Os revestimentos de baixa fricção melhoram o desempenho e a vida útil, ao mesmo tempo que minimizam a necessidade de lubrificantes húmidos em circunstâncias de trabalho que exijam resistência ao calor, aos produtos químicos ou às condições de sala limpa. Os revestimentos de baixo atrito reduzem a probabilidade de as partículas se agarrarem e serem recolhidas da superfície do balcão, resultando num menor tempo de limpeza. Como resultado, os compostos antiadesivos podem ser utilizados menos frequentemente durante o desenvolvimento de programas de ferramentas. Os revestimentos de baixo atrito têm-se tornado cada vez mais populares nos últimos anos para melhorar as qualidades de superfície, como a molhabilidade, a resistência à corrosão, a aderência e a resistência ao desgaste.

Prevê-se que o mercado global de revestimentos antifricção atinja os 1.569.387,00 mil dólares até 2028, face aos 894.725,60 mil dólares de 2020, com um CAGR de 7,9% no período previsto de 2021 a 2028. Devido ao seu potencial para melhorar as qualidades de superfície, como a molhabilidade, a resistência à corrosão, a adesão e a resistência ao desgaste, os revestimentos de baixo atrito tornaram-se cada vez mais populares nos últimos anos. Espera-se que a crescente utilização de revestimentos de baixo atrito em diversos setores impulsione a expansão do mercado num futuro próximo. Além disso, os fabricantes de revestimentos de baixo atrito estão a desenvolver novas soluções para satisfazer a crescente necessidade de produtos para aplicações específicas. À medida que as restrições ambientais à utilização de lubrificantes se tornam mais rigorosas e os custos de eliminação aumentam, os revestimentos de película fina de baixo atrito, que permitem que as superfícies se esfreguem umas nas outras com menos atrito e desgaste, estão a tornar-se mais populares.

A crescente procura por aplicações industriais impulsionará a taxa de crescimento do mercado

Os revestimentos antifricção são um tipo de solução lubrificante cuja formulação é semelhante à das tintas industriais comuns. É composto por lubrificantes sólidos e resinas como solventes. Os principais componentes dos lubrificantes sólidos são o dissulfeto de molibdénio, o politetrafluoretileno (PTFE) e a grafite. Estes revestimentos também são utilizados como lubrificantes secos na indústria automóvel. Isto está a impulsionar o crescimento do mercado. O aumento dos gastos dos agentes públicos e privados no desenvolvimento de infraestruturas promoverá também a taxa de crescimento do mercado. A investigação e o desenvolvimento contínuos relativos à implantação de tecnologias avançadas irão alargar novamente o âmbito de crescimento.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2021 a 2028

|

Ano base

|

2020

|

Anos Históricos

|

2019 (personalizável para 2013 - 2018)

|

Unidades quantitativas

|

Receita em mil dólares americanos, volumes em unidades, preços em dólares americanos

|

Segmentos abrangidos

|

Produto (MOS2, PTFE, grafite, FEP, PFA e dissulfeto de tungsténio) Natureza (à base de solvente e à base de água) Aplicação (peças automóveis, artigos de transmissão de energia, rolamentos, componentes de munições, componentes de válvulas e atuadores e outros) Utilização final (automóvel, aeroespacial, marítimo, construção, saúde e outros)

|

Países abrangidos

|

EUA, Canadá e México na América do Norte, Alemanha, França, Reino Unido, Holanda, Suíça, Bélgica, Rússia, Itália, Espanha, Turquia, Resto da Europa na Europa, China, Japão, Índia, Coreia do Sul, Singapura, Malásia, Austrália, Tailândia, Indonésia, Filipinas, Resto da Ásia-Pacífico (APAC) na Ásia-Pacífico (APAC), Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Israel, Resto do Médio Oriente e África (MEA) como parte do Médio Oriente e África (MEA), Brasil, Argentina e Resto da América do Sul como parte da América do Sul.

|

Participantes do mercado abrangidos

|

DuPont (EUA), Parker Hannifin Corp (EUA), CARL BECHEM GMBH (EUA), ASV Mutichemie Private Limited (Índia), Whitmore Manufacturing LLC. (Alemanha) entre outros.

|

Pontos de dados abordados no relatório

|

Além de insights de mercado, tais como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipa de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, epidemiologia de pacientes, análise de pipeline, análise de preços e estrutura regulamentar.

|

Análise de Segmentos:

O mercado global de revestimentos antifricção está segmentado em quatro segmentos notáveis que se baseiam no produto, natureza, aplicação e utilização final no mercado.

- Com base no produto, o mercado global de revestimentos antifricção está segmentado em MOS2, PTFE, grafite, FEP, PFA e SIDULFIDE DE TUNGSTÉNIO. Em 2021, prevê-se que o segmento MOS2 domine o mercado global de revestimentos antifricção, com 24,67% de quota de mercado, devido ao aumento da utilização de revestimentos MOS2 no setor automóvel, como revestimentos para peças internas de motores. Na Ásia-Pacífico, a procura de revestimentos à base de MOS2 é maior na China e na Índia devido à crescente utilização destes revestimentos no setor automóvel como óleos lubrificantes.

- Com base na natureza dos revestimentos, o mercado global de revestimentos antifricção está segmentado em à base de solventes e à base de água. Em 2021, prevê-se que o segmento à base de solventes domine o mercado global de revestimentos antifricção, com 74,99% do mercado, devido ao aumento da utilização industrial de revestimentos à base de solventes nos setores aeroespacial e de tecnologia alimentar. Na Ásia-Pacífico, a procura de revestimentos à base de solventes está a aumentar na China e na Índia, uma vez que a utilização destes revestimentos é elevada no setor automóvel da região.

O segmento à base de solventes dominará o segmento de revestimentos do mercado de revestimentos

O segmento à base de solventes emergirá como o segmento dominante em termos de revestimentos em 2021. Isto deve-se ao crescente número de concursos diretos no mercado, especialmente nas economias em desenvolvimento. Além disso, o crescimento e a expansão das indústrias de utilizadores finais em todo o mundo impulsionarão ainda mais o crescimento deste segmento.

- Com base na aplicação, o mercado global de revestimentos antifricção está segmentado em peças automóveis, artigos de transmissão de energia, rolamentos, componentes de munições, componentes de válvulas e atuadores, entre outros. Em 2021, prevê-se que o segmento de peças automóveis domine o mercado global de revestimentos antifricção com 36,81% de quota de mercado devido à crescente aplicação de revestimentos antifricção na indústria automóvel para evitar a corrosão, o ruído, a lubrificação a seco e. O segmento automóvel da Ásia-Pacífico domina na China e na Índia devido à crescente utilização de revestimentos antifricção na indústria automóvel.

- Com base no utilizador final, o mercado global de revestimentos antifricção pode ser segmentado em automóvel, aeroespacial, marítimo, construção, saúde e outros. Em 2021, prevê-se que o segmento automóvel domine o mercado global de revestimentos antifricção, com 34,98% de quota de mercado, devido ao aumento da utilização de revestimentos antifricção para reduzir o ruído e a vibração nos veículos. Na Ásia-Pacífico, a procura por revestimentos antifricção é cada vez mais consistente no segmento automóvel, uma vez que estes revestimentos são utilizados como revestimentos protetores em peças de substituição automóveis. Na Europa, a procura por revestimentos antifricção está a aumentar no segmento automóvel, uma vez que os revestimentos antifricção são utilizados na produção de veículos elétricos na região.

O segmento automóvel dominará o segmento de utilizadores finais do mercado de luvas de proteção

O setor automóvel emergirá como o segmento dominante no canal de distribuição em 2021, com aproximadamente 35% de quota de mercado. Isto deve-se ao número crescente de hospitais no mercado, especialmente nas economias em desenvolvimento. Além disso, o crescimento e a expansão da indústria automóvel em todo o mundo impulsionarão ainda mais o crescimento deste segmento.

Principais jogadores

A Data Bridge Market Research reconhece as seguintes empresas como participantes no mercado de luvas de proteção: Semperit AG Holding (Áustria), Supermax Corporation Berhad. (Malásia), YTY Group. (Malásia), Arista Networks, Inc. (EUA), Kossan Rubber Industries Bhd (Malásia), JIANGSU JAYSUN GLOVE CO.,LTD (China), Bluesail Medical Co., Ltd. (China), Shandong Yuyuan Latex Gloves Co., Ltd. (China), Zhanjiang Jiali Glove Products Co.,Ltd. (China), Top Glove Corporation Bhd (Malásia), Hartalega Holdings Berhad (Malásia), Robinson Healthcare (Reino Unido), SHIELD Scientific BV (Holanda) e PAUL HARTMANN AG (Alemanha).

Desenvolvimento de Mercado

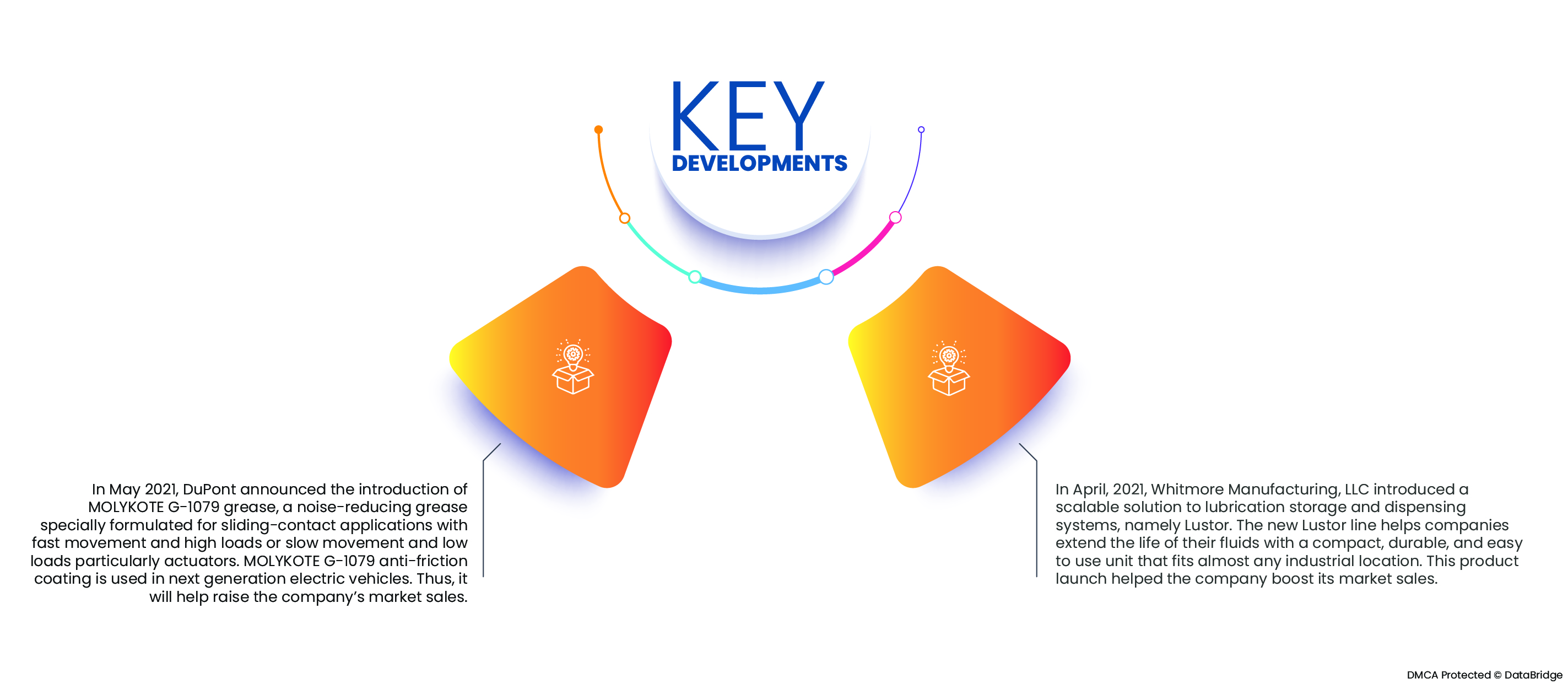

- Em maio de 2021, a DuPont anunciou o lançamento da massa lubrificante MOLYKOTE G-1079, uma massa lubrificante redutora de ruído especialmente formulada para aplicações de contacto deslizante com movimento rápido e cargas elevadas ou movimento lento e cargas baixas, especialmente atuadores. O revestimento antifricção MOLYKOTE G-1079 é utilizado em veículos elétricos de última geração. Desta forma, ajudará a aumentar as vendas da empresa no mercado.

- Em abril de 2021, a Whitmore Manufacturing, LLC introduziu uma solução escalável para sistemas de armazenamento e distribuição de lubrificação, denominada Lustor. A nova gama Lustor ajuda as empresas a prolongar a vida útil dos seus fluidos com uma unidade compacta, durável e fácil de utilizar, que se adapta a quase qualquer local industrial. O lançamento deste produto ajudou a empresa a aumentar as suas vendas no mercado.

Análise Regional

Geograficamente, os países abrangidos pelo relatório de mercado de luvas de proteção são EUA, Canadá e México na América do Norte, Alemanha, França, Reino Unido, Holanda, Suíça, Bélgica, Rússia, Itália, Espanha, Turquia, Resto da Europa na Europa, China, Japão, Índia, Coreia do Sul, Singapura, Malásia, Austrália, Tailândia, Indonésia, Filipinas, Resto da Ásia-Pacífico (APAC) na Ásia-Pacífico (APAC), Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Israel, Resto do Médio Oriente e África (MEA) como parte do Médio Oriente e África (MEA), Brasil, Argentina e Resto da América do Sul como parte da América do Sul.

De acordo com a análise de pesquisa de mercado da Data Bridge:

A Ásia-Pacífico é a região dominante no mercado de luvas de proteção durante o período previsto de 2021 a 2028

No período previsto, espera-se que a Ásia-Pacífico domine o mercado. Os revestimentos de polímero e fluoropolímero são muito procurados na região para garantir que os componentes de aço têm boas qualidades antiaderentes e deslizantes, bem como resistência ao desgaste. Os revestimentos antifricção são empregados principalmente em aplicações analíticas no setor automóvel. Construção, engenharia médica, engenharia solar, indústria do mobiliário e engenharia de energia eólica, todas utilizam este tipo de revestimento. O sector da construção civil desempenha um papel fundamental no revestimento antifricção para o desenvolvimento económico contínuo. O valor da produção da construção civil representou 25,9% do PIB da China em 2020, de acordo com o Departamento Nacional de Estatísticas, acima dos 6,2% de 2019.

Estima-se que a Europa seja a região com o crescimento mais rápido no mercado de luvas de proteção no período previsto de 2021 a 2028.

Devido à sua rápida industrialização, projecta-se que a Europa ofereça oportunidades de crescimento atractivas. A necessidade desta região de revestimentos de baixo atrito irá provavelmente aumentar à medida que a procura de revestimentos de baixo atrito crescer em sectores de utilização final, como os transportes e os automóveis. As economias desenvolvidas da Europa deverão expandir-se significativamente nos próximos anos.

Análise de Impacto da COVID-19

Durante a epidemia de COVID-19, o mercado dos revestimentos antifricção estava instável. Os revestimentos antifricção têm sido utilizados em diversos setores, incluindo petróleo e gás, automóvel, energia eólica, construção e outros. Devido à menor procura por parte do utilizador final, a produção de revestimentos antifricção diminuiu drasticamente durante a fase inicial da COVID-19. De acordo com a Associação Chinesa de Fabricantes de Automóveis, as vendas de automóveis na China caíram 11,9% em termos homólogos, para 1,86 milhões de unidades. Além disso, prevê-se que as indústrias de exploração e produção de petróleo e gás percam 1 bilião de dólares em receitas até 2020. As instalações de energia eólica nos países também diminuíram 30% em 2020 em comparação com o ano anterior.

Para obter informações mais detalhadas sobre as luvas de proteção no relatório de mercado, clique aqui – https://www.databridgemarketresearch.com/reports/global-anti-friction-coating-market