Flow control through industrial valves is crucial for the efficient and safe operation of pipelines and process systems. These valves regulate the flow of liquids, gases, and slurries, ensuring the processes meet desired parameters. By precisely adjusting the valve settings, industries can prevent overflows, maintain optimal pressure levels, and manage the rate of fluid transfer. This level of control is particularly vital in industries such as oil and gas, water treatment, and manufacturing, where precise flow management is essential for operational safety, product quality, and system efficiency. Industrial valves, acting as gatekeepers in the fluid transport and processing infrastructure, enable industries to uphold stringent standards, adhere to regulatory requirements, and enhance the reliability of their processes.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-industrial-valves-market

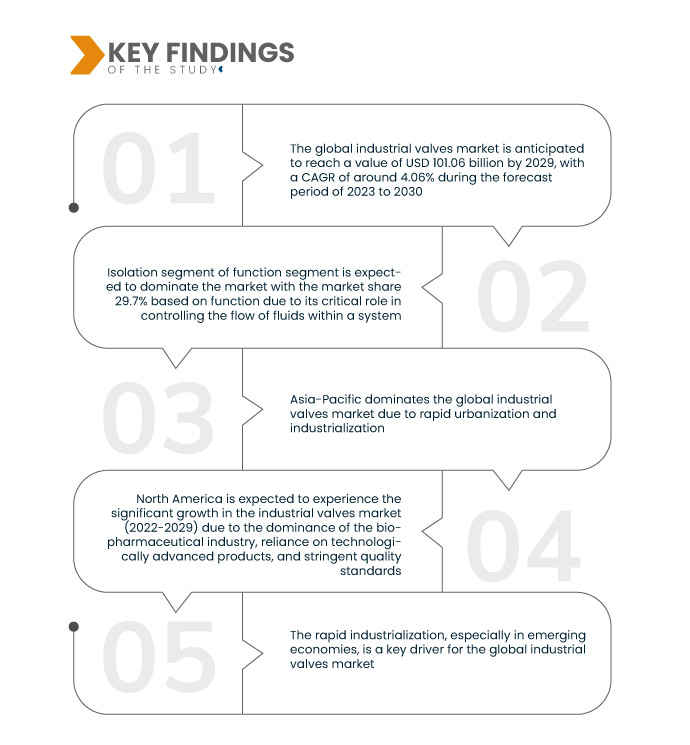

Data Bridge Market Research analyses the Global Industrial Valves Market was valued at USD 73.50 billion in 2021 and is expected to reach USD 101.06 billion by 2029, registering a CAGR of 4.06% during the forecast period of 2022-2029. The global industrial valves market is propelled by increasing infrastructure development, with a surge in projects such as water treatment plants, power generation facilities, and oil and gas pipelines.

Key Findings of the Study

Increasing emphasis on water and wastewater treatment is expected to drive the market's growth rate

The increasing focus on water and wastewater treatment is a significant driver for the global industrial valves market. Escalating concerns about water scarcity and stringent environmental regulations propels the demand for effective water treatment solutions. Industrial valves play a pivotal role in these processes by facilitating the precise control and regulation of fluid flow and supporting the treatment and distribution of clean water. These valves contribute crucially to wastewater management, ensuring compliance with environmental standards. As global awareness of water-related challenges grows, the demand for industrial water and wastewater treatment valves is expected to rise, fostering market growth.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2022 to 2029

|

Base Year

|

2021

|

Historic Years

|

2020 (Customizable to 2014- 2019)

|

Quantitative Units

|

Revenue in USD Billion, Volumes in Units, Pricing in USD

|

Segments Covered

|

Type (Gate Valve, Globe Valve, Ball Valve, Butterfly Valve, Diaphragm Valve, Check Valve, Plug Valve, Pinch Valve, Needle Valve, Pressure Relief Valve and Others), Function (Isolation, Regulation, Safety Relief Valve, Special Purpose and Non-Return), Material (Ductile Iron, Carbon Steel, Plastic, Brass, Bronze, Copper, Aluminium and Others), Accessories (Hydraulic Filter, Power Cable, Mounting Screw and Bolts, Seal Kits, Dust Protection Cover and Others), Size (1 Inch to 6 Inch, 6 Inch to 12 Inch, 12 Inch to 24 Inch, 24 Inch to 48 Inch and Above 48 Inch), Application (Oil and Gas, Water and Waste Treatment, Chemical, Energy and Utilities, Food and Beverages, Pharmaceutical, Agriculture, Marine, Automotive, Metals and Mining, Paper and Pulp and Others)

|

Countries Covered

|

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA).

|

Market Players Covered

|

Emerson Electric Co. (U.S.), Schlumberger Limited. (U.S.), Flowserve Corporation (U.S.), IMI (India), Metso Corporation (Finland), GE VALVE (India), Curtiss-Wright Corporation (U.S.), Crane Co. (U.S.), Neway valve. (China), McWane, Inc. (U.S.), ALFA LAVAL (Sweden), Rotork (U.K.), KITZ Corporation (Japan), KSB SE and Co. KGaA (Germany), Velan Inc. (Canada), Honeywell. (U.S.), Spirax-Sarco Engineering plc (U.K.), SAMSON AG (Germany), Forbes Marshall (India), and Swagelok Company (U.S.), among others

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The global industrial valves market is segmented on the basis of type, function, material, accessories, size, and application.

- On the basis of type, the global industrial valves market is segmented into gate valve, globe valve, ball valve, butterfly valve, diaphragm valve, check valve, plug valve, pinch valve, needle valve, pressure relief valve and others. The gate valve is expected to dominate the market with 21.7% market share due to their widespread use in various industries, including oil and gas, water and wastewater treatment, and chemical processing

- On the basis of function, the global industrial valves market is segmented into isolation, regulation, safety relief valve, special purpose, non-return. The isolation is expected to dominate the market with 29.7% market share because it plays a critical role in controlling the flow of fluids or gases by providing a reliable means to isolate and shut off pipelines, ensuring efficient maintenance, repair, and safety in various industrial processes

The isolation segment of function segment is expected to dominate the global industrial valves market during the forecast period of 2022-2029

Isolation is expected to dominate the global industrial valves market with the market share 29.7% based on function due to its critical role in controlling the flow of fluids within a system. Isolation valves serve as essential components for blocking or allowing the passage of liquids or gases, enabling the isolation of specific sections of a pipeline or system. This function is crucial for maintenance, repair, and safety procedures, allowing for the efficient shutdown and isolation of specific components or sections. Industries such as oil and gas, petrochemicals, and water treatment heavily rely on isolation valves to ensure controlled and secure operations.

- On the basis of material, the global industrial valves market is segmented into ductile iron, carbon steel, plastic, brass, bronze, copper, aluminium and others. The ductile iron is expected to dominate the market with 27.5% market share due to its superior strength, durability, and corrosion resistance, making it a preferred choice for applications in industries such as oil and gas, water treatment, and chemical processing

- On the basis of accessories, the global industrial valves market is segmented into hydraulic filter, power cable, mounting screw and bolts, seal kits, dust protection cover and others. The hydraulic filter is expected to dominate the market with 24.2% market share due to its crucial role in maintaining the cleanliness of hydraulic fluids, preventing contamination and ensuring the optimal performance and longevity of industrial valve systems

- On the basis of size, the global industrial valves market is segmented into 1 inch to 6 inch, 6 inch to 12 inch, 12 inch to 24 inch, 24 inch to 48 inch and above 48 inch. The 1 inch to 6 inch segment is expected to dominate the market with 27.5% market share due to its widespread application across various industries, including oil and gas, water treatment, and manufacturing

- На основе сферы применения глобальный рынок промышленной арматуры сегментируется на нефтегазовую, водоочистную и очистную, химическую, энергетическую и коммунальную, пищевую и безалкогольную, фармацевтическую, сельскохозяйственную, судостроительную, автомобильную, металлургическую и горнодобывающую, целлюлозно-бумажную и др. Ожидается, что нефтегазовый сегмент будет доминировать на рынке с долей рынка 20,1% из-за широкого использования в отрасли арматуры в различных процессах, таких как добыча, переработка и транспортировка нефти и газа.

Ожидается, что сегмент нефтегазовой отрасли будет доминировать на мировом рынке промышленной арматуры в прогнозируемый период 2022–2029 гг.

Ожидается, что сегмент нефтегазового сектора в сегменте применения будет доминировать на мировом рынке промышленной арматуры с долей рынка 20,1% из-за широкого использования в отрасли арматуры для управления и регулирования потока жидкостей в различных процессах. В нефтегазовом секторе промышленные арматуры имеют решающее значение в таких приложениях, как нефтепереработка, переработка газа и транспортировка по трубопроводам. Потребность в точном управлении потоком, управлении давлением и мерах безопасности обуславливает высокий спрос отрасли на арматуру. Растущая деятельность по разведке и добыче в нефтегазовом секторе во всем мире способствует устойчивому спросу на промышленную арматуру, еще больше укрепляя ее позицию как доминирующего сегмента применения на рынке.

Основные игроки

Компания Data Bridge Market Research выделяет следующие компании в качестве основных игроков на мировом рынке промышленной арматуры: Emerson Electric Co. (США), Schlumberger Limited. (США), Flowserve Corporation (США), IMI (Индия), Metso Corporation (Финляндия), GE VALVE (Индия), Curtiss-Wright Corporation (США).

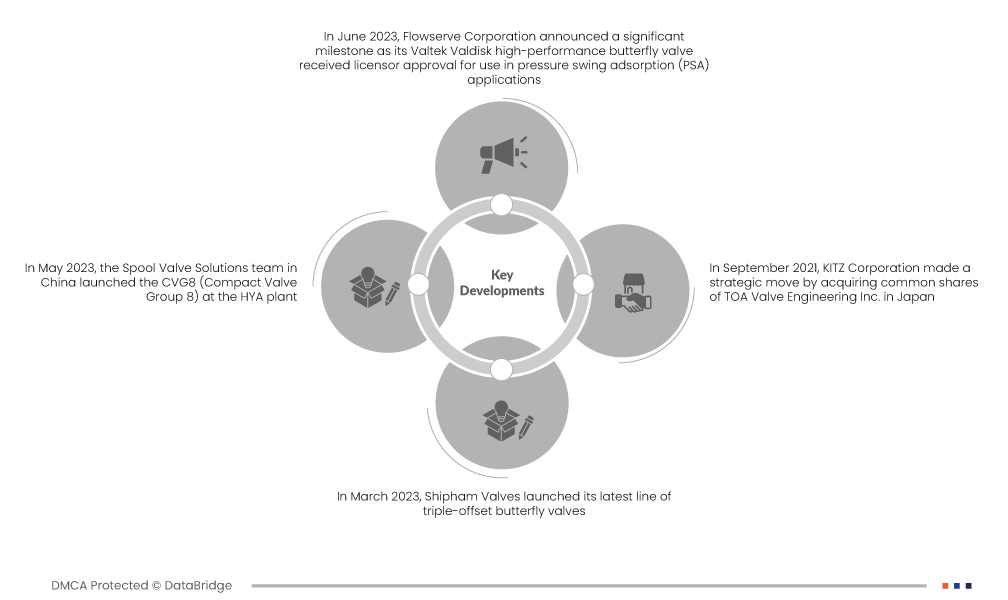

Развитие рынка

- В июне 2023 года корпорация Flowserve объявила о важном событии: ее высокопроизводительный дроссельный клапан Valtek Valdisk получил одобрение лицензиара на использование в приложениях адсорбции при переменном давлении (PSA). Одобрение последовало за строгим испытанием на выносливость в один миллион циклов, продемонстрировавшим способность клапана обеспечивать герметичное закрытие в таких приложениях, как нефтеперерабатывающие заводы и химические заводы. Новый клапан разработан для высокоцикловых и двунаправленных потоков, что отвечает особым потребностям этих отраслей

- В мае 2023 года команда Spool Valve Solutions в Китае запустила CVG8 (Compact Valve Group 8) на заводе HYA. Этот передовой компактный пропорциональный электромагнитный клапан с прямым приводом унаследовал модульную конструкцию и компактные характеристики конструкции от известного семейства секционных клапанов Danfoss. CVG8 известен своим быстрым откликом и замечательной точностью, а его индивидуальная модульная конструкция обеспечивает широкий спектр функциональных возможностей, что делает его универсальным дополнением к рынку клапанов

- В марте 2023 года Shipham Valves выпустила новейшие трехпозиционные дисковые затворы. Эта новая серия клапанов отличается исключительными элементами дизайна, включая быстрые операции на четверть оборота для быстрого открытия и закрытия. Клапаны также могут похвастаться постоянным профилем вокруг конической уплотнительной поверхности, что обеспечивает герметичность и эффективное уплотнение. Это нововведение удовлетворяет потребность в быстрой и надежной работе клапанов, что делает его достойным дополнением к ассортименту продукции Shipham Valves

- В сентябре 2021 года корпорация KITZ стратегически приобрела обыкновенные акции TOA Valve Engineering Inc. в Японии. Это приобретение было частью альянса капитала и бизнеса, направленного на повышение корпоративной стоимости обеих компаний. Соглашение способствовало взаимному обмену технологиями, сильными сторонами и стратегиями, связанными с клапанами, способствуя расширению бизнеса для корпорации KITZ и TOA Valve Engineering Inc.

Региональный анализ

Географически в отчете о мировом рынке промышленной арматуры рассматриваются следующие страны: США, Канада, Мексика, Бразилия, Аргентина, остальные страны Южной Америки, Германия, Италия, Великобритания, Франция, Испания, Нидерланды, Бельгия, Швейцария, Турция, Россия, остальные страны Европы, Япония, Китай, Индия, Южная Корея, Австралия, Сингапур, Малайзия, Таиланд, Индонезия, Филиппины, остальные страны Азиатско-Тихоокеанского региона, Саудовская Аравия, ОАЭ, Южная Африка, Египет, Израиль, остальные страны Ближнего Востока и Африки (MEA).

Согласно анализу Data Bridge Market Research:

Азиатско-Тихоокеанский регион будет доминирующим регионом на мировом рынке промышленной арматуры в прогнозируемый период 2022-2029 гг.

Азиатско-Тихоокеанский регион (APAC) доминирует на мировом рынке промышленных клапанов из-за стечения ряда факторов. Быстрая урбанизация региона подстегнула спрос на развитие инфраструктуры, при этом промышленные клапаны имеют решающее значение для управления потоками в строительных проектах. Быстро растущие промышленные секторы, особенно автомобилестроение, химическая промышленность и электроника, в значительной степени зависят от клапанов для эффективной работы. Текущие инфраструктурные проекты, экономический рост и технологические достижения еще больше подстегнули потребность в сложных промышленных клапанах в APAC. Правительственные инициативы, поддерживающие промышленное развитие и соблюдение правил, усиливают доминирование региона на рынке.

По оценкам, Северная Америка станет самым быстрорастущим регионом на мировом рынке промышленной арматуры в прогнозируемом периоде 2022–2029 гг.

Ожидается, что в Северной Америке будет наблюдаться существенный рост рынка промышленных клапанов с 2022 по 2029 год. Этот рост обусловлен ведущей биофармацевтической промышленностью региона, где промышленные клапаны имеют решающее значение для обработки жидкостей в фармацевтическом производстве. Доступность Северной Америки к технологически передовым продуктам и ее роль как инновационного центра способствуют внедрению сложных технологий промышленных клапанов. Строгие стандарты качества в биофармацевтическом секторе, активные научно-исследовательские и опытно-конструкторские работы и рыночная конкурентоспособность еще больше укрепляют позицию региона как ключевого игрока на мировом рынке промышленных клапанов в прогнозируемый период.

Для получения более подробной информации об отчете о мировом рынке промышленной арматуры нажмите здесь – https://www.databridgemarketresearch.com/reports/global-industrial-valves-market