في صناعة السيارات، يتمثل القلق البيئي الرئيسي في ارتفاع استهلاك الوقود وانبعاثات غازات الاحتباس الحراري. وقد أشار المعهد الدولي للألمنيوم في المملكة المتحدة إلى إمكانية توفير الطاقة وتقليل انبعاثات غازات الاحتباس الحراري من خلال تقليل وزن المواد. بمعنى آخر، يُعد تقليل وزن المركبات أفضل طريقة ممكنة لزيادة الطلب على المواد خفيفة الوزن.

تُسرّع المواد خفيفة الوزن حركة المركبات الخفيفة باستخدام طاقة أقل مقارنةً بالمركبات الثقيلة، كما تُعزز كفاءة السيارة. باستخدام هذه المواد، يُمكن للسيارات التحكم في مستوى الانبعاثات، وتوفير السلامة، وتوفير نظام إلكتروني متكامل دون زيادة وزنها. كما تُساعد في الحفاظ على ثبات مدى المركبات الكهربائية القابلة للشحن.

للاطلاع على التقرير الكامل، يُرجى زيارة الرابط التالي: https://www.databridgemarketresearch.com/reports/north-america-and-mena-aluminum-casting-market

تشير تحليلات Data Bridge Market Research إلى أن سوق صب الألومنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال إفريقيا من المتوقع أن يصل إلى قيمة 31.36 مليار دولار أمريكي بحلول عام 2031، من 18.66 مليار دولار أمريكي في عام 2023، بمعدل نمو سنوي مركب قدره 6.9٪ خلال الفترة المتوقعة من 2024 إلى 2031.

النتائج الرئيسية للدراسة

الاستخدام المتزايد للمعدن الألومنيوم بسبب الطلب المتزايد على أنظمة التدفئة والتهوية وتكييف الهواء في المباني التجارية

في المباني التجارية، توجد أنواع مختلفة من أنظمة التدفئة والتهوية وتكييف الهواء (HVAC) مع وحدات متعددة وأنظمة رش. يعتمد النظام كليًا على استخدام المبنى ومتطلبات التحكم في درجة الحرارة. يعتمد أفضل نظام تدفئة وتهوية وتكييف في المباني التجارية على عوامل مختلفة، منها كفاءة الطاقة، وقدرات التشغيل والصيانة، والطقس، وعوامل أخرى.

تشمل فئات أنظمة التدفئة والتهوية وتكييف الهواء عادةً المضخات الحرارية، وأنظمة VRF أو VRV، ووحدات لفائف المروحة والملفات المنفاخة، والتهوية الإزاحية. وقد ازداد استخدام الألومنيوم بشكل كبير في أنظمة التدفئة والتهوية وتكييف الهواء، وخاصةً في قنوات وتجهيزات المباني. تُعدّ قنوات الألومنيوم ممرًا للهواء يُستخدم لنقله عبر المبنى. ويُستخدم الألومنيوم لما يتميز به من قوة عالية ووزن خفيف، مما يسمح بتمدده لمسافات طويلة دون أي دعم.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2024 إلى 2031

|

سنة الأساس

|

2023

|

السنوات التاريخية

|

2022 (قابلة للتخصيص حتى 2016-2021)

|

الوحدات الكمية

|

الإيرادات بالمليار دولار أمريكي

|

القطاعات المغطاة

|

العملية (صب القالب غير القابل للتمدد والصب القالب القابل للتمدد)، المصدر (الأساسي (الألومنيوم الطازج) والثانوي (الألومنيوم المعاد تدويره))، المستخدم النهائي (السيارات، الصناعة، الفضاء، الإلكترونيات والكهرباء، البناء والتشييد، الأجهزة المنزلية ، الأدوات الهندسية، وغيرها)

|

الدول المغطاة

|

الولايات المتحدة، كندا، المكسيك، الإمارات العربية المتحدة، المملكة العربية السعودية، مصر، إسرائيل، البحرين، قطر، عُمان، الكويت، الجزائر، تونس، ليبيا، وبقية دول الشرق الأوسط وشمال أفريقيا

|

الجهات الفاعلة في السوق المغطاة

|

شركة ألكوا (الولايات المتحدة)، شركة الإمارات العالمية للألمنيوم (الإمارات العربية المتحدة)، شركة بيس للصناعات (الولايات المتحدة)، شركة كونسوليديتد ميتكو (الولايات المتحدة)، شركة بايروتك (الولايات المتحدة)، شركة ديناكاست (الولايات المتحدة)، شركة مارتينريا هونسيل (ألمانيا)، شركة تويوتا للصناعات (اليابان)، شركة واغستاف (الولايات المتحدة)، شركة ريوبي المحدودة (اليابان)، شركة تي بي آي أركيد (الولايات المتحدة)، شركة أركونيك (شركة تابعة لأبولو) (الولايات المتحدة)، شركة إل إيه ألومنيوم (الولايات المتحدة)، شركة ألكاست تكنولوجيز المحدودة (الولايات المتحدة)، شركة ريوكاست (الولايات المتحدة)، شركة جيبس (ألمانيا)، شركة مودرن ألومنيوم كاستينجز (الولايات المتحدة)، شركة ريلاينس فاوندري المحدودة (كندا)، شركة باسيفيك داي كاستينج (الولايات المتحدة)، شركة كاست ألومنيوم إندستريز (الإمارات العربية المتحدة)، شركة فير ألومنيوم (المملكة العربية السعودية)، شركة أليكو للصناعات المحدودة (الإمارات العربية المتحدة)، شركة الدمام المركزية للصب (المملكة العربية السعودية)، شركة ألوميسر (مصر)، مجموعة صن ميتال (الإمارات العربية المتحدة)، شركة أو إيه سي (عُمان)، شركة كابيتال ميدل إيست المحدودة (الإمارات العربية المتحدة)، وشركة ريجيد ميتال آند وود إندستريز ذ.م.م (الإمارات العربية المتحدة) وغيرها

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research أيضًا تحليلًا متعمقًا من الخبراء والإنتاج والقدرة التمثيلية الجغرافية للشركة وتخطيطات الشبكة للموزعين والشركاء وتحليل اتجاهات الأسعار التفصيلية والمحدثة وتحليل العجز في سلسلة التوريد والطلب.

|

تحليل القطاعات

يتم تصنيف سوق صب الألومنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال إفريقيا إلى ثلاثة قطاعات بارزة تعتمد على العملية والمصدر والمستخدم النهائي

- على أساس العملية، يتم تقسيم سوق صب الألومنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال أفريقيا إلى صب القالب غير القابل للاستهلاك، وصب القالب القابل للاستهلاك

في عام 2024، من المتوقع أن تهيمن شريحة صب القوالب غير القابلة للتمدد على سوق صب الألومنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال إفريقيا

من المتوقع أن تهيمن صناعة الصب بالقالب غير القابل للتمدد في عام 2024 على سوق الصب بالألمنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال إفريقيا بحصة 76.64% في أمريكا الشمالية و75.99% في منطقة الشرق الأوسط وشمال إفريقيا بسبب زيادة الطلب على المواد عالية القوة وخفيفة الوزن في صناعة السيارات.

- بناءً على المصدر، يُقسّم سوق صب الألومنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال أفريقيا إلى قسمين: أولي (ألومنيوم طازج) وثانوي (ألومنيوم مُعاد تدويره). في عام 2024، من المتوقع أن يُهيمن قطاع الأولي (الألومنيوم الطازج) على سوق صب الألومنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال أفريقيا، بحصة 86.28% في أمريكا الشمالية و85.17% في منطقة الشرق الأوسط وشمال أفريقيا.

- على أساس المستخدم النهائي، يتم تقسيم سوق صب الألومنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال إفريقيا إلى السيارات والصناعة والفضاء والإلكترونيات والكهرباء والبناء والتشييد والأجهزة المنزلية وأدوات الهندسة وغيرها.

من المتوقع أن يهيمن قطاع السيارات على سوق صب الألومنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال إفريقيا في عام 2024

ومن المتوقع أن تهيمن صناعة السيارات في عام 2024 على سوق صب الألومنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال أفريقيا بحصة تبلغ 42.18% في أمريكا الشمالية و35.69% في منطقة الشرق الأوسط وشمال أفريقيا بسبب الطلب المرتفع على المواد خفيفة الوزن والمتينة، إلى جانب الحاجة المتزايدة لصناعة السيارات إلى إنتاج فعال وأداء موفر للوقود.

اللاعبون الرئيسيون

قامت شركة Data Bridge Market Research بتحليل شركة Alcoa Corporation (الولايات المتحدة)، وMartinrea Honsel (شركة تابعة لشركة Martinrea International Inc.) (ألمانيا)، وEmirates Global Aluminum PJSC (الإمارات العربية المتحدة)، وPace Industries (الولايات المتحدة)، وDynacast (الولايات المتحدة) باعتبارها اللاعبين الرئيسيين العاملين في سوق صب الألومنيوم في أمريكا الشمالية.

تقوم شركة داتا بريدج للأبحاث السوقية بتحليل شركة الإمارات العالمية للألمنيوم (الإمارات العربية المتحدة)، وشركة ألكوا (الولايات المتحدة)، وشركة دايناكاست (الولايات المتحدة)، وشركة فير للألمنيوم (المملكة العربية السعودية)، وشركة أليكو للصناعات المحدودة (الإمارات العربية المتحدة) باعتبارها اللاعبين الرئيسيين العاملين في سوق صب الألومنيوم في منطقة الشرق الأوسط وشمال أفريقيا.

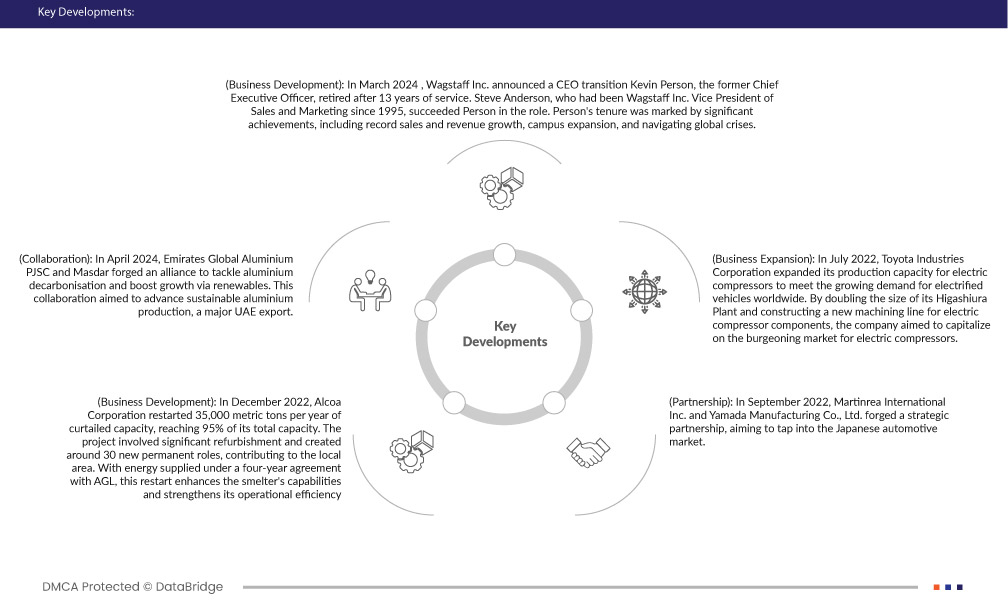

- في مارس 2024، أعلنت شركة واغستاف عن انتقالٍ في منصب الرئيس التنفيذي. تقاعد كيفن بيرسون، الرئيس التنفيذي السابق، بعد 13 عامًا من الخدمة. وخلفه في هذا المنصب ستيف أندرسون، الذي شغل منصب نائب رئيس المبيعات والتسويق في واغستاف منذ عام 1995. وقد تميزت فترة بيرسون بإنجازاتٍ كبيرة، شملت نموًا قياسيًا في المبيعات والإيرادات، وتوسعًا في مقر الشركة، وتجاوزًا للأزمات العالمية. وقد مهدت هذه التغييرات الطريق لشركة واغستاف لمواصلة النجاح والنمو تحت إشراف قادةٍ أكفاء.

- في أغسطس 2023، وقّعت شركة ألكوا اتفاقية جديدة مدتها تسع سنوات مع شركة AGL Energy Limited، لتأمين 300 ميجاوات من الطاقة لمصهر بورتلاند للألمنيوم بدءًا من 1 يوليو 2026. تضمن هذه الاتفاقية، التي تغطي نصف احتياجات المصهر من الطاقة، استقرار عملياته المستقبلية، مما يعود بالنفع على قوته العاملة التي تضم أكثر من 760 موظفًا ومتعاقدًا. مع التركيز على الطاقة المتجددة، تهدف ألكوا إلى زيادة خفض انبعاثات الكربون، بما يتماشى مع أهدافها طويلة الأجل في مجال الاستدامة.

- في ديسمبر 2022، أعادت شركة ألكوا تشغيل 35,000 طن متري سنويًا من طاقتها الإنتاجية المُخفّضة، لتصل إلى 95% من إجمالي طاقتها الإنتاجية. تضمن المشروع تجديدات واسعة النطاق، وأنشأ حوالي 30 وظيفة دائمة جديدة، مما ساهم في تنمية المنطقة. وبفضل توفير الطاقة بموجب اتفاقية مدتها أربع سنوات مع شركة AGL، يُعزز هذا التشغيل قدرات المصهر ويعزز كفاءته التشغيلية.

- في سبتمبر 2022، عرضت شركة ألكوا منتجاتها وابتكاراتها منخفضة الكربون في معرض ألمنيوم 2022، مؤكدةً التزامها بالاستدامة ومقدمةً حلولاً متطورة لعملائها في مختلف القطاعات. يُبرز هذا ريادة ألكوا في إنتاج الألمنيوم المستدام ويعزز مكانتها السوقية.

- في يوليو 2022، عززت شركة تويوتا للصناعات طاقتها الإنتاجية للضواغط الكهربائية لتلبية الطلب المتزايد على المركبات الكهربائية عالميًا. ومن خلال مضاعفة حجم مصنع هيغاشيورا التابع لها وإنشاء خط تصنيع جديد لمكونات الضواغط الكهربائية، سعت الشركة إلى الاستفادة من سوق الضواغط الكهربائية المزدهر. ومن المحتمل أن يؤدي هذا التوسع إلى زيادة الطلبات وفرص العمل لقسم صب الألومنيوم التابع لشركة تويوتا للصناعات، مما يدعم نموها وحضورها في سوق صناعة السيارات.

التحليل الإقليمي

من الناحية الجغرافية، البلدان التي يغطيها تقرير سوق صب الألومنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال أفريقيا هي الولايات المتحدة وكندا والمكسيك والإمارات العربية المتحدة والمملكة العربية السعودية ومصر وإسرائيل والبحرين وقطر وعمان والكويت والجزائر وتونس وليبيا وبقية دول الشرق الأوسط وشمال أفريقيا.

وفقًا لتحليل Data Bridge Market Research:

من المتوقع أن تكون أمريكا الشمالية هي المنطقة المهيمنة والأسرع نموًا في سوق صب الألومنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال إفريقيا

ومن المتوقع أن تصبح أمريكا الشمالية المنطقة المهيمنة والأسرع نمواً في سوق صب الألومنيوم بسبب التكنولوجيا المتقدمة والبنية التحتية القوية والطلب المرتفع من قطاعي السيارات والفضاء.

لمزيد من المعلومات التفصيلية حول تقرير سوق صب الألومنيوم في أمريكا الشمالية ومنطقة الشرق الأوسط وشمال إفريقيا، انقر هنا - https://www.databridgemarketresearch.com/reports/north-america-and-mena-aluminum-casting-market