Micronized salt's finely powdered form offers increased solubility, making it highly versatile in the food and beverage industries. The demand for ready-to-eat food products has risen due to consumers' busy lifestyles, resulting in a need for extended shelf life. Micronized salt is a valuable ingredient in food preservation, as its fine particles dissolve easily and uniformly, enhancing the overall product quality and extending shelf life by inhibiting microbial growth and maintaining food freshness.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-food-micronized-salt-market

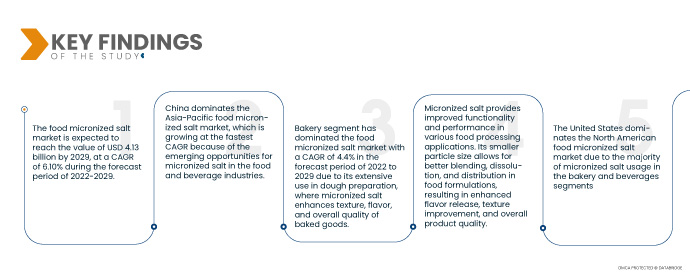

Data Bridge Market Research analyses that the Food Micronized Salt Market is valued at USD 2.57 billion in 2021 and is expected to reach the value of USD 4.13 billion by 2029, at a CAGR of 6.10% during the forecast period of 2022-2029. The increasing consumption of processed and convenience foods worldwide is a major driver for the food micronized salt market. Micronized salt is widely used as a flavor enhancer and preservative in various processed food products, including snacks, ready-to-eat meals, sauces, and seasonings.

Key Findings of the Study

Growing food service Industry is expected to drive the market's growth rate

The growing food service industry, comprising restaurants, cafes, and hotels, is witnessing substantial global growth. These establishments rely on micronized salt to elevate the flavor profile of their dishes and maintain consistent seasoning across their menu items. Micronized salt's fine particle size ensures better distribution and flavor perception, making it a preferred choice in professional kitchens. As the food service industry expands, the demand for micronized salt increases to meet the seasoning needs of these establishments.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Grade (Purity 98% - 99.5% and Purity Above 99.5%.), Application (Chocolate and Confectionery, Bakery,Functional Food, Dairy Products, Dairy Alternative, Processed Meat, Poultry and Seafood, Canned Fruits and Vegetables, Prepared Meals, Beverages and Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Market Players Covered

|

DuPont (U.S.), ADM (U.S.), Tate & Lyle (U.K.), Ingredion Incorporated (U.S.), Cargill Incorporated (U.S.), Roquette Frères (France), PureCircle Ltd (U.S.), MacAndrews & Forbes Holdings Inc. (U.S.), J.K. Sucralose Inc. (China), Ajinomoto Co. (Japan), Südzucker AG (Germany), Guilin Layn Natural Ingredients Corp. (China), Zhucheng Haotian Pharm Co., Ltd. (China), HSWT France SAS (France) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The food micronized salt market is segmented on the basis of grade and application

- On the basis of grade, the food micronized salt market is segmented into purity 98% - 99.5% and purity above 99.5%. In 2021, the purity above 99.5% segment has dominated the food micronized salt market with a CAGR of 3.5% in the forecast period of 2022 to 2029 due to the higher purity grade offering superior quality and meeting stringent industry standards.

In 2021, purity above 99.5% segment has dominated the grade segment of the food micronized salt market

In 2021, the purity above 99.5% segment has dominated the food micronized salt market owing to the grade with purity above 99.5% is commonly preferred in industries such as bakeries, snacks, processed foods, and beverages, where precise flavor profiles and consistent product quality are critical with a CAGR of 3.5% in the forecast period of 2022 to 2029

- On the basis of application, the food micronized salt market is segmented into chocolate and confectionery, bakery, functional food, dairy products, dairy alternative, processed meat, poultry and seafood, canned/preserved fruits and vegetables, prepared meal, beverages, and others. The bakery segment has dominated the food micronized salt market with a CAGR of 4.4% in the forecast period of 2022 to 2029 due to its extensive use in dough preparation, where micronized salt enhances texture, flavor, and overall quality of baked goods.

Major Players

Data Bridge Market Research recognizes the following companies as the major food micronized salt market players in food micronized salt market are DuPont (U.S.), ADM (U.S.), Tate & Lyle (U.K.), Ingredion Incorporated (U.S.), Cargill Incorporated (U.S.), Roquette Frères (France), PureCircle Ltd (U.S.), MacAndrews & Forbes Holdings Inc. (U.S.), J.K. Sucralose Inc. (China), Ajinomoto Co. (Japan)

Market Development

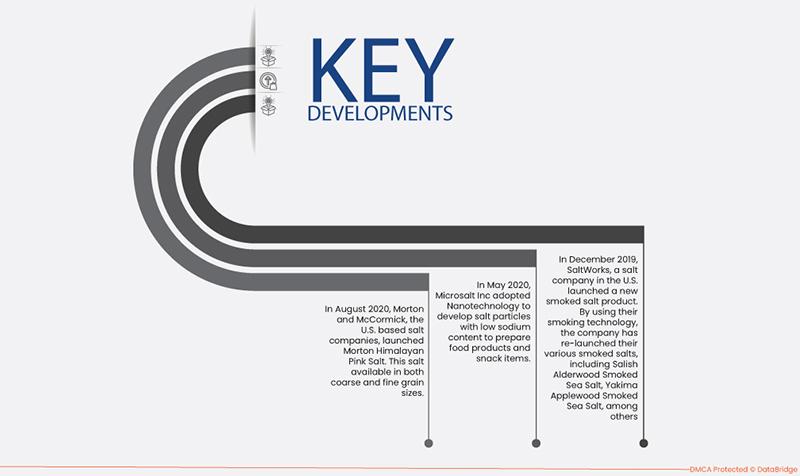

- In 2020, Products made with fleur de sel, sea salt, and pepper will be introduced by ZOUTMAN. This item, which is sold in portion sachets, is used in the food service sector to season food. The company is encouraged to launch new products and quicken its growth by the rising demand for portion packs.

- In 2020, Diamond Crystal Kosher salt in a new, more convenient size of 26 ounces has been added to the shelves by Cargill, Inc. Customers have been drawn to the launch thanks to its wide range of products.

- In 2020, CIECH Salz Deutschland GmbH, a company of CIECH Group, constructed a new salt plant in Stassfurt, Germany. This modern plant was built to have a capacity to produce 450 tons of evaporated salt per annum. This new site will expand the company and increases production.

- In 2019, SaltWorks, a salt company in the U.S. launched a new smoked salt product. Through the use of their smoking technology, the company has re-launched their various smoked salts, including Salish Alderwood Smoked Sea Salt, Yakima Applewood Smoked Sea Salt, among others.

Regional Analysis

Geographically, the countries covered in the food micronized salt market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

Asia-Pacific is the dominant region in the food micronized salt market during the forecast period 2022 -2029

Asia-Pacific dominates the food micronized salt market owing to China's dominant position in the Asia-Pacific attributed to several factors. Additionally, the country's large population and rapid urbanization have resulted in a booming food and beverage industry. Additionally, the emerging opportunities for micronized salt in this region, driven by the demand for convenient and high-quality food products, have contributed to the market's rapid growth. China's focus on technological advancements and expanding food processing capabilities further support the increasing adoption of micronized salt in the country's food industry.

North America is estimated to be the fastest growing region in the food micronized salt market for the forecast period 2022-2029

North America is expected to register a growing position in the food micronized salt market owing the U.S. with a leading position in the North America food micronized salt market for several reasons. Furthermore, the country's dominance can be attributed to the extensive usage of micronized salt in key segments like bakery and beverages. Micronized salt is commonly employed in baking processes to enhance dough texture and improve flavor. In the beverages industry, it is utilized for its quick solubility. These factors contribute to the United States' dominance in the North American food micronized salt market.

For more detailed information about the food micronized salt market report, click here – https://www.databridgemarketresearch.com/reports/global-food-micronized-salt-market