Au cours de la période de prévision, le marché des services financiers et d'assurance basés sur les jumeaux numériques devrait connaître une croissance substantielle. La technologie des jumeaux numériques a connu des avancées considérables grâce à l'essor de technologies telles que l'intelligence artificielle (IA), le big data, l'Internet des objets (IoT) et la puissance de calcul. L'apprentissage automatique, qui utilise les données pour modéliser et prédire l'état et la performance futurs des actifs, propulse cette technologie vers l'avant. L'utilisation croissante des jumeaux numériques dans le secteur de l'énergie devrait accélérer la transition vers les énergies renouvelables et ouvrir la voie à la neutralité carbone.

Accéder au rapport complet sur https://www.databridgemarketresearch.com/reports/global-digital-twin-financial-services-and-insurance-market

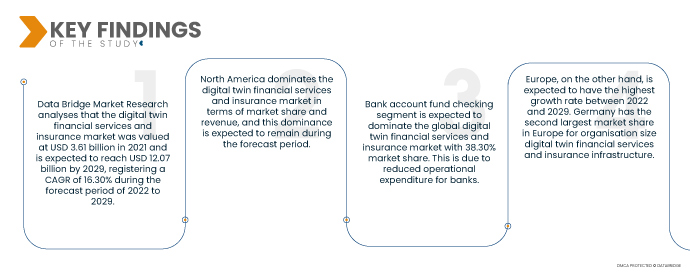

Data Bridge Market Research analyse que le marché des services financiers et de l'assurance des jumeaux numériques était évalué à 3,61 milliards USD en 2021 et devrait atteindre 12,07 milliards USD d'ici 2029, enregistrant un TCAC de 16,30 % au cours de la période de prévision de 2022 à 2029. L'utilisation croissante des services Internet et la demande croissante de divers utilisateurs finaux sont des facteurs importants qui stimulent l'expansion du secteur des services financiers et de l'assurance des jumeaux numériques.

La demande croissante de services cloud par le secteur des services bancaires et financiers devrait stimuler le taux de croissance du marché.

Certaines entreprises technologiques investissent massivement dans les plateformes cloud, l'IoT et l'analytique. Bien que les technologies de jumeaux numériques soient utilisées depuis de nombreuses années pour recréer le monde physique, les nouvelles avancées nécessitent un réexamen des capacités existantes. L'association de capteurs à faible coût et de l'IoT, de l'apprentissage automatique et de la fluidité du cloud permet des analyses plus complexes et des simulations en temps réel. Par conséquent, l'adoption croissante des plateformes cloud dans les secteurs bancaire et financier alimente l'expansion du marché.

Portée du rapport et segmentation du marché

Rapport métrique

|

Détails

|

Période de prévision

|

2022 à 2029

|

Année de base

|

2021

|

Années historiques

|

2020 (personnalisable de 2014 à 2019)

|

Unités quantitatives

|

Chiffre d'affaires en milliards USD, volumes en unités, prix en USD

|

Segments couverts

|

Type (jumeau numérique système, jumeau numérique processus et jumeau numérique produit), déploiement (cloud et sur site), application (vérification des fonds de compte bancaire, chèques de transfert de fonds numériques, génération de politiques et autres), technologie (IOT et IIOT, intelligence artificielle et apprentissage automatique, 5G, analyse de Big Data, blockchain et réalité augmentée, réalité virtuelle et réalité mixte)

|

Pays couverts

|

États-Unis, Canada et Mexique en Amérique du Nord, Allemagne, France, Royaume-Uni, Pays-Bas, Suisse, Belgique, Russie, Italie, Espagne, Turquie, Reste de l'Europe en Europe, Chine, Japon, Inde, Corée du Sud, Singapour, Malaisie, Australie, Thaïlande, Indonésie, Philippines, Reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), Arabie saoudite, Émirats arabes unis, Afrique du Sud, Égypte, Israël, Reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), Brésil, Argentine et Reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud

|

Acteurs du marché couverts

|

General Electric (États-Unis), IBM (États-Unis), PTC (États-Unis), Microsoft (États-Unis), Siemens AG (Allemagne), ANSYS, Inc (États-Unis), SAP SE (Allemagne), Oracle (États-Unis), Robert Bosch GmbH (Allemagne), Swim.ai, Inc. (États-Unis), Atos SE (France), ABB (Suisse), KELLTON TECH (Inde), AVEVA Group plc (Royaume-Uni), DXC Technology Company (États-Unis), Altair Engineering, Inc (États-Unis), Hexaware Technologies Limited (Inde), Tata Consultancy Services Limited (Inde), Infosys Limited (Bengaluru), NTT DATA, Inc. (Japon), TIBCO Software Inc. (États-Unis)

|

Points de données couverts dans le rapport

|

En plus des informations sur le marché telles que la valeur marchande, le taux de croissance, les segments de marché, la couverture géographique, les acteurs du marché et le scénario du marché, le rapport de marché organisé par l'équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et une analyse du pilon.

|

Analyse des segments :

Le marché mondial des services financiers et des assurances numériques jumeaux est segmenté en quatre segments notables qui sont basés sur le type, la technologie, le déploiement et l'application.

- Sur la base de leur type, le marché mondial des services financiers et d'assurances par jumeaux numériques est segmenté en jumeaux numériques système, jumeaux numériques processus et jumeaux numériques produit. Le segment des jumeaux numériques système devrait dominer le marché mondial des services financiers et d'assurances par jumeaux numériques avec 48,28 % de parts de marché, en raison de l'utilisation croissante des ordinateurs portables et des serveurs sur le lieu de travail pour le stockage et la maintenance de grands volumes de données au sein des organisations, ce qui stimule la demande de systèmes de jumeaux numériques.

- Sur le plan technologique, le marché mondial des services financiers et de l'assurance des jumeaux numériques est segmenté en plusieurs segments : IOT et IIOT, intelligence artificielle et apprentissage automatique, analyse du big data, 5G, blockchain, réalité augmentée, réalité virtuelle et réalité mixte. Le segment IOT et IIOT devrait dominer le marché mondial des services financiers et de l'assurance des jumeaux numériques avec 30,29 % de parts de marché grâce à l'intégration de toutes les ressources sur une plateforme unique et à la prévision des besoins des clients grâce aux données collectées. Il contribue également à l'amélioration de la prise de décision et à l'efficacité de la gestion des risques.

- En termes de déploiement, le marché mondial des services financiers et de l'assurance des jumeaux numériques est segmenté entre cloud et on-premise. Le cloud devrait dominer le marché mondial des services financiers et de l'assurance des jumeaux numériques avec 66,46 % de parts de marché. Cela s'explique principalement par l'intérêt croissant du secteur bancaire pour les bases de données cloud, la transition vers la numérisation, l'amélioration de la relation client, la montée en puissance de l'Internet des objets (IoT) et le besoin croissant de collecte et d'analyse de données en temps réel pour anticiper les problèmes potentiels et réduire les risques.

Le segment du cloud dominera le segment du déploiement du marché des services financiers et des assurances du jumeau numérique

Le cloud devrait s'imposer comme le segment dominant en termes de déploiement, avec une part de marché d'environ 66 %. Cette évolution s'explique par le nombre croissant d'activités de développement d'infrastructures sur le marché, notamment dans les économies en développement. De plus, la croissance et l'expansion du secteur des TIC à l'échelle mondiale renforceront la croissance de ce segment.

- En fonction des applications, le marché mondial des services financiers et de l'assurance basés sur les jumeaux numériques est segmenté en services de vérification de fonds bancaires, de vérification de virements numériques et de création de polices d'assurance, entre autres. Le segment des services de vérification de fonds bancaires devrait dominer le marché mondial des services financiers et de l'assurance basés sur les jumeaux numériques avec une part de marché de 38,30 %. Cette croissance s'explique par la réduction des dépenses opérationnelles des banques, l'amélioration de la gestion de l'expérience client, l'adoption croissante des services bancaires numériques par les consommateurs et la transition vers des modèles opérationnels rentables.

Le segment de la vérification des fonds des comptes bancaires dominera le segment des applications du marché des services financiers et des assurances jumeaux numériques

Le segment des comptes bancaires de vérification des fonds deviendra le segment dominant des applications. Ceci s'explique par les avancées technologiques croissantes sur le marché, notamment dans les économies en développement. De plus, la croissance et l'expansion des services de recherche et développement à l'échelle mondiale stimuleront la croissance de ce segment.

Acteurs majeurs

Data Bridge Market Research reconnaît les entreprises suivantes comme les principaux acteurs du marché : General Electric (États-Unis), IBM (États-Unis), PTC (États-Unis), Microsoft (États-Unis), Siemens AG (Allemagne), ANSYS, Inc (États-Unis), SAP SE (Allemagne), Oracle (États-Unis), Robert Bosch GmbH (Allemagne), Swim.ai, Inc. (États-Unis), Atos SE (France), ABB (Suisse), KELLTON TECH (Inde), AVEVA Group plc (Royaume-Uni), DXC Technology Company (États-Unis), Altair Engineering, Inc (États-Unis), Hexaware Technologies Limited (Inde), Tata Consultancy Services Limited (Inde), Infosys Limited (Bengaluru), NTT DATA, Inc. (Japon), TIBCO Software Inc. (États-Unis).

Développement du marché

- En janvier 2022, Google Cloud a lancé un jumeau numérique pour la chaîne d'approvisionnement, avec pour objectif d'offrir aux distributeurs et aux fabricants une visibilité sans précédent sur les opérations de leurs chaînes d'approvisionnement. Ces solutions innovantes, ainsi que la volonté croissante d'automatisation dans tous les secteurs, devraient stimuler la demande pour cette plateforme de jumeau numérique.

- En décembre 2021, Dassault Systèmes a noué un partenariat avec le groupe Renault. Cette collaboration prévoyait d'utiliser la plateforme cloud 3DEXPERIENCE de Dassault Systèmes pour développer des programmes destinés aux nouveaux véhicules et autres services de mobilité. Le groupe Renault utiliserait cette technologie pour gérer des jumeaux virtuels de ses configurations de produits.

Analyse régionale

Géographiquement, les pays couverts dans le rapport de marché sont les États-Unis, le Canada et le Mexique en Amérique du Nord, l'Allemagne, la France, le Royaume-Uni, les Pays-Bas, la Suisse, la Belgique, la Russie, l'Italie, l'Espagne, la Turquie, le reste de l'Europe en Europe, la Chine, le Japon, l'Inde, la Corée du Sud, Singapour, la Malaisie, l'Australie, la Thaïlande, l'Indonésie, les Philippines, le reste de l'Asie-Pacifique (APAC) en Asie-Pacifique (APAC), l'Arabie saoudite, les Émirats arabes unis, l'Afrique du Sud, l'Égypte, Israël, le reste du Moyen-Orient et de l'Afrique (MEA) en tant que partie du Moyen-Orient et de l'Afrique (MEA), le Brésil, l'Argentine et le reste de l'Amérique du Sud en tant que partie de l'Amérique du Sud.

Selon l'analyse de Data Bridge Market Research :

L'Amérique du Nord est la région dominante sur le marché des services financiers et des assurances numériques au cours de la période de prévision 2022-2029

L'Amérique du Nord domine le marché des services financiers et de l'assurance par jumeaux numériques en termes de parts de marché et de chiffre d'affaires, et cette domination devrait se maintenir durant la période projetée. Les États-Unis détiennent la plus grande part de marché pour ce secteur, en raison de la forte présence de grandes organisations et de jumeaux numériques de systèmes, de processus et de produits sur le territoire.

L'Europe devrait être la région connaissant la croissance la plus rapide sur le marché des services financiers et des assurances numériques au cours de la période de prévision 2022-2029.

L'Europe, en revanche, devrait connaître le taux de croissance le plus élevé entre 2022 et 2029. L'Allemagne détient la deuxième plus grande part de marché en Europe pour les services financiers et les infrastructures d'assurance de taille d'organisation en raison de la disponibilité d'analyses numériques avancées, d'intelligence artificielle et d'apprentissage automatique.

Pour plus d'informations sur le rapport de marché sur les services financiers et d'assurance jumeaux numériques, cliquez ici : https://www.databridgemarketresearch.com/reports/global-digital-twin-financial-services-and-insurance-market