The durability and longevity of polyvinyl chloride (PVC) compounds contribute to their significance in various applications, especially in construction. PVC compounds exhibit exceptional weathering, chemicals, and abrasion resistance, making them well-suited for demanding environments. PVC pipes exemplify these characteristics in construction, boasting a prolonged lifespan and requiring minimal maintenance. This durability ensures the structural integrity of installations and contributes to cost-effectiveness over time. The ability of PVC compounds to withstand harsh conditions positions them as a reliable choice, offering sustainable solutions in infrastructure projects where longevity and low maintenance are paramount considerations.

Access full Report @ https://www.databridgemarketresearch.com/reports/north-america-pvc-compound-market

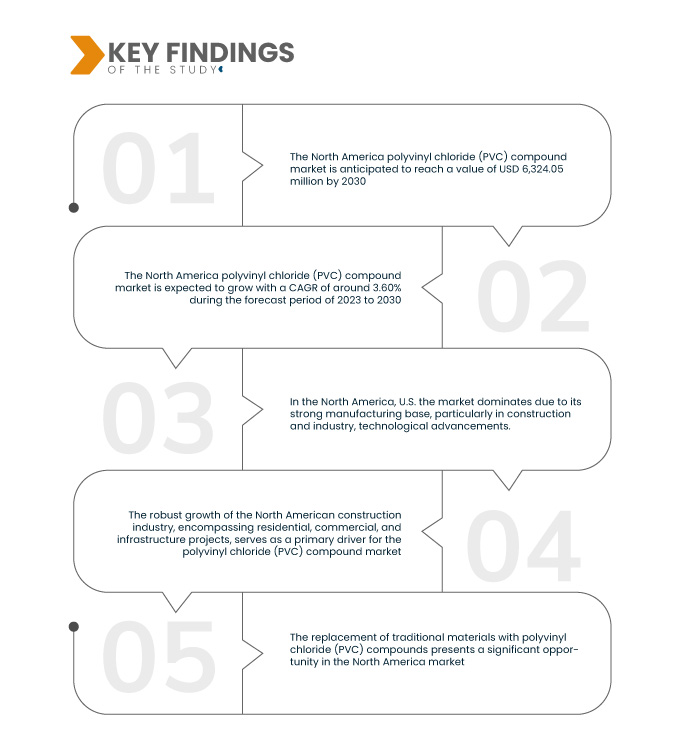

Data Bridge Market Research analyses the North America Polyvinyl Chloride (PVC) Compound Market, which was USD 4,765.60 million in 2022, is expected to reach USD 6,324.05 million by 2030 and is expected to undergo a CAGR of 3.60% during the forecast period of 2023 to 2030. The growing demand for PVC compounds in North America is driven by their indispensable role in key industrial sectors such as automotive, electrical, and manufacturing.

Key Findings of the Study

Increasing technological advancement is expected to drive the market's growth rate

Technological advancements in the North America polyvinyl chloride (PVC) compound market serve as a significant driver by fostering the development of high-performance and environmentally friendly formulations. Companies actively investing in research and development are enhancing the properties and applications of PVC compounds. This innovation meets evolving industry standards and aligns with the increasing demand for sustainable solutions. As a result, the market experiences growth as manufacturers introduce improved PVC formulations that cater to diverse applications and address environmental considerations, positioning them competitively in the market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million, Pricing in USD, and Volumes in Units

|

|

Segments Covered

|

Product (Rigid Product, Flexible Product), Type (Non-Plasticized PVC, Plasticized PVC), Compound (Dry PVC Compound, Wet PVC Compound), Manufacturing Process (Injection Molding, Extrusion, Others), Application (Pipe and Fitting, Profiles and Tubes, Wire and Cable, Film and Sheet, Others), Raw Material (PVC Resin, Plasticizers, Stabilizers, Lubricants, Fillers, Functional Additives, Alloying Polymers), End User (Medical, Building and Construction, Packaging, Automotive, Consumer Goods, Electrical and Electronics, Others)

|

|

Countries Covered

|

U.S., Canada and Mexico in North America

|

|

Market Players Covered

|

The Lubrizol Corporation (U.S.), Clariant (Switzerland), Avient Corporation (U.S.), LG Chem (South Korea), BASF SE (Germany), 3M (U.S.), Dow (U.S.), DuPont (U.S.), LSB INDUSTRIES (U.S.), Sika AG (Switzerland), Innospec (U.S.), ADEKA CORPORATION (Japan), Dorf Ketal Chemicals (I) Pvt. Ltd. (U.S.), PMC Specialties Group (U.S.), Chemplast Sanmar Limited (India), Westlake Chemical Corporation (U.S.), Mitsubishi Chemical Corporation (Japan), SABIC (Saudi Arabia), Afton Chemical (U.S.), LANXESS (Germany), Mayzo, Inc. (U.S.), Solvay (Belgium), Akzo Nobel N.V. (Netherlands), Arkema (France) and Eastman Chemical Company (U.S.)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis:

The North America polyvinyl chloride (PVC) compound market is segmented on the basis of product type, wound type, wound class, end user and distribution channel.

- On the basis of product, the North America polyvinyl chloride (PVC) compound market is segmented into rigid product, and flexible product

- On the basis of type, the North America polyvinyl chloride (PVC) compound market is segmented into non-plasticized PVC, and plasticized PVC

- On the basis of compound, the North America polyvinyl chloride (PVC) compound market is segmented into dry PVC compound, and wet PVC compound

- On the basis of manufacturing process, the North America polyvinyl chloride (PVC) compound market is segmented into injection moulding, extrusion, and others

- On the basis of application, the North America polyvinyl chloride (PVC) compound market is segmented into pipe and fitting, profiles and tubes, wire and cable, film and sheet, and others

- On the basis of raw material, the North America polyvinyl chloride (PVC) compound market is segmented into PVC resin, plasticizers, stabilizers, lubricants, fillers, functional additives, and alloying polymers

- On the basis of end user, the North America polyvinyl chloride (PVC) compound market is segmented into medical, building and construction, packaging, automotive, consumer goods, electrical and electronics, and others

Major Players

Data Bridge Market Research recognizes the following companies as the major North America polyvinyl chloride (PVC) compound market players in the North America polyvinyl chloride (PVC) compound market are The Lubrizol Corporation (U.S.), Clariant (Switzerland), Avient Corporation (U.S.), LG Chem (South Korea), BASF SE (Germany), 3M (U.S.), Dow (U.S.), DuPont (U.S.), LSB INDUSTRIES (U.S.), Sika AG (Switzerland), Innospec (U.S.)

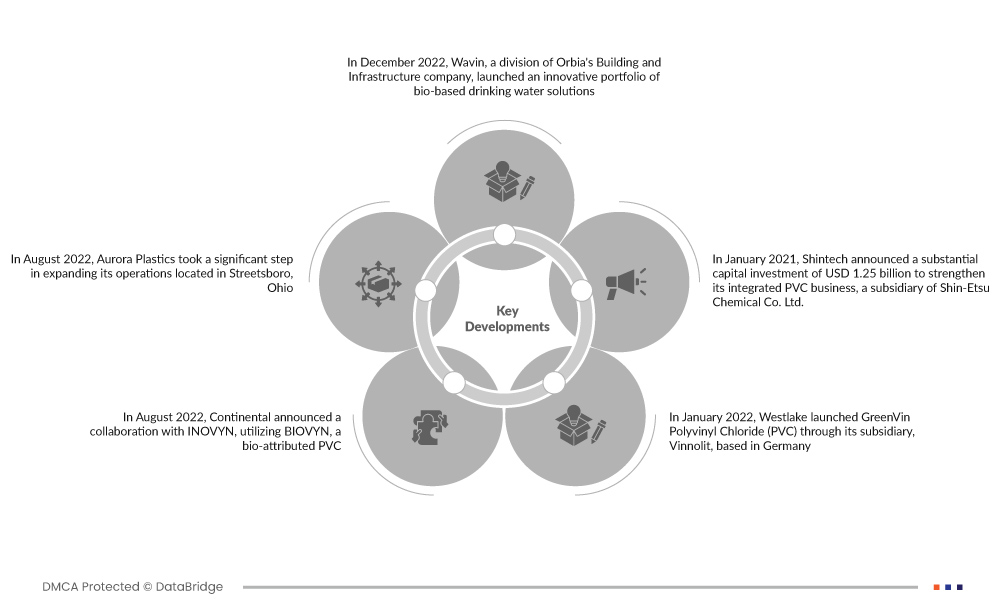

Market Developments

- In December 2022, Wavin, a division of Orbia's Building and Infrastructure company, launched an innovative portfolio of bio-based drinking water solutions. This forward-thinking product line addresses sustainability concerns by incorporating a biobased PVC. This innovative material substitutes traditional ethylene with bio ethylene derived from biomass waste streams and employs vegetable oil in its production. Wavin's introduction of these sustainable solutions reflects a commitment to providing water utilities and infrastructure contractors with environmentally conscious alternatives

- In August 2022, Aurora Plastics took a significant step in expanding its operations in Streetsboro, Ohio. This expansion, entailing over 100 million pounds of additional capacity, is geared towards enhancing the company's thermoplastic compounding capabilities. The focus lies on rigid PVC, rigid PVC alloys, and CPVC. This strategic move positions Aurora Plastics to meet the growing demand for thermoplastic compounds while reinforcing its presence in the market

- In August 2022, Continental announced a collaboration with INOVYN, utilizing BIOVYN, a bio-attributed PVC. This collaboration aims to produce technical and decorative surface materials for the automotive industry. By incorporating BIOVYN, sourced from sustainable bio-based origins, Continental aims to reduce its carbon footprint and cater to the increasing consumer demand for eco-friendly automotive products

- In January 2022, Westlake launched GreenVin polyvinyl chloride (PVC) through its subsidiary, Vinnolit, based in Germany. GreenVin PVC represents a significant stride towards environmental sustainability within the PVC industry. The innovation provides an eco-friendlier alternative for construction, automotive, and healthcare applications. This strategic move aligns with Westlake's commitment to expanding its product range while prioritizing sustainability in its offerings

- In January 2021, Shintech announced a substantial capital investment of USD 1.25 billion to strengthen its integrated PVC business, a subsidiary of Shin-Etsu Chemical Co. Ltd. This significant investment is geared towards expanding Shintech Inc.'s production capacity, to reach 3.62 million metric tons of PVC annually. This strategic move positions Shintech to meet the growing demand for PVC and further solidifies its position in the industry

Regional Analysis

Geographically, the countries covered in the North America polyvinyl chloride (PVC) compound market report are U.S., Canada, and Mexico in North America.

As per Data Bridge Market Research analysis:

U.S. is the dominant region in North America polyvinyl chloride (PVC) compound market during the forecast period 2023-2030

U.S. dominates the market due to a robust manufacturing base, particularly in the construction and industrial sectors, where PVC compounds have extensive applications. Technological advancements, a proactive approach to research and development, and a favorable regulatory environment contribute to the competitiveness of U.S. manufacturers. Additionally, the nation's active participation in global trade and infrastructure investments further strengthens its position, allowing U.S. companies to meet domestic and international demand for PVC compounds. Access to raw materials and a well-established supply chain also support the U.S. dominance in this market.

For more detailed information about the North America polyvinyl chloride (PVC) compound market report, click here – https://www.databridgemarketresearch.com/reports/north-america-pvc-compound-market