The treasury software market offers a spectrum of applications crucial for financial efficiency. From liquidity and cash management to investment management, debt management, financial risk management, compliance management, and tax planning management, each facet plays a pivotal role in optimizing corporate finances. These applications empower organizations to streamline their treasury processes, ensuring effective fund utilization, risk mitigation, and regulatory compliance. The versatility of treasury software makes it an indispensable tool for managing various financial aspects, fostering a comprehensive and strategic approach to financial management.

Access Full Report @ https://www.databridgemarketresearch.com/reports/latin-america-treasury-software-market

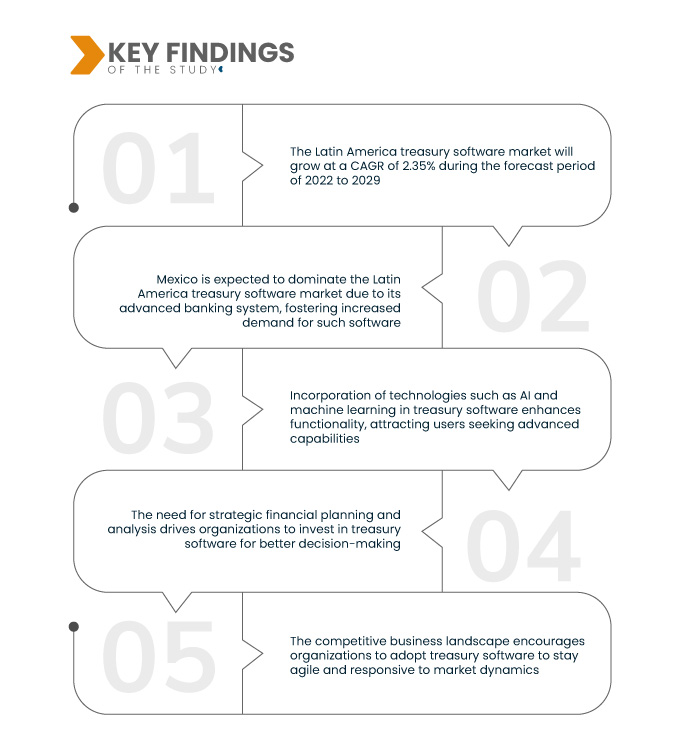

Data Bridge Market Research analyses that the Latin America Treasury Software Market will grow at a CAGR of 2.35% during the forecast period of 2022 to 2029. Globalization propels the treasury software market as businesses operating globally demand robust tools to navigate diverse currencies. The need for effective management in a multi-currency environment enhances the significance of treasury software, driving its adoption and contributing to market growth.

Key Findings of the Study

Regulatory compliance is expected to drive the market's growth rate

The treasury software market experiences growth driven by regulatory compliance demands. Stringent requirements necessitate sophisticated software solutions for effective compliance management. Organizations seek advanced treasury tools to navigate complex regulations, ensuring accuracy and adherence. The market thrives as businesses recognize the importance of adopting technology that streamlines compliance processes, providing them with the agility and efficiency required to meet regulatory standards, ultimately fostering market growth in response to the evolving regulatory landscape.

Report Scope and Market Segmentation

Report Metric

|

Details

|

Forecast Period

|

2022 to 2029

|

Base Year

|

2021

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

Segments Covered

|

Operating System (Windows, Linux, Mac, Android, and iOS), Application (Liquidity And Cash Management, Investment Management, Debt Management, Financial Risk Management, Compliance Management, Tax Planning Management, and Others), Organization Size(Large Enterprises, Small-Sized Enterprises And Medium-Sized Enterprises), Deployment Model (Cloud And On-Premises), Vertical (Into Banking, Financial Services And Insurance (BFSI), Government, Manufacturing, Healthcare, Consumer Goods, Chemicals, Energy, and Others)

|

Countries Covered

|

Mexico, Chile, Colombia, Argentina, Bolivia, Paraguay, Peru, Uruguay, Panama, Nicargua, Costa Rica, Ecuador, Honduras, Guatemala, El Salvador, The Dominican Republic and rest of Latin America

|

Market Players Covered

|

Wolters Kluwer N.V. (Netherlands), Ernst & Young Global Limited (U.K.), FIS (U.S.), SAP (Germany), Oracle (U.S.), ION (Ireland), Conta Azul (Brazil), Calypso (U.S.), Finastra (U.K.), Kyriba Corp. (U.S.), MUREX S.A.S (France).

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis:

The Latin America treasury software market is segmented on the basis of the operating system, application, organization size, deployment model, and vertical.

- On the basis of the operating system, the Latin America treasury software market is segmented into Windows, Linux, Mac, Android, and iOS

- On the basis of application, the Latin America treasury software market is segmented into liquidity and cash management, investment management, debt management, financial risk management, compliance management, tax planning management, and others

- On the basis of organization size, the Latin America treasury software market is segmented into large enterprises, small-sized enterprises, and medium-sized enterprises

- On the basis of the deployment model, the Latin America treasury software market is segmented into cloud and on-premises

- On the basis of vertical, the Latin America treasury software market is segmented into banking, financial services and insurance (BFSI), government, manufacturing, healthcare, consumer goods, chemicals, energy, and others

Major Players

Data Bridge Market Research recognizes the following companies as the Latin America treasury software market players in Latin America treasury software market are Wolters Kluwer N.V. (Netherlands), Ernst & Young Global Limited (U.K.), FIS (U.S.), SAP (Germany), Oracle (U.S.).

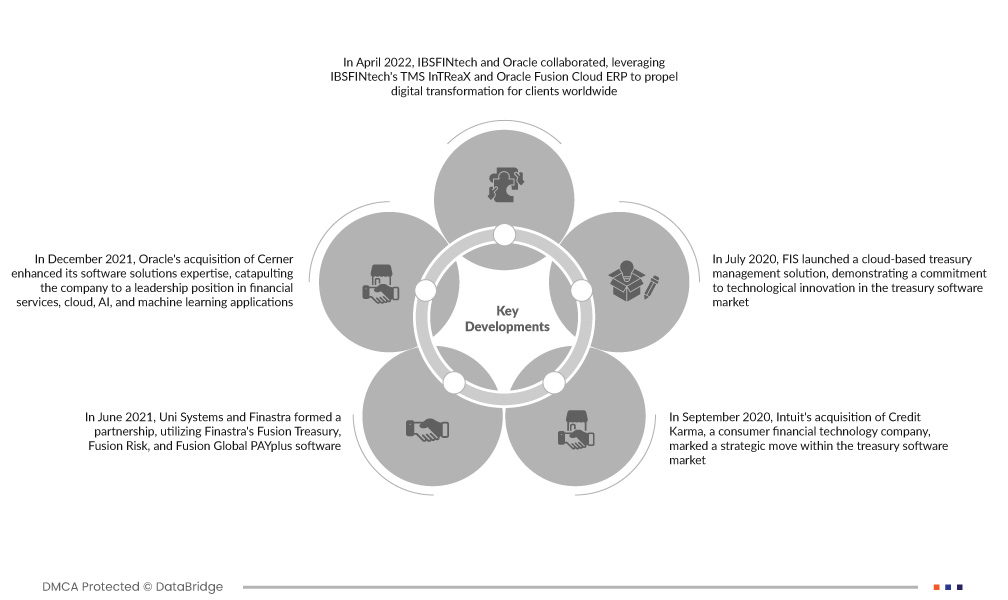

Market Developments

- In April 2022, IBSFINtech and Oracle collaborated, leveraging IBSFINtech's TMS InTReaX and Oracle Fusion Cloud ERP to propel digital transformation for clients worldwide. This strategic integration aims to expedite the digital evolution within the treasury software market, offering comprehensive ERP and TMS solutions for enhanced financial management and operational efficiency

- In December 2021, Oracle's acquisition of Cerner enhanced its software solutions expertise, catapulting the company to a leadership position in financial services, cloud, AI, and machine learning applications. This strategic move directly contributed to a significant boost in the company's revenue within the treasury software market

- In June 2021, Uni Systems and Finastra formed a partnership, utilizing Finastra's Fusion Treasury, Fusion Risk, and Fusion Global PAYplus software. This partnership enables Uni Systems to deliver comprehensive treasury, risk, and payment solutions with on-site implementation and support services, reinforcing their collective presence in the dynamic treasury software market

- In September 2020, Intuit's acquisition of Credit Karma, a consumer financial technology company, marked a strategic move within the treasury software market. This acquisition enabled Intuit to broaden its financial services offerings, incorporating Credit Karma's technology to enhance its suite of tools, providing users with a more comprehensive financial management experience

- In July 2020, FIS launched a cloud-based treasury management solution, demonstrating a commitment to technological innovation in the treasury software market. This launch aimed to provide businesses with advanced tools for efficient treasury management, leveraging the benefits of cloud technology to enhance accessibility, scalability, and overall performance in financial operations

Regional Analysis

Geographically, the countries covered in the Latin America treasury software market report are Mexico, Chile, Colombia, Argentina, Bolivia, Paraguay, Peru, Uruguay, Panama, Nicargua, Costa Rica, Ecuador, Honduras, Guatemala, El Salvador, The Dominican Republic and rest of Latin America.

As per Data Bridge Market Research analysis:

Mexico is expected to dominate the Latin America treasury software market in the forecast period 2022-2029

Mexico is expected to dominate the Latin America treasury software market due to its advanced banking system, fostering increased demand for such software. The country has systematically modernized its banking and treasury management, ensuring a secure and efficient financial landscape. This transformation reflects Mexico's commitment to aligning with global financial technology trends, making it a key player in driving the adoption of treasury software solutions in the broader Latin American region.

For more detailed information about the Latin America treasury software market report, click here – https://www.databridgemarketresearch.com/reports/latin-america-treasury-software-market