The Saudi Arabia dental CAD/CAM systems market refers to the specialized sector within the broader dental industry that encompasses the design and manufacturing of dental prosthetics, restorations, and orthodontic appliances using computerized technologies. These systems enable dental professionals, including dentists, prosthodontists, and dental laboratories, to create precise and customized dental solutions, such as crowns, bridges, veneers, dentures, and orthodontic devices, with the aid of advanced software and automated manufacturing processes. The market encompasses the hardware components (scanners and milling machines) and software solutions that are essential for the digital design and fabrication of dental restorations, such as associated consumables and services. This market serves both dental healthcare providers and dental laboratories, aiming to improve the accuracy, speed, and quality of dental treatments while enhancing patient outcomes.

Access Full Report @ https://www.databridgemarketresearch.com/reports/saudi-arabia-dental-cad-cam-systems-market

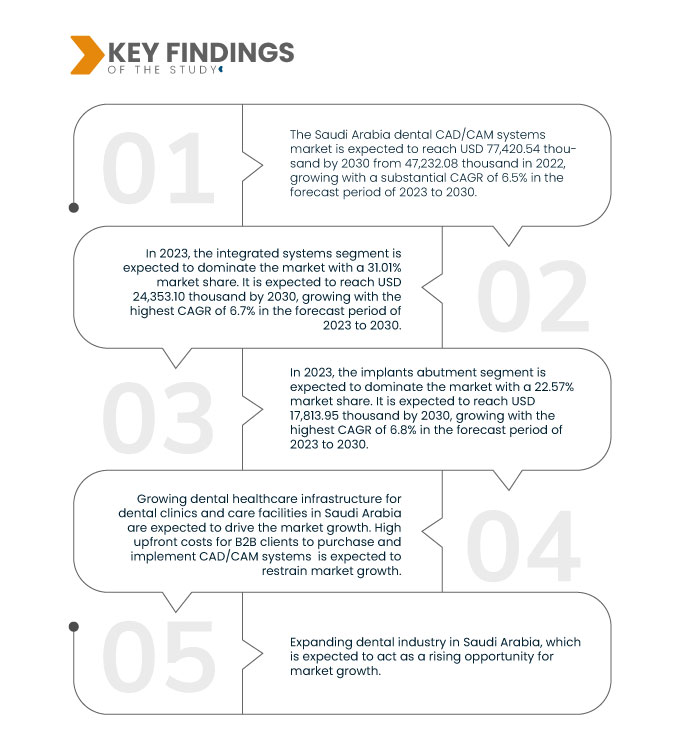

Data Bridge Market Research analyzes that the Saudi Arabia Dental CAD/CAM Systems Market is expected to reach USD 77,420.54 thousand by 2030 from 47,232.08 thousand in 2022, growing with a substantial CAGR of 6.5% in the forecast period of 2023 to 2030. The growing demand for advanced CAD/CAM systems is expected to grow the market.

Key Findings of the Study

Growing dental healthcare infrastructure for dental clinics and care facilities in Saudi Arabia

The expansion of dental healthcare infrastructure in Saudi Arabia serves as a significant driver for the Saudi Arabia CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) systems market in the country. Dental clinics and care facilities in Saudi Arabia are growing and modernizing. The demand for CAD/CAM systems is on the rise, driven by several key factors, such as increasing dental facilities, quality and precision requirements, efficiency and time savings, and government support. The increasing number of dental facilities, coupled with the demand for quality, efficiency, and customization, is propelling the adoption of CAD/CAM technology. Dental clinics and care facilities embrace these systems to provide advanced and patient-centric care. The growth of the market in Saudi Arabia is poised for continued expansion. Thus, the growing dental healthcare infrastructure for dental clinics and care facilities in Saudi Arabia is expected to drive market growth.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2023 to 2030

|

|

Base Year

|

2022

|

|

Historic Year

|

2021 (Customizable 2015-2020)

|

|

Quantitative Units

|

Revenue in USD Thousand, Volume in Units, and Pricing in USD/Unit

|

|

Segments Covered

|

Product Type (Integrated Systems, Milling Equipment, Scanners, Furnace, Dental CAD/CAM Software, and Accessories), Capabilities (Implants Abutment, Inlays & Onlays, Veneers, Crowns & Bridges, Fixed Partial Denture, Full Mouth Reconstruction, Complete Dentures, and Others), Application (3D Printing, Dental Milling, Dental Scanning, and Dental Software), System (Chair Side Systems and Lab Systems), Modality (Portable and Standalone), End User (Dental Clinics & Laboratories, Dental Hospitals, Research/Academic Institutes, and Others), Distribution Channel (Direct Tender and Retail Sales)

|

|

Country Covered

|

Saudi Arabia

|

|

Market Players Covered

|

3M (U.S.), Dentsply Sirona (U.S.), Ivoclar Vivadent (Liechtenstein), PLANMECA OY (Finland), Institut Straumann AG (Switzerland), 3D Systems, Inc (U.S.), imes-icore GmbH (Germany), and Kulzer GmbH (Germany) among others.

|

|

Data Points Covered in the Report

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Segment Analysis:

The Saudi Arabia dental CAD/CAM systems market is segmented into seven notable segments based on product type, capabilities, application, system, modality, end user, and distribution channel.

- On the basis of product type, the market is segmented into integrated systems, milling equipment, scanners, furnace, dental CAD/CAM software, and accessories.

In 2023, the integrated systems segment is expected to dominate the Saudi Arabia dental CAD/CAM systems market

In 2023, the integrated systems segment is expected to dominate the market with a 31.01% market share due to the integrated systems in dental CAD/CAM streamline workflow, reducing errors and saving time while also ensuring precision and consistency, leading to cost savings and enhanced patient satisfaction.

- On the basis of capabilities, the market is segmented into implants abutment, inlays & onlays, veneers, crowns & bridges, fixed partial denture, full mouth reconstruction, complete dentures, and others.

In 2023, the implants abutment segment is expected to dominate the Saudi Arabia dental CAD/CAM systems market

In 2023, the implants abutment segment is expected to dominate the market with a 22.57% market share owing to its offer of exceptional precision in fit and aesthetics, improving long-term implant success rates and patient satisfaction. Their custom design ensures optimal function and minimizes the risk of complications.

- On the basis of application, the market is segmented into 3D printing, dental milling, dental scanning, and dental software. In 2023, the 3D printing segment is expected to dominate the market with a 41.66% market share

- On the basis of the system, the market is segmented into chair side systems and lab systems. In 2023, the chair side systems segment is expected to dominate the market with a 58.43% market share.

- On the basis of modality, the market is segmented into portable and standalone. In 2023, the portable segment is expected to dominate the market with a 62.25% market share.

- On the basis of end user, the market is segmented into dental clinics & laboratories, dental hospitals, research/academic institutes, and others. In 2023, the dental clinics & laboratories segment is expected to dominate the market with a 57.59% market share.

- On the basis of distribution channel, the market is segmented into direct tender and retail sales. In 2023, the direct tender segment is expected to dominate the market with a 63.26% market share.

Major Players

Data Bridge Market Research analyzes 3M (U.S.), Dentsply Sirona (U.S.), Ivoclar Vivadent (Liechtenstein), PLANMECA OY (Finland), and Institut Straumann AG (Switzerland) as the major market players in the Saudi Arabia dental CAD/CAM systems market.

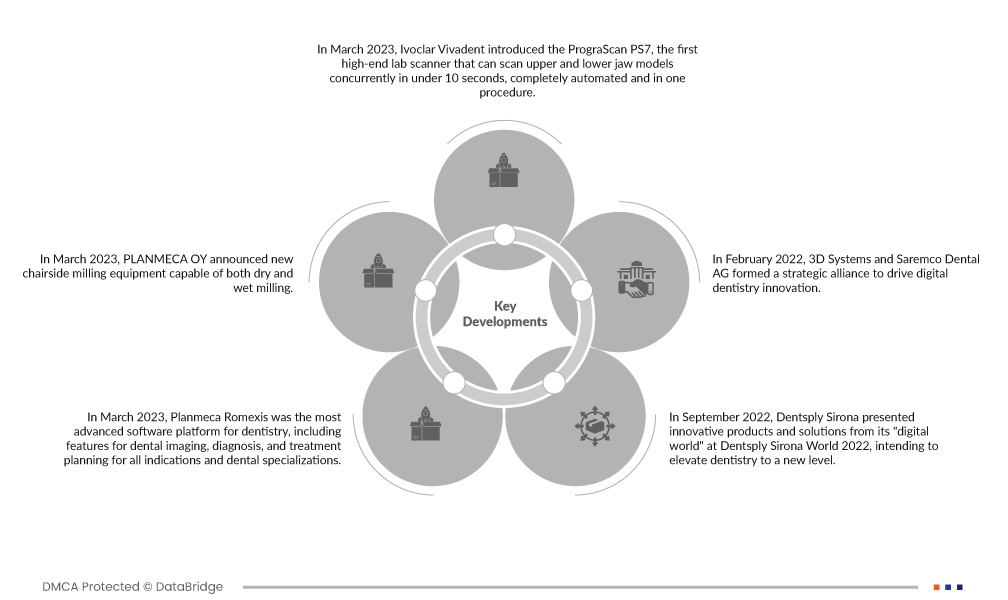

Market Development

- In March 2023, Ivoclar Vivadent introduced the PrograScan PS7, the first high-end lab scanner that can scan upper and lower jaw models concurrently in under 10 seconds, completely automated and in one procedure. This new PrograScan PS7 is specifically designed for dentistry laboratories with high-volume throughputs. The new PrograScan PS7 works smoothly with all Ivoclar Vivadent operations, both traditional and digital.

- In March 2023, PLANMECA OY announced new chairside milling equipment capable of both dry and wet milling. The Planmeca PlanMill 35 milling unit processes a wide range of materials accurately and effectively, making it a perfect partner for dental practices seeking an all-in-one solution for fabricating dental restorations in-house - particularly from zirconium dioxide. This allows the organization to stay ahead of its inventive footprints with the greatest efficiency and precision

- In March 2023, Planmeca Romexis was the most advanced software platform for dentistry, including features for dental imaging, diagnosis, and treatment planning for all indications and dental specializations. Planmeca is delighted to unveil various enhancements and new AI-based features to Romexis at the International Dental Show 2023, which assist in optimizing daily operations at a dental office and make dealing with patient photos and treatment planning even easier and faster.

- In September 2022, Dentsply Sirona presented innovative products and solutions from its "digital world" at Dentsply Sirona World 2022, intending to elevate dentistry to a new level. One of the highlights is the new Primescan Connect, a laptop-based version of Dentsply Sirona's easy-to-use, rapid, and precise intraoral scanner Primescan. DS Core completes the digital dentistry experience by adding new features. This facilitated the company's foray into digital dentistry.

- In February 2022, 3D Systems and Saremco Dental AG formed a strategic alliance to drive digital dentistry innovation. This collaboration combines the power of 3D Systems' industry-leading NextDent digital dentistry solution with the materials science expertise of Saremco, allowing dental laboratories and clinics to address a wide range of indications with unparalleled accuracy, repeatability, productivity, and lower total cost.

Regional Analysis

On the basis of geography, the country covered is Saudi Arabia.

For more detailed information about the Saudi Arabia dental CAD/CAM systems market report, click here – https://www.databridgemarketresearch.com/reports/saudi-arabia-dental-cad-cam-systems-market