Aggregate refers to a building construction material with a coarse and grainy texture. Some commonly used aggregates include Sand, crushed stone, gravel, broken blast-furnace slag, boiler ash, burned shale and clay. These aggregates are mixed with cement, bitumen, lime and gypsum to be used for construction applications. They provide enhanced abrasive power, porosity, volume, stability, resistance to wear and erosion to the building. Compared to other construction materials, aggregates are more durable, chemical-resistant and can withstand high temperatures. As a result, they find extensive applications in the construction of industrial, commercial and residential complexes.

Access Full Report at https://www.databridgemarketresearch.com/reports/saudi-arabia-aggregate-market

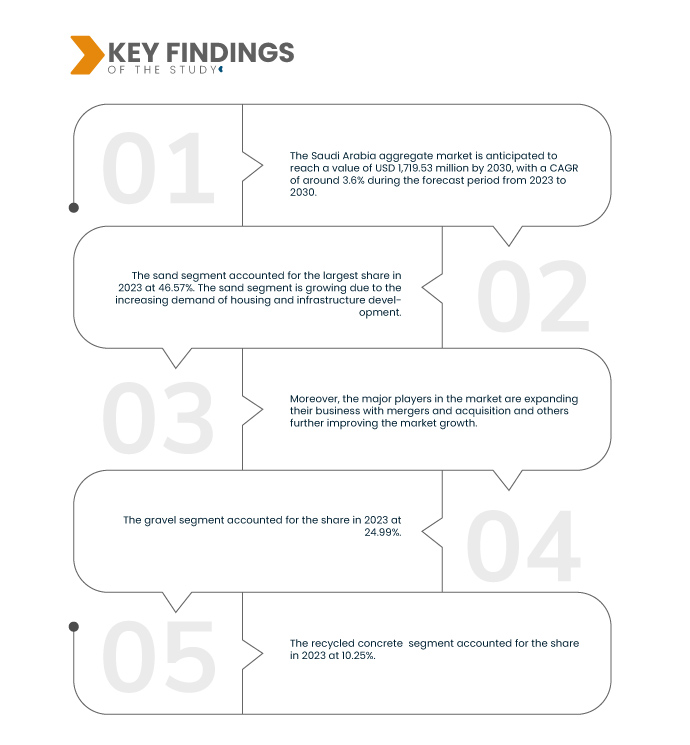

Data Bridge Market Research analyses that the Saudi Arabia Aggregate Market is expected to grow at a CAGR of 3.6% in the forecast period of 2023 to 2030 and is expected to reach USD 1,719.53 million by 2030. The sand segment is projected to propel the growth of the market as they are widely used in the Saudi Arabia aggregate market.

Key Findings of the Study

Rising Investment in Housing and Infrastructure Development

Natural aggregates including crushed stone, sand, and gravel—are essential raw materials used for residential construction projects. The residential market in Saudi Arabia is continuously expanding, which will have a positive impact and will favor market growth. This is owing to the growing demand from the fast-growing urban population, which is a direct result of an inflow of Saudi nationals and expatriates who are relocating to Riyadh and other cities from other regions. Similar to Riyadh, Jeddah's residential market is also seeing apartment prices surge by 11.7% in Q3 2021, which is the strongest growth rate in at least five years.

In Riyadh, apartment prices in Riyadh were up 17% in Q3 2021, the highest rate of increase in at least five years. Meanwhile, villa prices increased by close to 10% over the same period.

Moreover, the Saudi government is trying to respond to the increasing housing demand by implementing public housing programs in which houses are either owned or allocated by a public body to a particular person or a family. In addition, increasing investments by the governments to support the development of residential projects will fuel the market shortly.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015 – 2020)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Product (Sand, Gravel, Recycled Concrete, Crushed Stone), Application (Infrastructure, Commercial, Industrial, Residential)

|

|

Market Players Covered

|

Saudi ReadyMix (Saudi Arabia), Mastour ReadyMix (Subsidiary of Mastour Holding Group) (Saudi Arabia), Al-Rashed Cement Company (Saudi Arabia), Al Safwa Ltd. (Saudi Arabia), Qassim Cement Co. (Saudi Arabia), YCC (Saudi Arabia), Eastern Province Cement Co. (Saudi Arabia), Saudi Cement (Saudi Arabia), Nassir Hazza & Bros. (Saudi Arabia), CityCement (Saudi Arabia), Yamama Cement (Saudi Arabia), SPCC (Saudi Arabia)

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The Saudi Arabia aggregate market is segmented based on based on product and application.

- On the basis of product, the market is segmented into sand, gravel, recycled concrete, and crushed stone.

In 2023, sand segment of the product segment is expected to dominate the market

In 2023, sand segment is expected to dominate the market with a market share of 46.57%, as it is the main building material for concrete and stone masonry in hydraulic engineering.

- On the basis of application, the market is segmented into infrastructure, commercial, industrial, and residential.

In 2023, the infrastructure segment of the application segment is expected to dominate the market

In 2023, infrastructure segment is expected to dominate the market with 40.81% market share, as aggregates are widely used in infrastructural construction projects such as roads, highways, flyovers, and railway tracks.

Major Players

Data Bridge Market Research recognizes the following companies as the major aggregate market players in Saudi Arabia aggregate market are Saudi ReadyMix (Saudi Arabia), Mastour ReadyMix (Subsidiary of Mastour Holding Group) (Saudi Arabia), Al-Rashed Cement Company (Saudi Arabia), Al Safwa Ltd. (Saudi Arabia), Qassim Cement Co. (Saudi Arabia), YCC (Saudi Arabia), Eastern Province Cement Co. (Saudi Arabia), Saudi Cement (Saudi Arabia), Nassir Hazza & Bros. (Saudi Arabia), CityCement (Saudi Arabia), Yamama Cement (Saudi Arabia), SPCC (Saudi Arabia).

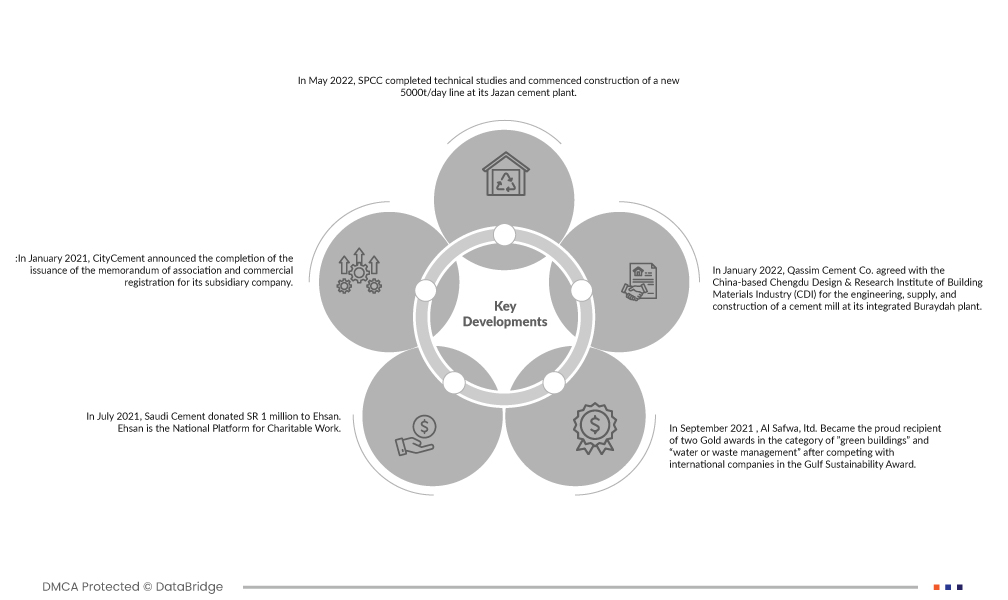

Market Development

- In January 2022, Qassim Cement Co. entered into an agreement with China-based Chengdu Design & Research Institute of Building Materials Industry (CDI) for the engineering, supply, and construction of a cement mill at its integrated Buraydah plant. This new mill will have a production capacity of 300 tonnes per hour and the project is budgeted at around USD 40 million.

- In September 2021, Al Safwa, ltd. became the proud recipient of two gold awards in the category of" green buildings" and "water or waste management" after competing with international companies in the Gulf Sustainability Award. This has enhanced company's image in the market.

- In January 2021, CityCement announced the completion of the issuance of the memorandum of association and commercial registration for its subsidiary company.

- In July 2021, Saudi Cement donated SR 1 million to Ehsan. Ehsan is the National Platform for Charitable Work.

- In May 2022, SPCC completed technical studies and commenced construction of a new 5000t/day line at its Jazan cement plant.

As per Data Bridge Market Research analysis:

For more detailed information about the India oligonucleotides synthesis market report, click here –https://www.databridgemarketresearch.com/reports/saudi-arabia-aggregate-market