تُخفّض الطلاءات الواقية تكاليف الصيانة من خلال عملها كحاجز ضد التدهور البيئي. في الصناعات المعرضة للتآكل والتلف أو الظروف القاسية، تُوفّر هذه الطلاءات درعًا واقيًا يمنع تلف المعدات والهياكل. ومن خلال تشكيل حاجز مرن، تُقلّل من الحاجة إلى عمليات الإصلاح والصيانة المتكررة. ويكتسب هذا أهمية بالغة في القطاعات التي قد يُؤدي فيها التوقف عن العمل إلى خسائر مالية فادحة.

يمكنك الوصول إلى التقرير الكامل على https://www.databridgemarketresearch.com/reports/south-america-protective-coating-market

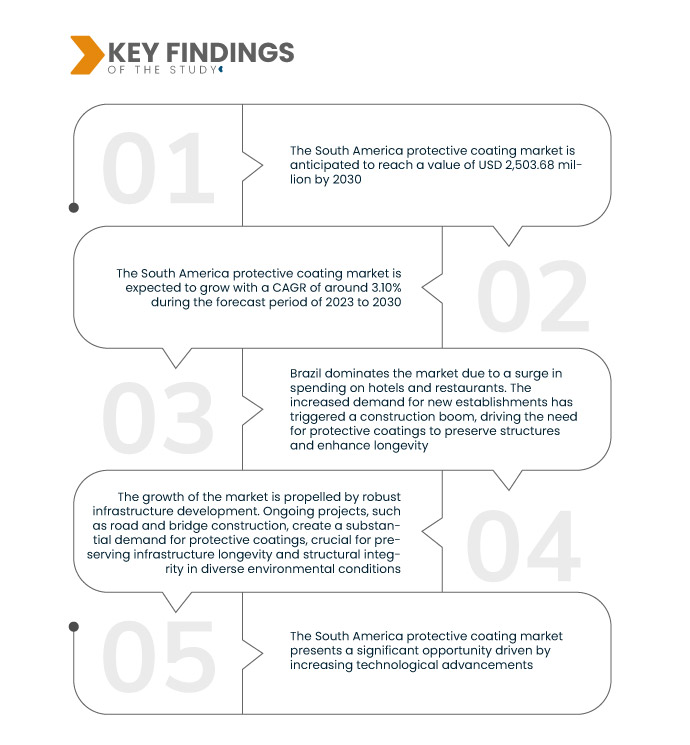

تُحلل شركة داتا بريدج لأبحاث السوق سوق الطلاء الواقي في أمريكا الجنوبية ، والذي بلغ 1,961.14 مليون دولار أمريكي في عام 2022، ومن المتوقع أن يصل إلى 2,503.68 مليون دولار أمريكي بحلول عام 2030، وأن يشهد معدل نمو سنوي مركب قدره 3.10% خلال الفترة المتوقعة من 2023 إلى 2030. يُعدّ النمو السريع في التصنيع في أمريكا الجنوبية، وخاصةً في قطاعات التصنيع والنفط والغاز والبتروكيماويات، محركًا رئيسيًا لسوق الطلاء الواقي في المنطقة. كما أن ازدياد الأنشطة الصناعية يُعزز الطلب على الطلاءات التي تحمي المعدات وخطوط الأنابيب والهياكل من التآكل والاحتكاك والتعرض للمواد الكيميائية القاسية، مما يُسهم في نمو سوق الطلاء الواقي في المنطقة.

النتائج الرئيسية للدراسة

من المتوقع أن يؤدي نمو قطاع السيارات إلى دفع معدل نمو السوق

يُعد نمو قطاع السيارات محركًا رئيسيًا لسوق الطلاءات الواقية في أمريكا الجنوبية. ومع توسع صناعة السيارات في المنطقة، يزداد الطلب على الطلاءات الواقية للمركبات. تضمن هذه الطلاءات مقاومة التآكل، وتعزز المتانة، وتضفي لمسة جمالية جذابة. ومع تزايد توقعات المستهلكين للحصول على تشطيبات عالية الجودة، تلعب الطلاءات الواقية دورًا محوريًا في تلبية هذه التوقعات. ويعزز توسع قطاع السيارات الطلب على الطلاءات، ويؤكد أهمية الحلول الوقائية في الحفاظ على عمر المركبات وجاذبيتها البصرية في أمريكا الجنوبية.

نطاق التقرير وتقسيم السوق

مقياس التقرير

|

تفاصيل

|

فترة التنبؤ

|

من 2023 إلى 2030

|

سنة الأساس

|

2022

|

السنوات التاريخية

|

2021 (قابلة للتخصيص حتى 2015-2020)

|

الوحدات الكمية

|

الإيرادات بالملايين من الدولارات الأمريكية، والحجم بالأطنان، والتسعير بالدولار الأمريكي

|

القطاعات المغطاة

|

النوع (طلاء غير عضوي وطلاء عضوي)، نوع المنتج (أكريليك، إيبوكسي، بوليستر، بولي يوريثين ، ألكيد، إسترات فينيل ، وغيرها)، عملية التصنيع (الطريقة الميكانيكية، الطريقة الكيميائية، والطريقة الكهروكيميائية)، التكنولوجيا (المحمولة بالمذيبات، والمحمولة بالماء، والطلاء بالمسحوق، والمعالجة بالأشعة فوق البنفسجية، وغيرها)، التطبيق (الأصباغ، والراتنجات المتخصصة، والحشوات، وغيرها)، المستخدم النهائي (البناء والتشييد، والفضاء الجوي، والسيارات، والصناعة، والبحرية، والنفط والغاز، وتوليد الطاقة، والتعدين، وغيرها)

|

الدول المغطاة

|

البرازيل والأرجنتين وكولومبيا وبيرو وبقية دول أمريكا الجنوبية

|

الجهات الفاعلة في السوق المغطاة

|

شركة إكسون موبيل (الولايات المتحدة)، شركة بي بي جي للصناعات (الولايات المتحدة)، شركة باسف إس إي (ألمانيا)، شركة أو كيو ش.م.ع.م (عُمان)، شركة واكر كيمي إيه جي (ألمانيا)، شركة ساسول إس إيه (جنوب أفريقيا)، شركة ميرك كي جي إيه إيه (ألمانيا)، شركة إيستمان للكيماويات (الولايات المتحدة)، شركة رينر للطلاءات (البرازيل)، شركة أركيما (فرنسا)، شركة أكسالتا لأنظمة الطلاء، ذ.م.م (الولايات المتحدة)، شركة هانتسمان إنترناشونال ذ.م.م (الولايات المتحدة)، شركة سيكا إيه جي (سويسرا)، شركة شيروين ويليامز (الولايات المتحدة)، وشركة إتش بي فولر (الولايات المتحدة).

|

نقاط البيانات التي يغطيها التقرير

|

بالإضافة إلى الرؤى حول سيناريوهات السوق مثل القيمة السوقية ومعدل النمو والتجزئة والتغطية الجغرافية واللاعبين الرئيسيين، تتضمن تقارير السوق التي تم تنظيمها بواسطة Data Bridge Market Research أيضًا تحليلًا متعمقًا من الخبراء والإنتاج والقدرة التمثيلية الجغرافية للشركة وتخطيطات الشبكة للموزعين والشركاء وتحليل اتجاهات الأسعار التفصيلية والمحدثة وتحليل العجز في سلسلة التوريد والطلب.

|

تحليل القطاعات:

يتم تقسيم سوق الطلاء الواقي في أمريكا الجنوبية على أساس النوع ونوع المنتج وعملية التصنيع والتكنولوجيا والتطبيق والمستخدم النهائي.

- على أساس النوع، يتم تقسيم سوق الطلاء الواقي في أمريكا الجنوبية إلى طلاء غير عضوي وطلاء عضوي

- على أساس نوع المنتج، يتم تقسيم سوق الطلاء الواقي في أمريكا الجنوبية إلى الأكريليك والإيبوكسي والبوليستر والبولي يوريثين والألكيد وإسترات الفينيل وغيرها

- على أساس عملية التصنيع، يتم تقسيم سوق الطلاء الواقي في أمريكا الجنوبية إلى الطريقة الميكانيكية والطريقة الكيميائية والطريقة الكهروكيميائية

- على أساس التكنولوجيا، يتم تقسيم سوق الطلاء الواقي في أمريكا الجنوبية إلى طلاء محمول بالمذيبات، وطلاء محمول بالماء، وطلاء مسحوق، ومعالج بالأشعة فوق البنفسجية، وغيرها

- على أساس التطبيق، يتم تقسيم سوق الطلاء الواقي في أمريكا الجنوبية إلى أصباغ، وراتنجات متخصصة، ومواد مالئة، وغيرها

- على أساس المستخدم النهائي، يتم تقسيم سوق الطلاء الواقي في أمريكا الجنوبية إلى البناء والتشييد، والفضاء، والسيارات، والصناعة، والبحرية، والنفط والغاز، وتوليد الطاقة، والتعدين، وغيرها

اللاعبون الرئيسيون

تعترف شركة Data Bridge Market Research بالشركات التالية باعتبارها اللاعبين الرئيسيين في سوق الطلاء الواقي في أمريكا الجنوبية: Exxon Mobil Corporation (الولايات المتحدة)، و PPG Industries (الولايات المتحدة)، و BASF SE (ألمانيا)، و OQ SAOC (عمان)، و WACKER CHEMIE AG (ألمانيا)، و SASOL SA (جنوب إفريقيا)، و Merck KGaA (ألمانيا)، و Eastman Chemical Company (الولايات المتحدة).

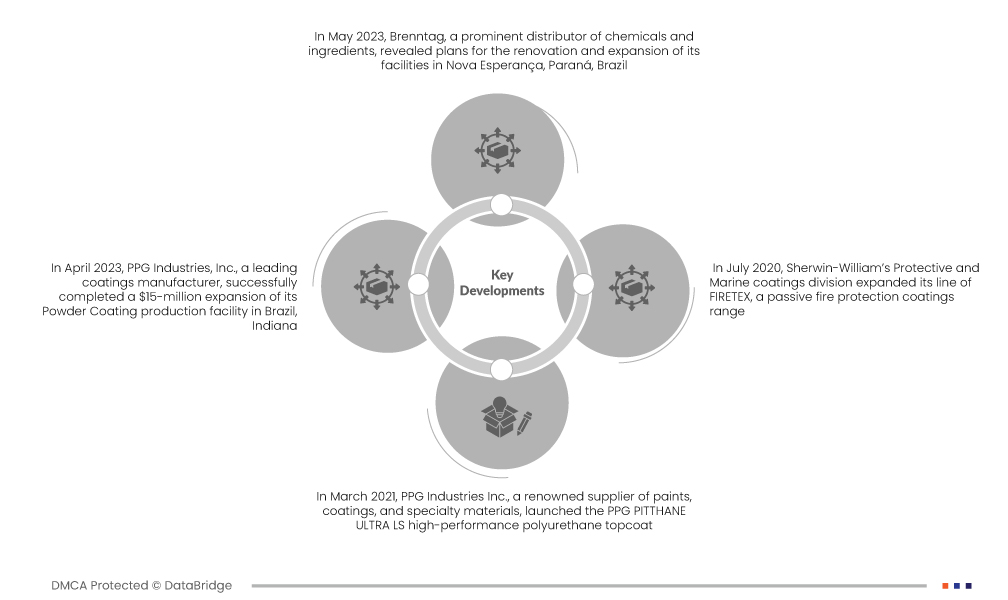

تطورات السوق

- في مايو 2023، كشفت شركة برينتاج، الموزع الرائد للمواد الكيميائية والمكونات، عن خطط لتجديد وتوسيع منشآتها في نوفا إسبيرانكا، بارانا، البرازيل. ويشمل هذا الاستثمار الضخم توسيع مساحة التخزين إلى 2000 متر مربع، وتركيب 14 خزانًا بسعة 675 مترًا مكعبًا. كما جُهز الموقع بمختبر جديد لمراقبة الجودة ومفاعلين مخصصين لإنتاج الأسمدة السائلة. ويسمح هذا التوسع بطاقة إنتاجية أولية تصل إلى 2000 طن سنويًا، مما يعزز التزام برينتاج بتعزيز قدراتها في المنطقة.

- في أبريل 2023، أكملت شركة PPG Industries, Inc.، الشركة الرائدة في تصنيع الطلاءات، توسعةً بقيمة 15 مليون دولار أمريكي لمنشأتها لإنتاج طلاء المساحيق في البرازيل، إنديانا. وشمل الاستثمار دمج خطي إنتاج متطورين متخصصين في مسحوق المعادن الملتصقة، إلى جانب دمج قدرات التعبئة والتغليف الآلية. يهدف هذا التوسع الاستراتيجي إلى تلبية الطلب المتزايد من العملاء على حلول الطلاء المستدامة في قطاعي الأجهزة والتصنيع الصناعي العام. وتُظهر PPG Industries التزامها بالبقاء في طليعة تقنيات الطلاء المبتكرة والصديقة للبيئة.

- في مارس 2021، أطلقت شركة PPG Industries Inc.، وهي مورد رائد للدهانات ومواد الطلاء والمواد المتخصصة، طلاء البولي يوريثان العلوي عالي الأداء PPG PITTHANE ULTRA LS. صُمم هذا الطلاء العلوي خصيصًا للاستخدام في البيئات المسببة للتآكل، ويتميز بلمعانه الخفيف، مما يقلل من الوهج ويغطي عيوب السطح بفعالية. يمثل طرح طلاء PPG PITTHANE ULTRA LS تقدمًا ملحوظًا في محفظة منتجات PPG Industries، حيث يلبي احتياجات الصناعات التي يكتسب فيها الأداء والجمال أهمية بالغة.

- في يوليو 2020، وسع قسم الطلاءات الوقائية والبحرية في شركة شيروين-ويليام خط إنتاج فايرتكس، وهو طلاء سلبي للحماية من الحرائق. حسّن هذا التوسع التطبيقات وخفض التكلفة للأصول البرية من خلال السماح بالتحكم الدقيق في معلمات سمك الطلاء. ويؤكد التزام شيروين-ويليامز بتطوير تقنيات الحماية من الحرائق التزامها بتوفير حلول متطورة لسلامة وسلامة الأصول البرية.

التحليل الإقليمي

من الناحية الجغرافية، البلدان التي يغطيها تقرير سوق الطلاء الواقي في أمريكا الجنوبية هي البرازيل والأرجنتين وكولومبيا وبيرو وبقية أمريكا الجنوبية

وفقًا لتحليل Data Bridge Market Research:

البرازيل هي المنطقة المهيمنة في سوق الطلاء الواقي في أمريكا الجنوبية خلال الفترة المتوقعة 2023-2030

ترتبط هيمنة البرازيل على سوق الطلاء الواقي ارتباطًا وثيقًا بارتفاع الإنفاق في قطاعي الفنادق والمطاعم. وقد أدى ارتفاع الدخل المتاح للإنفاق ونمو الطبقة المتوسطة إلى زيادة الإنفاق على خدمات الضيافة، مما عزز الطلب على الفنادق والمطاعم الجديدة. وقد أدى ذلك بدوره إلى زيادة ملحوظة في أنشطة البناء والتجديد. برزت الطلاءات الواقية كعنصر أساسي في الحفاظ على هذه الهياكل وتعزيز عمرها الافتراضي، وحمايتها من العوامل البيئية، والمساهمة في متانتها وجمالها. يعكس هذا التوجه نموًا اقتصاديًا أوسع، وتوسعًا حضريًا، وتركيزًا متزايدًا على حلول الطلاء عالية الجودة في مختلف الصناعات، مما يجعل البرازيل مركزًا رئيسيًا لسوق الطلاء الواقي المتطور.

لمزيد من المعلومات التفصيلية حول تقرير سوق الطلاء الواقي في أمريكا الجنوبية ، انقر هنا - https://www.databridgemarketresearch.com/reports/south-america-protective-coating-market