Orthopedic implants are devices that are used to replace or repair damaged bones, joints, and other tissues. They are used to treat a variety of orthopedic conditions. Orthopedic implants are made from a variety of materials, including metal, plastic, and ceramic. The type of material that is used depends on the specific implant and the patient's needs. Orthopedic implants are a safe and effective treatment for a variety of orthopedic conditions. They can help patients to regain their mobility and reduce pain, which can improve their quality of life. Orthopedic implants are used in a variety of ways, depending on the specific condition that is being treated. For example, joint replacements are typically performed under general anesthesia.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-orthopedic-implants-including-dental-implants-market

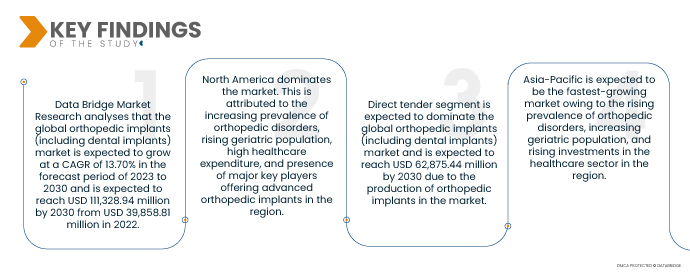

Data Bridge Market Research analyses that the Global Orthopedic Implants (Including Dental Implants) Market is expected to grow at a CAGR of 13.70% in the forecast period of 2023 to 2030 and is expected to reach USD 111,328.94 million by 2030 from USD 39,858.81 million in 2022. The increasing prevalence of orthopedic disorders is one of the major drivers of the global orthopedic implants market. Orthopedic disorders are a major cause of disability and pain, and they can significantly impact a person's quality of life. The rising geriatric population is another major driver of the market. The geriatric population is more susceptible to orthopedic disorders, and they are more likely to require treatment. The demand for minimally invasive procedures is also driving the growth of the market. Minimally invasive procedures are less invasive than traditional surgical procedures, and they have a shorter recovery time. This makes them a more attractive option for patients.

Growing demand for minimally invasive surgeries is expected to drive the market's growth rate

Growing knowledge and availability of minimally invasive surgical procedures as a result of the numerous benefits offered by these surgeries is another important driving reason responsible for market expansion. Furthermore, rising engagement in sporting and physical activities is directly impacting the rising number of sports injuries necessitating medical attention, which is predicted to have an impact on market development. The demand for minimally invasive procedures is increasing since they result in fewer traumas and faster recovery than invasive operations.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015- 2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Product Type (Reconstructive Joint Replacements, Spinal Implants, Motion Preservation Devices/Non-Fusion Devices, Dental Implants, Trauma Implants, Orthobiologics, and Others), Biomaterial (Metallic Biomaterials, Ceramic Biomaterial, Polymeric Biomaterials, Natural Biomaterials, and Others), Procedures (Open Surgery, Minimally Invasive Surgery (MIS), and Others), Fixation Type (Cement Orthopedic Implants, Cementless Orthopedic Implants, and Hybrid Orthopedic Implants), End User (Hospitals, Clinics, Ambulatory Surgical Centers, Home Care Settings, Academic and Research Institutes, and Others), Distribution Channel (Direct Tender, Retail Sales, and Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America

|

|

Market Players Covered

|

CONMED Corporation (U.S.), Wright Medical Group N.V. (U.S.), Stryker (U.S.), Medtronic (Ireland), Smith+Nephew (U.K.), Zimmer Biomet (U.S.), Integra LifeSciences (U.S.), B. Braun Melsungen AG (Germany), Arthrex (US), Baxter (U.S.), Medical Device Business Services, Inc. (U.S.), Globus Medical (U.S.), DJO, LLC (U.S.), NuVasive, Inc. (U.S.), Orthopedic Implant Co. (U.S.), Aesculap Inc. (U.S.), Flexicare Medical Limited (U.K.), BioTek Instruments, Inc. (U.S.), Narang Medical Limited (India), Auxein Medical (India), Uteshiya Medicare (India)

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework

|

Segment Analysis:

The global orthopedic implants (including dental implants) market is categorized into six notable segments based on product type, biomaterials, procedure, fixation type, end user, and distribution channel.

- On the basis of product type, the global orthopedic implants (including dental implants) market is segmented into reconstructive joint replacements, spinal implants, motion preservation devices/ non-fusion devices, dental implants, trauma implants, orthobiologics, and others. Reconstructive joint replacement segment is expected to dominate the global orthopedic implants (including dental implants) market and is expected to reach USD 58,878.33 million by 2030 due to the rise in orthopedic problems all over the world.

- On the basis of biomaterial, the global orthopedic implants (including dental implants) market is segmented into metallic biomaterials, ceramic biomaterials, polymer biomaterials, natural biomaterials, and others. Metallic biomaterials segment is expected to dominate the global orthopedic implants (including dental implants) market and is expected to reach USD 62,446.17 million by 2030 due to increased technological advancement in orthopedic surgical procedures.

- On the basis of procedures, the global orthopedic implants (including dental implants) market is segmented into open surgery and minimally invasive surgery (MIS). Open surgery is expected to dominate the market and is expected to reach USD 68,919.09 million by 2030 due to high technological advancement and growing market players.

- On the basis of fixation type, the global orthopedic implants (including dental implants) market is segmented into cement orthopedic implants, cementless orthopedic implants, and hybrid orthopedic implants. Cement orthopedic implants segment is expected to dominate the global orthopedic implants (including dental implants) market and is expected to reach USD 62,786.36 million by 2030 due to increased strategic collaboration between key market players.

- On the basis of end user, the global orthopedic implants (including dental implants) market is segmented into hospitals, clinics, ambulatory care center, home care settings, academic and research institutes, and others. Hospitals segment is expected to dominate the market and is expected to reach USD 46,482.67 million by 2030 due to government regulations and initiatives taken in the market.

The hospitals segment will dominate the end user segment of the orthopedic implants (including dental implants) market

The hospitals segment will emerge as the dominating segment end user segment. This is because of the growing number of hospitals in the market especially in the developing economies. Further, growth and expansion of research development services on a global scale will further bolster the growth of this segment.

- On the basis of distribution channel, the global orthopedic implants (including dental implants) market is segmented into direct tender, retail sales, and others. Direct tender segment is expected to dominate the global orthopedic implants (including dental implants) market and is expected to reach USD 62,875.44 million by 2030 due to the production of orthopedic implants in the market.

The direct tender segment will dominate the distribution channel segment of the orthopedic implants (including dental implants) market

The direct tender segment will emerge as the dominating segment under distribution channel. This is because of the growing number of infrastructural development activities in the market especially in the developing economies. Further, growth and expansion of the healthcare industry all around the globe will further bolster the growth of this segment.

Major Players

Data Bridge Market Research recognizes the following companies as the major market players: CONMED Corporation (U.S.), Wright Medical Group N.V. (U.S.), Stryker (U.S.), Medtronic (Ireland), Smith+Nephew (U.K.), Zimmer Biomet (U.S.), Integra LifeSciences (U.S.), B. Braun Melsungen AG (Germany), Arthrex (US), Baxter (U.S.), Medical Device Business Services, Inc. (U.S.), Globus Medical (U.S.), DJO, LLC (U.S.), NuVasive, Inc. (U.S.), Orthopedic Implant Co. (U.S.), Aesculap Inc. (U.S.), Flexicare Medical Limited (U.K.), BioTek Instruments, Inc. (U.S.), Narang Medical Limited (India), Auxein Medical (India), Uteshiya Medicare (India).

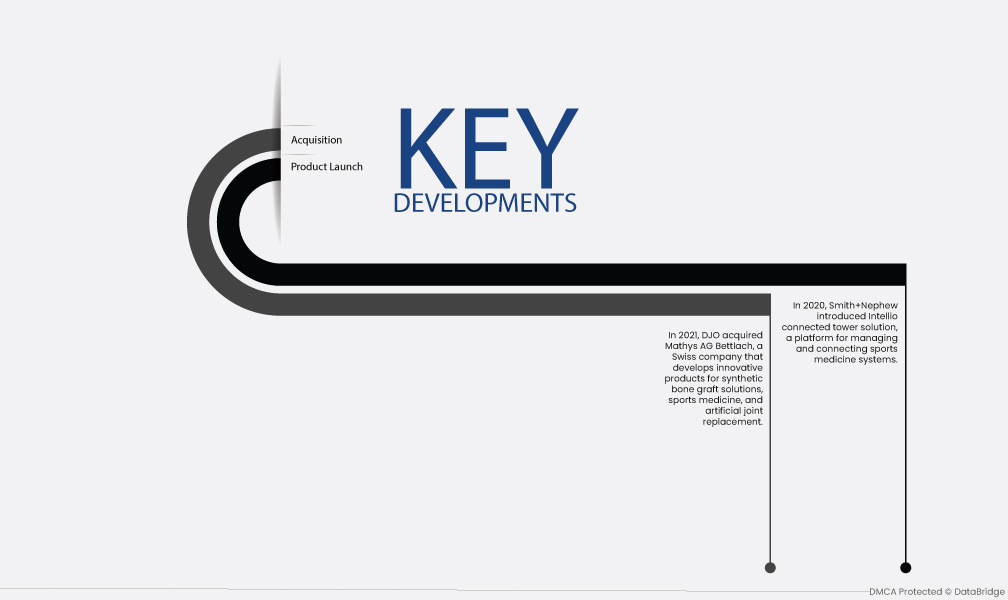

Market Development

- In 2021, DJO acquired Mathys AG Bettlach, a Swiss company that develops innovative products for synthetic bone graft solutions, sports medicine, and artificial joint replacement. The acquisition will allow DJO to expand its product portfolio and strengthen its position in the orthopedic market. DJO is a global leader in the orthopedic market, with a wide range of products that include implants, surgical instruments, and rehabilitation devices. The acquisition of Mathys AG Bettlach will add a number of innovative products to DJO's portfolio, including synthetic bone graft solutions, sports medicine products, and artificial joint replacements. These products will allow DJO to offer a more comprehensive range of solutions to its customers, and they will also help DJO to expand into new markets.

- In 2020, Smith+Nephew introduced Intellio connected tower solution, a platform for managing and connecting sports medicine systems. Intellio enables wireless connection and control of arthroscopy surgical towers. Intellio is a cloud-based platform that allows healthcare professionals to manage and connect their sports medicine systems. Intellio is designed to improve the efficiency and effectiveness of arthroscopy procedures. The platform can help to reduce the time required for procedures, improve the accuracy of surgery, and improve patient outcomes. Smith+Nephew is a global leader in the orthopedic market, with a wide range of products that include implants, surgical instruments, and rehabilitation devices.

Regional Analysis

Geographically, the countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

North America is the dominant region in the orthopedic implants (including dental implants) market during the forecast period 2023-2030

North America dominates the market. This is attributed to the increasing prevalence of orthopedic disorders, rising geriatric population, high healthcare expenditure, and presence of major key players offering advanced orthopedic implants in the region.

Asia-Pacific is estimated to be the fastest growing region in the orthopedic implants (including dental implants) market in the forecast period 2023-2030

Asia-Pacific is expected to be the fastest-growing market owing to the rising prevalence of orthopedic disorders, increasing geriatric population, and rising investments in the healthcare sector in the region.

For more detailed information about the orthopedic implants (including dental implants) market report, click here – https://www.databridgemarketresearch.com/reports/global-orthopedic-implants-including-dental-implants-market