In the excipients market, diversity reigns as products span organic and inorganic origins, categorized into primary and secondary excipients. Polymers, sugars, alcohols, minerals, gelatin, and more constitute a wide array of offerings. Organic excipients, derived from natural sources, and inorganic alternatives cater to various pharmaceutical and healthcare needs. Primary excipients play a foundational role, while secondary excipients contribute to formulation stability, exemplifying the market's versatility in serving the pharmaceutical, biopharmaceutical, and nutraceutical industries with innovative and effective solutions.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-excipients-market

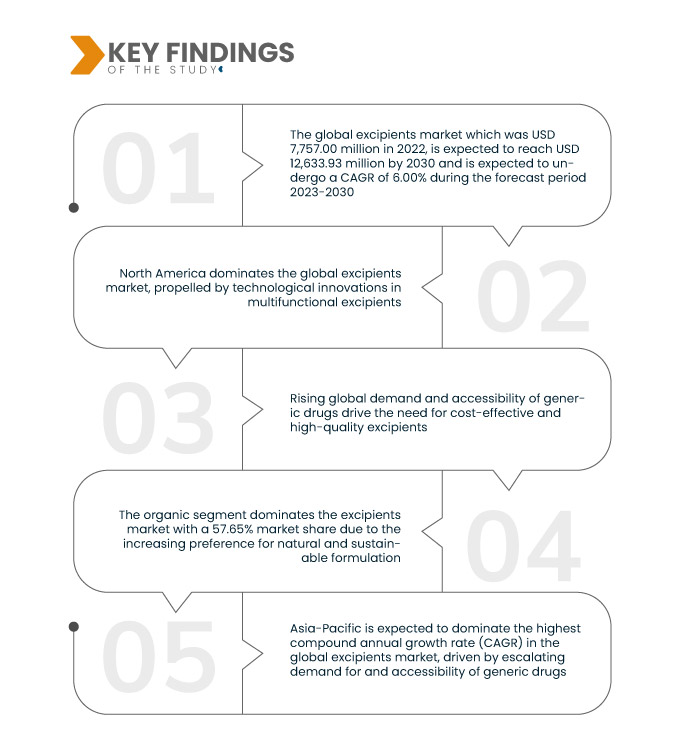

Data Bridge Market Research analyses that the Global Excipients Market which was USD 7,757.00 million in 2022, is expected to reach USD 12,633.93 million by 2030, and is expected to undergo a CAGR of 6.00% during the forecast period 2023-2030. The surge in chronic diseases globally propels pharmaceutical research, intensifying the need for innovative excipients in drug development. These excipients play a pivotal role in formulating effective and patient-friendly medications, addressing the complexities associated with chronic conditions and enhancing treatment outcomes.

Key Findings of the Study

The expanding geriatric population is expected to drive the market's growth rate

The excipients market is driven by the expanding geriatric population globally, necessitating pharmaceutical solutions tailored to specific age-related needs. As seniors constitute a significant demographic, excipients play a crucial role in formulating medications suitable for this cohort, considering factors such as ease of administration and enhanced drug absorption. This demographic shift propels the demand for specialized excipients, reflecting the industry's response to the unique formulation challenges associated with an aging population and their diverse healthcare requirements.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Origin (Organic, Inorganic), Category (Primary Excipients, Secondary Excipients), Products (Polymers, Sugars, Alcohols, Minerals, Gelatin, Others), Chemistry Type (Plant, Animals, Synthetic, Minerals), Chemical Synthesis (Lactose Monohydrate, Sucralose, Polysorbate, Benzyl Alcohol, Cetosteary Aclohol, Soy Lecithin, Pregelatinized Starch, Others), Functionality (Binders and Adhesives, Disintegrants, Coating Material, Disintegrants, Solubilizers, Flavors, Sweetening Agents, Diluents, Lubricants, Buffers, Emulsifying Agents, Preservatives, Antioxidants, Sorbents, Solvents, Emollients, Glidients, Chelating Agents, Antifoaming Agents, Others), Dosage Form (Solid, Semi-Solid, Liquid), Route of Administration (Oral Excipients, Topical Excipients, Parenteral Excipients, Other Excipients), End User (Pharmaceutical and Biopharmaceutical Companies, Contract Formulators, Research Organization and Academics, Others), Distribution Channel (Direct Tender, Retail Sales, Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

Dow (U.S.), Roquette Frères (France), JRS PHARMA (Germany), Evonik Industries AG (Germany), The Lubrizol Corporation (A Subsidiary of Berkshire Hathaway Inc.) (U.S.), BASF SE (Germany), Ashland (U.S.), Kerry Group PLC (Ireland), Shin-Etsu Chemical Co., Ltd. (Japan), Colorcon (U.S.), Chemische Fabrik Budenheim (Germany), Peter Greven GmbH & Co. KG (Germany), ADM (U.S.), Croda International Plc (U.K.), BENEO (Germany), Avantor, Inc. (U.S.), Omya AG (Switzerland), DFE Pharma (Netherlands), Pfanstiehl, Inc. (U.S.) and MEGGLE Group Wasserburg (Germany)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The global excipients market is segmented on the basis of origin, category, products, chemistry type, chemical synthesis, functionality, dosage form, route of administration, end user, and distribution channel.

- On the basis of origin, the global excipients market is segmented into organic, and inorganic. The organic segment dominates the excipients market with a 57.65% market share due to the increasing preference for natural and sustainable formulations

The organic segment of the origin segment dominates the global excipients market during the forecast period of 2023-2030

The organic segment dominates the excipients market with a 57.65% market share due to the increasing preference for natural and sustainable formulations. Organic excipients, derived from natural sources, align with the rising demand for clean label products, pharmaceutical safety, and environmentally conscious practices, making them a preferred choice in pharmaceutical and healthcare industries.

- On the basis of category, the global excipients market is segmented into primary excipients and secondary excipients. The primary excipients segment dominates the excipients market with a 56.41% market share as these foundational components play a critical role in drug formulations

The primary excipients segment of the category segment dominates the global excipients market during the forecast period of 2023-2030

The primary excipients segment dominates the excipients market with a 56.41% market share as these foundational components play a critical role in drug formulations. Essential for ensuring drug stability and effectiveness, primary excipients are integral to pharmaceutical formulations, making this segment a cornerstone in meeting diverse therapeutic requirements across the healthcare industry.

- On the basis of products, the global excipients market is segmented into polymers, sugars, alcohols, minerals, gelatin, and others. The polymer segment leads the excipients market with a 39.97% market share due to the versatility of polymers in pharmaceutical formulations, providing stability and controlled drug release

- On the basis of chemistry type, the global excipients market is segmented into plant, animals, synthetic, and minerals. The plant segment leads the excipients market with a 45.35% market share, driven by the demand for natural and sustainable formulations in pharmaceutical and healthcare industries

- On the basis of chemical synthesis, the global excipients market is segmented into lactose monohydrate, sucralose, polysorbate, benzyl alcohol, cetosteary aclohol, soy lecithin, pregelatinized starch, and others. The lactose monohydrate prevails in the excipients market with a 36.27%market share due to its wide applicability as a versatile filler and binder in pharmaceutical formulations

- On the basis of functionality, the global excipients market is segmented into binders and adhesives, disintegrants, coating material, disintegrants, solubilizers, flavors, sweetening agents, diluents, lubricants, buffers, emulsifying agents, preservatives, antioxidants, sorbents, solvents, emollients, glidients, chelating agents, antifoaming agents, others. The binders and adhesives lead the excipients market with a 10.48% market share, essential in pharmaceutical formulations for ensuring cohesion, compression, and tablet integrity during production

- On the basis of dosage form, the global excipients market is segmented into solid, semi-solid, and liquid. The solid segment is excipient market leader with a 46.27% market share, crucial in tablet and capsule formulations, providing stability, consistency, and controlled drug release.

- On the basis of route of administration, the global excipients market is segmented into oral excipients, topical excipients, parenteral excipients, and other excipients. Oral excipients lead the market with a 44.52% market share, pivotal in pharmaceutical formulations for oral delivery, ensuring dosage form stability, solubility, and bioavailability

- On the basis of end user, the global excipients market is segmented into pharmaceutical and biopharmaceutical companies, contract formulators, research organization and academics, and others. Pharmaceutical and biopharmaceutical companies lead the excipients market with a 43.42% market share, steering innovation and demand for specialized ingredients in drug formulations and delivery systems

- On the basis of distribution channel, the global excipients market is segmented into direct tender, retail sales, and others. The direct tender segment prevails in the excipients market with a 59.11% market share, indicating a dominant procurement method for pharmaceutical formulations and drug manufacturing

Major Players

Data Bridge Market Research recognizes the following companies as the global excipients market players in global excipients market are Dow (U.S.), Roquette Frères (France), JRS PHARMA (Germany), Evonik Industries AG (Germany), The Lubrizol Corporation (A Subsidiary of Berkshire Hathaway Inc.) (U.S.), BASF SE (Germany).

Market Developments

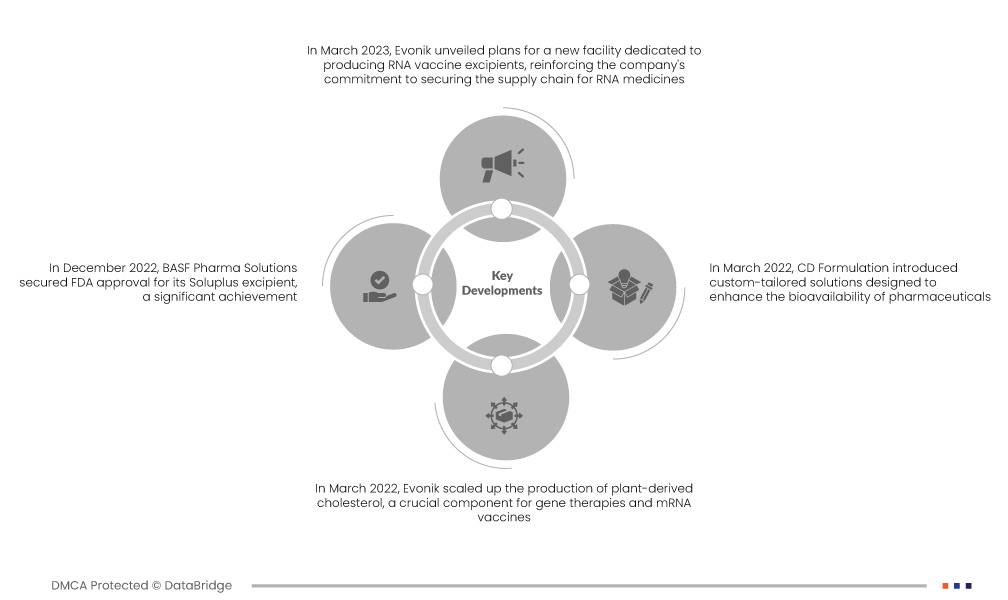

- In March 2023, Evonik unveiled plans for a new facility dedicated to producing RNA vaccine excipients, reinforcing the company's commitment to securing the supply chain for RNA medicines. The strategic move addresses the increasing demand for such excipients and positions Evonik as a key player in supporting the pharmaceutical industry's efforts in RNA-based vaccine development. The plant is expected to commence operations in 2025, contributing to enhanced global vaccine production capabilities

- In December 2022, BASF Pharma Solutions secured FDA approval for its Soluplus excipient, a significant achievement. Soluplus enhances the oral bioavailability and solubility of challenging, poorly soluble active pharmaceutical ingredients. This regulatory green light marks the excipient's role in addressing formulation difficulties, enabling more effective drug development. The approval contributes to the pharmaceutical industry by offering innovative solutions to enhance drug performance and efficacy

- In March 2022, Evonik scaled up the production of plant-derived cholesterol, a crucial component for gene therapies and mRNA vaccines. This expansion, particularly of PhytoChol, addresses the growing demand for cholesterol in the German market. By ensuring a robust supply chain for essential vaccine components, Evonik contributes to supporting the production of gene therapies and mRNA vaccines, aligning with the global efforts in healthcare advancements

- In March 2022, CD Formulation introduced custom-tailored solutions designed to enhance the bioavailability of pharmaceuticals. Poor bioavailability has long been a challenge in drug development, impacting the effectiveness of medications. CD Formulation's innovative offerings aim to address this issue by optimizing the delivery of active ingredients, potentially revolutionizing drug formulations and improving their therapeutic impact

Regional Analysis

Geographically, the countries covered in the global excipients market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

North America is the dominant region in the global excipients market during the forecast period 2023-2030

North America dominates the global excipients market, propelled by technological innovations in multifunctional excipients. The region experiences a growing demand for pharmaceutical products across diverse therapeutic domains, driving the market's expansion. Advanced excipients play a pivotal role in enhancing drug formulations, ensuring efficacy, and meeting stringent quality standards. This dominance underscores North America's commitment to pharmaceutical advancements, reflecting its position as a key contributor to the global excipients landscape.

Asia-Pacific is expected to dominate the global excipients market in the forecast period 2023-2030

Asia-Pacific is expected to dominate the highest compound annual growth rate (CAGR) in the global excipients market, driven by escalating demand for and accessibility of generic drugs. The region's emphasis on innovation in biopharmaceuticals further propels growth. With a burgeoning pharmaceutical industry and evolving healthcare landscape, Asia-Pacific emerges as a pivotal player, contributing significantly to the global excipients market by meeting diverse therapeutic demands and advancing pharmaceutical formulations.

For more detailed information about the global excipients market report, click here – https://www.databridgemarketresearch.com/reports/global-excipients-market