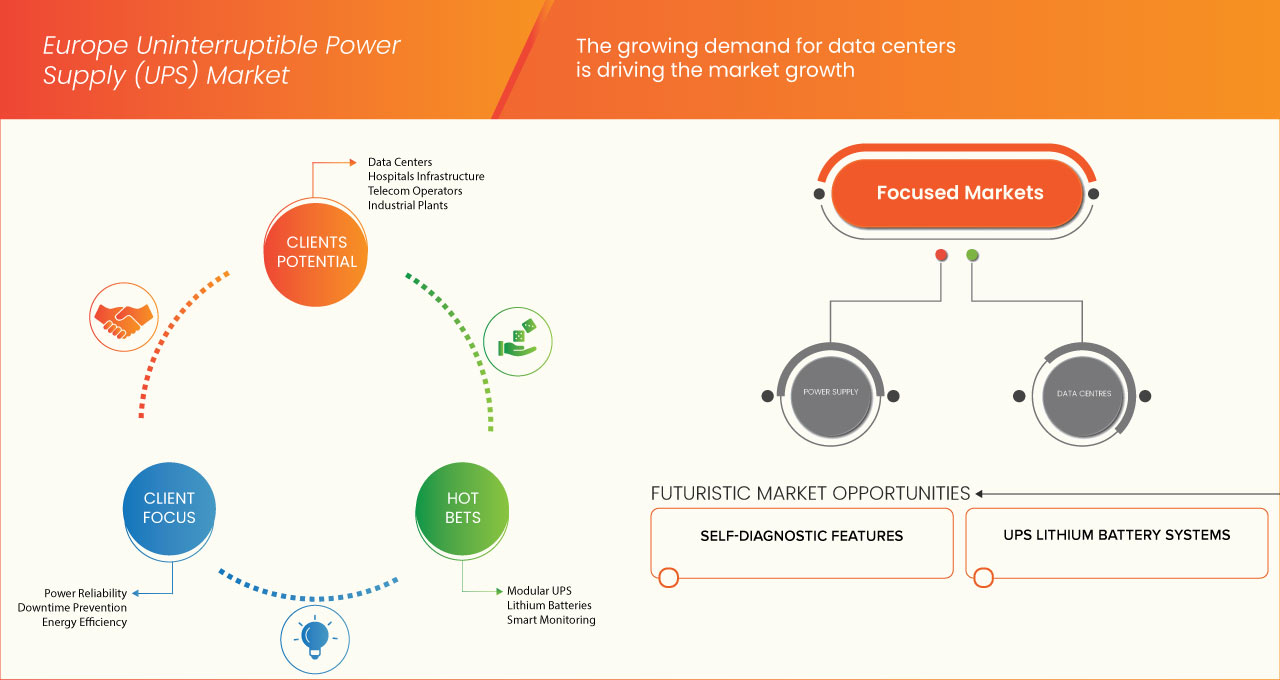

The Growing Demand For Data Centers

- In Europe, the relentless surge in digitalization is driving an unprecedented expansion in data center infrastructure. From major cities such as Frankfurt, London, and Amsterdam to emerging edge locations across Central and Eastern Europe, the need for robust data storage and processing capabilities has become mission-critical. This surge is fueled by the rapid growth of cloud computing, AI workloads, IoT adoption, and e-commerce, which are reshaping how businesses and consumers interact with digital services.

- With the increasing power density requirements of edge computing and AI-based workloads, modern data centers are shifting toward modular, lithium-ion-based UPS architectures to enhance flexibility, reduce space consumption, and support long-term operational resilience. This structural transformation places UPS systems at the core of data center design, making them indispensable for the region’s digital future.

- For instance, in February 2025, as reported by Reuters, Europe is set to witness a record 937 MW of new data center capacity rollout, marking the largest annual increase in its history. Key cities including Frankfurt, London, Amsterdam, Paris, and Dublin are leading this surge, driven by the growing demand for cloud computing, AI workloads, and edge services. This rapid expansion is placing significant pressure on energy infrastructure and accelerating the need for high-performance UPS systems to ensure uninterrupted power and operational continuity across Europe’s increasingly power-dense data environments, both inland and offshore—cutting losses and stabilizing the grid across regions

Uninterruptible Power Supply (UPS) Market Dynamics

Driver

Rising Demand for Energy Efficiency in Data Center

- These advancements in digital infrastructure—characterized by massive data generation, rising adoption of AI and cloud computing, and decentralization of computing—are significantly fueling demand for robust and efficient UPS systems across Europe. Leading UPS manufacturers are actively developing advanced, modular, lithium-ion-based solutions that can seamlessly scale with high-density data center environments while maintaining uptime and power quality. As Europe continues to invest in new data center capacity, edge nodes, and sustainable IT infrastructure, UPS systems are emerging as foundational assets, ensuring operational continuity and energy resilience, which further propels the growth of the European UPS market.

- Across Europe, the rapid acceleration of digitalization has triggered an extraordinary surge in demand for data centers. Whether in densely populated cities or remote rural areas, the need for reliable and efficient data storage and processing infrastructure has become essential. The widespread adoption of cloud computing drives this rising demand, the Internet of Things (IoT), e-commerce expansion, and the overall growth of the digital economy. As both businesses and consumers increasingly rely on data-heavy applications and services, the pressure on data centers to deliver continuous, uninterrupted operations has never been greater.

- For instance, In June 2025, as reported by Reuters, Europe is experiencing a substantial shift in data center development, with electrical grid constraints in traditional hubs compelling operators to diversify locations. The Ember think-tank warns that nearly 50% of Europe's data center capacity may relocate outside established markets—Frankfurt, London, Amsterdam, Paris, and Dublin—by 2035, as power-hungry AI and edge computing demands strain existing UPS-backed infrastructure

Restraint/Challenge

Malfunctions In Uninterruptible Power Supply Systems

- Uninterruptible Power Supply (UPS) systems are designed to provide a seamless bridge during power disruptions, but they are not immune to failure—especially when overlooked or improperly maintained. One of the most common causes of UPS malfunction is battery degradation. Most UPS systems rely on VRLA (Valve-Regulated Lead-Acid) or lithium-ion batteries, which naturally wear out over time, especially when exposed to high temperatures, deep discharges, or poor ventilation.

- In addition to battery issues, dust accumulation and overheating pose serious risks. Internal components, such as capacitors, fans, and transformers, can overheat if airflow is blocked or cooling systems fail, leading to sudden shutdowns or even hardware damage. Research from Hatch Power and Jinnuo Global notes that capacitor aging, especially after 5–7 years of continuous use, is a leading cause of electrical instability in UPS units.

- Modern UPS systems often include software monitoring tools; however, these can also fail due to outdated firmware, communication errors, or misconfigurations. When monitoring systems go silent, critical warning signs, such as battery health or temperature spikes, may be missed until it’s too late. Furthermore, human error— such as poor installation, neglecting firmware updates, or using the wrong type of replacement parts—remains a significant contributor to UPS malfunctions.

- For instance, In June 2023, according to blog published by SkyRadar, power source errors stemming from UPS (Uninterruptible Power Supply) malfunctions plagued the Europe Uninterruptible Power Supply (UPS) market. These issues, including battery failures, faulty components, improper maintenance, or inadequate capacity, disrupted power supply, impacting critical equipment. Despite the UPS's role in ensuring continuous electrical supply during outages, such errors led to significant operational challenges. Economic uncertainties, high initial costs, and regulatory hurdles further hindered market growth

Uninterruptible Power Supply (UPS) Market Scope

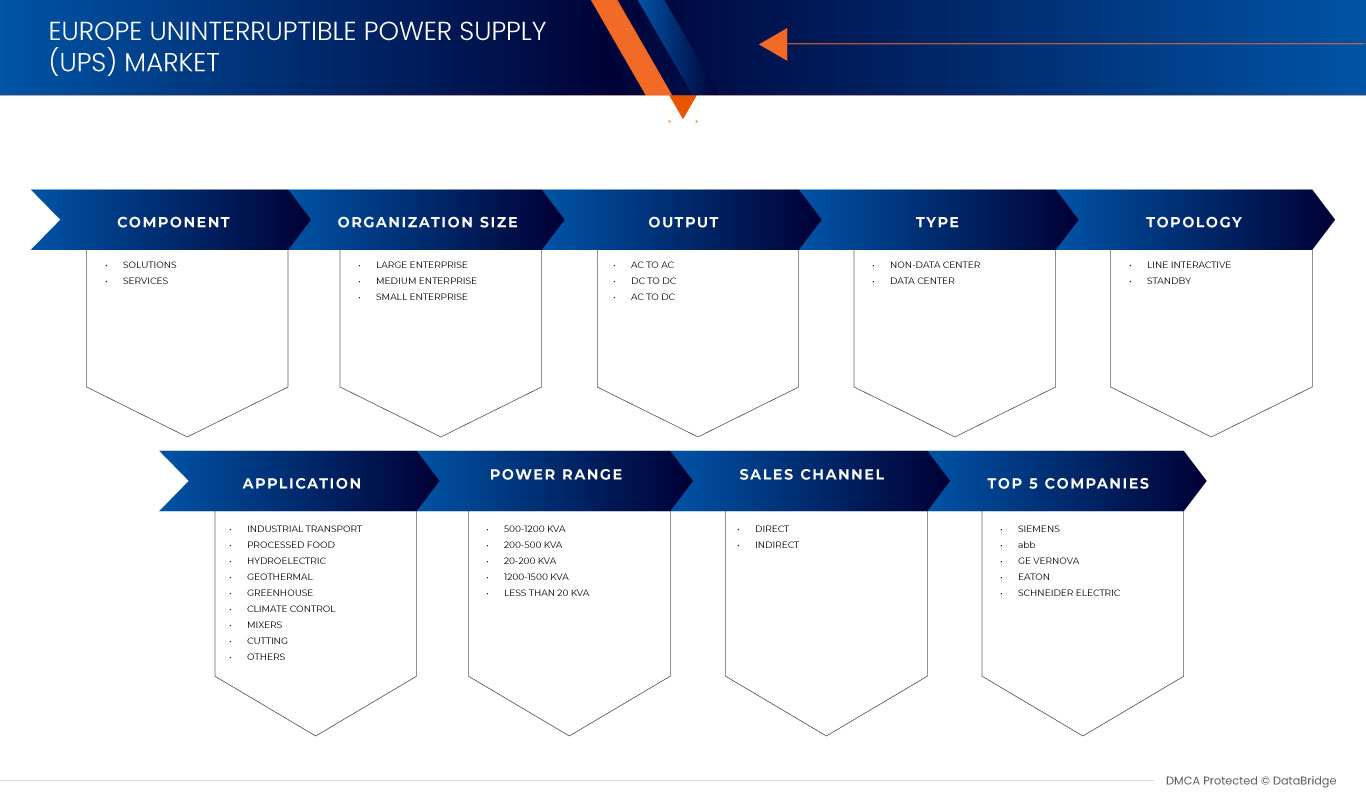

The Europe Uninterruptible Power Supply (UPS) market is segmented into eight notable segments based on components, organization size, type, output, topology, application, power range, and sales channel.

- By Components

On the basis of components, the Europe Uninterruptible Power Supply (UPS) market is segmented into solutions and services. In 2025, the solutions segment is expected to dominate the market with share of 75.62% and is expected to grow with highest CAGR during the forecast period, due to the solution offerings include installation, maintenance, and technical support services. These services ensure optimal UPS performance and longevity, helping businesses minimize downtime, enhance energy efficiency, and comply with industry regulations across various operational environments.

- By Organization Size

On the basis of organization size, the Europe Uninterruptible Power Supply (UPS) market is segmented into large enterprise, medium enterprise, and small enterprise. In 2025, the large enterprise segment is expected to dominate the market with share of 55.16% and is expected to grow with highest CAGR during the forecast period due to their substantial financial resources and expansive infrastructure, enabling them to invest in robust UPS solutions tailored to their complex operational needs, ensuring uninterrupted power supply and business continuity.

- By Output

On the basis of output, the Europe Uninterruptible Power Supply (UPS) market is segmented into AC to AC, DC to DC, and AC to DC. AC to AC is further sub-segmented by type into three phase and single phase. In 2025, AC to AC segment is expected to dominate the market with share 42.76% and is expected to grow with highest CAGR during the forecast period, due to their efficient conversion of AC power, ensuring seamless and stable output, essential for sensitive electronic devices, thus offering superior reliability and performance.

- By Type

On the basis of type, the Europe Uninterruptible Power Supply (UPS) market is segmented into non-data center and data center. In 2025, the non-data center segment is expected to dominate the market with share 64.16% due to its healthcare, manufacturing, transportation, and commercial buildings. These sectors demand reliable power protection to maintain continuous operations, protect sensitive equipment, and prevent disruptions caused by voltage fluctuations or unexpected outages.

Data Center is expected to grow with highest CAGR during the forecast period. This growth is primarily driven by the rapid expansion of cloud computing, increasing data traffic, and the rising number of hyperscale and colocation facilities. As uninterrupted power is critical for data centers, demand for reliable and scalable UPS solutions continues to rise.

- By Topology

On the basis of topology, the Europe Uninterruptible Power Supply (UPS) market is segmented into line interactive and standby. In 2025, the line interactive segment is expected to dominate the market with share 58.54% and is expected to grow with highest CAGR during the forecast period due to its cost-efficiency and reliable performance in moderate power environments. They provide automatic voltage regulation, ideal for small businesses and office applications requiring protection from power surges, sags, and short-term outages.

- By Application

On the basis of application, the Europe Uninterruptible Power Supply (UPS) market is segmented into industrial transport, processed food, hydroelectric, geothermal, greenhouse, climate control, mixers, cutting, and others. In 2025, the industrial transport segment is expected to dominate the market with share 21.57% and is expected to grow with highest CAGR during the forecast period. due to its critical reliance on continuous power for operations, making UPS systems indispensable for maintaining productivity and safety across railways, airports, and logistics hubs. The sector's robust demand stems from the imperative to prevent power disruptions, ensuring seamless operations and safeguarding against potential losses.

- By Power Range

On the basis of power range, the Europe Uninterruptible Power Supply (UPS) market is segmented into 500-1200 KVA, 200-500 KVA, 20-200 KVA, 1200-1500 KVA, and less than 20 KVA. In 2025, the 500-1200 KVA segment is expected to dominate the market with share 28.58% and is expected to grow with highest CAGR during the forecast period, due to its optimal balance between power capacity and scalability, meeting the diverse needs of businesses while ensuring efficient energy utilization and cost-effectiveness. Its robust performance and versatility make it the preferred choice for safeguarding critical operations across various industries.

- By Sales Channel

On the basis of sales channel, the Europe Uninterruptible Power Supply (UPS) market has been segmented into direct and indirect. In 2025, direct segment is expected to dominate the market with share 65.17% and is expected to grow with highest CAGR during the forecast period due to streamlined communication and tailored solutions, fostering stronger client relationships and swift problem resolution, thus driving higher sales volumes.

Uninterruptible Power Supply (UPS) Market Regional Analysis

- Germany is expected to dominate the UPS (Uninterruptible Power Supply) with market share 19.88% due to its strong engineering legacy, exceptional product reliability, and commitment to innovation and sustainability. Renowned for precision manufacturing and industrial efficiency, German-made UPS systems are highly sought-after across sectors such as healthcare, manufacturing, and data centers where power reliability is critical

- The country’s significant investment in research and development fosters advanced, energy-efficient technologies that align with modern trends such as smart grid integration and renewable energy support. Moreover, Germany’s national focus on sustainability further strengthens its market position by driving the development of eco-friendly UPS solutions

- Combined with its central location and strong export capabilities within Europe, Germany’s strategic advantages make it a key leader in shaping the future of the UPS industry

Uninterruptible Power Supply (UPS) Market Share

The Uninterruptable Power Supply (UPS) industry is primarily led by well-established companies, including:

- Siemens (Germany)

- ABB (Swizerland)

- GE Vernova (U.S.)

- Toshiba Energy Systems & Solutions Corporation (Japan)

- Mitsubishi Electric Corporation (Japan)

- Schneider Electric (France)

- Delta electronics, Inc. (Taiwan)

- Panduit Corp. (U.S.)

- AEG (Canada)

- Eaton (Ireland)

- Vertiv Group Corp. (U.S.)

- Norden (Denmark)

- Langley Holdings plc (U.K.)

- Shenzhen Kstar Science&Technology Co.,Ltd (China)

- RPS Spa (Europe)

- Legrand (France)

- SOCOMEC (France)

- Cyber Power Systems (USA), Inc. (U.S.)

- FSP GROUP (Taiwan)

- Huawei Digital Power Technologies Co., Ltd. (Taiwan)

Latest Developments in Europe Uninterruptible Power Supply (UPS) Market

- In April 2024, according to a press release by Schneider Electric, the company launched the new Galaxy VL 3-phase UPS with lithium-ion battery modules and Live Swap capability. Designed for edge, small, and medium data centers, the UPS delivers up to 99% efficiency in ECOnversion mode and supports energy storage integration, advancing sustainability goals and reducing total cost of ownership in Europe

- In March 2024, Eaton expanded its EnergyAware UPS range across Europe, enabling industrial and commercial customers to participate in energy markets. These systems support grid-balancing services by storing and discharging energy, aligning with Europe’s growing emphasis on renewable energy stability and decentralized energy systems

- In February 2024, Vertiv introduced the Liebert EXL S1 UPS with Dynamic Online mode for the European market, reducing energy losses by up to 30% while maintaining constant power quality. The solution is tailored for large-scale facilities such as colocation centers, offering higher efficiency and smaller footprint in compliance with EU energy regulations

- In December 2023, Delta Electronics showcased its Modular UPS series at the Data Centre World event in Frankfurt, Germany. The system, designed for scalable deployment, supports critical infrastructure by offering hot-swappable modules and high power density, meeting the increasing demand for flexible backup in European data centers

- In October 2023, Huawei launched its SmartLi UPS solution across key European markets, including Germany and the UK. The system features advanced lithium-ion batteries and AI-based energy management to optimize performance, extend battery life, and reduce maintenance needs for telecommunications and cloud service providers

- In January 2021, according to an article published by Delta Power Solutions, Delta Electronics introduced the Ultron DPS UPS model, boasting superior reliability and power density for mega-scale data centers, with capacities ranging from 300 to 1200 kVA. This addition expands the UPS family offerings. Rated at 1000-1200 kVA, it features a compact footprint, catering to large and colocation data centers' needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.