Fuel cards issued by companies to employees for fuel purchases enhance expense tracking and control, facilitating easy monitoring of fuel costs. Equipped with reporting features, these cards enable efficient analysis and management of fuel consumption for businesses. Typically offered by oil companies or financial institutions, fuel cards provide discounts and detailed reporting. The market serves fleet management and businesses with substantial fuel needs, offering a streamlined solution for transaction management without specifying market drivers.

Access Full Report @ https://www.databridgemarketresearch.com/reports/spain-fuel-cards-market

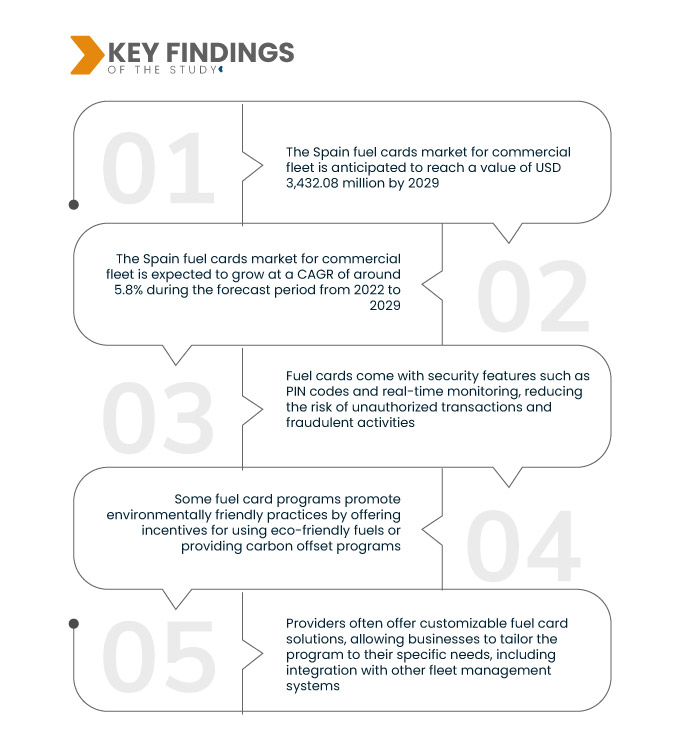

Data Bridge Market Research analyses that the Spain Fuel Cards Market for commercial fleet which was USD 2,186.11 million in 2021, is expected to reach USD 3,432.08 million by the year 2029, at a CAGR of 5.8% during the forecast period of 2022 to 2029. Fuel cards in Spain provide commercial fleets with cost efficiency by leveraging bulk-purchasing discounts and negotiating favorable fuel prices. This strategic approach leads to substantial and sustainable cost savings over time, enhancing the financial viability of fleet operations.

Key Findings of the Study

Increase in demand for contactless fuel transactions is expected to drive the market's growth rate

The fuel cards market is experiencing growth propelled by an increased demand for contactless fuel transactions. As consumers and businesses seek efficient and hygienic payment options, contactless transactions through fuel cards have gained prominence. These cards offer a convenient and secure method for purchasing fuel, reducing physical contact and enhancing transaction speed. The surge in demand for contactless solutions amid the global shift towards digital payments is a key driver fueling the expansion of the fuel cards market.

Report Scope and Market Segmentation

|

Report Metric

|

Details

|

|

Forecast Period

|

2022 to 2029

|

|

Base Year

|

2021

|

|

Historic Years

|

2020 (Customizable to 2014-2019)

|

|

Quantitative Units

|

Revenue in USD Million, Volumes in Units, Pricing in USD

|

|

Segments Covered

|

Card Type (Universal Fuel Cards, Branded Fuel Cards, Merchant Fuel Cards), Features (Mobile Payment and Cardless Transactions, Vehicle Reporting, Real-Time Updates, EMV Compliant, Tokenization, Others), Subscription Type (Registered Card, Bearer Card), Utility (Oil Fee Payment, Toll Fee Payment, Vehicle Parking Fees, Fleet Maintenance, Others), End-User (Fleets, Commercial Road Transport (CRT))

|

|

Market Players Covered

|

BP p.l.c. (U.K.), DKV EURO SERVICE GmbH + Co. KG (Germany), MORGAN FUELS (Ireland), W.A.G. payment solutions. a.s. (Czech Republic), WEX Europe Services (U.K.), UNION TANK Eckstein GmbH & Co KG (A Subsidiary of Edenred company) (Netherlands), Cepsa (Spain), Galp Energia (A Subsidiary of Galp) (Portugal), Repsol (Spain), IDS Europe B.V. (Netherlands), C2A (France), Andamur (Spain), AS 24 (A Subsidiary of TotalEnergies company) (France)

|

|

Data Points Covered in the Report

|

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

|

Segment Analysis:

The Spain fuel cards market for commercial fleet is segmented on the basis of card type, features, subscription type, utility, and end-user.

- On the basis of card type, the Spain fuel cards market for commercial fleet has been segmented into universal fuel cards, branded cards, and merchant fuel cards

- On the basis of features, the Spain fuel cards market for commercial fleet has been segmented into vehicle reporting, EMV compliant, tokenization, real-time updates, mobile payment and card-less transactions, and others

- On the basis of subscription type, the Spain fuel cards market for commercial fleet has been segmented into registered card, and bearer card

- On the basis of utility, the Spain fuel cards market for commercial fleet has been segmented into oil fee payment, toll fee payment, vehicle parking fees, fleet maintenance, and others.

- On the basis of end-user, the Spain fuel cards market for commercial fleet is segmented into commercial road transport (CRT) and fleets

Major Players

Data Bridge Market Research recognizes the following companies as the major Spain fuel cards market for commercial fleet players in Spain fuel cards market for commercial fleet are BP p.l.c. (U.K.), DKV EURO SERVICE GmbH + Co. KG (Germany), MORGAN FUELS (Ireland), W.A.G. payment solutions. a.s. (Czech Republic), WEX Europe Services (U.K.)

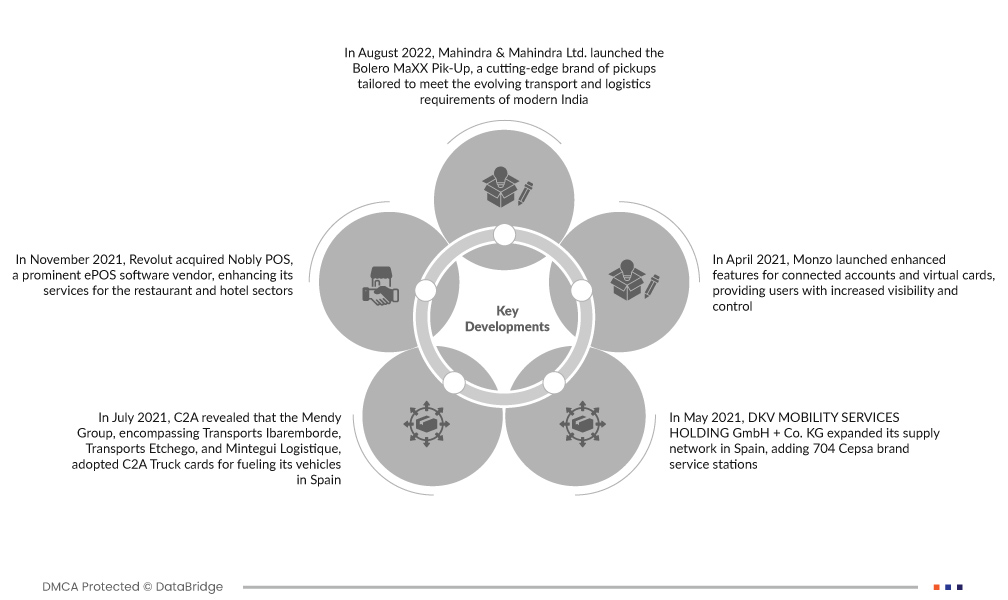

Market Developments

- In August 2022, Mahindra & Mahindra Ltd. launched the Bolero MaXX Pik-Up, a cutting-edge brand of pickups tailored to meet the evolving transport and logistics requirements of modern India. The launch reflects Mahindra's commitment to providing innovative solutions in the automotive sector, addressing the dynamic needs of the country's transportation landscape

- In November 2021, Revolut acquired Nobly POS, a prominent ePOS software vendor, enhancing its services for the restaurant and hotel sectors. With a strong presence in the U.K., U.S., and Australia, Nobly's system amplifies Revolut's support for hospitality SMEs. This strategic move aims to propel the growth of Revolut's Business and Acquiring products in the global market

- In July 2021, C2A revealed that the Mendy Group, encompassing Transports Ibaremborde, Transports Etchego, and Mintegui Logistique, adopted C2A Truck cards for fueling its vehicles in Spain. Directed by Patrick Mendy, the group mandated C2A cards for cross-border travel and all Spain-based drivers. Leveraging a 12% discount, the C2A card enabled a EUR 0.05 per litre recovery on the Spanish TICPE, showcasing the financial benefits of their strategic fuel management approach

- In May 2021, DKV MOBILITY SERVICES HOLDING GmbH + Co. KG expanded its supply network in Spain, adding 704 Cepsa brand service stations. Of these, 44 strategically positioned stations cater to trucks along major transit routes, while 660 are in urban areas. This expansion also allows DKV customers to conveniently use their fuel cards for gas payments at Cepsa stations

- In April 2021, Monzo launched enhanced features for connected accounts and virtual cards, providing users with increased visibility and control. The updated features include a per-account summary, seamless income transfers, and quick access to pending transactions within the app, offering users a more comprehensive and user-friendly banking experience

For more detailed information about the Spain fuel cards market for commercial fleet report, click here – https://www.databridgemarketresearch.com/reports/spain-fuel-cards-market