Global Digital Twin Financial Services And Insurance Market

Market Size in USD Billion

CAGR :

%

USD

5.67 Billion

USD

19.00 Billion

2024

2032

USD

5.67 Billion

USD

19.00 Billion

2024

2032

| 2025 –2032 | |

| USD 5.67 Billion | |

| USD 19.00 Billion | |

|

|

|

|

What is the Global Digital Twin Financial Services and Insurance Market Size and Growth Rate?

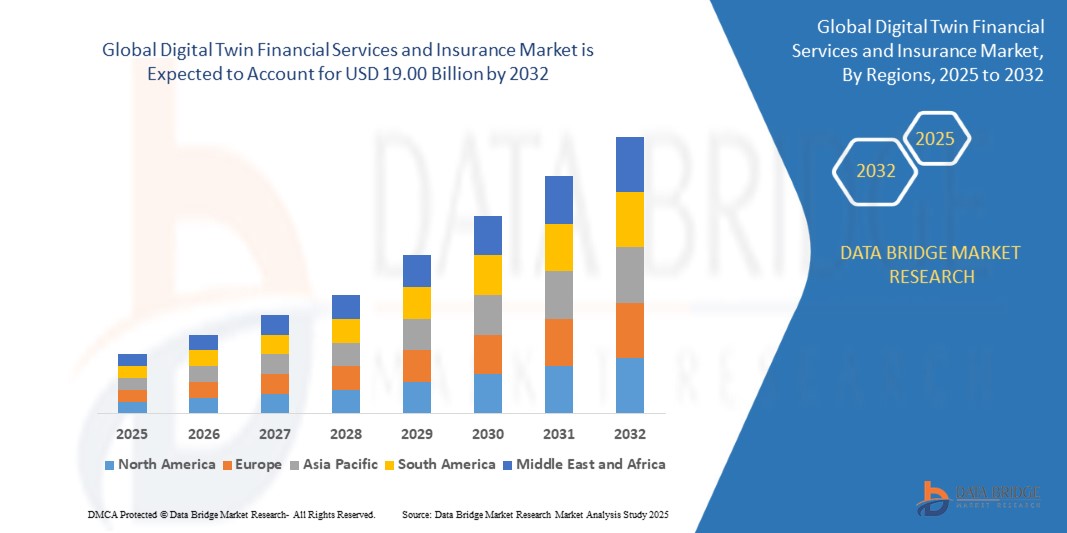

- The global digital twin financial services and insurance market size was valued at USD 5.67 billion in 2024 and is expected to reach USD 19.00 billion by 2032, at a CAGR of 16.30% during the forecast period

- In recent years, the market for digital twin financial services and insurance is expected to grow rapidly during the forecast period. Due to help from developing technologies such as artificial intelligence (AI), big data, the Internet of things (IoT), and processing power, digital twin technology has seen significant advancement in its capabilities

- Machine learning, which allows the use of data to simulate and anticipate future asset conditions and performance, is advancing the technology. The growing use of digital twins in the energy sector is projected to accelerate the transition to renewable energy and pave the way for net-zero emissions

What are the Major Takeaways of Digital Twin Financial Services and Insurance Market?

- The market is likely to be driven by the growth of the industry 4.0 smart industry. The smart industry is the next step in the evolution of manufacturing systems, incorporating data from system-wide physical, operational, and human resources to drive manufacture, repairs, inventory management, and operations digitization to satisfy the demand for production competence

- Furthermore, rising urbanization and increasing level of disposable income will drive market value growth. Another significant factor influencing the market’s growth rate is the increasing demand for surveillance and maintenance

- North America dominated the digital twin financial services and insurance market with the largest revenue share of 41.2% in 2024, fueled by growing investments in advanced analytics, AI integration, and digital infrastructure across the banking and insurance sectors

- Asia-Pacific region is poised to grow at the fastest CAGR of 15.6% from 2025 to 2032, driven by rapid digitalization, increasing financial inclusion, and technological advancements in markets such as China, Japan, and India

- The System Digital Twin segment dominated the digital twin financial services and insurance market with the largest revenue share of 47.5% in 2024, owing to its ability to replicate entire financial ecosystems

Report Scope and Digital Twin Financial Services and Insurance Market Segmentation

|

Attributes |

Digital Twin Financial Services and Insurance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analyvsis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Digital Twin Financial Services and Insurance Market?

“AI-Driven Risk Assessment and Personalized Financial Modeling”

- A significant and accelerating trend in the global digital twin financial services and insurance market is the integration of artificial intelligence (AI) and real-time data analytics to create highly personalized risk models and financial simulations. These advanced digital twin solutions are transforming how insurers and financial institutions assess risk, model scenarios, and deliver customer-centric services

- For instance, leading players are leveraging AI-powered digital twins to simulate customer behaviors, predict claim probabilities, and optimize underwriting processes, enhancing both operational efficiency and customer satisfaction

- AI-enabled digital twins in financial services allow institutions to conduct real-time simulations of market fluctuations, credit risks, and investment outcomes, enabling more informed decision-making. For instance, insurers are increasingly using digital twin technology to simulate health or vehicle usage patterns, providing tailored coverage and dynamic premium adjustments

- The combination of digital twins, predictive analytics, and AI facilitates the development of highly responsive financial products that adapt to individual customer needs, market dynamics, and regulatory changes. This is reshaping the industry towards more proactive, data-driven service delivery

- Companies such as Siemens Financial Services and Microsoft Azure are advancing digital twin solutions tailored for banking and insurance applications, offering institutions greater visibility into systemic risks and customer engagement patterns

- The growing demand for personalized, agile, and risk-optimized financial services is driving the widespread adoption of AI-powered digital twins across banking, insurance, and wealth management sectors globally

What are the Key Drivers of Digital Twin Financial Services and Insurance Market?

- The increasing demand for data-driven insights, coupled with growing regulatory pressures and the need for real-time risk management, are key factors accelerating the adoption of digital twin technology across the financial services and insurance industries

- For instance, in March 2024, Allianz SE collaborated with technology providers to integrate digital twin models for dynamic risk assessment in property insurance, enhancing claims accuracy and reducing operational costs. Such innovations are boosting industry growth

- Financial institutions and insurers face evolving market uncertainties, making real-time simulations, predictive risk modeling, and dynamic scenario planning essential for maintaining competitiveness and ensuring resilience

- Furthermore, the rise of hyper-personalized financial products, driven by consumer expectations for tailored services and transparent pricing, is making digital twin technology a critical enabler for product innovation and customer engagement

- The integration of digital twins with cloud platforms, AI tools, and IoT data streams enables organizations to simulate entire ecosystems—from customer journeys to market environments—resulting in more agile, scalable, and customer-centric operations

Which Factor is challenging the Growth of the Digital Twin Financial Services and Insurance Market?

- Data privacy concerns, cybersecurity risks, and integration complexities represent significant barriers to broader adoption of digital twin technology within financial services and insurance sectors. As digital twins rely heavily on sensitive customer data and real-time system monitoring, any vulnerabilities could result in breaches, regulatory penalties, or loss of customer trust

- For instance, reports of cyberattacks targeting AI-based financial systems have raised apprehension among industry stakeholders regarding the security of digital twin deployments

- To overcome these challenges, organizations must prioritize end-to-end encryption, robust identity management, and regular system audits. Leading players such as IBM emphasize cybersecurity by integrating advanced data protection mechanisms into their financial digital twin platforms

- In addition, the complexity of integrating digital twins with legacy IT infrastructures, alongside the relatively high initial investment required for AI, analytics, and simulation capabilities, can deter adoption, especially among smaller institutions

- While digital twins offer significant long-term value, addressing these technological and cost-related barriers through improved security standards, flexible deployment models, and regulatory alignment is critical for sustained market expansion

How is the Digital Twin Financial Services and Insurance Market Segmented?

The market is segmented on the basis of type, deployment, application, and technology.

• By Type

On the basis of type, the digital twin financial services and insurance market is segmented into System Digital Twin, Process Digital Twin, and Product Digital Twin. The System Digital Twin segment dominated the digital twin financial services and insurance market with the largest revenue share of 47.5% in 2024, owing to its ability to replicate entire financial ecosystems, enabling institutions to simulate operations, monitor performance, and predict risks in real-time. The strong demand for integrated system models in banking and insurance to enhance efficiency and mitigate operational disruptions drives segment growth.

The Process Digital Twin segment is expected to witness the fastest growth rate of 19.8% from 2025 to 2032, driven by the increasing need for dynamic process optimization in financial transactions, risk modeling, and policy generation. Process-level twins offer granular visibility into specific workflows, enhancing agility and operational accuracy.

• By Deployment

On the basis of deployment, the digital twin financial services and insurance market is segmented into Cloud and On-Premises. The Cloud segment held the largest market revenue share in 2024, driven by its scalability, cost-efficiency, and seamless integration with AI, IoT, and advanced data analytics platforms. Cloud-based digital twins allow financial institutions to rapidly deploy, update, and scale digital models without significant infrastructure investments.

The On-Premises segment is anticipated to witness a steady growth rate, favored by organizations with stringent data privacy requirements and complex legacy systems, especially within highly regulated banking and insurance environments where localized control remains critical.

• By Application

On the basis of application, the digital twin financial services and insurance market is segmented into Bank Account Funds Checking, Digital Fund Transfer Checks, Policy Generation, and Others. The Bank Account Funds Checking segment dominated the market with the largest revenue share of 41.3% in 2024, as financial institutions increasingly utilize digital twin models to simulate, monitor, and optimize account balances, transaction histories, and real-time fund availability, enhancing fraud prevention and operational efficiency.

The Policy Generation segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by insurers leveraging digital twins to create personalized policies based on predictive behavior models, real-time data simulations, and dynamic risk assessments.

• By Technology

On the basis of technology, the digital twin financial services and insurance market is segmented into IoT and IIoT, Artificial Intelligence and Machine Learning, 5G, Big Data Analytics, Blockchain, and Augmented Reality, Virtual Reality, and Mixed Reality. The Artificial Intelligence and Machine Learning segment accounted for the largest market revenue share in 2024, driven by the growing reliance on AI/ML for advanced predictive analytics, scenario simulations, and intelligent decision-making within digital twin platforms for financial services.

The Blockchain segment is expected to witness the fastest CAGR from 2025 to 2032, supported by the need for secure, transparent, and decentralized data management within digital twin ecosystems, especially for transactions, identity verification, and smart contract applications across banking and insurance sectors.

Which Region Holds the Largest Share of the Digital Twin Financial Services and Insurance Market?

- North America dominated the digital twin financial services and insurance market with the largest revenue share of 41.2% in 2024, fueled by growing investments in advanced analytics, AI integration, and digital infrastructure across the banking and insurance sectors

- Financial institutions in the region are leveraging digital twin technology to simulate customer behavior, optimize risk management, and enhance operational efficiency

- The region's strong technology ecosystem, presence of major AI and cloud solution providers, and increased focus on real-time monitoring of financial assets have significantly boosted the demand for digital twin solutions in financial services and insurance

U.S. Digital Twin Financial Services and Insurance Market Insight

The U.S. digital twin financial services and insurance market captured the largest revenue share in 2024 within North America, driven by the early adoption of digital transformation strategies by banks and insurers. U.S. financial institutions are actively deploying Digital Twins to improve fraud detection, streamline policy generation, and enhance customer experience through AI-driven simulations. The growing emphasis on operational efficiency, coupled with increased reliance on cloud platforms and predictive analytics, is expected to further propel market growth in the U.S. over the forecast period.

Europe Digital Twin Financial Services and Insurance Market Insight

The Europe digital twin financial services and insurance market is projected to grow steadily, driven by stringent regulatory frameworks, rising adoption of advanced risk modeling, and increased digitalization across financial sectors. European banks and insurance companies are utilizing Digital Twins to ensure regulatory compliance, optimize capital management, and enhance operational resilience. Key regional markets such as Germany, the U.K., and France are experiencing robust demand for data-driven, AI-enabled Digital Twin platforms that support real-time decision-making and improve customer personalization.

U.K. Digital Twin Financial Services and Insurance Market Insight

The U.K. market is expected to witness considerable growth throughout the forecast period, supported by strong FinTech innovation, regulatory push for digital banking, and increased investments in AI and data analytics. The integration of Digital Twins in financial services is enabling better simulation of customer interactions, fraud detection, and optimized product offerings. U.K. insurers are increasingly adopting these solutions to enhance underwriting processes, predict claims, and personalize policy generation.

Germany Digital Twin Financial Services and Insurance Market Insight

The Germany market is anticipated to expand steadily, with growing emphasis on technological innovation, data security, and process optimization within the banking and insurance industries. German financial institutions are deploying Digital Twin platforms to simulate complex processes, test operational scenarios, and enhance compliance with evolving regulatory standards. The country's advanced digital infrastructure and focus on secure, privacy-centric solutions are driving adoption.

Which Region is the Fastest Growing in the Digital Twin Financial Services and Insurance Market?

Asia-Pacific region is poised to grow at the fastest CAGR of 15.6% from 2025 to 2032, driven by rapid digitalization, increasing financial inclusion, and technological advancements in markets such as China, Japan, and India. Government initiatives promoting smart banking and digital transformation, coupled with rising adoption of AI, IoT, and cloud computing, are fueling demand for Digital Twin solutions across the region. Financial institutions are leveraging Digital Twins to improve customer experiences, simulate risk, and optimize operations, particularly in high-growth economies.

Japan Digital Twin Financial Services and Insurance Market Insight

The Japan market is gaining momentum due to the country's strong technology ecosystem, aging population, and focus on financial innovation. Banks and insurers are integrating Digital Twins to simulate customer journeys, predict system performance, and personalize financial products. The growing emphasis on AI-driven simulations and real-time data analytics is accelerating market growth, particularly in insurance underwriting and claims processing.

China Digital Twin Financial Services and Insurance Market Insight

The China market accounted for the largest share in Asia-Pacific in 2024, supported by the country's booming FinTech sector, smart city development, and widespread adoption of AI and IoT technologies. Chinese banks and insurers are increasingly utilizing Digital Twin platforms to enhance fraud detection, streamline policy generation, and support predictive decision-making. The government's digital transformation initiatives and robust domestic technology landscape further reinforce market expansion.

Which are the Top Companies in Digital Twin Financial Services and Insurance Market?

The digital twin financial services and insurance industry is primarily led by well-established companies, including:

- General Electric (U.S.)

- IBM (U.S.)

- PTC (U.S.)

- Microsoft (U.S.)

- Siemens AG (Germany)

- ANSYS, Inc (U.S.)

- SAP SE (Germany)

- Oracle (U.S.)

- Robert Bosch GmbH (Germany)

- Swim.ai, Inc. (U.S.)

- Atos SE (France)

- ABB (Switzerland)

- KELLTON TECH (India)

- AVEVA Group plc (U.K.)

- DXC Technology Company (U.S.)

- Altair Engineering, Inc (U.S.)

- Hexaware Technologies Limited (India)

- Tata Consultancy Services Limited (India)

- Infosys Limited (India)

- NTT DATA, Inc. (Japan)

- TIBCO Software Inc. (U.S.)

What are the Recent Developments in Global Digital Twin Financial Services and Insurance Market?

- In April 2023, IBM and Cosmo Tech announced the integration of their platforms, where Cosmo Tech's solution connects to the IBM Maximo Application Suite. This integration empowers asset managers to simulate the entire physical and financial life cycle of their asset network, even under unprecedented conditions, enhancing predictive maintenance and decision-making capabilities

- In September 2022, NVIDIA and Deloitte expanded their partnership to simplify the development, integration, and deployment of hybrid-cloud solutions for global businesses. This collaboration aims to accelerate the adoption of AI-driven technologies and digital twins across various industries

- In September 2022, Altair completed its acquisition of RapidMiner, strengthening its data analytics and machine learning capabilities. This strategic move enhances Altair's digital twin offerings by enabling more advanced predictive modeling and real-time insights for industrial applications

- In July 2022, Microsoft and Cosmo Tech announced a collaboration to integrate their digital twin platforms, combining Microsoft Azure Digital Twins with Cosmo Tech's 360° Simulation platform. This partnership allows enterprise customers to track carbon emissions in near real-time and simulate future sustainability initiatives, supporting their journey toward net-zero emissions

- In February 2022, Ansys launched the upgraded ANSYS Twin Builder 2022 R1, enhancing predictive analytics by merging physical and virtual sensor data. The latest features simplify digital twin deployment, improve workflow efficiency, and provide interactive web applications, streamlining user engagement with simulation models

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.