The global cargo inspection market is crucial for ensuring the safety and compliance of international trade. It covers a broad spectrum of inspection services for diverse cargo types. Inspection activities, focusing on quality, quantity, and regulatory adherence, contribute to risk mitigation and trade facilitation. With the continuous demand for oil and gas worldwide, major industry players such as PAO Novatek are entering agreements to produce and ship liquefied natural gas. Such developments underscore the importance of robust cargo inspection in facilitating the import and export of natural gas and hydrocarbon gas liquids on a global scale.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-cargo-inspection-market

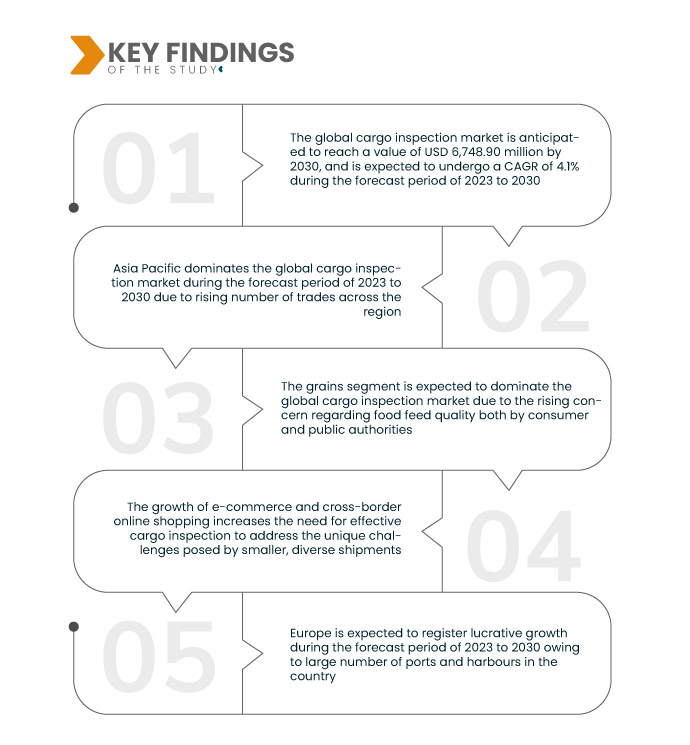

Data Bridge Market Research analyses that the Global Cargo Inspection Market which was USD 2,730.00 million in 2022, is expected to reach USD 6,748.90 million by 2030, and is expected to undergo a CAGR of 4.1% during the forecast period of 2023 to 2030. The increasing initiatives taken to reduce methane emission from gas processing, production, and transportation to protect the environment and reduce greenhouse gases therefore boosting the growth of the global cargo inspection market.

Key Findings of the Study

Increasing security concerns and regulations are expected to drive the market's growth rate

The escalating global security threats necessitate robust cargo inspection measures to effectively identify and thwart the transportation of illicit or hazardous materials across borders. Enhanced inspection technologies and procedures are crucial for detecting potential security risks, ranging from smuggling to terrorism. Governments and organizations prioritize investing in state-of-the-art cargo inspection systems to fortify border controls and safeguard international trade routes, thereby mitigating the potential threats posed by the movement of harmful or unauthorized goods.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Industry Type (Mining, Metals, Agriculture, Oil, Gas, Petrochemicals, Chemicals, Machine Manufacturing, Automotive, Medical Devices and Others), Type (LNG, LPG, Coal, Iron Ore, Grains, Fertilizers, Ro-Ro, Cruise and Others), Offering (Product, Services), Inspection Type (Bunker Quantity Surveys, Hold and Hatch Inspection Hold Survey, Draft Survey, Cargo Damage Survey, Cargo Lashing/ Handling/Logistics, Cargo Tally Verification Draft Survey, Cargo Survey, Pre-Shipment Inspection, Cargo Sampling (Oil), Cargo Measurement (Oil), Proof and Inspection of Asset, Pre-Vetting Inspection, Pre-Purchase Vessel Inspection, Vessel On/Off Hire Survey, Vessel Condition and Damage Survey, Cleanliness ISM Preparation Audit, Marine Warranty Survey Navigation Audit and Others), Technology (Non-Intrusive Inspection Technology, Non-Destructive Evaluation (NDE) Technology), Port Types (Sea Ports, Inland Ports, Dry Ports, Warm Water Ports)

|

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of the Middle East and Africa

|

|

Market Players Covered

|

SGS Group (Switzerland), Bureau Veritas SA (France), Intertek Group plc (U.K.), ALS Limited (Australia), Cotecna Inspection SA (Switzerland), Peterson & Conmtrol Union (Netherlands), SWISS APPROVAL International (Switzerland), AIM Control Group (Vietnam), Cargo Inspection Group (U.K.), Alex Stewart International (U.K.), CWM Survey & Inspection BV (Netherlands), Certispec Group (U.K.), and Cargo Inspectors and Superitendence Co. Pvt. Ltd. (India)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The global cargo inspection market is segmented into six notable segments which are based on the industry type, type, offering, inspection type, technology, and port types

- On the basis of industry type, the cargo inspection market is segmented into mining, metals, agriculture, oil, gas, petrochemicals, chemicals, machine manufacturing, automotive, medical devices, and others. The agriculture segment is expected to dominate the global cargo inspection market with a 23.53% market share due to the rise in the export and import duties for agro-commodity worldwide product

- On the basis of type, the cargo inspection market is segmented into LNG, LPG, coal, iron ore, grains, fertilizers, Ro-Ro, cruise, and others. The grains segment is expected to dominate the global cargo inspection market with 29.09% market share due to the rising concern regarding food feed quality both by consumer and public authorities

The grains segment is expected to dominate the global cargo inspection market

The grains segment is expected to dominate the global cargo inspection market with 29.09% market share due to the rising concern regarding food feed quality both by consumer and public authorities, which has made every company focus on varied factors, including health and safety, quality, environment, and others

- On the basis of offering, the cargo inspection market is segmented into product and services. Product is further sub segmented into 3D, micro, and robotic. The product segment is expected to dominate the global cargo inspection market with 53.03% market share due to continuous technological advancement in 3D scanners, robotics, and others to provide improved and accurate inspection services

- On the basis of inspection type, the cargo inspection market is segmented into bunker quantity survey, hold and hatch inspection hold survey, draft survey, cargo damage survey, cargo lashing/ handling/logistics, cargo tally verification draft survey, cargo survey, pre-shipment inspection, cargo sampling (oil), cargo measurement (oil), proof and inspection of asset, pre-vetting inspection, pre-purchase vessel inspection, vessel on/off hire survey, vessel condition and damage survey, cleanliness ISM preparation audit, marine warranty survey navigation audit and others. The bunker quantity survey segment is expected to dominate the global cargo inspection market with a 20.04% market share due to automation. It provides impartial, independent quantity measurement inspection services for marine fuels, issuing detailed bunker survey reports to confirm fuel delivery and report bunker fuel shortages, further augmenting the market's growth

- On the basis of technology, the cargo inspection market is segmented into non-intrusive inspection technology and non-destructive evaluation (NDE) technology. The non-intrusive Inspection technology segment is expected to dominate the global cargo inspection market The non-intrusive inspection technology segment is expected to dominate the global cargo inspection market with a 65.93% market share as this is considered the mature field of technology as it not only locates the detect

The non-intrusive inspection technology segment is expected to dominate the global cargo inspection market

The non-intrusive inspection technology segment is expected to dominate the global cargo inspection market with a 65.93% market share as this is considered the mature field of technology as it not only locates the detect but also provides precise information regarding size, orientation, and shape for that particular defect. Moreover, cost-effectiveness and reliability are other factors that drives its overall share

- On the basis of port types, the cargo inspection market is segmented into sea ports, inland ports, warm water ports, and dry ports. The sea ports segment is expected to dominate the global cargo inspection market with a 67.83% market share due increase in the preference for trading activities via seaports in every country compared to other port types

Major Players

Data Bridge Market Research recognizes the following companies as the major global cargo inspection market players in global cargo inspection market are SGS SA (Switzerland), Bureau Veritas (France), Intertek Group plc (U.K.), ALS Limited (Australia), Cotecna (India), Alex Stewart International (India), AHK Group Ltd (U.K.), CWM Survey & Inspection BV(U.S.), Camin Cargo Control (U.S.), Swiss Approval International (Switzerland) (South Africa), Peterson and Control Union (South Africa)

Market Developments

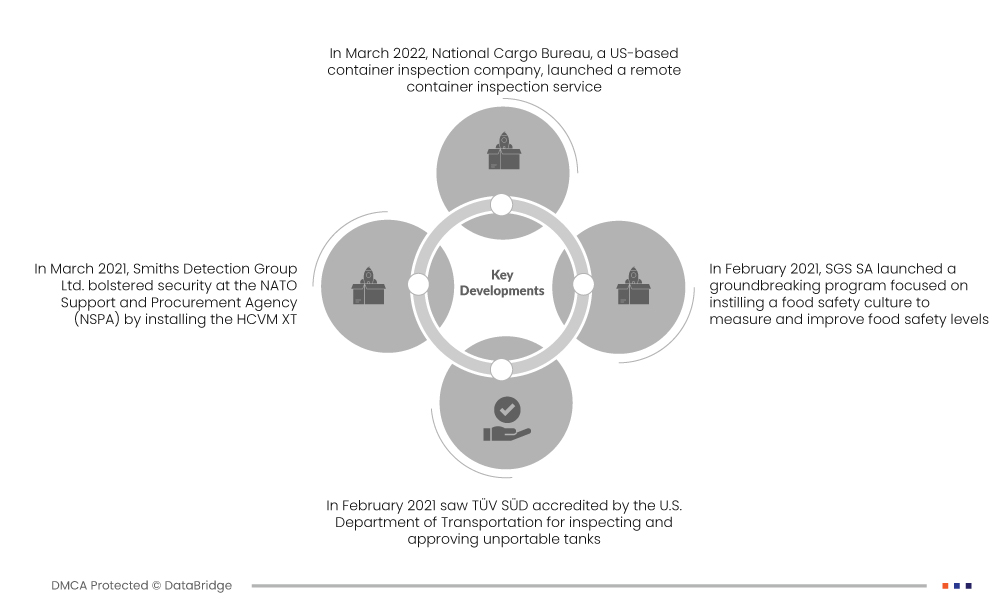

- In March 2022, National Cargo Bureau, a US-based container inspection company, launched a remote container inspection service based on the web-base container inspection database and access portal. Customers can use the new service to remotely assess and inspect container transport units with the assistance of NCB's surveyor staff. Media files and client data are automatically posted to the mobile platform via this device

- In March 2021, Smiths Detection Group Ltd. bolstered security at the NATO Support and Procurement Agency (NSPA) by installing the HCVM XT, a mobile high-energy inspection system. This system scans external construction vehicles and equipment for potential threats, including radiological materials, explosive devices, weaponry, and covert surveillance equipment, fortifying the site's defenses against security risks

- In February 2021, TÜV SÜD was accredited by the U.S. Department of Transportation for inspecting and approving unportable tanks. This accreditation, aligning with international regulations such as ADR/RID, IMDG Code, and TPED, enhances the company's credibility, attracting more customers and fostering growth

- In February 2021, SGS SA launched a groundbreaking program focused on instilling a food safety culture to measure and improve food safety levels. This initiative not only broadens SGS's business portfolio but also contributes to increased revenue and profit generation by addressing critical aspects of food safety in the market

Regional Analysis

Geographically, the countries covered in the global cargo inspection market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of the Middle East and Africa

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in the global cargo inspection market during the forecast period 2023-2030

Asia-Pacific dominates the global cargo inspection market due to its vast population, extensive ports, and harbors. The region's non-intrusive inspection technology segment is particularly influential, driven by the strategic importance of the South China Sea and the increasing volume of trade. With robust infrastructures, Asia-Pacific excels in implementing efficient cargo inspection processes, reinforcing its position as a key player in the global market, and facilitating secure and streamlined international trade across its dynamic and expansive economic landscape.

Europe is estimated to be the fastest-growing region in the global cargo inspection market for the forecast period 2023-2030

Europe is expected to dominate and emerge as the fastest-growing region in the global cargo inspection market. This dominance is propelled by the region's increasing reliance on non-intrusive inspection technologies in sea trade. The presence of a substantial number of ports and harbors further contributes to this growth, emphasizing the significance of efficient cargo inspection processes in ensuring the security and compliance of maritime activities across the continent.

For more detailed information about the global cargo inspection market report, click here – https://www.databridgemarketresearch.com/reports/global-cargo-inspection-market