The term "generic injectables " describes the injectable administration of pharmaceuticals using generic drugs. The drug delivery method is preferred due to its effectiveness in providing accurate dosage management and serving as a backup when oral administration is not feasible or is not as effective. Generic injectable medication administration is essential to healthcare because it offers reasonably priced substitutes without sacrificing therapeutic requirements.

Access full Report @ https://www.databridgemarketresearch.com/reports/india-and-europe-generic-injectable-market

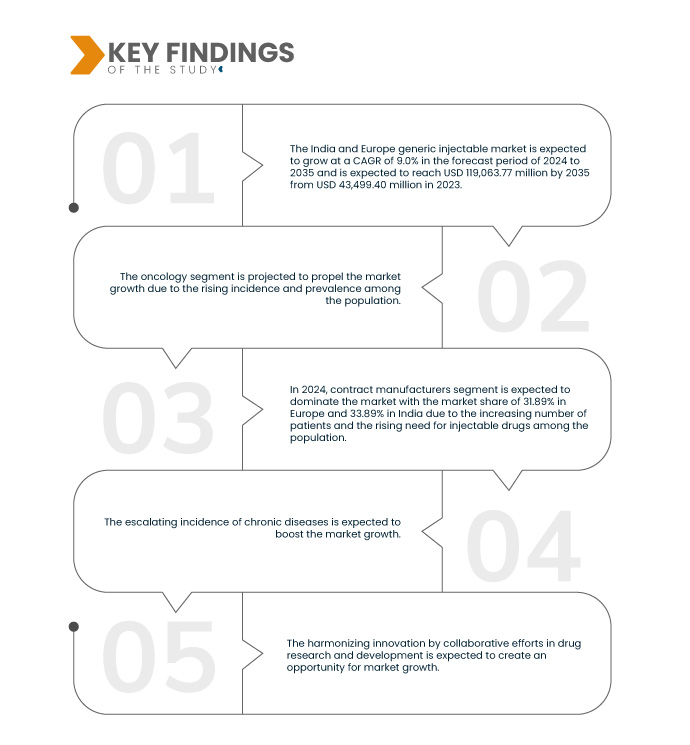

Data Bridge Market Research analyzes that the India and Europe Generic Injectable Market is growing at a CAGR of 9.0% in the forecast period of 2024 to 2035 and is expected to reach USD 119,063.77 million by 2031 from USD 43,499.40 million in 2023. Escalating the incidence of chronic diseases and a surge in the development and production of generic injectable is expected to drive the market's expansion.

Key Findings of the Study

Availability of a wide variety of distribution channel

The diversity in distribution channels, including retail pharmacies, hospital pharmacies, online platforms, and government healthcare facilities, contributes to increased accessibility and availability of generic injectable drugs across various population segments. This wide array of channels ensures that these medications reach urban and rural areas, addressing regional disparities in healthcare access. Furthermore, multiple distribution options promote healthy competition, fostering efficiency and affordability in the market. The convenience and flexibility offered by diverse distribution channels benefit consumers by providing multiple access points and facilitating efficient market penetration for manufacturers. This dynamic environment contributes to the overall improvement of healthcare services and outcomes in the Indian market, reflecting the positive impact of an expansive and competitive distribution network for generic injectables, driving the market growth.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2035

|

|

Base Year

|

2023

|

|

Historic Year

|

2022 (Customizable to 2016–2021)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Therapeutic Application (Oncology, Cardiovascular Disorders, Infectious Diseases, Pain Management, Metabolic Disorder (Diabetes), and Immunology Disorders), Biosimilar Drugs (Semaglutide, Ibutidlide Fumarate, Evolocumab, Alirocumab, Anidulafungin, Dulaglutide, Lixisenatide, Exenatide, Liraglutide, and Adalimumab), End User (Direct Sales Distributors, Pharmaceutical Wholesalers, Drug Stores, Pharmacy, Group Purchasing Organizations (GPOs), and Others), Distribution Channel (Pharmaceutical Wholesalers, Contract Manufacturers, Pharmacy Chains, Group Purchasing Organizations (GPOs), and Others)

|

|

Market Players Covered

|

Cipla Inc. (India), Concord Biotech (India), Dr. Reddy’s Laboratories Ltd (India), Sanofi (U.S.), Viatris Inc., Fresenius Kabi AG (Germany), Sandoz Group AG (Switzerland), GLENMARK PHARMACEUTICALS LTD (India), Gland Pharma Limited (India), Par Pharmaceutical (India), Aurobindo Pharma (India), Hikma Pharmaceuticals PLC (U.K.) Intas Pharmaceuticals Ltd. (India), Sun Pharmaceutical Industries Ltd (India), Amneal Pharmaceuticals LLC (U.S.) Viatris Inc (U.S.), Zydus Group (India), Lupin (India), among others

|

|

Country/Region Covered

|

India and Europe

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis

India and Europe generic injectables market is categorized into four notable segments based on therapeutic application, biosimilar drugs, end user, and distribution channel.

- On the basis of therapeutic application, the India and Europe generic injectable market is segmented into oncology, cardiovascular disorders, infectious diseases, pain management, metabolic disorder (diabetes), immunology disorders

In 2024, the oncology segment is expected to dominate the India and Europe generic injectables market

In 2024, the oncology segment is expected to dominate the India and Europe generic injectable market with the market share of 44.42% in Europe and 39.65% in India surge in development and production of generic injectable.

- On the basis of biosimilar drugs, the India and Europe generic injectable market is segmented into semaglutide, ibutilide fumarate, evolocumab, alirocumab, anidulafungin, exenatide, lixisenatide, dulaglutide, and adalimumab

In 2024, the ibutilide fumarate segment of the biosimilar drugs segment is expected to dominate the India and Europe generic injectable market

In 2024, the ibutilide fumarate segment is expected to dominate the India and Europe generic injectable market with the market share of 40.33% in Europe and 43.50% in India due to surge in development and production of generic injectable

- On the basis of end user, the market is segmented into direct sales distributors, pharmaceutical wholesalers, drug stores, pharmacy, group purchasing organizations (GPOs), and others. In 2024, the direct sales distributors segment is expected to dominate the India and Europe generic injectable market with a market share of 26.04% in Europe and 24.41% in India

- On the basis of distribution channel, the market is segmented into pharmaceutical wholesalers, contract manufacturers, pharmacy chains, Group Purchasing Organizations (GPOs), and others. In 2024, the contract manufacturers segment is expected to dominate the India and Europe generic injectable market with a market share of 31.89% in Europe and 33.89% in India

Major Players

Data Bridge Market Research analyzes Fresenius SE & Co. KGaA (Germany), Sun Pharmaceutical Industries Ltd. (India), Amneal Pharmaceuticals LLC. (U.S.) Zydus Group (India), Lupin (India) as major market players in India and Europe generic injectables market.

Market Development

- In January 2024, Sun Pharmaceutical Industries Limited and Taro Pharmaceutical Industries Ltd. officially entered into a definitive merger agreement. Under this agreement, Sun Pharma, as the controlling shareholder of Taro, will acquire all outstanding ordinary shares of Taro, excluding those already held by Sun Pharma or its affiliates. The acquisition will be at a cash price of USD 43.00 per share without interest. This merger is anticipated to create a more robust and competitive entity, driving potential benefits such as increased market presence, operational efficiency, and expanded capabilities for Sun Pharma and Taro Pharmaceutical Industries Ltd

- In November 2023, Fresenius Kabi introduced Tyenne, its biosimilar of tocilizumab referencing RoActemra (tocilizumab), in the European Union. Tyenne marks the inaugural tocilizumab biosimilar in Europe for addressing various inflammatory and immune diseases. It will expand its product range

- In August 2023, Aurobindo Pharma secured final approval from the U.S. Food and Drug Administration (USFDA) for the production and commercialization of Vancomycin Hydrochloride for Injection USP in Single-Dose Vials with strengths of 1.25 g/vial and 1.5 g/vial. These formulations are bioequivalent and therapeutically equivalent to the reference listed drug (RLD), Vancomycin Hydrochloride for Injection USP, manufactured by Mylan Laboratories Ltd

- In June 2023, Dr. Reddy's Laboratories Ltd. announced the opening of its new, dedicated division "RGenX," marking its entry into the Indian commercial generics market. Dr. Reddy believes this will give patients more affordable and more access to a greater selection of products. The new venture will advance the company's objective of serving more than 1.5 billion patients by 2030. This has helped the company to expand its business with product availability

- In December 2023, Hikma Pharmaceuticals PLC introduced Phenylephrine HCl Injection, USP, available in 500mcg/5mL and 1,000mcg/10mL doses. This product is now available in the United States in ready-to-use vials. Its intended use is to elevate blood pressure in adults experiencing clinically significant hypotension primarily caused by vasodilation during anesthesia. This helped the company to expand its market.

Geographical Analysis

Geographically, the country/region covered in the market report are India and Europe.

As per Data Bridge Market Research analysis:

Europe is expected to be the dominant and fastest-growing region in the India and Europe generic injectable market

Europe is expected to dominate the market due to the Availability of a wide variety of distribution channels. Also, it is expected to grow due to escalating incidence of chronic diseases in the region.

For more detailed information about the India and Europe generic injectable market report, click here – https://www.databridgemarketresearch.com/reports/india-and-europe-generic-injectable-market