Orthopedic implants, including dental implants, are crucial medical devices. They restore mobility and quality of life for patients suffering from joint issues, fractures, or tooth loss. These implants feature biocompatible materials that integrate with the body's tissues, ensuring stability and durability. They are used in orthopedic surgeries such as joint replacements and fracture fixation. Dental implants provide a long-lasting solution for missing teeth, enhancing oral function and aesthetics. Overall, orthopedic implants greatly improve patients' well-being by restoring physical mobility and dental health.

Access Full Report @ https://www.databridgemarketresearch.com/reports/mena-and-gcc-orthopedic-implants-including-dental-implants-market

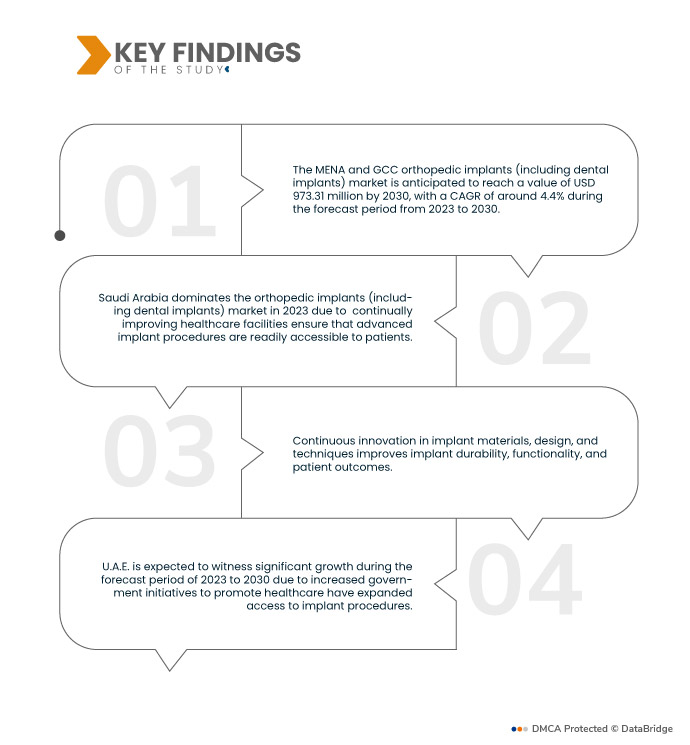

Data Bridge Market Research analyses that the MENA and GCC Orthopedic Implants (Including Dental Implants) Market is valued at USD 689.67 million in 2022 and is expected to reach USD 973.31 million by 2030, registering a CAGR of 4.4% during the forecast period of 2023 to 2030. The aging population experiences more orthopedic and dental problems, such as joint degeneration and tooth loss. This demographic trend fuels the demand for orthopedic and dental implants as effective solutions for addressing these age-related health issues, driving growth in the implant market.

Key Findings of the Study

Dental health awareness is expected to drive the market's growth rate

Increasing awareness about dental health and the benefits of dental implants as a durable tooth replacement option is a significant driver in the market. Patients are seeking long-term solutions that mimic natural teeth and improve their overall oral health. This awareness encourages more people to consider dental implants over traditional options, such as dentures or bridges. As a result, the demand for dental implants continues to rise as patients prioritize their dental well-being and quality of life.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Products (Reconstructive Joint Replacements, Spinal Implants, Trauma And Craniomaxillofacial, Dental Implants, Orthobiologics), Devices Type (Internal Fixation Devices And External Fixation Devices), Biomaterial (Metallic Biomaterials, Polymeric Biomaterials, Ceramic Biomaterials, Natural Biomaterials And Others), Procedures (Open Surgery And Minimally Invasive Surgery (Mis)), End User (Hospitals, Ambulatory Care Center, Specialized Clinics, Orthopedic Centers And Others), Ownership (Government And Private)

|

|

Countries Covered

|

Saudi Arabia, Kuwait, U.A.E., Qatar, Bahrain, and Oman

|

|

Market Players Covered

|

3M (U.S.), B. Braun Melsungen AG (Germany), Integra LifeSciences (U.S.), Depuy Synthes (A subsidiary of JnJ) Inc. (U.S.), Zimmer Biomet (U.S), Smith & Nephew plc (U.K), Medtronic (Ireland), Stryker (U.S.), Changzhou Waston Medical Appliance Co., Ltd. (U.S.), Narang Medical Limited (India), W. L. Gore & Associates, Inc. (U.S.), Arthrex, Inc. (U.S.) , GE HEALTHCARE (U.S.), DJO, LLC (A subsidiary of Colfax Corporation) (China), curex (U.S.), Samay Surgical (India), Dongguan Traumed Technology Co., Ltd. (China), Abou Hamela Group (Egypt)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework

|

Segment Analysis:

The MENA and GCC orthopedic implants (including dental implants) market is segmented on the basis of products, devices type, biomaterial, procedures, end user, and ownership.

- On the basis of products, the orthopedic implants (including dental implants) market is segmented into reconstructive joint replacements, spinal implants, trauma and craniomaxillofacial implants, dental implants, and orthobiologics. In 2023, the reconstructive joint replacements segment dominates the orthopedic implants (including dental implants) market with a CAGR of 5.1% during the forecast period 2023 to 2030 as the aging population increases, so does the prevalence of joint-related conditions such as osteoarthritis.

In 2023, the reconstructive joint replacements segment dominates the orthopedic implants (including dental implants) market with a CAGR of 5.1% during the forecast period 2023 to 2030

In 2023, the reconstructive joint replacements segment dominates the orthopedic implants (including dental implants) market with a CAGR of 5.1% during the forecast period 2023 to 2030 as reconstructive joint replacements, such as hip and knee replacements, offer effective solutions for restoring mobility and alleviating pain. Technological advancements have led to durable and innovative implant designs, enhancing patient outcomes. Additionally, these procedures have become more accessible, with improved surgical techniques and reduced recovery times.

- On the basis of devices type, the orthopedic implants (including dental implants) market is segmented into internal fixation devices and external fixation devices. In 2023, internal fixation devices segment dominates the orthopedic implants (including dental implants) market with a CAGR of 4.5% during the forecast period 2023 to 2030 as these devices, including screws, plates, and nails, are crucial for stabilizing fractures and facilitating bone healing.

- On the basis of biomaterial, the orthopedic implants (including dental implants) market is segmented into metallic biomaterials, polymeric biomaterials, ceramic biomaterials, natural biomaterials, and others. In 2023, the metallic biomaterials segment will dominate the orthopedic implants (including dental implants) market with a CAGR of 4.7% during the forecast period 2023 to 2030 as metallic biomaterials, such as titanium and stainless steel, are prized for their strength, durability, and biocompatibility, making them ideal for orthopedic implants such as joint replacements and spinal devices.

- On the basis of procedures, the orthopedic implants (including dental implants) market is segmented into open surgery and minimally invasive surgery (MIS). In 2023, the open surgery segment dominates the orthopedic implants (including dental implants) market with a CAGR 4.5% during the forecast period 2023 to 2030 as traditional open surgery procedures provide direct visibility and tactile feedback for orthopedic surgeons, allowing for precise implant placement, especially in complex cases.

- On the basis of end user, the orthopedic implants (including dental implants) market is segmented into hospitals, ambulatory care center, specialized clinics, orthopedic centers and others. In 2023, hospitals segment dominates the orthopedic implants (including dental implants) market with a CAGR of 4.8% during the forecast period 2023 to 2030 as hospitals serve as primary centers for surgical procedures, including orthopedic surgeries.

In 2023, the hospitals segment dominates the orthopedic implants (including dental implants) market with a CAGR of 4.8% during the forecast period 2023 to 2030

In 2023, the hospitals segment dominates the orthopedic implants (including dental implants) market with a CAGR of 4.8% during the forecast period 2023 to 2030 as they have access to advanced equipment, experienced surgeons, and comprehensive patient care facilities, making them the preferred choice for complex orthopedic implant procedures. Moreover, hospitals often receive referrals for specialized orthopedic cases, further bolstering their dominance in this market. As the global population ages and orthopedic issues become more prevalent, the demand for hospital-based orthopedic implant procedures continues to rise, solidifying the hospitals segment's leading position in market growth.

- On the basis of ownership, the orthopedic implants (including dental implants) market is segmented into government and private. In 2023, the government segment dominates the orthopedic implants (including dental implants) market with a CAGR of 4.7% during the forecast period 2023 to 2030 due to its significant role in regulating and funding healthcare systems.

Major Players

Data Bridge Market Research recognizes the following companies as the major MENA and GCC orthopedic implants (including dental implants) market players in MENA and GCC orthopedic implants (including dental implants) market are 3M (U.S.), B. Braun Melsungen AG (Germany), Integra LifeSciences (U.S.), Depuy Synthes (A subsidiary of JnJ) Inc. (U.S.), Zimmer Biomet (U.S), Smith & Nephew plc (U.K), Medtronic (Ireland), Stryker (U.S.), Changzhou Waston Medical Appliance Co., Ltd. (U.S.)

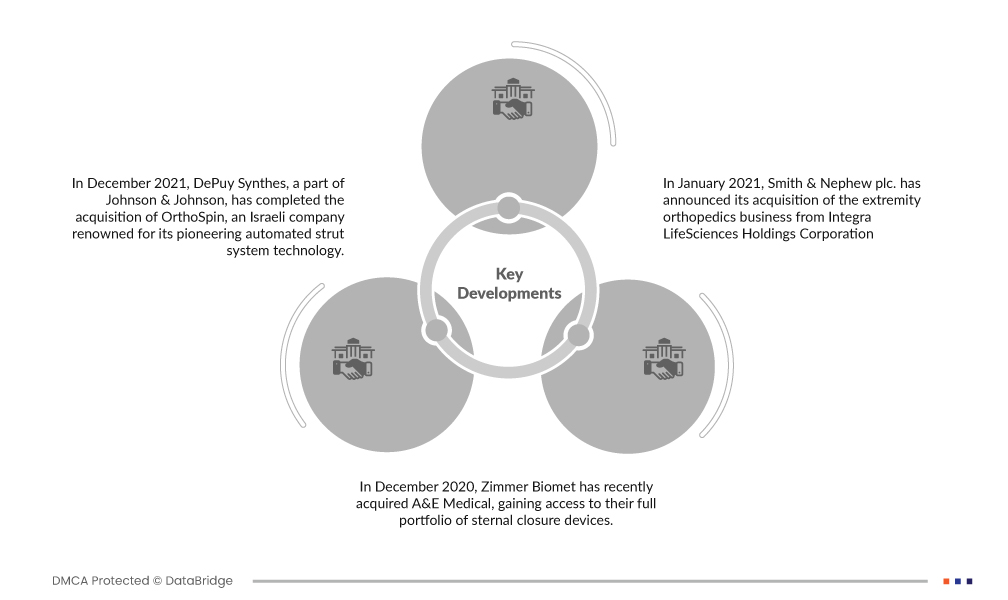

Market Developments

- In December 2021, DePuy Synthes, a part of Johnson & Johnson, has completed the acquisition of OrthoSpin, an Israeli company renowned for its pioneering automated strut system technology. This innovative system complements DePuy Synthes' MAXFRAME Multi-Axial Correction System, an external ring fixation system, enhancing the company's capabilities in the realm of medical innovation.

- In December 2020, Zimmer Biomet has recently acquired A&E Medical, gaining access to their full portfolio of sternal closure devices. This strategic acquisition significantly expands Zimmer Biomet's orthopedic implants portfolio, positioning the company for increased sales and heightened demand in the market. This move is expected to drive future revenue growth for Zimmer Biomet.

- In January 2021, Smith & Nephew plc. announced its acquisition of the extremity orthopedics business from Integra LifeSciences Holdings Corporation. This strategic move has effectively expanded the company's product portfolio.

Regional Analysis

Geographically, the countries covered in the MENA and GCC orthopedic implants (including dental implants) market report are Saudi Arabia, Kuwait, U.A.E., Qatar, Bahrain, and Oman

As per Data Bridge Market Research analysis:

Saudi Arabia dominates MENA and GCC in orthopedic implants (including dental implants) market during the forecast period 2023 - 2030

In 2023, Saudi Arabia dominates the MENA and GCC orthopedic implants (including dental implants) market due to strong presence of major industry players drives innovation and competition, enhancing the quality and variety of available implants. Furthermore, exceptional healthcare infrastructure in developed regions supports the seamless integration of these implants. Lastly, a significant population dealing with injuries and surgeries, particularly in an aging demographic, contributes to sustained market growth as implants become vital solutions in restoring mobility and quality of life.

U.A.E. is expected to witness significant growth during the forecast period of 2023 to 2030

In 2023, the U.A.E. is expected to witness significant growth due to rising awareness among the public about the benefits of implants and advanced surgical options has driven patient demand. Third, a large and growing population pool, combined with a rising need for quality healthcare, has created a substantial market for these advanced medical technologies. In sum, these factors converge to fuel the expansion of the Orthopedic Implants market in response to heightened healthcare awareness and demand.

For more detailed information about the orthopedic implants (including dental implants) market report, click here – https://www.databridgemarketresearch.com/reports/mena-and-gcc-orthopedic-implants-including-dental-implants-market