India is currently experiencing severe freshwater scarcity as a result of a growing population, rapid urbanization, and increased demand for water from agriculture, industry, and households. As a result, there is a growing demand for alternative water sources, such as the treatment and reuse of produced water generated by oil and gas operations. Treated produced water is not typically considered drinkable because it can still contain trace amounts of contaminants that may be harmful to human health. Produced water is extracted along with oil and gas during production operations, and it can contain a variety of pollutants, such as salts, hydrocarbons, metals, and chemicals. But the treated water can be reused in industries, agriculture, and many other places. With freshwater resources becoming scarce, these industries are turning to alternative sources of water, such as produced water and treating it for reuse.

Access full Report @ https://www.databridgemarketresearch.com/reports/india-produced-water-treatment-market

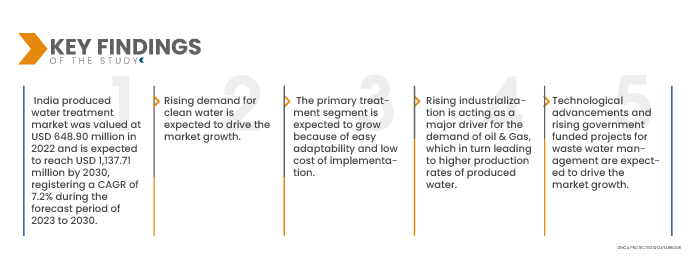

Data Bridge Market Research analyses that the India Produced Water Treatment Market is expected to grow at a CAGR of 7.2% from 2023 to 2030 and is expected to reach USD 1,131.71 million by 2030. The rise in awareness regarding the importance of produced water treatment is expected to propel the market's growth.

Key Findings of the Study

ENVIRONMENTAL CONCERNS REGARDING THE DISCHARGE OF PRODUCED WATER

The discharge of produced water into the environment can have negative environmental impacts, as the water can contain contaminants, such as oil, grease, and metals. This has led to growing environmental concerns regarding the discharge of produced water from oil and gas operations in India, which is expected to drive the adoption of produced water treatment technologies.

Produced water treatment technologies offer a solution to the environmental concerns surrounding the discharge of produced water by treating the water and removing contaminants before it is discharged. This helps to protect the environment and ensure compliance with environmental regulations.

The Indian government has implemented various regulations and guidelines to address the environmental concerns surrounding the discharge of produced water. For example, the Central Pollution Control Board (CPCB) has issued guidelines for the management of produced water from oil and gas operations, which include the treatment and reuse of produced water.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Stages (Primary Treatment, Secondary Treatment, Tertiary Treatment And Others), Treatment Type (Chemical Treatment, Physical Treatment, Biological Treatment, Combined Systems and Others), Hydrocarbon Resource (Conventional Gas, Oil Sands, Conventional Gas, Coal-Bed Methane, Tight Oil, Shale Gas) Capacity (Less Than 100 Thsnd Bl/Day, 100 To 500 Thsnd Bl/Day, Above 500 Thsnd Bl/Day) Production Source (Natural Gas, Crude Oil) Technology (Membrane Filteration, Thermal Technology, Biological Aerated Filter(BAF), Hydrocyclones, Gas Flotation, Evaporation Pond, Adsorption, Media Filteration, Ion Exchange Technology, Macro-Porous Extraction Technology, Chemical Oxidation, Others) End User (Oil Industries, Gas Industries)

|

|

Countries Covered

|

India

|

|

Market Players Covered

|

Thermax Limited. (India) , divaenvitec (India), SOPAN (India), www.paramountlimited.com (India), BPC (India), IEI (India), ALFA LAVAL (India), Aquatech International LLC. (U.S.), WABAG (India), IDE (Israel), Wex Technologies (India), NETSOL WATER SOLUTIONS PVT. LTD. (India), OVIVO (India), DuPont (U.S.), Gradiant (U.S.), Hindustan Dorr-Oliver Ltd. (India), NOV Inc. (U.S.), Chokhavatia Associates (India), ULTRA PURE WATER TECHNOLOGIES (India), Veolia (India) among Others.

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the data bridge market research also include depth expert analysis, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The produced water treatment market is segmented into stages, treatment type, hydrocarbon resource, capacity, production source, technology, end user.

- On the basis of stages, the India produced water treatment market is segmented into primary treatment, secondary treatment, tertiary treatment and others.

In 2023, the primary treatment segment is expected to dominate the market due to a rise in industrialization and urbanization

In 2023, the primary treatment segment is expected to dominate the market due to a rise in industrialization and urbanization. The primary treatment segment is expected to reach the highest CAGR of 7.8% in the forecast period of 2023-2030.

- On the basis of treatment type, India produced water treatment market is segmented into chemical treatment, physical treatment, biological treatment, combined systems and others. In 2023, physical treatment segment is expected to dominate the market with a share of 49.28% because they are easily applicable and cost-effective.

- On the basis of hydrocarbon resources, India produced water treatment market is segmented into conventional oil, oil sands, conventional gas, coal bed-methane, tight oil, and shale gas. In 2023, conventional gas segment is expected to dominate the market with a share of 34.35% due to the increasing age of conventional gas resources, due to which higher quantities of produced water is being produced from conventional gas excavation sites.

- On the basis of capacity, India produced water treatment market is segmented into less than 100 thsnd bl/day, 100 To 500 thsnd bl/day, and above 500 thsnd bl/day. In 2023, less than 100 thsnd bl/day segment is expected to dominate the market with a share of 65.71% because many companies are launching pilot scale projects for produced water treatment where the processing capacity is less than 100 thousand barrels per day.

- On the basis of production source, India produced water treatment market is segmented into natural gas and crude oil. In 2023, crude oil segment is expected to dominate the market with a share of 59.03% due to higher level of contaminated produced water is generated during the crude oil extraction process, which needs to be treated for further reuse.

- On the basis of technology, India produced water treatment market is segmented into membrane filtration, thermal technology, biological aerated filter(baf), hydrocyclones, gas flotation, evaporation pond, adsorption, media filtration, ion exchange technology, macro-porous polymer technology, chemical oxidation, others. In 2023, the Biological Aerated Filter (Baf) segment is expected to dominate the marketwith a share of 20.29% as it is more popular among these technologies as it gives a higher level of purification rate of produced water and also cost effective.

- On the basis of end user,India produced water treatment market is segmented into oil industries, gas industries.

In 2023, the oil industries segment is projected to hold the largest share of the end user segment in the India produced water treatment market

In 2023, oil industries segment is expected to dominate the market because oil excavation is the major contributor to produced water production. Oil industries segment is expected to grow with a CAGR of 7.4% in the forecast period of 2023 to 2030.

Major Players

Data Bridge Market Research recognizes the following companies as the major market players in the produced water treatment market. They are Thermax Limited. (India) , divaenvitec (India), SOPAN (India), www.paramountlimited.com (India), BPC (India), IEI (India), ALFA LAVAL (India), Aquatech International LLC. (U.S.), WABAG (India), IDE (Israel), Wex Technologies (India), NETSOL WATER SOLUTIONS PVT. LTD. (India), OVIVO (India), DuPont (U.S.), Gradiant (U.S.), Hindustan Dorr-Oliver Ltd. (India), NOV Inc. (U.S.), Chokhavatia Associates (India), ULTRA PURE WATER TECHNOLOGIES (India), Veolia (India) among others.

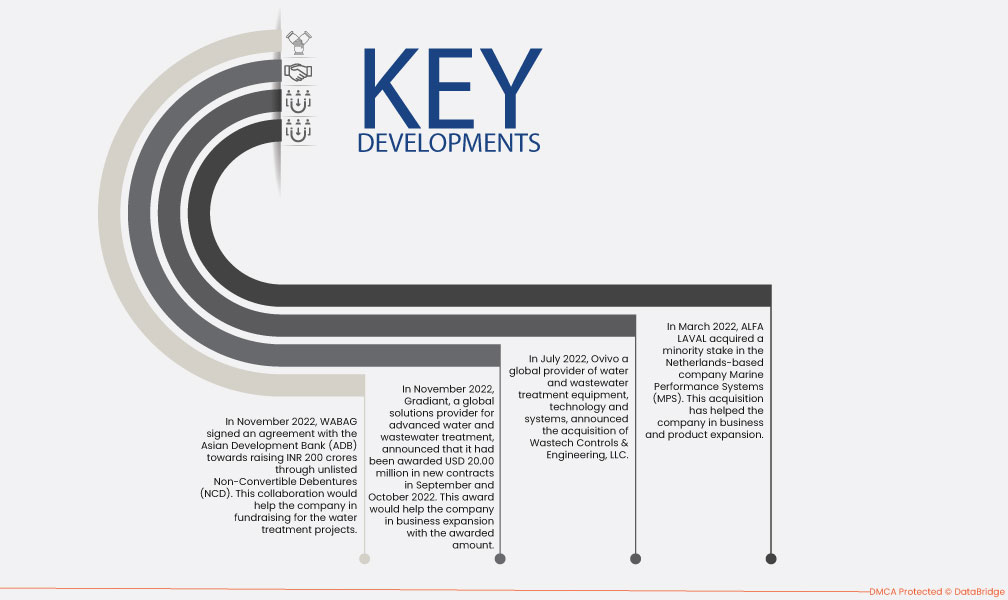

Market Developments

- In November 2022, WABAG signed an agreement with the Asian Development Bank (ADB) towards raising INR 200 crores through unlisted Non-Convertible Debentures (NCD). This collaboration would help the company in fundraising for the water treatment projects.

- In November 2022, Gradiant, a global solutions provider for advanced water and wastewater treatment, announced that it had been awarded USD 20.00 million in new contracts in September and October 2022. This award would help the company in business expansion with the awarded amount.

- In July 2022, Ovivo, a global provider of water and wastewater treatment equipment, technology and systems, announced the acquisition of Wastech Controls & Engineering, LLC.

- In March 2022, ALFA LAVAL acquired a minority stake in the Netherlands-based company Marine Performance Systems (MPS). This acquisition has helped the company in business and product expansion.

Regional Analysis

Geographically, the country covered in the produced water treatment market report is India.

As per Data Bridge Market Research analysis

India produced water treatment market is expected to grow at a CAGR of 7.2% due to rising government funded projects for waste water management and rising awareness in the importance of produced water treatment.

For more detailed information about the India produced water treatment market, click here – https://www.databridgemarketresearch.com/reports/india-produced-water-treatment-market