The digital lending platform market offers various components, including solutions and services, catering to diverse lending needs. These components seamlessly integrate with both on-premises and cloud deployment models. The solutions provide advanced features for efficient loan management, while services encompass support and customization. The flexibility of deployment models ensures adaptability to varying organizational structures, fostering the digital transformation of lending processes with enhanced accessibility and scalability, driving the market's evolution in the dynamic financial technology landscape.

Access full Report @ https://www.databridgemarketresearch.com/reports/global-digital-lending-platform-market

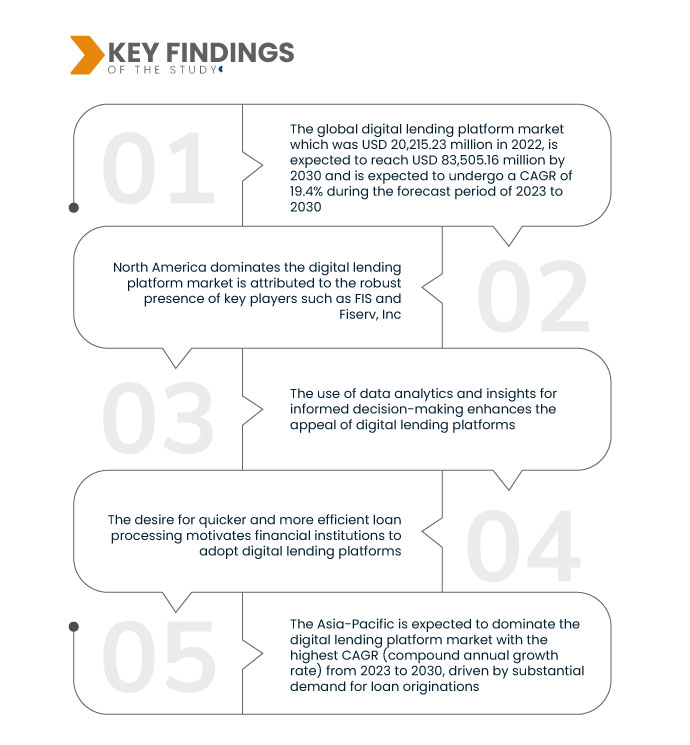

Data Bridge Market Research analyses that the Global Digital Lending Platform Market, which was USD 20,215.23 million in 2022, is expected to reach USD 83,505.16 million by 2030 and is expected to undergo a CAGR of 19.4% during the forecast period of 2023 to 2030. Supportive regulatory frameworks and initiatives play a crucial role in driving the adoption of digital lending platforms by providing a foundation for compliance and security. This encouragement ensures that financial institutions confidently embrace these platforms, fostering their widespread implementation in the financial sector.

Key Findings of the Study

Cost efficiency is expected to drive the market's growth rate

The cost-effectiveness of digital lending platforms is a pivotal driver in their adoption by financial institutions. These platforms streamline operations, cutting down on the overheads and complexities associated with traditional lending processes. By optimizing workflows and automating tasks, they enhance operational efficiency, reducing overall expenses. Financial institutions are drawn to the economic advantages of digital lending platforms, making them a strategic choice to improve resource management and stay competitive in the evolving financial landscape.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Component (Solutions, Services), Deployment Model (On Premises, Cloud), Loan Amount Size (Less than US$ 7,000, US$ 7,001 to US$ 20,000, More than US$ 20,001), Subscription Type (Free, Paid), Loan Type (Automotive Loan, SME Finance Loan, Personal Loan, Home Loan, Consumer Durable, Others), Vertical (Banking, Financial Services, Insurance Companies, P2P (Peer-to-Peer) Lenders, Credit Unions, Saving and Loan Associations)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

General Electric (U.S.), IBM (U.S.), PTC (U.S.), Microsoft (U.S.), Siemens AG (Germany), ANSYS, Inc (U.S.), SAP SE (Germany), Oracle (U.S.), Robert Bosch GmbH (Germany), Swim.ai, Inc. (U.S.)., Atos SE (France), ABB (Switzerland), KELLTON TECH (India), AVEVA Group plc (U.K.), DXC Technology Company (U.S.), Altair Engineering, Inc (U.S.), Hexaware Technologies Limited (India), Tata Consultancy Services Limited (India), Infosys Limited (Bengaluru), NTT DATA, Inc. (Japan), TIBCO Software Inc. (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis:

The global digital lending platform market is segmented on the basis of component, deployment model, loan amount size, subscription type, loan type, and vertical.

- On the basis of component, the global digital lending platform market is segmented into solutions, and services

- On the basis of deployment model, the global digital lending platform market is segmented into on premises, and cloud

- On the basis of loan amount size, the global digital lending platform market is segmented into less than US$ 7,000, US$ 7,001 to US$ 20,000, more than US$ 20,001

- On the basis of subscription type, the global digital lending platform market is segmented into free, paid

- On the basis of loan type, the global digital lending platform market is segmented into automotive loan, SME finance loan, personal loan, home loan, consumer durable, and others

- On the basis of vertical, the global digital lending platform market is segmented into banking, financial services, insurance companies, P2P (peer-to-peer) lenders, credit unions, saving and loan associations

Major Players

Data Bridge Market Research recognizes the following companies as the global digital lending platform market players in global digital lending platform market are General Electric (U.S.), IBM (U.S.), PTC (U.S.), Microsoft (U.S.), Siemens AG (Germany), ANSYS, Inc (U.S.), SAP SE (Germany), Oracle (U.S.), Robert Bosch GmbH (Germany), Swim.ai, Inc. (U.S.)., Atos SE (France), ABB (Switzerland), KELLTON TECH (India).

Market Developments

- In 2021, Newgen Software unveiled NewgenONE, a cutting-edge digital transformation platform. This platform is designed to manage unstructured data and elevate customer engagement efficiently. With advanced capabilities, NewgenONE empowers organizations to navigate digital transformation seamlessly, offering solutions for enhanced data management and customer interaction, positioning it as a valuable asset in the evolving landscape of digital business processes

- In 2021, TPBank in Vietnam partnered with Nucleus Software to bolster its digital commerce capabilities. Leveraging FinnOne Neo, TPBank implemented instant digital loans, optimizing processes and enhancing credit assessments. This collaboration enabled TPBank to elevate its digital banking services, offering customers seamless access to quick and efficient loan solutions while reinforcing its commitment to advancing its digital presence in the financial landscape

- In 2020, Finastra unveiled the Fusion Credit Connect solution, accessible on both Salesforce AppExchange and Finastra's FusionFabric.cloud. This innovative solution aims to transform communication between corporate banks and borrowers, enhancing customer experience. By fostering improved interactions, it is anticipated to contribute to expanding the company's customer base

Regional Analysis

Geographically, the countries covered in the global digital lending platform market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

North America is the dominant region in the global digital lending platform market during the forecast period 2023-2030

North America dominates the digital lending platform market is attributed to the robust presence of key players such as FIS and Fiserv, Inc. These industry leaders offer diverse lending solutions on a unified platform. The increasing adoption of digital lending technology in the U.S. and Canada contributes significantly to market expansion, showcasing the region's advanced financial technology landscape and fostering continued growth in the digital lending sector.

Asia-Pacific is expected to dominate the global digital lending platform market in the forecast period 2023-2030

The Asia-Pacific is expected to dominate the digital lending platform market with the highest CAGR (compound annual growth rate) from 2023 to 2030, driven by substantial demand for loan origination. China, a market leader in the region, experiences growth fueled by expanding banks. This expansion reflects the rising importance of digital lending and propels overall market growth, showcasing the region's dynamic financial landscape and increasing reliance on advanced lending technologies.

For more detailed information about the global digital lending platform market report, click here – https://www.databridgemarketresearch.com/reports/global-digital-lending-platform-market