The most prevalent metallic element, making up more than 8% of the mass of the Earth's crust, aluminum is a lightweight, silvery-white, non-magnetic, and ductile metal. It is also the most often utilized non-ferrous metal. The applications include roofing, foil insulation, windows, cladding, doors, shopfronts, balustrading, and architectural hardware. Treadplates and commercial flooring are two more typical uses for aluminum.

Access Full Report @ https://www.databridgemarketresearch.com/reports/saudi-arabia-aluminum-market

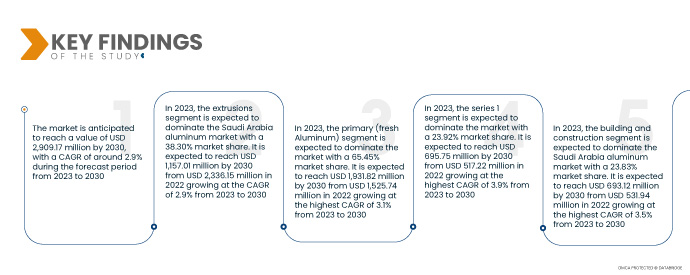

Data Bridge Market Research analyzes that the Saudi Arabia Aluminum Market is expected to grow with a CAGR of 2.9% from 2023 to 2030 and is expected to reach USD 2,909.17 million by 2030.

Key Findings of the Study

Policies for decarbonization and transformation to a more sustainable world are expected to drive the market growth

Since Saudi Arabia's CO2 emissions are rising yearly, the country has committed to surpassing net zero carbon emissions by 2060. The nation is investing significantly in renewable energy sources while simultaneously trying to reduce energy waste and increase energy efficiency. Additionally, Saudi Arabia is investing in green infrastructure projects and researching ways to store and transmit energy. These initiatives demonstrate Saudi Arabia's commitment to combating climate change and setting an example for a more sustainable future.

The aluminum sector in Saudi Arabia also contributes a small percentage to the country's CO2 emissions. The main aluminum sector uses more than 900 TWh of power annually and emits 1.1 gigatons of greenhouse gases (GHG). Primary aluminum would rank as the fifth-largest electricity consumer in the world if it were a nation. Millions of tons of perfluorocarbon GHG gases, sulfur dioxide, nitrous oxides, and volatile compounds are also released during primary aluminum manufacturing along with CO2. In addition, 175 million tons of hazardous caustic red mud waste from alumina refinement for smelters every year must be kept in storage. As environmental restrictions tighten worldwide, decarbonization efforts are accelerating in the Middle East.

The majority of the decarbonization plan will need to be provided by the private sector, but it will build on the foundation laid forth by the government. Private sector industrialists are actively integrating sustainability elements into their corporate and commercial plans to guarantee efficient sustainability measures are implemented throughout their industrial value chain. The Saudi Arabian government supports sustainable business growth by establishing best practices, launching projects focused on innovation, and encouraging information exchange. As a result, the market is projected to grow due to the manufacturers adhering to decarbonization and transitioning to a more sustainable world regulation, which is expected to drive market growth.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Years

|

2021 (Customizable to 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Million, and Volume in Thousand Tons

|

|

Segments Covered

|

By Category (Castings, Extrusion, Forging, Flat Rolled Products, and Pigments and Powders), Source (Primary (Fresh Aluminum) and Secondary (Recycled Aluminum)), Series (Series 1, Series 2, Series 3, Series 4, Series 5, Series 6, Series 7, and Series 8), End-User (Automotive, Industrial, Packaging, Building & Construction, Electrical & Electronics, Aerospace, Household Appliances, Engineering Tools, Packaging, and Others)

|

|

Regions Covered

|

Saudi Arabia

|

|

Market Players Covered

|

Al Taiseer Group Talco Industrial Company (Saudi Arabia), Alcoa Corporation (Ma’aden) (U.S.), alupco (Saudi Arabia), Aboura Metals (Saudi Arabia), Alma (Saudi Arabia), and alsaleh (Saudi Arabia) among others

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

|

Segment Analysis

The market is segmented into four notable segments based on category, source, series, and end-user.

- Based on category, the market is segmented into casting, extrusions, forging, flat-rolled products, and pigments and powders.

In 2023, the extrusions segment of the category is anticipated to dominate the Saudi Arabia aluminum market.

In 2023, the extrusions segment is expected to dominate the Saudi Arabia aluminum market due to its lightweight, strong, corrosion-resistant, quick-to-market, sustainable, excellent conductors, noncombustible, nontoxic, and others.

- On the basis of source, the market is segmented into primary (fresh aluminum) and secondary (recycled aluminum). In 2023, the primary (fresh aluminum) segment is expected to dominate the market with a 65.45% market share due to its wide use in electrical applications and foil and packaging. In addition, it can be alloyed with other elements to provide higher strength.

- On the basis of series, the market is segmented into series 1, series 2, series 3, series 4, series 5, series 6, series 7, and series 8. In 2023, the series 1 segment is expected to dominate the market with a 23.92% market share as it is used in applications such as chemical equipment, sheets, plates, foil, metal tableware, and others.

- On the basis of end-user, the market is segmented into automotive, industrial, building & construction, electrical & electronics, aerospace, household appliances, engineering tools, packaging, and others.

In 2023, the building and construction segment of end-use is anticipated to dominate the Saudi Arabia aluminum market.

In 2023, the building and construction segment is expected to dominate the market with a 23.83% market share due to its adaptability, lightness, affordability, and capacity to give additional durability and support.

Major Players

Data Bridge Market Research recognizes the following companies as the major players in the Saudi Arabia aluminum market that includes Al Taiseer Group Talco Industrial Company (Saudi Arabia), Alcoa Corporation (Ma’aden) (U.S.), alupco (Saudi Arabia), Aboura Metals (Saudi Arabia), Alma (Saudi Arabia), and alsaleh (Saudi Arabia).

Market Development

- In January 2023, to further enhance the company's strict emphasis on operational efficiency, cost, and innovation, Alcoa Corporation announced restructure of its Executive Leadership Team. Two current members of the Executive Leadership Team will have their duties changed as of February 1, 2023, and a new Chief Financial Officer, William F. Oplinger, was appointed. This reorganization will guarantee ongoing progress and spotlight Alcoa's strategy for running low-cost, margin-focused, sustainable manufacturers

For more detailed information about the Saudi Arabia aluminum market report, click here – https://www.databridgemarketresearch.com/reports/saudi-arabia-aluminum-market