Global Vinyl Ester Market

Market Size in USD Billion

CAGR :

%

USD

1.30 Billion

USD

2.17 Billion

2024

2032

USD

1.30 Billion

USD

2.17 Billion

2024

2032

| 2025 –2032 | |

| USD 1.30 Billion | |

| USD 2.17 Billion | |

|

|

|

|

Vinyl Ester Market Size

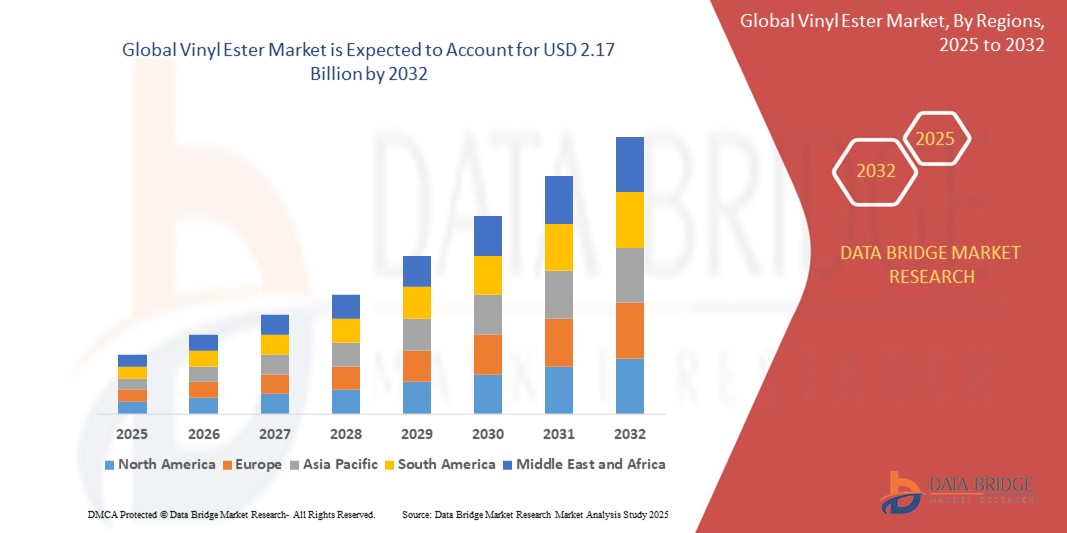

- The global vinyl ester market size was valued at USD 1.30 billion in 2024 and is expected to reach USD 2.17 billion by 2032, at a CAGR of 6.65% during the forecast period

- The market growth is largely fueled by the increasing demand for corrosion-resistant, high-performance materials across industries such as chemical processing, marine, infrastructure, and renewable energy. Vinyl ester resins are gaining traction due to their superior mechanical strength, thermal stability, and resistance to chemicals, making them ideal for use in harsh and demanding environments. This growing reliance on durable composite materials is a key driver propelling the market forward

- Furthermore, expanding applications in flue gas desulfurization units, wind turbine components, and industrial pipelines are accelerating the adoption of vinyl ester resins. As industries seek cost-effective solutions for extending equipment life and reducing maintenance, vinyl esters are becoming the preferred choice, thereby significantly boosting the industry's growth

Vinyl Ester Market Analysis

- Vinyl esters are thermosetting resins formed by the reaction of epoxy resins with acrylic or methacrylic acids, offering a unique balance of strength, flexibility, and chemical resistance. They are widely used in the production of fiber-reinforced plastics for applications in tanks, pipes, marine structures, and pollution control equipment

- The market is witnessing strong growth due to increased infrastructure development, environmental regulations promoting corrosion-resistant materials, and growing demand in renewable energy sectors. Their ability to withstand aggressive conditions while offering lightweight, durable performance continues to expand their use across industrial applications

- North America dominated the vinyl ester market with a share of 40.5% in 2024, due to strong demand across chemical processing, water treatment, and infrastructure sectors

- Asia-Pacific is expected to be the fastest growing region in the vinyl ester market during the forecast period due to rapid industrialization, urbanization, and infrastructure development across emerging economies

- Pipes and tanks segment dominated the market with a market share of 61.95% in 2024, due to the growing need for corrosion-resistant materials in chemical storage and wastewater treatment facilities. Vinyl ester resins are widely used in this segment due to their mechanical strength, resistance to aggressive chemicals, and long service life, which significantly reduce maintenance costs. The increasing investments in infrastructure, especially in developing economies, further bolster demand in this segment

Report Scope and Vinyl Ester Market Segmentation

|

Attributes |

Vinyl Ester Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Vinyl Ester Market Trends

“Increasing Demand for Corrosion-Resistant Materials”

- The vinyl ester market is experiencing robust growth due to escalating demand for materials offering superior corrosion resistance, especially in highly corrosive and demanding environments. This makes vinyl ester resins a preferred choice over polyester and epoxy resins in industrial tanks, pipelines, marine structures, and infrastructure rehabilitation

- For instance, Ashland Global, a leading vinyl ester resin supplier, has seen increased demand for its Derakane line of corrosion-resistant resins, which are widely used in marine, water treatment, and chemical processing applications requiring long-term durability and chemical resistance

- The marine industry continues to adopt vinyl ester for shipbuilding and offshore components to withstand saltwater and harsh chemicals, while the wind energy sector leverages its fatigue resistance for manufacturing turbine blades

- Advanced product innovations, such as vinyl esters with higher heat resistance and faster cure times, are gaining market traction due to their application flexibility in sectors such as transportation and process industries

- Lifecycle cost benefits—driven by reduced maintenance needs and extended service life—are making vinyl esters a compelling alternative to traditional materials such as steel, reinforcing their adoption in public infrastructure and industrial facilities

- Government support for corrosion mitigation in water utilities and transportation projects is further encouraging investment in composite-based solutions where vinyl esters are vital components

Vinyl Ester Market Dynamics

Driver

“Growing Infrastructure Projects”

- The surge in spending on infrastructure—spanning bridges, industrial tanks, wind turbines, desalination plants, and pipelines—is significantly boosting demand for vinyl ester resins due to their resistance to corrosion, fatigue, and high-stress environments

- For instance, Swancor, a Taiwan-based company with global operations, has supplied vinyl ester resins for major offshore wind projects, particularly in Asia-Pacific, where corrosion resistance and structural reliability are critical for long-term turbine performance

- Aging infrastructure in Europe and North America has also led to the rehabilitation of water supply and wastewater treatment systems that favor vinyl ester composites for their extended service life and minimal maintenance requirements

- In India, government-backed initiatives such as the Smart Cities Mission and industrial corridor development are creating demand for vinyl ester composites in structural rehabilitation and new construction projects across sectors

- Strategic partnerships between resin manufacturers and construction firms are enhancing specification rates and spreading awareness about the performance benefits of vinyl ester-based composite solutions

Restraint/Challenge

“High Production Costs”

- Vinyl ester resin production involves high-cost raw materials such as epoxies, styrene, and methacrylic acid, which are sensitive to oil and petrochemical price fluctuations—directly affecting manufacturers' cost structures and market pricing

- For instance, Reichhold Industries, a major player in resin manufacturing, has periodically adjusted pricing for its vinyl ester portfolio in response to volatility in styrene and epoxy prices, especially during periods of global supply chain disruptions

- Complying with strict regulatory frameworks such as EU REACH increases costs related to formulation changes, emissions control, and material documentation, particularly for producers operating across multiple jurisdictions

- Smaller manufacturers and regional resin suppliers often face difficulty absorbing these costs or passing them on to cost-sensitive segments such as construction or utilities, limiting broader product penetration

- The combination of fluctuating raw material costs, environmental compliance burdens, and capital investment requirements continues to challenge the expansion of vinyl ester resins in lower-margin or mass-market applications

Vinyl Ester Market Scope

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the vinyl ester market is segmented into Bisphenol A, Novolac, Brominated Fire Retardant, Elastomer Modified, and Others. The Bisphenol A segment dominated the largest market revenue share of 54.99% in 2024, primarily due to its high chemical resistance, strong adhesion properties, and suitability across various industrial applications. Its excellent performance in corrosive environments makes it the preferred choice for storage tanks, pipelines, and structural composites in chemical processing industries. Manufacturers also favor Bisphenol A-based vinyl esters for their cost-effectiveness and ease of formulation, which supports their continued dominance in global markets.

The Novolac segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by its superior thermal and chemical resistance. Novolac-based vinyl esters are increasingly used in high-performance applications where long-term durability under extreme conditions is critical, such as in flue gas desulfurization systems and marine coatings. Their crosslinking density and structural integrity also make them ideal for infrastructure and industrial construction sectors experiencing rising demand for advanced corrosion-resistant materials.

- By Application

On the basis of application, the vinyl ester market is segmented into Pipes and Tanks, Marine, Wind Energy, FGD and Precipitators, and Pulp and Paper. The Pipes and Tanks segment held the largest market revenue share of 61.95% in 2024, driven by the growing need for corrosion-resistant materials in chemical storage and wastewater treatment facilities. Vinyl ester resins are widely used in this segment due to their mechanical strength, resistance to aggressive chemicals, and long service life, which significantly reduce maintenance costs. The increasing investments in infrastructure, especially in developing economies, further bolster demand in this segment.

The Wind Energy segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the global transition toward renewable energy and the growing deployment of wind turbines. Vinyl esters are increasingly preferred in wind energy applications for manufacturing lightweight yet high-strength rotor blades. Their ability to withstand mechanical stress and environmental exposure enhances the operational efficiency and life span of turbine components, aligning well with the sustainability goals of the energy sector.

Vinyl Ester Market Regional Analysis

- North America dominated the vinyl ester market with the largest revenue share of 40.5% in 2024, driven by strong demand across chemical processing, water treatment, and infrastructure sectors

- The region benefits from a well-established industrial base, high awareness regarding corrosion resistance, and continued investment in upgrading aging pipelines and storage systems

- The use of vinyl ester in FRP applications for tanks, pipes, and flue gas scrubbers is widespread due to stringent regulatory standards and performance requirements in corrosive environments

U.S. Vinyl Ester Market Insight

The U.S. accounted for the largest share of the North America vinyl ester market in 2024, supported by rising infrastructure modernization initiatives and demand for high-performance composites in marine, pulp and paper, and FGD systems. The country’s leadership in innovation and composite technology, along with stringent environmental and safety regulations, has accelerated the use of vinyl ester in corrosion-resistant linings and structural components. The focus on cost-effective and durable materials in industrial retrofits continues to propel the U.S. market forward.

Europe Vinyl Ester Market Insight

The Europe vinyl ester market is projected to grow at a significant CAGR over the forecast period, fueled by increasing demand for advanced materials in industrial, marine, and energy sectors. The region's strict environmental regulations and focus on sustainable construction practices have encouraged the adoption of vinyl ester resins in flue gas desulfurization units, water treatment systems, and wind energy components. Countries such as Germany, the U.K., and France are leading the adoption of vinyl ester-based composites, driven by growing emphasis on infrastructure resilience, corrosion resistance, and operational efficiency in harsh environments.

U.K. Vinyl Ester Market Insight

The U.K. vinyl ester market is anticipated to register notable growth over the forecast period, supported by rising investments in marine infrastructure, energy transition projects, and chemical processing plants. The need for high-performance materials that offer longevity, minimal maintenance, and environmental safety is fueling the use of vinyl ester resins across key industrial sectors. The growing shift toward lightweight and corrosion-resistant materials in industrial applications is further supporting demand.

Germany Vinyl Ester Market Insight

Germany’s vinyl ester market is expected to expand at a steady pace, backed by the country’s focus on sustainable technologies, renewable energy, and industrial innovation. The demand for vinyl ester resins is rising across flue gas desulfurization systems, offshore wind energy projects, and advanced manufacturing segments. Germany’s strong engineering base and environmental compliance culture are aligning well with the use of long-lasting and chemically stable composites.

Asia-Pacific Vinyl Ester Market Insight

The Asia-Pacific vinyl ester market is projected to grow at the fastest CAGR between 2025 and 2032, led by rapid industrialization, urbanization, and infrastructure development across emerging economies. Countries such as China, India, and Japan are witnessing rising demand for corrosion-resistant, lightweight, and durable materials in sectors such as water treatment, power generation, and construction. Government support for renewable energy projects and the region’s emergence as a key manufacturing hub for composites are contributing to the affordability and availability of vinyl ester-based products. Growing investments in chemical plants, pipelines, and FRP tanks continue to drive market expansion across the region.

Japan Vinyl Ester Market Insight

Japan is seeing steady growth in its vinyl ester market, driven by the country’s demand for precision-engineered, durable materials in marine and industrial applications. The integration of vinyl ester resins into components used in wind turbines, water treatment systems, and corrosion-resistant linings aligns with Japan’s focus on reliability, innovation, and environmental performance. The country’s ongoing efforts to upgrade aging infrastructure also support the use of advanced composite materials.

China Vinyl Ester Market Insight

China captured the largest revenue share in the Asia-Pacific vinyl ester market in 2024, supported by large-scale industrialization, robust infrastructure investment, and a growing emphasis on modern manufacturing technologies. The increasing use of vinyl ester in FRP pipes, tanks, and renewable energy systems is driven by the country's need for cost-effective, high-performance materials. With strong domestic production capacity and rising awareness of the benefits of corrosion-resistant composites, China continues to lead regional market growth.

Vinyl Ester Market Share

The vinyl ester industry is primarily led by well-established companies, including:

- Ashland (U.S.)

- Swancor Holding Co. (Taiwan)

- Aliancys (Switzerland)

- Reichhold LLC (U.S.)

- Hexion (U.S.)

- DIC CORPORATION (Japan)

- Interplastic Corporation (U.S.)

- Akzo Nobel N.V. (Netherlands)

- Nivitex Fibreglass and Resins (India)

- Sir Industriale (Italy)

- Scott Bader Company Ltd (U.K.)

Latest Developments in Global Vinyl Ester Market

- In December 2024, SIR INDUSTRIALE expanded its product portfolio with the launch of SIRESTER VE 64-M-140, a new vinyl ester resin formulation. This addition is expected to enhance the company’s position in the high-performance resin segment by catering to industrial applications demanding superior chemical resistance and mechanical strength. The move reflects growing demand for advanced composite materials in infrastructure, marine, and chemical sectors, and signals SIR INDUSTRIALE’s focus on innovation to meet evolving end-user requirements

- In October 2021, Lone Star Funds acquired AOC from CVC Capital Partners, marking a significant ownership change for one of the leading producers of vinyl ester and unsaturated polyester resins. This acquisition is poised to accelerate AOC’s strategic growth, supported by Lone Star’s financial backing and global investment expertise. The transition is expected to enable AOC to expand its technological capabilities and global reach, strengthening its position in the competitive resins market, particularly in high-demand sectors such as construction, automotive, and marine

- In July 2021, Black Diamond Capital Management announced the repurchase of shares in Speciality Chemicals International Limited from Invest Industrial, making it the controlling shareholder of the Polynt-Reichhold group. This shift in ownership is set to bring strategic direction and financial stability to the company, allowing it to focus on long-term growth within the vinyl ester and composite materials market. The move enhances the group’s ability to invest in new technologies, expand its global operations, and respond more effectively to market demand across various industrial applications

- In July 2020, Showa Denko inaugurated new plants in Shanghai dedicated to the production of vinyl ester resin and synthetic resin emulsion. This expansion strengthens the company's manufacturing footprint in Asia and enhances its ability to meet growing regional demand. With China emerging as a key market for corrosion-resistant resins due to rapid infrastructure growth and industrialization, this development positions Showa Denko to capitalize on increased consumption across sectors such as water treatment, energy, and construction, while also improving supply chain responsiveness.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Vinyl Ester Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Vinyl Ester Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Vinyl Ester Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.