The growing emphasis of key players on technological advancements in molecular diagnostics and their indulgence in collaboration and partnerships with other organizations have a significant impact on the market for orthopedic surgical robots. The 15th century saw the earliest recorded applications of orthopedic surgery. Modern orthopedic surgery and musculoskeletal research reduce the invasiveness of surgery and improve the quality and durability of implanted components. The human skeletal system's function is restored by using orthopedic surgical robots to treat bone deformities. Recently, new, cutting-edge orthopedic surgical robot products have been created in an effort to boost the market's growth, and the key players in the industry are expanding their product lines. Orthopedic products are produced by a large number of market participants.

Access Full Report @ https://www.databridgemarketresearch.com/reports/global-orthopedic-surgical-robots-market

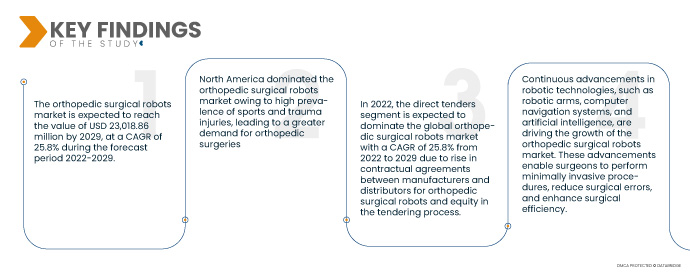

Data Bridge Market Research analyses that the Orthopedic Surgical Robots Market is expected to reach the value of USD 23,018.86 million by 2029, at a CAGR of 25.8% during the forecast period 2022-2029. Advancements in robotic technology, including improved imaging systems, haptic feedback, and augmented reality, have enhanced the capabilities of orthopedic surgical robots. These technological advancements have improved surgical planning, navigation, and intraoperative guidance, making robotic-assisted procedures more efficient and reliable.

Increasing demand for precision and personalized healthcare is expected to drive the market's growth rate

As patients and healthcare providers prioritize precision and personalized healthcare, the demand for orthopedic surgical robots continues to rise. These advanced technologies enable surgeons to plan and execute procedures with exceptional accuracy and customization, resulting in improved patient outcomes. Integrating robotic assistance, orthopedic surgeries can be tailored to individual patients, enhancing surgical precision and ultimately leading to more successful and efficient procedures in the field of orthopedic medicine.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2022 to 2029

|

Base Year

|

2021

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

Segments Covered

|

Product Type (Robotic System, Robotic Accessories, and Software and Services), End User (Hospital and Ambulatory Surgery Centers (ASCS)), Distribution Channel (Direct Tenders and Third Party Distributors)

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

Market Players Covered

|

Johnson & Johnson Services, Inc. (U.S.), Stryker (U.S.), Zimmer Biomet (U.S.), Smith & Nephew (U.K.), Corin Group (U.K.), NuVasive, Inc. (U.S.), Brainlab AG (Germany), Integrity Implants Inc. d/b/a/ Accelus (U.S.), Beijing Tinavi Medical Technologies Co., Ltd (China), Medtronic (Ireland), Globus Medical, Inc. (U.S.), Accuray Incorporated (U.S.), THINK Surgical, Inc. (U.S.), CUREXO, INC. (U.S.)

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The orthopedic surgical robots market is segmented on the basis of product type, end user and distribution channel.

- On the basis of product type, the global orthopedic surgical robots market is segmented into robotic system, robotic accessories, and software and services. In 2022, the robotic system segment is expected to dominate the global orthopedic surgical robots market with a CAGR of 25.8% from 2022 to 2029 due to the core technology that enables the precision and automation of surgical procedures. These systems provide the mechanical and technological infrastructure necessary for surgeons to perform robotic-assisted orthopedic surgeries with enhanced accuracy, control, and visualization

In 2022, the robotic system segment is expected to dominate the product type segment of the global orthopedic surgical robots market

In 2022, the robotic system segment is expected to dominate the global orthopedic surgical robots market owing to the increased prevalence bone disease and advanced features such as robotic arms, surgical tools, imaging systems, and navigation capabilities, enabling surgeons to perform complex and precise surgeries with a CAGR of 25.8% from 2022 to 2029.

- On the basis of end user, the global orthopedic surgical robots market is segmented into hospital, and ambulatory surgery centers (ASCS). In 2022, the hospital segment is expected to dominate the global orthopedic surgical robots market with a CAGR of 25.8% from 2022 to 2029 due to the availability of advanced orthopedic surgical robots, rise in count of patients admitted in hospitals, undergoing hip and knee replacements and increase in disposable income.

- On the basis of distribution channel, the global orthopedic surgical robots market is segmented into direct tenders and third party distributors. In 2022, the direct tenders segment is expected to dominate the global orthopedic surgical robots market with a CAGR of 25.8% from 2022 to 2029 due to rise in contractual agreements between manufacturers and distributors for orthopedic surgical robots and equity in the tendering process.

In 2022, the direct tenders segment is expected to dominate the distribution channel of the global orthopedic surgical robots market

In 2022, the direct tenders segment is expected to dominate the global orthopedic surgical robots market owing to the purchase of high-value equipment like orthopedic surgical robots involves a careful evaluation of technical specifications, after-sales support, and pricing with a CAGR of 25.8% from 2022 to 2029.

Major Players

Data Bridge Market Research recognizes the following companies as the major orthopedic surgical robots market players in orthopedic surgical robots market are Johnson & Johnson Services, Inc. (U.S.), Stryker (U.S.), Zimmer Biomet (U.S.), Smith & Nephew (U.K.), Corin Group (U.K.), NuVasive, Inc. (U.S.), Brainlab AG (Germany), Integrity Implants Inc. d/b/a/ Accelus (U.S.), Beijing Tinavi Medical Technologies Co., Ltd (China), Medtronic (Ireland).

Market Development

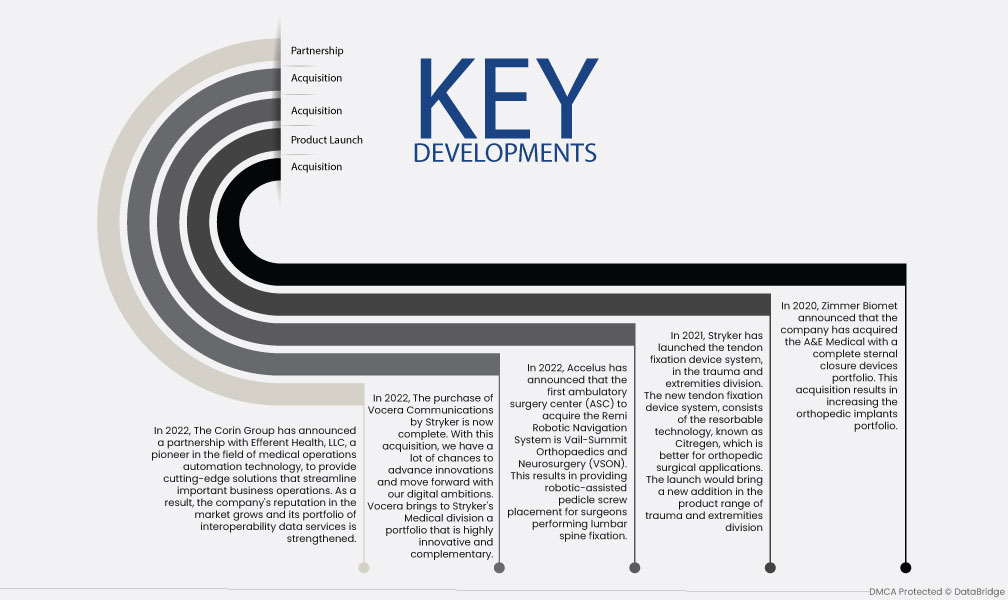

- In 2022, The Corin Group has announced a partnership with Efferent Health, LLC, a pioneer in the field of medical operations automation technology, to provide cutting-edge solutions that streamline important business operations. As a result, the company's reputation in the market grows and its portfolio of interoperability data services is strengthened.

- In 2022, The purchase of Vocera Communications by Stryker is now complete. With this acquisition, we have a lot of chances to advance innovations and move forward with our digital ambitions. Vocera brings to Stryker's Medical division a portfolio that is highly innovative and complementary.

- In 2022, Accelus has announced that the first ambulatory surgery center (ASC) to acquire the Remi Robotic Navigation System is Vail-Summit Orthopaedics and Neurosurgery (VSON). This results in providing robotic-assisted pedicle screw placement for surgeons performing lumbar spine fixation.

- In 2021, Stryker has launched the tendon fixation device system, in the trauma and extremities division. The new tendon fixation device system, consists of the resorbable technology, known as Citregen, which is better for orthopedic surgical applications. The launch would bring a new addition in the product range of trauma and extremities division

- In 2020, Zimmer Biomet announced that the company has acquired the A&E Medical with a complete sternal closure devices portfolio. This acquisition results in increasing the orthopedic implants portfolio.

Regional Analysis

Geographically, the countries covered in the orthopedic surgical robots market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

As per Data Bridge Market Research analysis:

North America is the dominant region in the orthopedic surgical robots market during the forecast period 2022 to 2029

North America's dominance in the global orthopedic surgical robots market can be attributed to several factors. The region experiences a high prevalence of sports and trauma injuries, leading to a greater demand for orthopedic surgeries. Additionally, the region invests significantly in the treatment of chronic bone diseases, further driving the market growth for orthopedic surgical robots and related devices. These factors contribute to the adoption and utilization of advanced technologies in orthopedic procedures in North America.

For more detailed information about the orthopedic surgical robots market report, click here – https://www.databridgemarketresearch.com/reports/global-orthopedic-surgical-robots-market